At Davies Wealth Management, we understand the importance of personal finance planning for achieving financial success.

Effective financial planning is the cornerstone of a secure financial future, enabling you to reach your goals and weather unexpected challenges.

This guide will walk you through the essential steps to create a robust personal finance plan, from setting clear objectives to managing your savings effectively.

What Are Your Financial Goals?

Define Your Financial Objectives

Start by listing all your financial aspirations, both short-term and long-term. Short-term goals might include paying off credit card debt or saving for a vacation, while long-term goals could be buying a home or retiring comfortably. Be specific about the amounts you need and the timeframes you’re aiming for. For instance, instead of “save for retirement,” set a goal like “accumulate $623,994 in retirement savings by age 65.”

Assess Your Current Financial Situation

Before you map out your journey, you need to know your starting point. Calculate your net worth by subtracting your liabilities from your assets. This gives you a clear picture of where you stand financially. According to the most recent data from the Federal Reserve’s 2022 Survey of Consumer Finances, the average net worth of American families is over $1.063 million. Knowing where you fall relative to this benchmark can help you set realistic goals.

Next, review your income, expenses, and debt. Track your spending for a month to understand your cash flow. This exercise often reveals surprising spending patterns and opportunities for savings. Many people find that they spend 20-30% more than they realize on non-essential items.

Create a Realistic Timeline

With your goals defined and your current situation assessed, it’s time to create a timeline. Be realistic about what you can achieve and when. For example, if you’re aiming to save $50,000 for a down payment on a house in five years, you’ll need to set aside about $830 per month (assuming a 5% annual return on your savings).

Prioritize your goals based on urgency and importance. Emergency savings should typically top your list – try to save 3-6 months of living expenses. A recent Bankrate survey revealed that more than 1 in 4 people (26 percent) who pulled from their emergency savings in the past year withdrew $1,000-$2,499, highlighting the critical need for this financial buffer.

Review and Adjust Regularly

Goal-setting isn’t a one-time event. As your life circumstances change, so will your financial priorities. We recommend you review your goals annually and adjust as needed. This flexibility ensures your financial plan remains aligned with your evolving life situation and aspirations.

Now that you’ve set clear, measurable financial goals and created a realistic timeline to achieve them, you’ve taken the first step towards financial success. The next step is to create a comprehensive budget that supports these goals and turns your financial aspirations into reality.

How to Create a Budget That Works

Track Your Income and Expenses

The first step in creating an effective budget is to understand your cash flow clearly. List all sources of income, including your salary, investment returns, and any side hustles. Then, track every single expense for at least a month. This includes fixed costs like rent and utilities, as well as variable expenses such as groceries, entertainment, and impulse purchases.

Many people underestimate their spending by 20-30%. To avoid this pitfall, use your bank and credit card statements to ensure accuracy. You might discover that your daily coffee habit adds up to over $100 a month, or that subscription services you rarely use cost you $50 monthly.

Consider using a budget app to track your expenses and save time. Budgeting apps are designed for on-the-go expense tracking and can provide valuable insights into your spending habits.

Categorize Your Spending

After you have a comprehensive list of expenses, categorize them into groups such as housing, transportation, food, entertainment, and savings. This categorization helps identify patterns in your spending habits and areas where you might overspend.

