Tax planning and strategies can significantly impact your financial well-being. At Davies Wealth Management, we understand the importance of optimizing your tax situation to preserve and grow your wealth.

Effective tax planning goes beyond simply filing your returns on time. It involves a comprehensive approach to managing your finances, maximizing deductions, and leveraging available opportunities to minimize your tax burden legally.

Understanding Tax Planning Fundamentals

What Is Tax Planning?

Tax planning is a strategic approach to manage finances with the goal of minimizing tax liability within legal boundaries. It requires a thorough understanding of the tax code, identification of tax-saving opportunities, and informed decision-making about income, investments, and expenses.

The impact of effective tax planning cannot be underestimated. Implementation of sound tax strategies can potentially save individuals thousands of dollars annually (freeing up resources for savings, investments, or other financial goals). Moreover, proper tax planning helps avoid costly mistakes and reduces the risk of audits or penalties from the Internal Revenue Service (IRS).

Key Components of Effective Tax Strategies

Timing

Careful consideration of when to recognize income or incur expenses can potentially lower overall tax burden. For example, if an individual expects to be in a lower tax bracket next year, it might make sense to defer some income to that year (if possible).

Leveraging Deductions and Credits

The U.S. tax code offers numerous opportunities to reduce taxable income or directly lower tax bills. Contributing to a traditional IRA or 401(k) can lower taxable income, while the Child Tax Credit can directly reduce tax liability for those with qualifying children.

Asset Allocation

Strategic placement of investments in different types of accounts (taxable, tax-deferred, and tax-free) optimizes after-tax returns. Holding growth stocks in a taxable account and bonds in a tax-deferred account (like a traditional IRA) can be more tax-efficient in many cases.

Debunking Common Tax Optimization Myths

Myth 1: All Tax Deductions Are Equally Beneficial

The value of a deduction depends on an individual’s tax bracket. A $1,000 deduction is worth $370 to someone in the 37% tax bracket but only $120 to someone in the 12% bracket.

Myth 2: Tax Planning Is Only for the Wealthy

While high-net-worth individuals may have more complex tax situations, everyone can benefit from basic tax planning strategies. Even simple actions like contributing to a retirement account or timing charitable donations can lead to significant tax savings for individuals at all income levels.

Myth 3: Aggressive Tax Planning Always Leads to Better Outcomes

Overly aggressive strategies can increase the risk of audits and penalties. The goal should be to minimize taxes within the bounds of the law, not to evade taxes altogether.

As we move forward to discuss implementing effective tax reduction strategies, it’s important to note that professional guidance can significantly enhance the effectiveness of your tax planning efforts. A qualified tax advisor can help navigate the complexities of the tax code and develop a personalized strategy that aligns with your overall financial goals.

