Financial planning is a journey with distinct stages, each crucial for building a secure financial future. At Davies Wealth Management, we’ve guided countless clients through these financial planning stages, helping them achieve their goals and dreams.

Understanding how to navigate these stages can make the difference between financial struggle and financial freedom. This guide will walk you through the key steps, providing practical advice to help you take control of your financial destiny.

Where Do You Stand Financially?

Net Worth: Your Financial Snapshot

Financial planning begins with a clear picture of your current financial situation. Your net worth provides this snapshot. To calculate it, list all your assets (savings accounts, investments, property, and valuable possessions) and subtract your debts (mortgages, loans, and credit card balances). This calculation reveals your financial health. A 2023 Federal Reserve report states that the median net worth for U.S. households was $121,700 (though this varies widely based on age and other factors).

Income and Expenses: The Cash Flow Picture

Understanding your cash flow is essential. Track your income sources and all expenses for at least three months. This process often uncovers surprising spending patterns. Average expenditures for all consumer units in 2023 were $77,280, a 5.9-percent increase from 2022, and average income before taxes increased 8.3 percent. Compare your spending to these benchmarks to identify potential savings areas.

Debt and Savings: Balancing Act

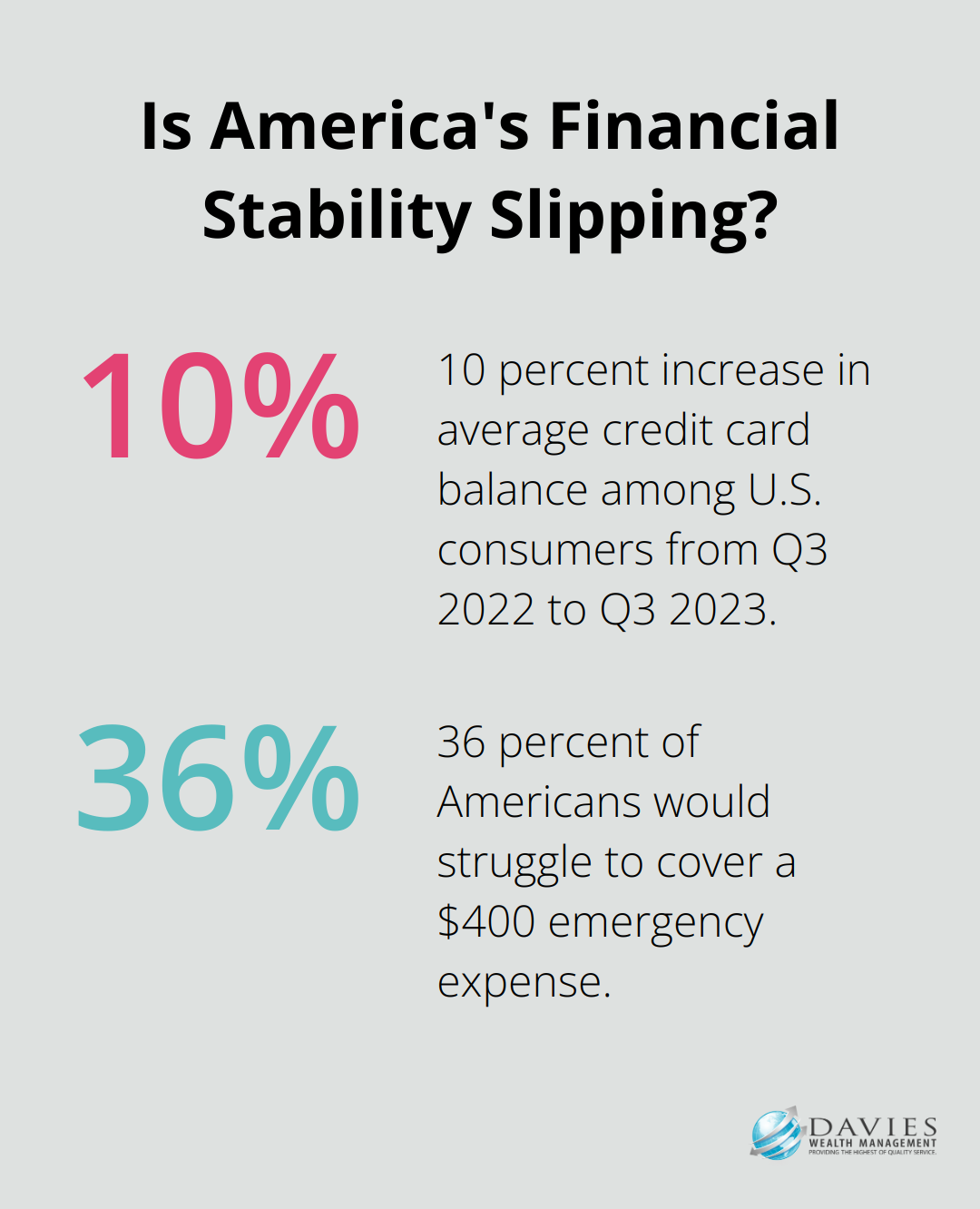

Evaluate your debt levels and savings. Experian’s report shows the average credit card balance among U.S. consumers was $6,501 as of Q3 2023, exactly 10% more than in Q3 2022. If your debt exceeds this, consider prioritizing debt repayment. For savings, try to build an emergency fund covering 3-6 months of expenses. The Federal Reserve reports that 36% of Americans would struggle to cover a $400 emergency expense, highlighting the importance of this financial cushion.

