At Davies Wealth Management, we understand that optimizing tax strategies for W2 employees can be a complex task.

Many workers overlook valuable opportunities to reduce their tax burden and maximize their take-home pay.

This guide will explore effective methods to optimize your tax situation, from maximizing deductions to leveraging tax-advantaged accounts.

How W2 Employees Can Maximize Tax Deductions

Understanding Standard vs. Itemized Deductions

W2 employees must choose between the standard deduction and itemizing deductions. For 2023, the standard deduction stands at $13,850 for single filers and $27,700 for married couples filing jointly. Itemizing proves beneficial when the total of itemized deductions exceeds these amounts.

Key Deductions for W2 Employees

Homeowners can deduct mortgage interest on their home mortgage debt. This deduction includes discussions on points and how to report deductible interest on your tax return. Property taxes also offer deduction opportunities, but state and local tax (SALT) deductions cap at $10,000.

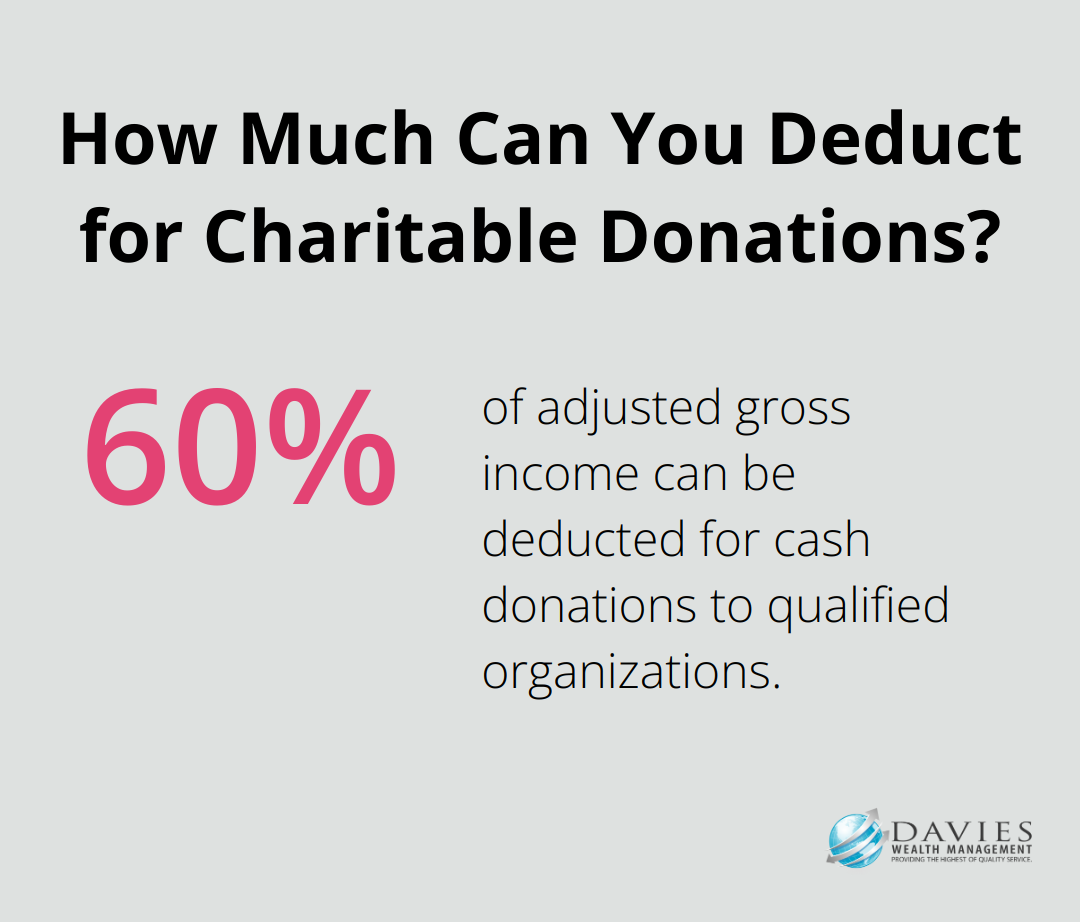

Charitable contributions provide substantial tax benefits. Cash donations to qualified organizations allow deductions up to 60% of adjusted gross income. Non-cash donations (e.g., clothing or household items) can be deducted based on fair market value.

Some states still permit deductions for unreimbursed job expenses on state tax returns, despite their elimination from federal taxes. Check your state’s specific tax laws to determine eligibility.