Effective Tax Reduction Techniques

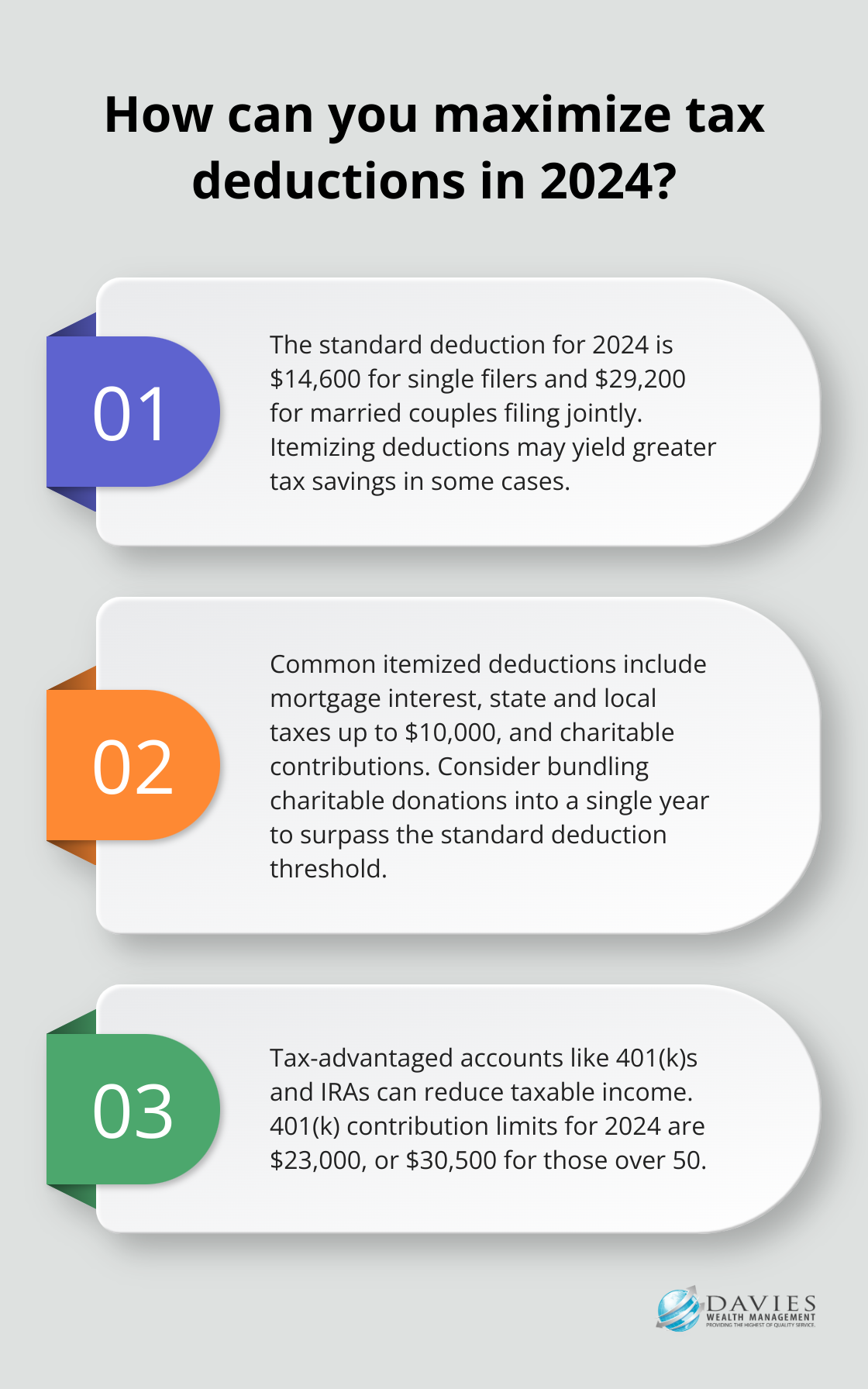

Maximize Your Deductions

Tax reduction forms a critical part of financial planning. The standard deduction for 2024 stands at $14,600 for single filers and $29,200 for married couples filing jointly. However, itemizing deductions might yield greater tax savings in some cases.

Common itemized deductions include:

- Mortgage interest

- State and local taxes (up to $10,000)

- Charitable contributions

If you’re close to the standard deduction threshold, consider bundling your charitable donations into a single year to surpass it and itemize.

