Welcoming a newborn into your family is a joyous occasion, but it also brings significant financial responsibilities. At Davies Wealth Management, we understand the importance of newborn financial planning to secure your child’s future.

This comprehensive guide will walk you through essential steps to prepare your finances for your new arrival. From budgeting and saving to insurance considerations, we’ll cover key aspects to help you navigate this exciting chapter of your life.

Financial Foundations for New Parents

Revamping Your Budget

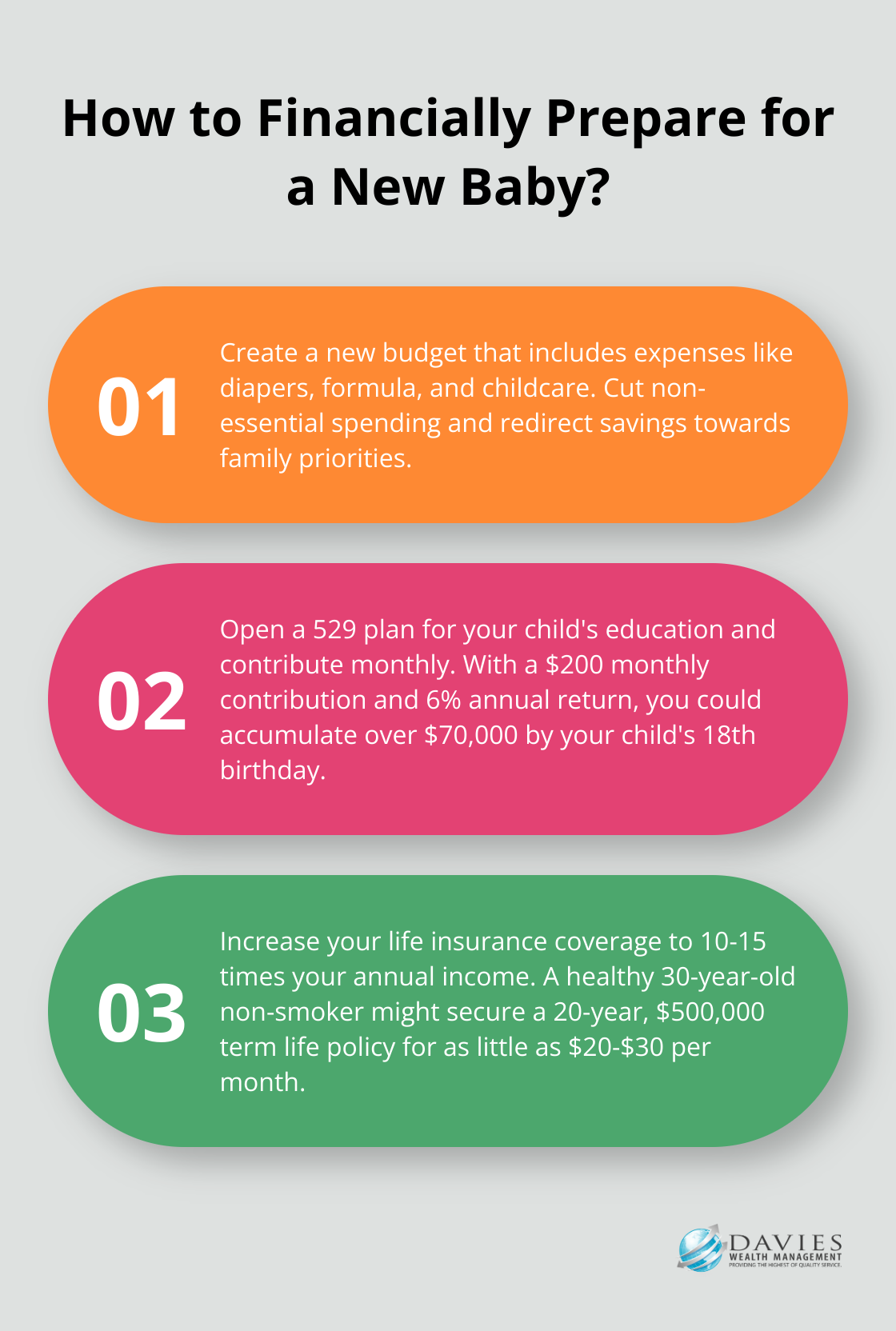

Parenthood transforms your finances. Your first task is to overhaul your budget. Track your current spending for a month. Then, add new expenses like diapers, formula, and childcare. Prepare for a significant increase in your monthly outgoings.

Eliminate non-essential expenses where possible. Many new parents naturally spend less on dining out and entertainment. Redirect these savings towards your new family priorities.

Boosting Your Emergency Fund

An emergency fund is essential for all families, especially those with a newborn. Increasing your emergency fund is one of the key financial planning tips for new parents. Try to save at least six months of living expenses. This may seem challenging, but even small, consistent contributions make a difference.

Automate your savings. Set up a direct deposit from your paycheck into a high-yield savings account. Online banks often offer better interest rates than traditional brick-and-mortar institutions.

