Divorce can be a challenging time, both emotionally and financially. At Davies Wealth Management, we understand the complexities of financial planning for divorcees and the importance of rebuilding a solid financial foundation.

This guide will walk you through the essential steps to navigate your finances after a divorce, helping you regain control and set new goals for your future.

Reassessing Your Financial Landscape After Divorce

Conducting a Financial Inventory

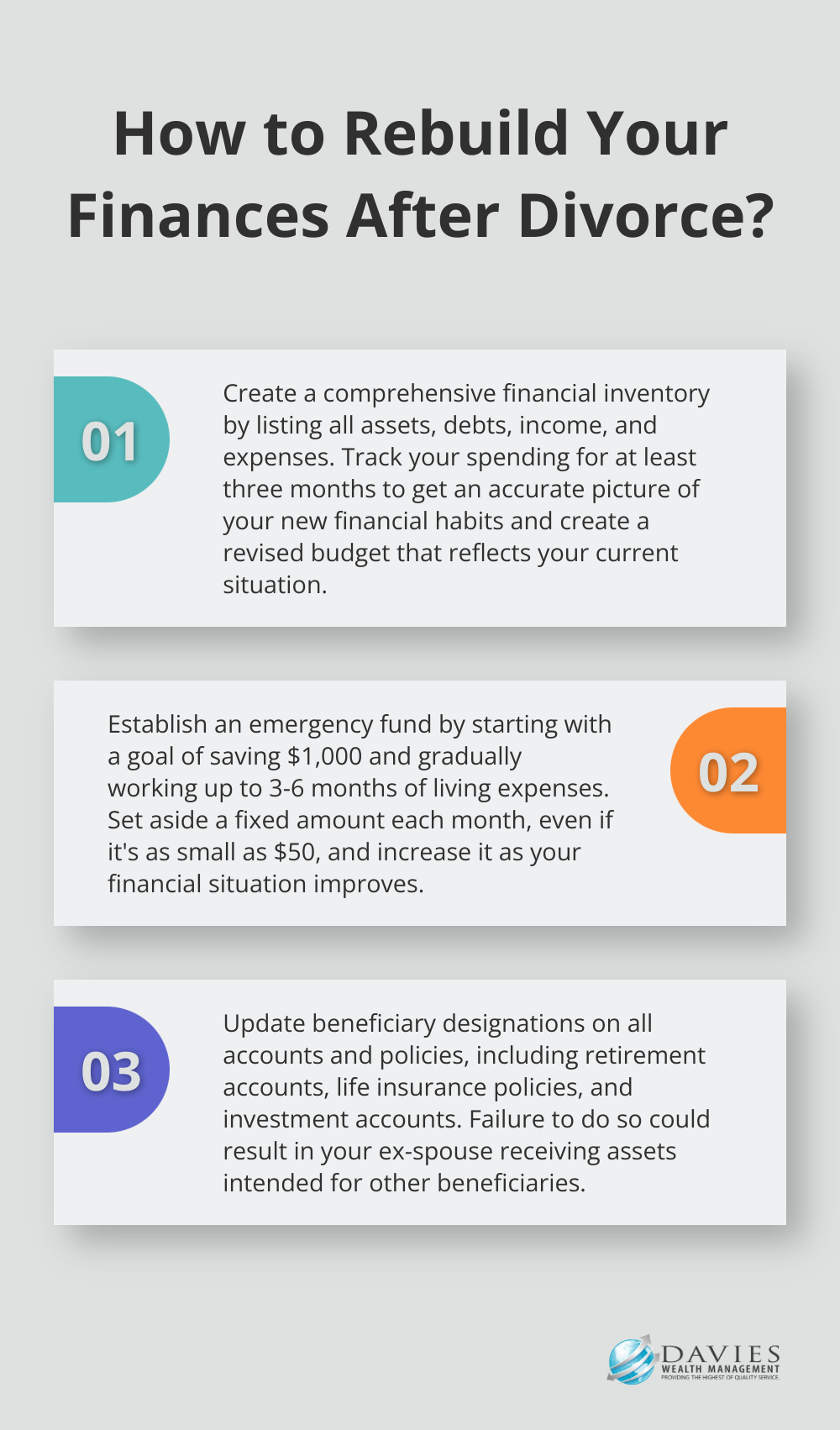

After a divorce, you must take stock of your new financial reality. This process involves a comprehensive review of your assets, debts, income, and expenses. Start by listing all your assets and debts. This includes bank accounts, investment portfolios, retirement accounts, real estate, vehicles, and personal property. Don’t forget to include any debts such as mortgages, car loans, credit card balances, or personal loans. This inventory will serve as the foundation for your new financial plan.

A study by the Institute for Divorce Financial Analysts found that 22% of divorces are primarily caused by money issues. A clear understanding of your financial position can help you avoid future conflicts and make informed decisions.

Revising Your Budget

Your income and expenses have likely changed significantly post-divorce. Create a new budget that reflects your current financial situation. Track your spending for at least three months to get an accurate picture of your new financial habits.

Include all sources of income, such as salary, alimony, child support, or investment returns. On the expense side, account for housing costs, utilities, groceries, transportation, insurance, and any new expenses you’ve taken on since the divorce.

Understanding Tax Implications

Divorce can have significant tax consequences. Your filing status will change, and you may face new tax liabilities or benefits. For example, if you’re now the head of household with dependents, you might be eligible for certain tax credits.

Alimony payments made under divorce agreements executed after December 31, 2018, are not deductible by the payer spouse or includable in the income of the recipient spouse. This change (part of the Tax Cuts and Jobs Act of 2017) can significantly impact your tax situation.

Working closely with tax professionals can help you navigate these complex tax issues. A comprehensive financial plan should take into account any potential tax implications, helping you make the most of your new financial situation.