The Power of Accurate Record-Keeping

Proper documentation supports all claimed deductions. Maintain detailed records of potentially deductible expenses throughout the year. This includes receipts, bank statements, and mileage logs. The IRS requires documentation to support all deductions on tax returns.

A dedicated credit card for deductible expenses simplifies tracking. Many tax preparation software options offer features to organize and categorize expenses throughout the year.

Staying Informed About Tax Law Changes

Tax laws evolve frequently. What qualified as a deduction last year might not apply this year. Stay informed about current tax laws or consult with a tax professional to optimize your deduction strategy.

Leveraging Tax-Advantaged Accounts

W2 employees should explore tax-advantaged accounts to further reduce their taxable income. These accounts can offer tax benefits such as deductible contributions, tax-free growth, and tax-free withdrawals for eligible individuals.

As we move forward, let’s examine how these tax-advantaged accounts can play a pivotal role in your comprehensive tax optimization plan.

Maximizing Retirement Savings for Tax Benefits

The 401(k) Decision: Traditional vs. Roth

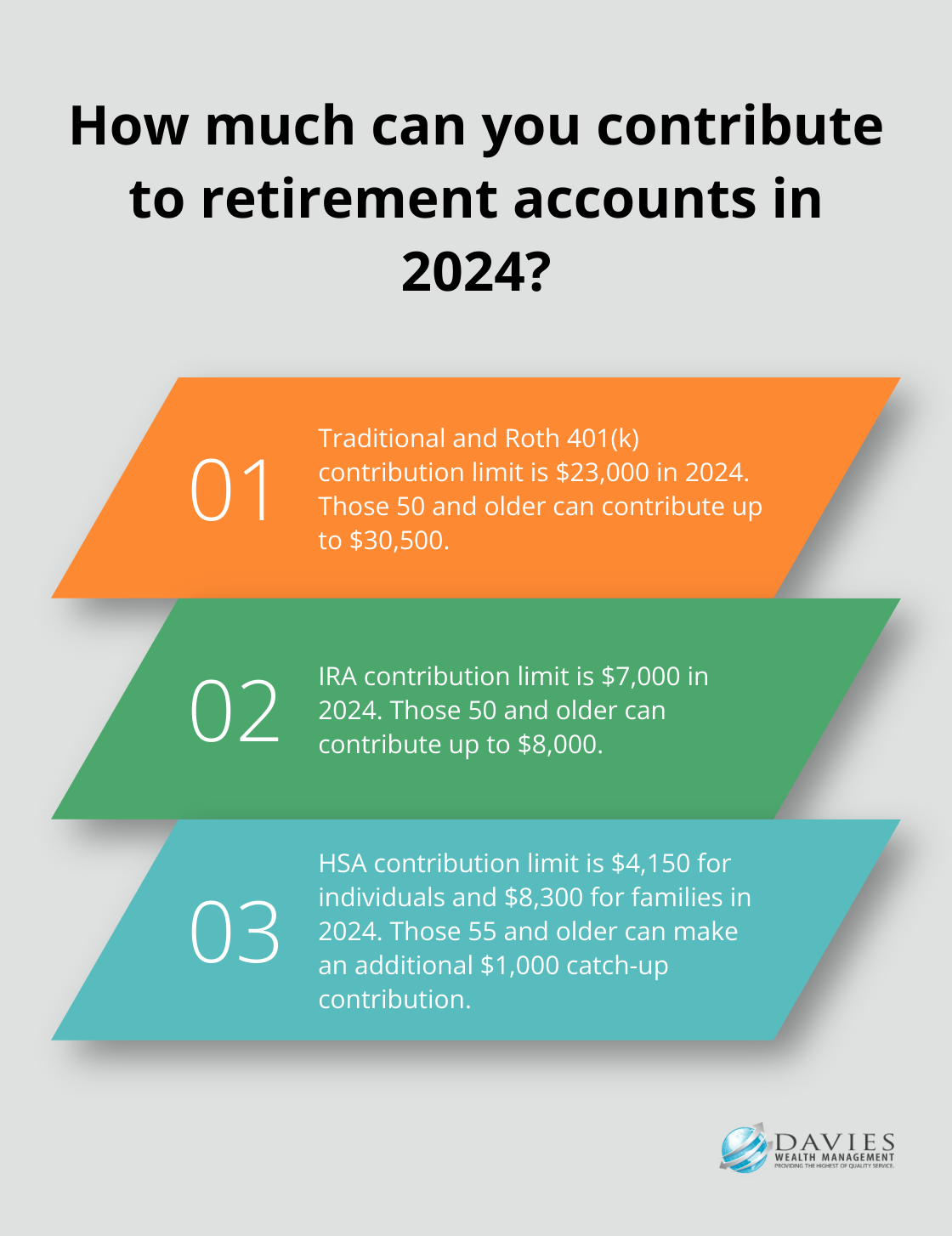

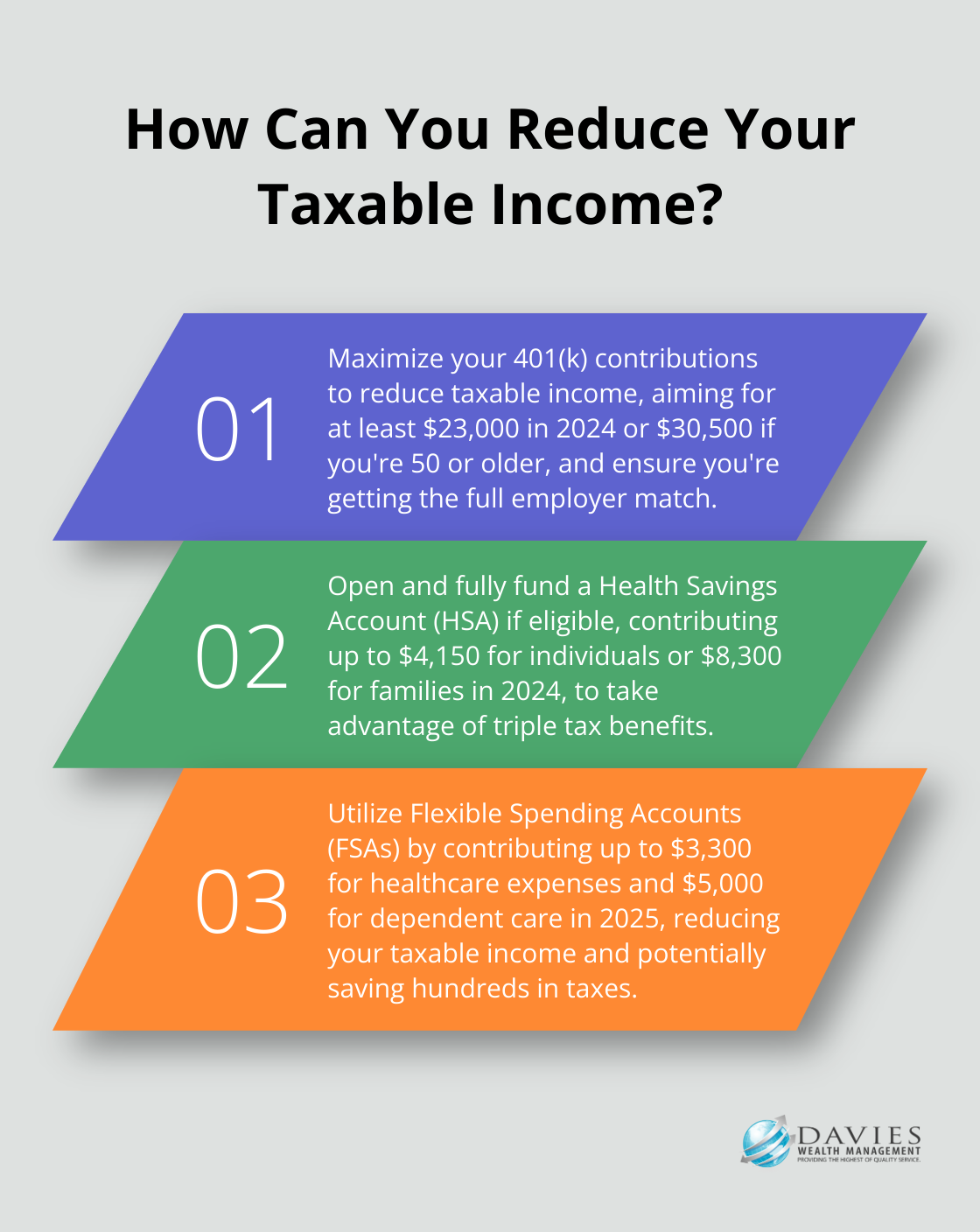

W2 employees must choose between traditional and Roth 401(k) options. Traditional 401(k) contributions reduce current taxable income. Employees can contribute up to $23,000 to their 401(k) in 2024 ($30,500 for those 50 and older). This results in substantial tax savings, especially for high-income earners.

Roth 401(k) contributions use after-tax dollars but provide tax-free growth and qualified withdrawals in retirement. This option appeals to those who expect higher tax brackets in retirement or believe current tax rates are low.