Leverage Tax-Advantaged Accounts

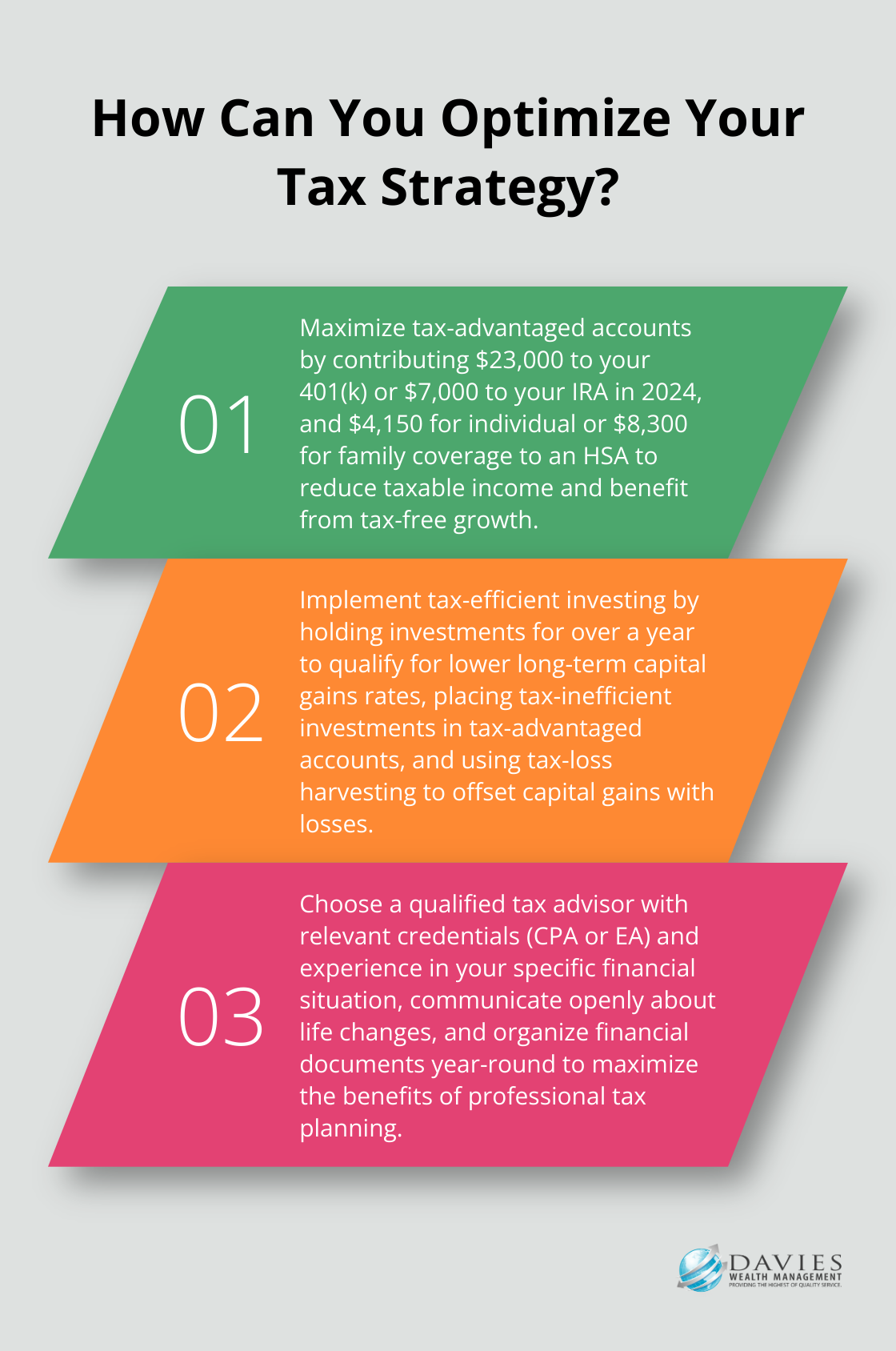

Tax-advantaged accounts offer a powerful way to reduce your taxable income. Traditional 401(k)s and IRAs allow you to contribute pre-tax dollars, which effectively lowers your taxable income for the year. For 2024, contribution limits are:

- 401(k): $23,000 ($30,500 if you’re over 50)

- IRA: $7,000 ($8,000 if you’re over 50)

Health Savings Accounts (HSAs) provide triple tax benefits:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

In 2024, you can contribute up to $4,150 for individual coverage or $8,300 for family coverage to an HSA.

Strategic Timing of Income and Expenses

The timing of your income and expenses can significantly impact your tax liability. If you’re self-employed or have control over when you receive income, consider deferring income to the following year if you expect to be in a lower tax bracket.

Similarly, accelerating deductible expenses into the current year can lower your taxable income. For instance, making a large charitable donation before year-end could provide immediate tax benefits.