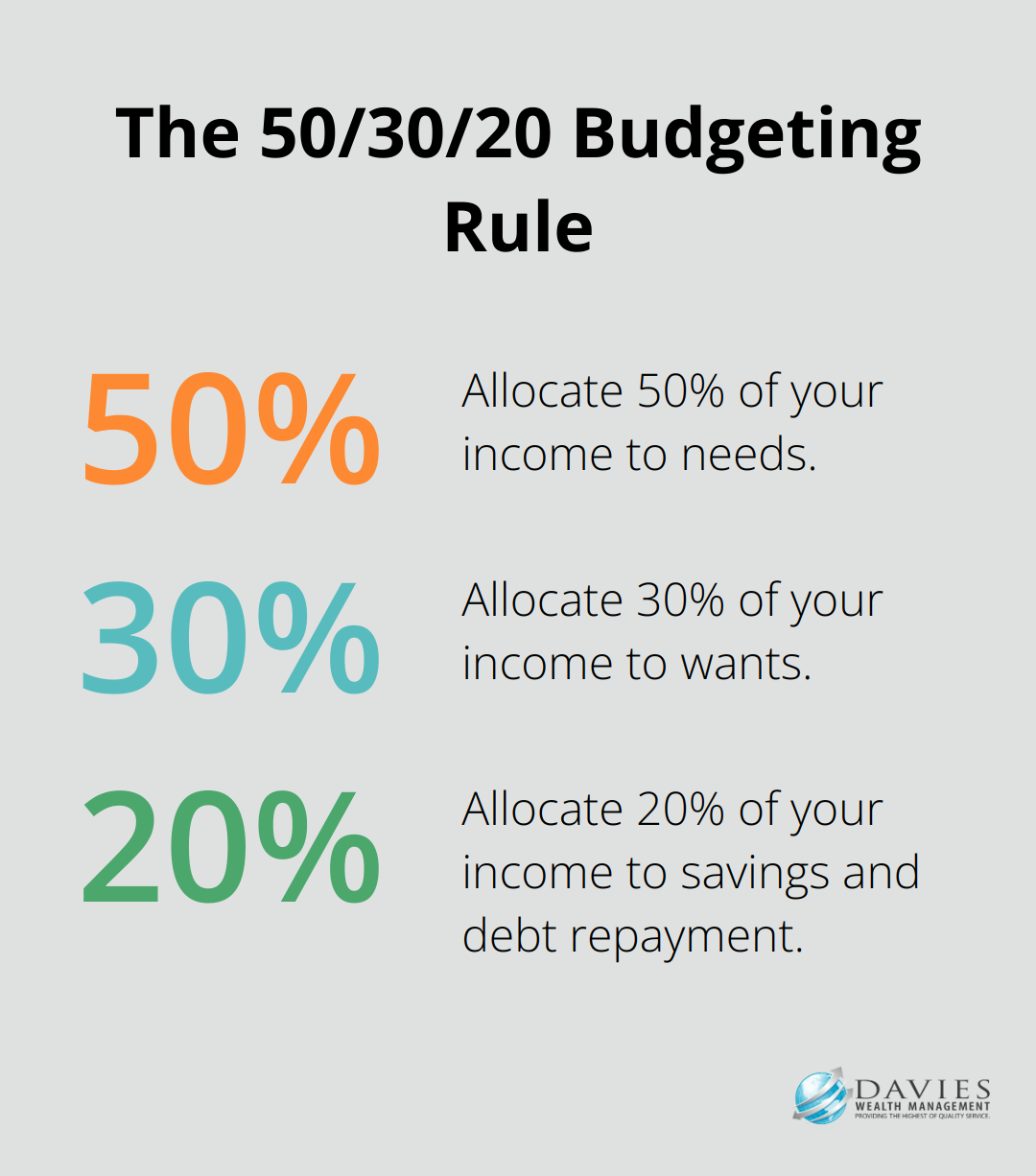

A useful guideline is the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. However, you can adjust these percentages based on your personal financial goals and circumstances.

Identify Savings Opportunities

With your expenses categorized, look for areas where you can cut back. Focus on your “wants” category first. Could you reduce dining out from three times a week to once? Or switch to a more affordable gym membership?

Don’t overlook small changes either. Using a latte factor calculator, you might be shocked to find out how much you’re wasting by spending $2-$5 daily over a period of 10-20 years. You can redirect these savings towards your financial goals, whether that’s building an emergency fund or investing for retirement.

Leverage Budgeting Tools

While spreadsheets can work for budgeting, dedicated apps and tools can make the process much easier and more insightful. Popular options include Mint or YNAB (You Need A Budget). These tools can automatically categorize your expenses, track your progress towards financial goals, and even alert you when you overspend in certain categories.

Stick to Your Budget

Creating a budget is just the first step. The key to success is to stick to it and review and adjust regularly as your financial situation changes. Try to review your budget monthly at first, then quarterly as you become more comfortable with your spending patterns. This regular review will help you stay on track and make necessary adjustments to reach your financial goals.

With a solid budget in place, you’re well-positioned to take the next step in your financial journey: building and managing your savings effectively.

How to Maximize Your Savings

At Davies Wealth Management, we believe that building and managing your savings is a critical component of financial success. A robust savings strategy provides a safety net for unexpected expenses and fuels your long-term financial goals.

Establish an Emergency Fund

Your first savings priority should be to establish an emergency fund. This financial cushion protects you from life’s unexpected curveballs, reduces stress, and prevents the need to rely on high-interest credit cards or loans. An emergency fund is a cash reserve that’s specifically set aside for unplanned expenses or financial emergencies.

To build your emergency fund quickly, consider temporarily redirecting funds from non-essential expenses. For instance, cut back on dining out or entertainment for a few months to accelerate your savings. Place these funds in a high-yield savings account for easy access and better interest rates.

Explore Different Savings Options

Once your emergency fund is in place, explore different savings options to maximize your returns. High-yield savings accounts, certificates of deposit (CDs), and money market accounts often offer better interest rates than traditional savings accounts. High-interest deposit accounts beat regular bank accounts when it comes to the best places for your money, helping your balance grow faster.

For longer-term goals, consider investment options like index funds or ETFs. These can potentially offer higher returns over time (though they come with more risk). Always align your savings strategy with your risk tolerance and time horizon.

Set Up Automatic Savings

Automation is a powerful tool for consistent saving. Set up automatic transfers from your checking account to your savings accounts on payday. This “pay yourself first” approach ensures you save before you have a chance to spend. Many employers also offer direct deposit into multiple accounts, allowing you to automatically divert a portion of your paycheck to savings.

Increase Your Savings Rate

Increasing your savings rate is essential for accelerating your financial progress. Start by thoroughly reviewing your budget to identify additional savings opportunities. Can you negotiate better rates on recurring bills like insurance or phone plans? Could you downsize your living space or vehicle to reduce major expenses?

Consider adopting a “savings challenge” to motivate yourself. For example, the 52-week money challenge, where you save increasing amounts each week, can help you accumulate a significant sum in a year. Adjust the amounts based on your income and goals.

Additionally, earmark any windfalls – tax refunds, bonuses, or gifts – for savings. This strategy can provide significant boosts to your savings without impacting your regular budget.

Final Thoughts

Personal finance planning shapes your future and creates opportunities for you and your loved ones. It provides a roadmap to financial security, reduces stress, and empowers you to make informed decisions about your money. The importance of personal finance planning cannot be overstated, as it allows you to take control of your finances and achieve your goals.

We encourage you to take action and start planning for your financial success today. Implement the strategies we’ve discussed, from tracking your expenses to automating your savings. Small steps taken consistently can lead to significant results over time (especially when compounded over years).

At Davies Wealth Management, we help individuals achieve their financial goals through personalized wealth management solutions. Our team of experts can provide the guidance and support you need to navigate your financial journey with confidence. Don’t wait to secure your financial future – the steps you take today will pave the way for a more prosperous tomorrow.

Leave a Reply