A combination of both traditional and Roth contributions often provides the best tax diversification in retirement. The optimal mix depends on your current tax situation, expected future income, and financial goals.

Exploring IRA Opportunities

Individual Retirement Accounts (IRAs) offer additional tax-advantaged savings. Traditional IRAs allow tax-deductible contributions up to $7,000 in 2024 ($8,000 for those 50 or older), subject to income limits for those with workplace retirement plans. Earnings grow tax-deferred until withdrawal.

Roth IRAs provide tax-free growth and withdrawals in retirement but don’t offer immediate tax deductions. High-income earners who exceed contribution limits can use the backdoor Roth IRA strategy (non-deductible contribution to a traditional IRA followed by immediate conversion to a Roth IRA).

Harnessing the Power of HSAs

Health Savings Accounts (HSAs) offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2024, individuals with high-deductible health plans can contribute up to $4,150 to an HSA (families can contribute up to $8,300). Those 55 and older can make an additional $1,000 catch-up contribution.

HSAs serve as powerful retirement savings tools. After age 65, you can withdraw funds for non-medical expenses without penalty (paying only income tax, similar to a traditional IRA). This flexibility makes HSAs attractive for long-term savings beyond healthcare costs.

Maximizing Employer Matches

Many employers offer matching contributions to 401(k) plans. You should contribute at least enough to receive the full employer match (this is essentially free money). Employer matches don’t count towards your annual contribution limit, allowing you to save even more for retirement while reducing your tax burden.

Considering Mega Backdoor Roth Strategies

Some 401(k) plans allow for after-tax contributions beyond the standard limits. These contributions can then be converted to a Roth account, potentially allowing for significant additional tax-free growth. This strategy (known as the mega backdoor Roth) can be complex, so consult with a financial advisor to determine if it’s appropriate for your situation.

The next chapter will explore additional strategies for reducing taxable income, including Flexible Spending Accounts (FSAs) and educational expense considerations.

How to Further Reduce Your Taxable Income

Maximize Flexible Spending Accounts (FSAs)

