Tax season can be a challenging time for many, but it doesn’t have to be. At Davies Wealth Management, we believe that understanding and implementing the best tax-saving strategies can significantly impact your financial well-being.

In this post, we’ll explore effective ways to maximize your tax savings and optimize your financial situation. From leveraging retirement accounts to exploring real estate investments, we’ll cover a range of strategies to help you keep more of your hard-earned money.

Understanding Your Tax Situation

Know Your Tax Bracket

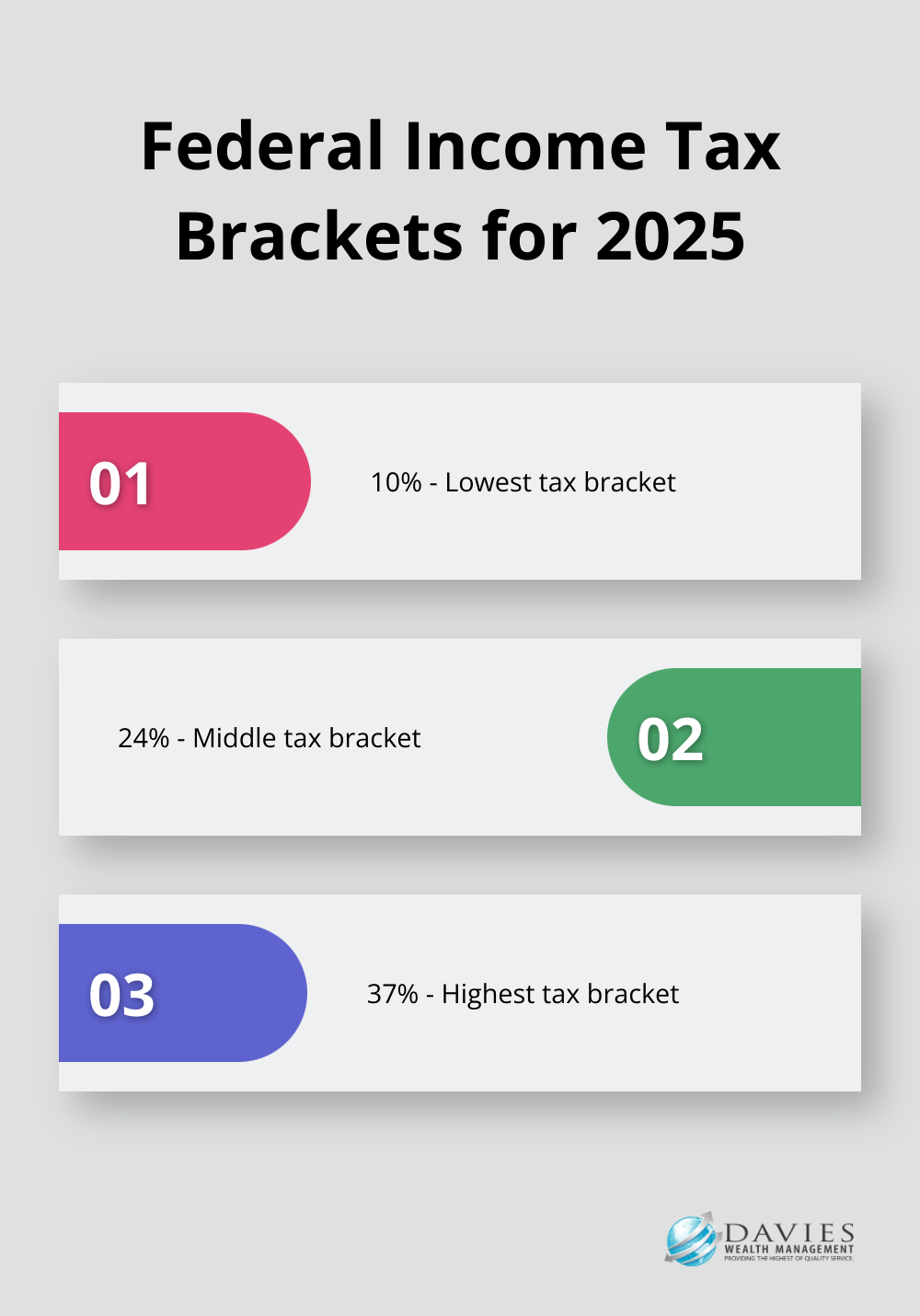

Your tax bracket determines the percentage of your income that goes to the government. For 2025, the federal income tax has seven tax rates: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Understanding where you fall is essential for your overall tax strategy. If you’re near the edge of a bracket, increasing your 401(k) contributions could lower your taxable income and potentially place you in a lower bracket.

