Divorce can turn your financial world upside down. At Davies Wealth Management, we understand the challenges of post-divorce financial planning and the importance of regaining control over your finances.

This guide will walk you through the essential steps to assess your new financial situation, create a sustainable budget, and rebuild your financial future after a divorce. We’ll provide practical advice to help you navigate this transition and set yourself up for long-term financial success.

Taking Stock After Divorce

Divorce marks a significant financial turning point, requiring a thorough assessment of your new financial landscape. This chapter will guide you through the essential steps to evaluate your post-settlement financial situation.

Cataloging Assets and Liabilities

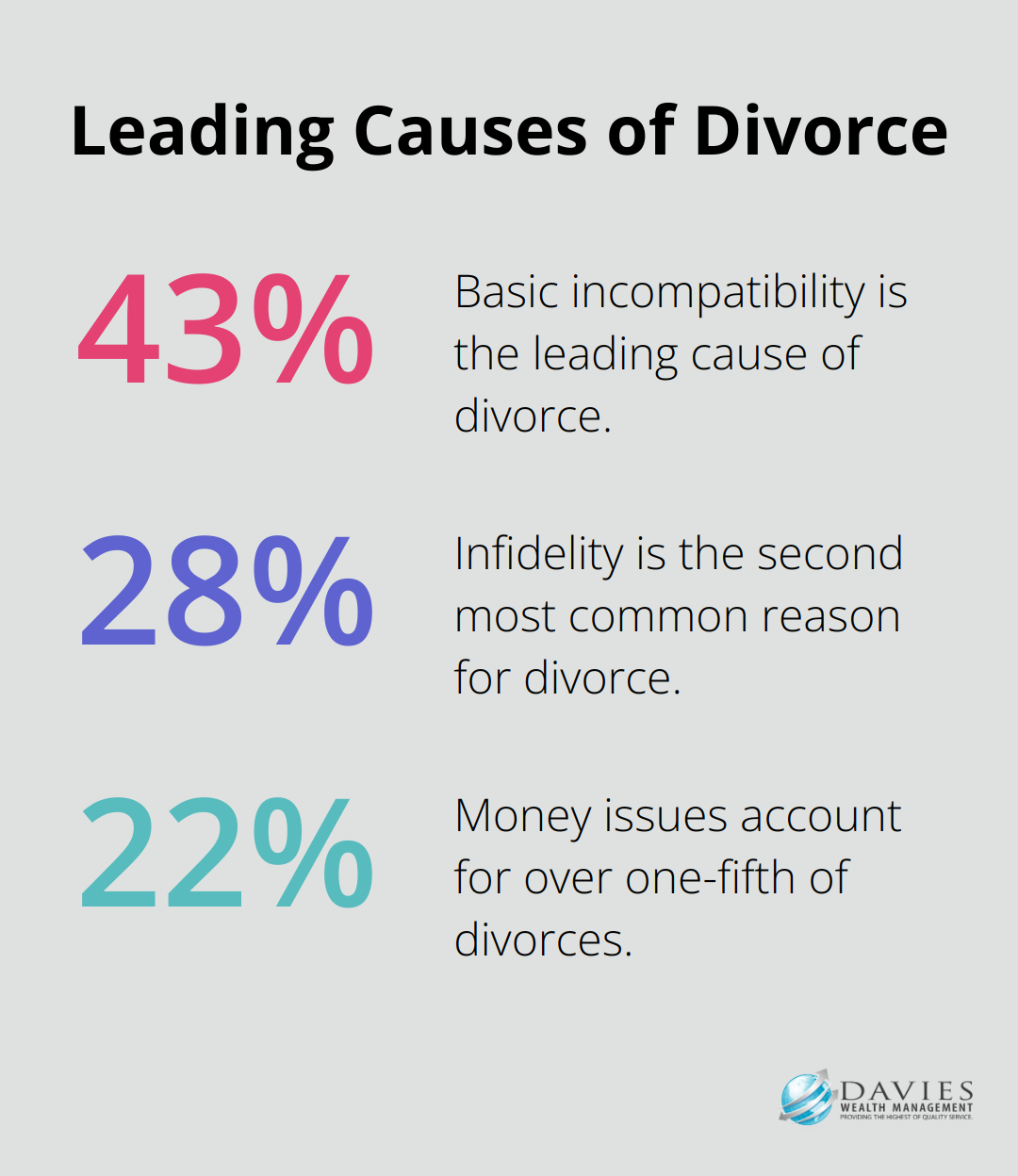

Start with a comprehensive inventory of all assets and debts allocated to you in the divorce settlement. This includes bank accounts, retirement funds, real estate, vehicles, and any outstanding loans or credit card balances. A study by the Institute for Divorce Financial Analysts reveals that basic incompatibility (43%), infidelity (28%), and money issues (22%) are the leading causes of divorce, highlighting the importance of clarity in financial matters.