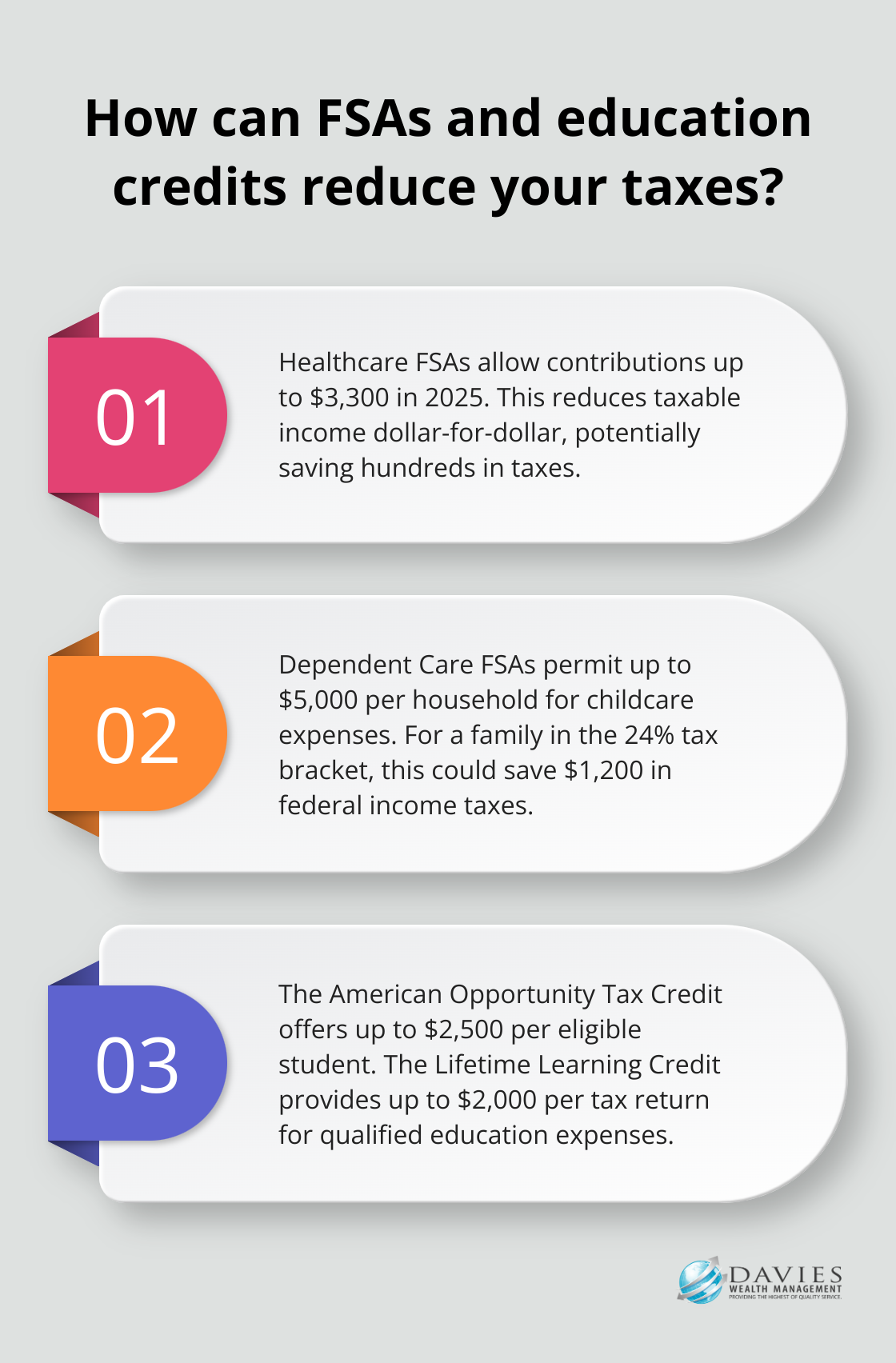

FSAs offer W2 employees a powerful tool to reduce taxable income. These employer-sponsored accounts allow you to set aside pre-tax dollars for specific expenses. Healthcare FSAs, the most common type, cover out-of-pocket medical costs. In 2025, you can contribute up to $3,300 to a healthcare FSA, which reduces your taxable income dollar-for-dollar. This reduction can potentially save you hundreds in taxes.

FSAs typically have a “use it or lose it” policy. You must estimate your annual healthcare expenses carefully to avoid forfeiting unused funds. Some plans offer a grace period or allow you to carry over a limited amount to the next year. Check with your employer for specific rules.

Utilize Dependent Care FSAs

If you have children under 13 or care for a disabled dependent, a Dependent Care FSA can offer substantial tax savings. In 2025, you can contribute up to $5,000 per household ($2,500 if married filing separately) to cover eligible childcare or adult dependent care expenses.

This benefit directly reduces your taxable income, potentially moving you into a lower tax bracket. For a family in the 24% tax bracket, maxing out a Dependent Care FSA could save $1,200 in federal income taxes.

Take Advantage of Educational Expenses and Tax Credits

Education-related tax benefits can significantly reduce your tax liability. The American Opportunity Tax Credit (AOTC) offers up to $2,500 per eligible student for the first four years of higher education. The Lifetime Learning Credit (LLC) provides up to $2,000 per tax return for qualified education expenses (with no limit on the number of years you can claim it).

For ongoing professional development, you may deduct work-related education expenses that maintain or improve skills required in your current job. While this deduction is no longer available on federal returns, some states still allow it.

Consider Combining Strategies

You can combine these strategies to dramatically reduce your taxable income. For example, a high-earning professional with two children in daycare could save over $3,000 in taxes by maximizing both healthcare and dependent care FSAs. Another individual pursuing an MBA while working full-time could leverage education credits and state-level deductions to offset a significant portion of their tax liability.

Seek Professional Guidance

Tax laws change frequently, and individual circumstances vary. While these strategies can be powerful, they require careful planning and execution. Try to consult with a financial advisor to develop a comprehensive tax strategy tailored to your unique situation.

Final Thoughts

Tax strategies for W2 employees require a multifaceted approach. You can significantly reduce your tax burden by leveraging deductions, maximizing contributions to tax-advantaged accounts, and utilizing tools like FSAs. The key lies in understanding which strategies align best with your financial situation and goals.

Tax laws evolve with each legislative session, making it essential to stay informed about these changes. You must regularly review and adjust your tax strategies to take advantage of the most current opportunities for savings. The complexities of tax law often necessitate professional guidance to navigate the intricacies of tax planning and integrate tax strategies into your broader financial goals.

At Davies Wealth Management, we specialize in creating comprehensive financial plans that incorporate tax-efficient strategies for W2 employees (and other high-income individuals). Our team of experts can guide you through tax optimization, ensuring you make the most of every opportunity to secure your financial future. For personalized assistance with tax strategies for W2 employees, contact Davies Wealth Management today.

Leave a Reply