Tax-Efficient Investing

Implementing tax-efficient investing strategies can help minimize your tax burden. Consider these approaches:

- Hold investments for more than a year to qualify for long-term capital gains rates (which are typically lower than short-term rates).

- Place tax-inefficient investments (like bonds) in tax-advantaged accounts.

- Use tax-loss harvesting to offset capital gains with losses.

Work with a Professional

Tax laws change frequently, and navigating the complexities of the tax code can be challenging. A qualified tax professional can help you develop a comprehensive tax strategy tailored to your unique financial situation. They can identify opportunities for tax savings that you might overlook on your own and ensure you remain compliant with all relevant tax laws and regulations.

As we move forward, it’s important to consider how these tax reduction techniques fit into your overall financial plan. The next section will explore the benefits of working with a professional tax advisor and how they can help you implement these strategies effectively.

Working with a Professional Tax Advisor

Benefits of Partnering with a Tax Expert

The complex world of taxes can overwhelm even the most financially savvy individuals. A professional tax advisor brings valuable expertise to the table, potentially saves you significant time and money, and reduces stress.

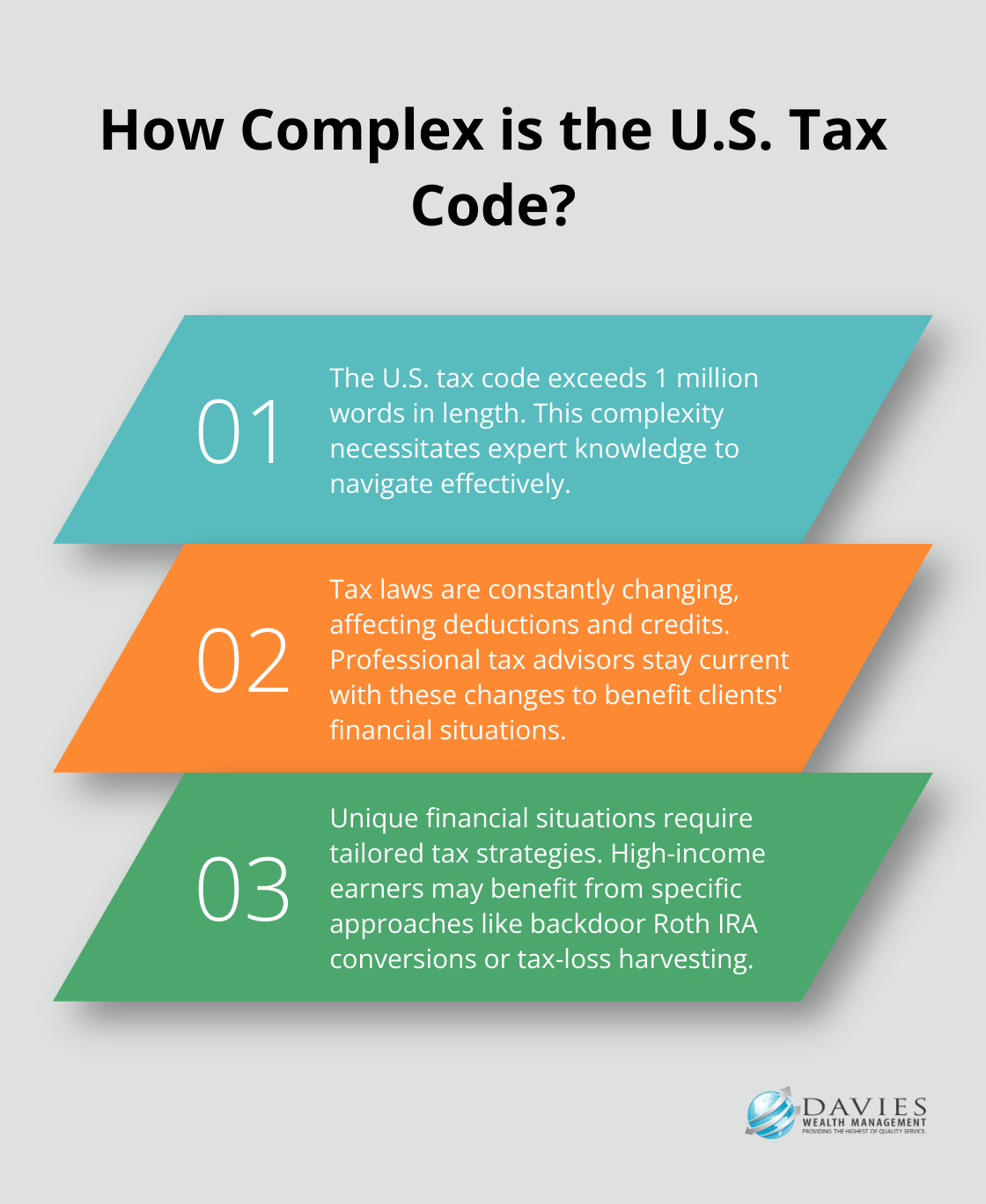

Tax laws are notoriously complex and constantly change. The U.S. tax code is well over 1 million words long. A seasoned tax expert stays current with these changes, ensures you don’t miss new deductions or credits that could benefit your financial situation.

Every individual’s financial situation is unique. A tax professional can develop a tailored strategy that aligns with your specific goals and circumstances. For high-income earners, they might suggest strategies like backdoor Roth IRA conversions or tax-loss harvesting to optimize your tax situation.

Audit Protection and Risk Mitigation

While audit rates vary, certain factors can increase your chances of being audited. A tax professional not only helps minimize audit risk but also provides representation if you face an audit. This support proves invaluable in navigating the complex audit process.

How to Choose the Right Tax Advisor

When selecting a tax advisor, consider their qualifications, experience, and areas of expertise. Look for credentials such as Certified Public Accountant (CPA) or Enrolled Agent (EA). These designations indicate a high level of expertise and adherence to professional standards.