Regular Review and Adjustment

Reassessing your financial landscape after divorce is not a one-time event. It’s an ongoing process that requires regular review and adjustment as your life circumstances change. Set aside time (at least annually) to review your financial inventory, budget, and tax situation. This practice will help you stay on top of your finances and make necessary adjustments as you move forward.

As you complete this reassessment phase, you’ll have a clear picture of your current financial standing. This knowledge will prove invaluable as you move on to the next step: rebuilding your financial foundation.

Rebuilding Your Financial Safety Net

Establishing a Solid Emergency Fund

The first step in rebuilding your financial foundation after divorce involves creating a robust emergency fund. This fund serves as a financial buffer, protecting you from unexpected expenses or income disruptions. Financial experts recommend starting with a goal of saving $1,000 and working your way up from there. Ultimately, the goal should be to save 3–6 months of living expenses.

A survey by Bankrate reveals that only 39% of Americans can cover a $1,000 emergency expense from their savings. Don’t fall into this trap. Start small by setting aside a fixed amount each month (even $50 can accumulate to $600 in a year), and increase it as your financial situation improves.

Reassessing Insurance Coverage

Divorce often necessitates changes in insurance coverage. Review all your policies, including health, life, disability, and property insurance. Ensure that your coverage aligns with your new circumstances and provides adequate protection.

Life insurance is an important part of the divorce process but is often overlooked. Don’t make that mistake. If you’re now the sole provider for your children, you might need to increase your life insurance coverage.

Updating Beneficiary Designations

A critical yet often overlooked step in post-divorce financial planning involves updating beneficiary designations on various accounts and policies. This includes retirement accounts, life insurance policies, and investment accounts. Failure to update these designations could result in your ex-spouse receiving assets intended for other beneficiaries.

A U.S. Supreme Court case (Egelhoff v. Egelhoff) found that divorce courts have wide discretion to divide property upon dissolution of a marriage, including by revoking spousal beneficiary designations. Therefore, it’s imperative to review and update all your accounts promptly after your divorce is finalized.