Analyzing Cash Flow Changes

Your income and expense structure will likely change post-divorce. Calculate your new monthly income, including salary, alimony, child support, or investment returns. Then, list all your expenses, from housing and utilities to groceries and entertainment. This exercise will provide a clear picture of your financial standing and help identify areas where adjustments may be necessary.

Reassessing Insurance and Beneficiaries

It’s critical to review and update all insurance policies and beneficiary designations after divorce. This includes life insurance, health insurance, and retirement accounts.

Evaluating Retirement Plans

Divorce often impacts retirement savings. Review your current retirement accounts and adjust your contributions if necessary. Consider opening new accounts if you previously relied on joint retirement savings. It’s also important to understand how the division of retirement assets in the divorce settlement affects your long-term financial goals.

Addressing Tax Implications

The tax landscape changes significantly after divorce. Understand your new tax filing status and how it affects your overall tax liability. Consider consulting with a tax professional to navigate potential issues such as the tax implications of asset transfers, alimony payments, or changes in property ownership.

As you work through these steps, you’ll gain a clearer understanding of your new financial reality. This knowledge forms the foundation for creating a post-divorce budget that aligns with your current situation and future goals. Remember to revisit your financial priorities, be prepared for one-off expenses, and build an emergency savings fund.

Crafting Your Post-Divorce Financial Blueprint

Master Income and Expense Tracking

The foundation of your post-divorce budget is a clear understanding of your cash flow. Financial management tools like Mint or YNAB can help you categorize and track every dollar coming in and going out. These apps sync with your bank accounts, providing real-time insights into your spending patterns. Try to track your expenses for at least three months to get an accurate picture of your financial habits.

Set SMART Financial Goals

With a clear view of your finances, it’s time to set goals. The SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) is an effective approach. Instead of a vague goal like “save more,” set a specific target such as “save $10,000 for an emergency fund within 12 months.” Prioritize these goals based on your immediate needs and long-term aspirations.

Implement Debt Management Strategies

If you carry debt post-divorce, tackling it should be a priority. The debt avalanche method focuses on paying the loan with the highest interest rate first while making minimum payments on others, which can save you money in the long run. Alternatively, the debt snowball method targets the smallest debts first, providing quick wins and motivation.

Build Your Financial Safety Net

An emergency fund is essential for financial stability, especially after a major life change like divorce. Try to save 3-6 months of living expenses in a high-yield savings account. Start small if necessary – even $500 can provide a buffer against unexpected costs. Set up automatic transfers from your checking account on payday to automate your savings.

Adjust Your Lifestyle

Post-divorce life often requires lifestyle adjustments. Review your spending habits and identify areas where you can cut back (e.g., entertainment, dining out, or subscription services). This doesn’t mean eliminating all enjoyment from your life, but rather finding a balance that allows you to live comfortably while meeting your financial goals.

As you implement these strategies, you’ll find yourself on firmer financial footing. However, rebuilding your financial future involves more than just budgeting. The next step is to look at long-term financial planning, including reassessing your retirement goals and investment strategies in light of your new circumstances.