Ask potential advisors about their experience with situations similar to yours. Business owners need someone well-versed in business tax law. Those with complex investment portfolios require an advisor with expertise in investment taxation.

Inquire about their fee structure upfront. Some advisors charge by the hour, while others have flat fees for specific services. Understanding the cost beforehand helps you budget for this important service.

Maximizing Your Advisor Relationship

To get the most out of your partnership with a tax advisor, maintain open and frequent communication. Inform them of major life changes such as marriage, divorce, or the birth of a child, as these events can significantly impact your tax situation.

Organize your financial documents throughout the year. This practice not only makes tax season smoother but also allows your advisor to provide more comprehensive advice. Consider using digital tools or apps to track expenses and store receipts, making it easier to share information with your advisor.

The Role of Wealth Management in Tax Planning

While wealth management firms like Davies Wealth Management don’t typically provide direct tax preparation services, they play a critical role in overall tax planning. A comprehensive wealth management approach considers the tax implications of every financial decision.

Wealth managers can help identify qualified tax advisors who align with your needs and coordinate with them to create a comprehensive financial strategy. This collaboration minimizes your tax burden while maximizing your wealth potential.

Final Thoughts

Tax planning and strategies require ongoing attention and adjustment as financial situations evolve and tax laws change. Regular reviews of tax strategies ensure you take advantage of all available opportunities and adapt to new regulations. This proactive approach can lead to substantial savings over time and help you achieve your long-term financial goals more efficiently.

We understand the complexities of tax planning and its important role in overall wealth management. Our team of experts can help you navigate the intricacies of tax optimization, ensuring that your financial strategies align with your goals while minimizing your tax burden. Whether you’re a professional athlete, business owner, or individual seeking financial security, we offer tailored solutions to meet your unique needs.

To learn more about how we can assist you with tax planning and comprehensive wealth management, visit our website and take the first step towards a more secure financial future. Effective tax planning and strategies create a solid foundation for long-term financial success. You can preserve more of your hard-earned wealth and put it to work towards achieving your financial aspirations.

Leave a Reply