Professional Athletes: Unique Financial Landscapes

For professional athletes, who often have high but potentially short-term incomes, this assessment process is particularly important. Their unique financial situations require specialized strategies to navigate the complexities of their financial landscape. Davies Wealth Management offers expertise in this area, ensuring athletes are well-prepared for both their active career years and beyond.

A thorough assessment of your current financial situation lays the groundwork for effective goal-setting and planning. This clear understanding of where you stand financially propels you forward in the financial planning process. The next step involves setting concrete financial goals and creating a plan to achieve them.

What Are Your Financial Goals?

Short-Term vs. Long-Term Goals

Financial goals fall into two categories: short-term (less than a year) and long-term (5+ years). Short-term goals often include building an emergency fund, paying off credit card debt, or saving for a vacation. Long-term goals typically involve retirement savings, buying a home, or funding children’s education.

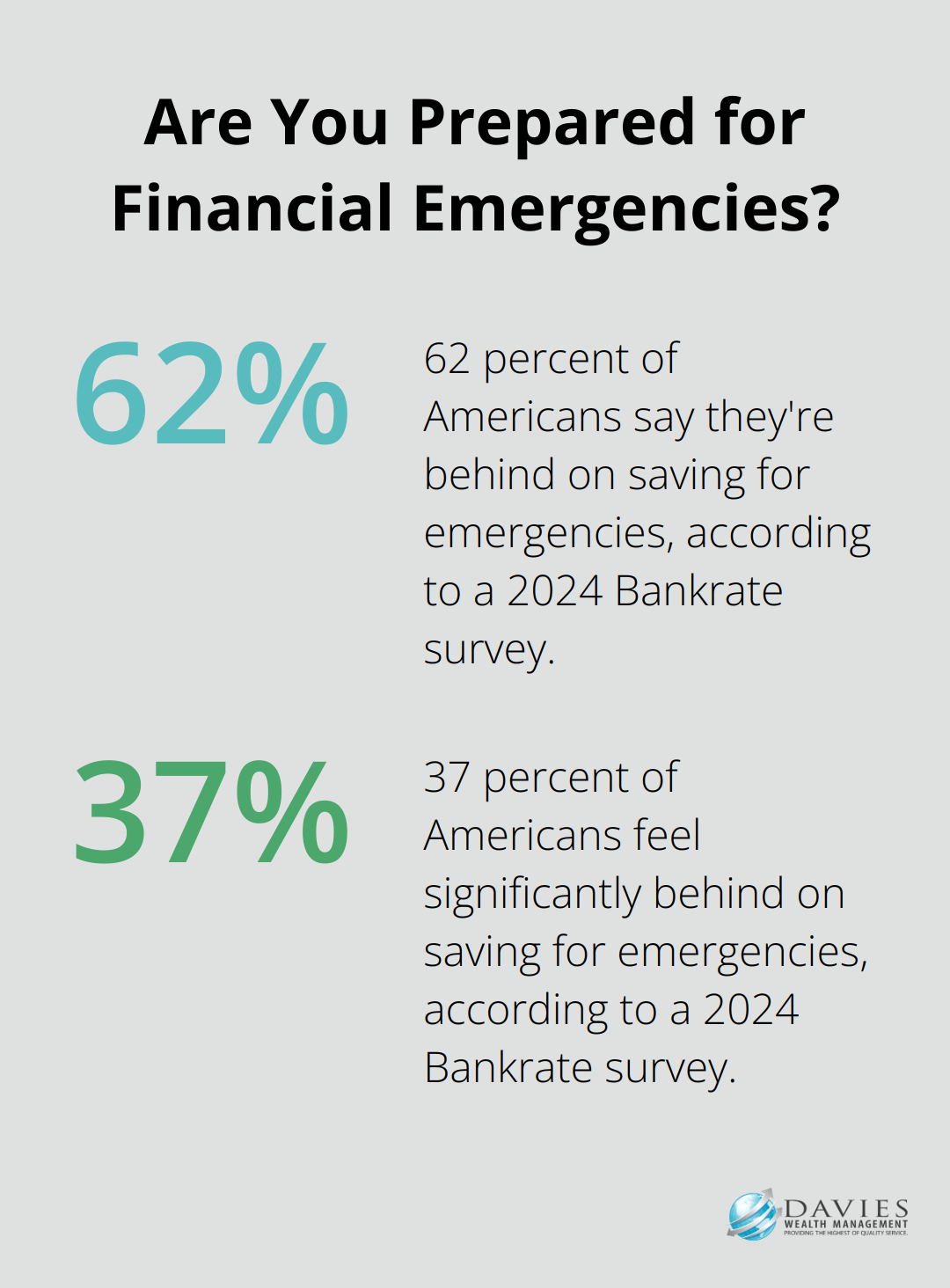

A 2024 survey by Bankrate revealed that nearly two-thirds of Americans (62 percent) say they’re behind on saving for emergencies, including 37 percent who feel significantly behind. This statistic highlights the need to set short-term goals for financial stability before tackling longer-term objectives.

Prioritizing Your Financial Objectives

After identifying your goals, prioritize them. Consider factors like urgency, importance, and potential impact on your overall financial health. For example, if you carry high-interest credit card debt, paying it off should take precedence over saving for a luxury vacation.

Professional athletes face unique prioritization challenges. The NFL Players Association reports that the average NFL career lasts 3.3 years. This brief earning window requires athletes to prioritize long-term financial security alongside short-term needs.

Creating Your Financial Action Plan

Develop a concrete plan with your prioritized goals. Set specific, measurable targets for each goal. Instead of “save more for retirement,” try to “increase 401(k) contributions by 2% annually.”

Establish a timeline for each goal. Be realistic – the Federal Reserve reports that the median retirement account balance for Americans aged 55-64 is just $134,000 (far below what most financial advisors recommend). This gap underscores the importance of starting early and setting achievable milestones.