Navigating Healthcare Costs

Healthcare costs can increase dramatically with a new baby. Review your health insurance policy carefully. Understand what’s covered for prenatal care, delivery, and pediatric visits.

A study found that the average out-of-pocket spending for a vaginal birth was $1,875, while for a c-section it was about 5% higher at $1,962. Start setting aside money for these expenses immediately.

Consider opening a Health Savings Account (HSA) if you’re eligible. HSAs offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Planning for Childcare

Childcare often represents one of the largest expenses for new parents. Research options and costs in your area early.

Investigate Dependent Care Flexible Spending Accounts (FSAs) offered by many employers. These allow you to set aside pre-tax dollars for childcare expenses, potentially saving you thousands each year.

Seeking Professional Guidance

Financial planning for a newborn requires careful consideration and expert advice. A professional financial advisor can help you navigate this complex landscape, ensuring you make informed decisions that align with your long-term goals. At Davies Wealth Management, we specialize in helping new parents create comprehensive financial strategies tailored to their unique situations.

As we move forward, let’s explore how to secure your child’s future through smart saving and investment strategies.

Securing Your Child’s Financial Future

Start with a Simple Savings Account

Opening a savings account for your newborn marks an excellent first step. Many banks offer special children’s savings accounts with no fees and competitive interest rates. Capital One’s Kids Savings Account, for example, offers a 0.30% APY with no minimum balance requirement. This account can store monetary gifts from family and friends, introducing your child to the concept of saving early on.

Leverage the Power of 529 Plans

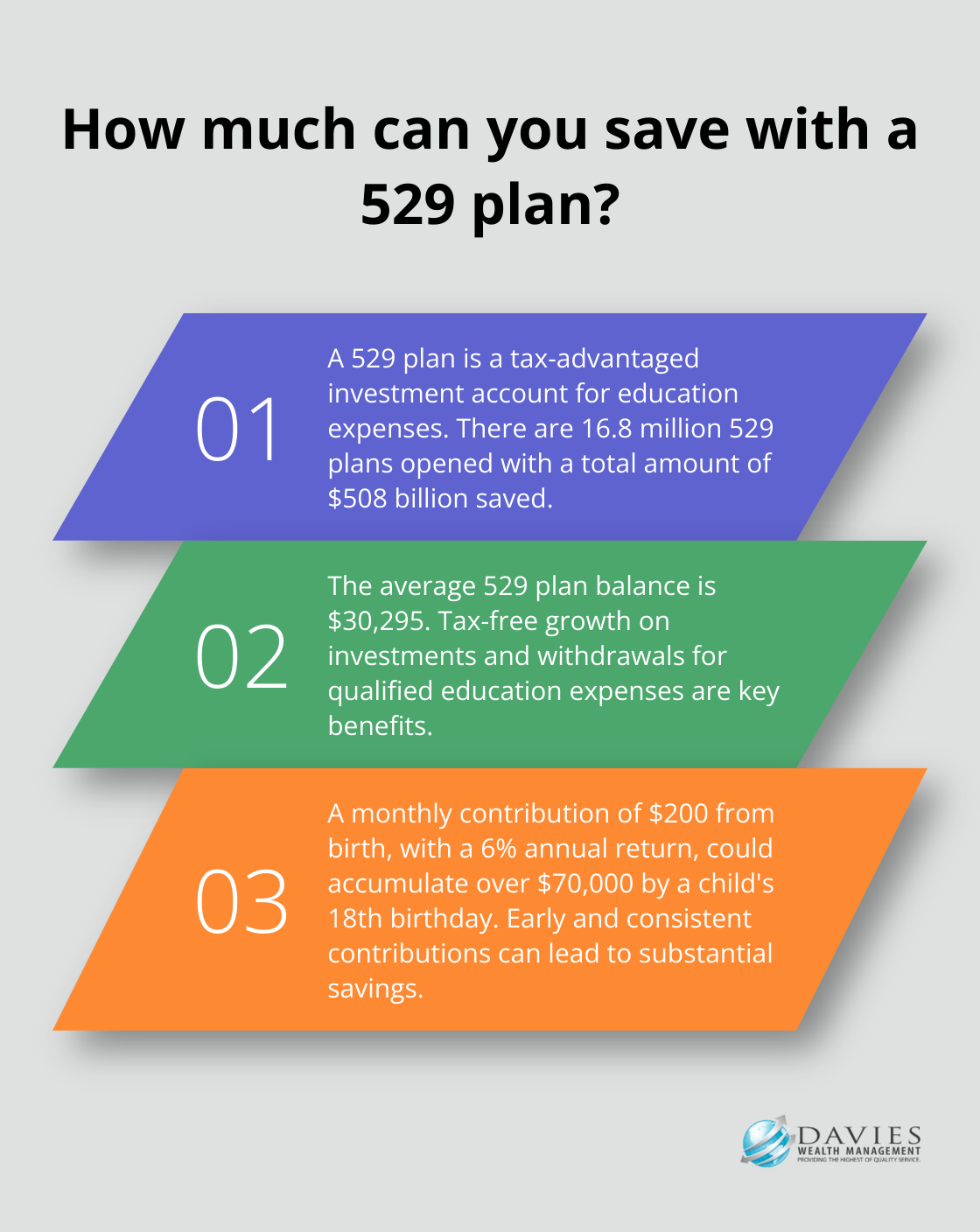

A 529 plan is a tax-advantaged investment account designed specifically for education expenses. These plans offer significant benefits:

- Tax-free growth on investments

- Tax-free withdrawals for qualified education expenses

- Potential state tax deductions on contributions

The total amount saved in 529 plans is $508 billion, with 16.8 million plans opened. The average 529 plan balance is $30,295. Early contributions can lead to substantial savings. For instance, a monthly contribution of $200 from birth, assuming a 6% annual return, could accumulate over $70,000 by your child’s 18th birthday.

Explore Custodial Accounts for Flexibility

Uniform Gifts to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) accounts provide more flexibility than 529 plans. These custodial accounts allow you to save and invest on behalf of your child for any purpose, not just education.

UGMA/UTMA accounts offer some tax advantages. If your child’s interest, dividends, and other unearned income total more than $2,600, it may be subject to a specific tax on the unearned income.

Consider Professional Guidance

The complexity of these options can overwhelm new parents. Professional financial advisors specialize in creating comprehensive financial strategies for families. They can help you select the right mix of savings and investment vehicles tailored to your family’s unique needs and goals.

The key to successful long-term saving is consistency. Start early, contribute regularly, and adjust your strategy as your child grows and your financial situation evolves.

Proper financial preparation can help manage the costs associated with raising a child and help to ensure your family’s financial stability.

As you secure your financial future, it’s equally important to protect your growing family through appropriate insurance coverage. Let’s explore the insurance considerations that new parents should keep in mind.

Protecting Your Family’s Financial Future

Life Insurance: A Foundation of Financial Security

Life insurance is essential for new parents, providing financial security by covering both working and stay-at-home parents. The birth of a child often requires an increase in your coverage. A general rule suggests having 10-15 times your annual income in life insurance, but this can vary based on your specific circumstances.

Term life insurance often proves the most cost-effective option for new parents. A healthy 30-year-old non-smoker might secure a 20-year, $500,000 term life policy for as little as $20-$30 per month. This affordable coverage ensures your family’s financial stability even in your absence.

Consider coverage for both parents, even if one isn’t the primary breadwinner. The cost of replacing childcare and household management can be substantial.

Disability Insurance: Protecting Your Income

Social Security Disability Insurance (SSDI) or “Disability” provides monthly payments to people who have a condition that affects their ability to work. This protection is particularly important for new parents who rely on their income to support their growing family.

The Social Security Administration reports that one in four 20-year-olds will become disabled before reaching retirement age. Despite this, many people overlook disability insurance. If your employer offers group disability insurance, it often provides a good starting point. However, these policies typically only cover 60% of your base salary and may have other limitations.

Try to supplement employer-provided coverage with an individual disability insurance policy. These policies offer more comprehensive coverage and stay with you even if you change jobs. While costs vary, expect to pay between 1-3% of your annual income for a robust disability insurance policy.

Health Insurance: Navigating New Needs

The arrival of a newborn significantly impacts your health insurance needs. A Kaiser Family Foundation analysis found the average cost of having a baby is nearly $18,900 for people with large employer group insurance.

Review your current health insurance policy carefully. Understand your deductible, out-of-pocket maximum, and coverage for pediatric care. Many plans allow you to add your newborn within 30 days of birth without waiting for open enrollment.

Consider switching to a family health insurance plan if you and your partner have separate policies. While family plans cost more, they often provide better overall coverage and can simplify your healthcare management.

High-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) can offer an excellent option for young, healthy families. (In 2023, families can contribute up to $7,750 to an HSA, offering triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.)

Navigating these insurance decisions can prove complex. A financial consultant can help you assess your specific needs and design a comprehensive insurance strategy that provides optimal protection for your growing family. The right insurance coverage isn’t just about financial protection-it’s about peace of mind as you embark on the exciting journey of parenthood.

Final Thoughts

Newborn financial planning requires a comprehensive approach to secure your family’s future. You must revise your budget, increase your emergency fund, and plan for higher healthcare costs to establish a solid foundation. Opening savings accounts, understanding 529 college savings plans, and exploring custodial accounts will help you start saving for your child’s future early.

Insurance plays a key role in protecting your family’s financial well-being. You should review and update life insurance policies, explore disability insurance options, and understand health insurance changes to safeguard your family’s financial security. These steps will provide peace of mind as you embark on the exciting journey of parenthood.

At Davies Wealth Management, we specialize in helping new parents create tailored financial strategies. Our expertise in investment management, retirement planning, and tax-efficient strategies can help you make informed decisions that align with your long-term goals. We encourage you to seek professional guidance to navigate the complexities of financial planning for your growing family.

Leave a Reply