Seeking Professional Guidance

Rebuilding your financial foundation after a divorce can feel overwhelming. A team of experienced advisors can guide you through this process, helping you make informed decisions about emergency savings, insurance coverage, and beneficiary designations. They can work with you to create a personalized plan that addresses your unique needs and sets you on the path to financial security.

As you progress through this phase of rebuilding your financial safety net, you’ll find yourself better prepared to tackle the next crucial step: creating a new financial plan tailored to your post-divorce life and goals. This plan will help you chart a course for your financial future, taking into account your new circumstances and aspirations.

Crafting Your Post-Divorce Financial Roadmap

Set New Financial Goals

Your post-divorce life brings a new set of financial priorities. Take time to reflect on what you want to achieve in the short and long term. Short-term goals might include paying off divorce-related debts or saving for a down payment on a new home. Long-term goals could involve funding your children’s education or planning for a comfortable retirement.

A Fidelity Investments study found that nearly 3-in-4 Americans are preparing for unexpected financial events in 2025. Be specific when setting your goals. Instead of “I want to save more,” try “I want to save $10,000 for a down payment on a house within two years.” This specificity makes your goals measurable and achievable.

Adjust Your Retirement Strategy

Divorce often impacts retirement plans significantly. You need to adjust your strategy to account for changes in your financial situation. Start by reviewing your current retirement savings and project your future needs based on your new circumstances.

According to the National Retirement Risk Index, the retirement security of women in their 50s is assessed. This risk can increase after divorce. Consider increasing your retirement contributions if possible. If you’re over 50, take advantage of catch-up contributions to retirement accounts.

Leverage Professional Guidance

Navigating post-divorce finances can be complex. Working with a financial advisor provides valuable insights and helps you make informed decisions. An advisor can help you create a comprehensive financial plan, optimize your investment strategy, and provide ongoing support as you work towards your goals.

When choosing an advisor, look for someone who understands your unique situation and aligns with your values. Ask about their experience working with divorced clients and their approach to financial planning. This is a long-term relationship, so it’s important to find someone you trust and feel comfortable with.

Reevaluate Your Investment Strategy

Your investment strategy may need adjustments to align with your new financial situation and goals. Review your risk tolerance (which may have changed post-divorce) and adjust your asset allocation accordingly. Consider diversifying your portfolio to spread risk and potentially increase returns.

A Vanguard study found that a globally diversified portfolio of 60% stocks and 40% bonds declined about 16% in 2022. This difference can significantly impact your long-term financial health, especially in a post-divorce scenario where every dollar counts.

Plan for Tax Efficiency

Divorce often changes your tax situation. You may move into a different tax bracket or lose certain deductions. Plan your finances with tax efficiency in mind. This might involve strategies like maximizing contributions to tax-advantaged accounts (e.g., 401(k)s, IRAs) or considering tax-efficient investment vehicles.

If your tax situation has become more complex post-divorce, consider working with a tax professional (in addition to your financial advisor) to ensure you’re making the most tax-efficient decisions possible.

Final Thoughts

Financial planning for divorcees requires careful consideration and strategic decision-making. You must reassess your financial situation, rebuild your safety net, and craft a new financial roadmap to regain control of your finances. This process is ongoing and demands regular review and adjustment as your life circumstances change.

Davies Wealth Management understands the unique challenges of post-divorce financial planning. Our team of experts provides personalized advice and comprehensive wealth management solutions tailored to your specific needs (whether you’re a professional athlete or an individual looking to secure your financial future). We help you navigate this new chapter in your life with confidence.

Your financial journey is unique, and there’s no one-size-fits-all solution. Take control of your finances, set new goals, and work with trusted professionals to build a secure and prosperous future. For personalized advice on financial planning after divorce, contact our team at Davies Wealth Management.

Leave a Reply