Determine the actions needed to reach each goal. This might involve automating savings, cutting unnecessary expenses, or seeking additional income sources. For complex goals like retirement planning or managing a professional athlete’s finances, working with a specialized financial advisor can provide invaluable guidance and strategies.

Regular Review and Adjustment

Your life circumstances will change, and so should your financial objectives and strategies. Schedule regular reviews of your financial plan (at least annually) to ensure it remains aligned with your current situation and future aspirations.

Seeking Professional Guidance

For those with complex financial situations (such as professional athletes or high-net-worth individuals), professional guidance can prove invaluable. Davies Wealth Management specializes in creating personalized financial plans that address unique challenges and opportunities. Our expertise in areas like athlete wealth management ensures that even those with non-traditional income patterns can create robust, achievable financial plans.

As you move forward in your financial journey, the next step involves implementing your carefully crafted plan and monitoring your progress towards your goals.

Put Your Financial Plan into Action

Automate Your Financial Strategies

One of the most effective ways to implement your financial plan is through automation. Set up automatic transfers to your savings and investment accounts on payday. This strategy can help build consistency and overcome financial obstacles. For retirement savings, take full advantage of employer-sponsored 401(k) plans. The IRS has increased the contribution limit for 401(k) plans to $23,500 for 2025.

For professional athletes, who often have irregular income streams, we recommend a system that automatically allocates a percentage of each paycheck or endorsement deal to various financial goals. This approach ensures consistent progress towards long-term objectives, even with fluctuating income.

Conduct Regular Financial Check-Ups

Your financial plan requires regular attention and adjustments. Schedule quarterly reviews of your progress and annual comprehensive assessments of your entire financial picture. During these check-ups, evaluate your cash flow, investment performance, and progress towards your goals.