Charting Your Financial Comeback

Revamp Your Retirement Strategy

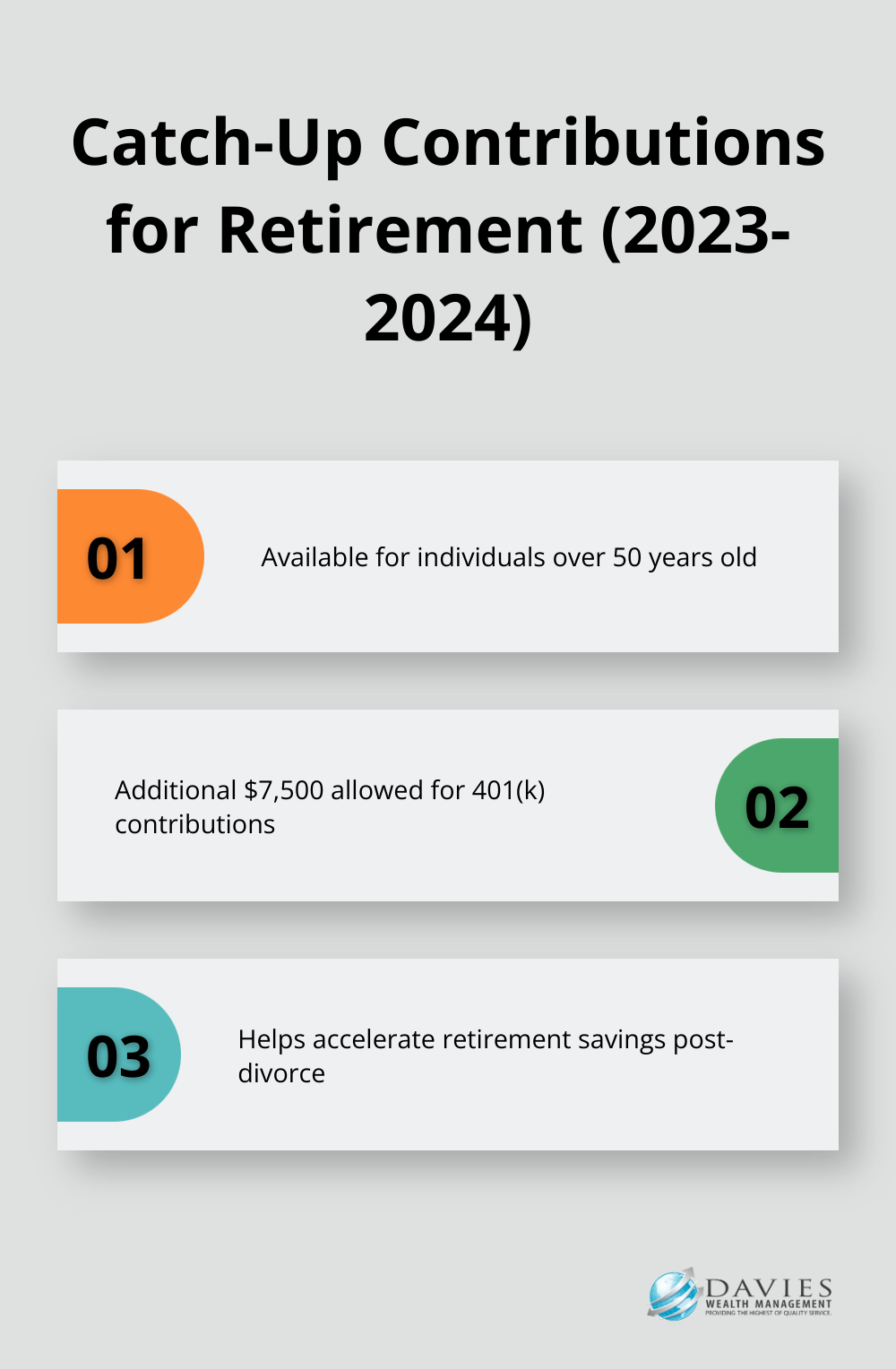

Divorce often impacts retirement savings significantly. Review your current retirement accounts and adjust your contributions. If you received a portion of your ex-spouse’s retirement assets, consider rolling them into an IRA to maintain tax-deferred growth. For those over 50, take advantage of catch-up contributions to accelerate your savings. The IRS allows an additional $7,500 for 401(k)s in 2023 and 2024.

Navigate the Tax Maze

The tax implications of divorce can be complex. Alimony payments are no longer tax-deductible for the payer or taxable for the recipient for divorces finalized after 2018. Property transfers between spouses during divorce are generally tax-free, but selling assets later may trigger capital gains taxes. Consult a tax professional to understand how your new financial situation affects your tax liability and to explore strategies for minimizing your tax burden.

Seize New Investment Opportunities

Post-divorce presents an ideal time to reassess your investment strategy. Your risk tolerance and financial goals may have changed. Consider diversifying your portfolio to spread risk and potentially increase returns. Low-cost index funds or ETFs can provide broad market exposure with minimal fees. If you’re new to investing, robo-advisors offer an accessible entry point with automated portfolio management. For more personalized guidance, work with a financial advisor to tailor your investment strategy to your specific needs and goals.

Update Your Estate Plan

Divorce necessitates a thorough review and update of your estate planning documents. This includes your will, trusts, power of attorney, and healthcare directives. Remove your ex-spouse as a beneficiary from your life insurance policies and retirement accounts (if applicable). Consider naming new beneficiaries, such as children or other family members. Update your power of attorney and healthcare proxy to designate someone you trust to make financial and medical decisions on your behalf if you become incapacitated.

Reassess Your Insurance Coverage

Post-divorce, your insurance needs will likely change. Review and update your health insurance coverage, especially if you were previously covered under your ex-spouse’s plan. Consider life insurance to protect your children’s financial future (if applicable). Evaluate your property and casualty insurance needs, particularly if you’ve moved to a new home or acquired new assets in the divorce settlement. Long-term care insurance might also be worth considering as you plan for your future as a single individual.

Final Thoughts

Post-divorce financial planning presents challenges but also offers a fresh start. You must review your assets, debts, income, expenses, and insurance coverage to regain control of your finances. Create a sustainable budget, prioritize financial goals, manage debt, and build an emergency fund to set yourself up for long-term success.

Professional guidance can significantly impact your post-divorce financial journey. At Davies Wealth Management, we specialize in helping individuals navigate complex financial situations (including divorce aftermath). Our team provides personalized advice and strategies tailored to your unique circumstances and goals.

Davies Wealth Management offers comprehensive financial planning services, including investment management and retirement planning. We understand the unique challenges of post-divorce financial planning and can help create a roadmap for your financial future. Take this opportunity to reassess your goals, redefine your priorities, and build a strong financial foundation for your new life.

Leave a Reply