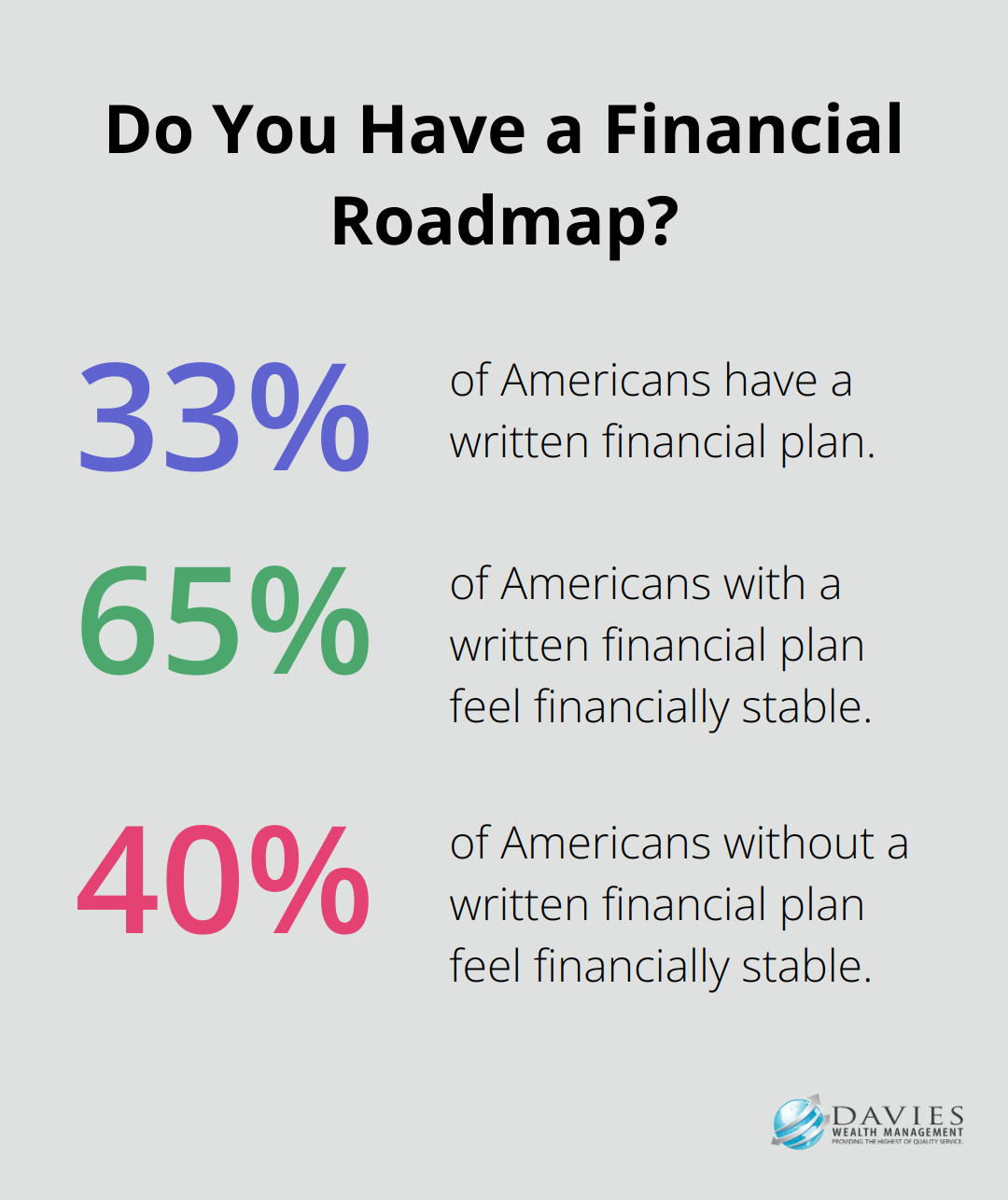

A survey by Charles Schwab found that only 33% of Americans have a written financial plan. Of those who do, 65% feel financially stable, compared to just 40% of those without a plan. Regular reviews help maintain this sense of financial stability and allow for timely adjustments when needed.

Measure Progress and Celebrate Milestones

Tracking your progress is essential for maintaining motivation and ensuring you’re on the right path. Use financial apps or spreadsheets to monitor your net worth, debt reduction, and savings growth. Set specific milestones and celebrate when you reach them. For example, when you pay off a credit card or reach 25% of your retirement savings goal, acknowledge the achievement.

For professional athlete clients, we often set up milestone-based rewards systems. This approach helps maintain focus during peak earning years and encourages smart financial decisions. Whether it’s reaching a certain net worth or fully funding a post-career business venture, these milestones provide tangible markers of financial progress.

Seek Professional Guidance

Implementing a financial plan can be complex, especially for those with unique financial situations. Professional athletes, high-net-worth individuals, or those with complex financial landscapes often benefit from expert advice. A qualified financial advisor can provide tailored strategies, help navigate market fluctuations, and ensure your plan stays aligned with your goals as your life circumstances change.

Stay Committed to Your Plan

Implementing your financial plan is an ongoing process that requires dedication and flexibility. Financial planning is a marathon, not a sprint. Stay committed to your plan, make adjustments as needed, and don’t hesitate to seek professional guidance when necessary. With consistent effort and the right strategies, you’ll be well-positioned to achieve your financial goals and secure your financial future.

Final Thoughts

Financial planning stages require dedication, knowledge, and adaptability. Each step shapes your financial future, from assessing your current situation to implementing strategies. The process demands continuous attention and adjustment as your life circumstances and financial objectives evolve.

Regular check-ups, automated savings, and milestone celebrations keep you engaged in your financial journey. Professional guidance can make a significant difference, especially for those with complex financial situations such as professional athletes. Our team at Davies Wealth Management creates comprehensive financial plans that address specific needs of individuals, families, and athletes.

Financial planning builds wealth, reduces stress, and helps achieve life aspirations. Take action today to secure a more prosperous future for yourself and your loved ones. Our specialized guidance provides invaluable insights and tailored solutions to equip you for financial success.

Leave a Reply