Deductions and Credits That Matter

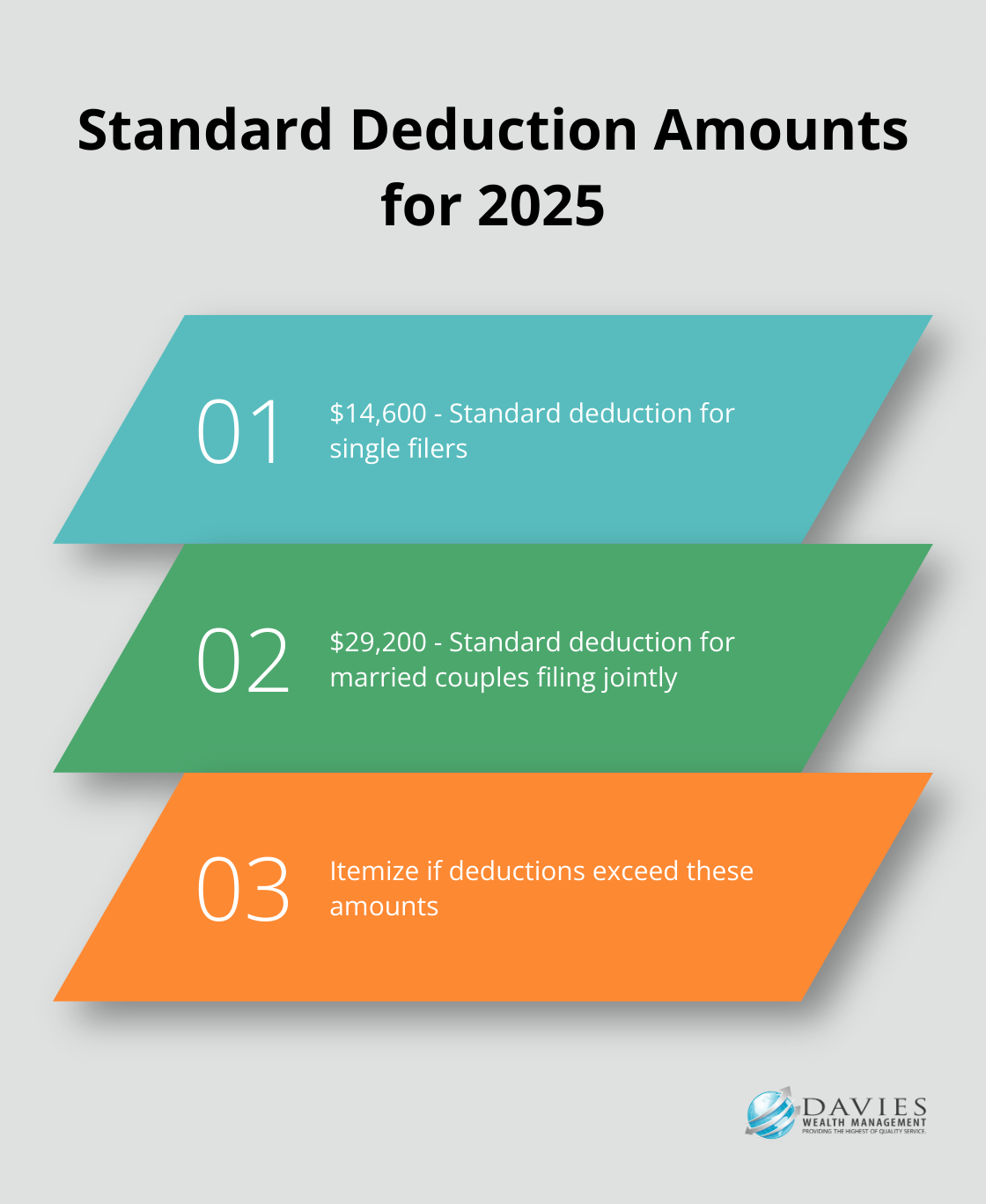

Deductions and credits can significantly reduce your tax bill. Common deductions include mortgage interest, state and local taxes, and charitable contributions. In 2025, the standard deduction stands at $14,600 for single filers and $29,200 for married couples filing jointly. Itemizing could save you more if your itemized deductions exceed these amounts.

Tax credits offer even more value because they directly reduce your tax bill dollar-for-dollar. The Child Tax Credit provides up to $2,000 per qualifying child. The Earned Income Tax Credit can offer up to $8,046 for low to moderate-income workers with three or more children.

Life Changes and Your Taxes

Major life events can substantially impact your tax situation. Marriage, having a child, buying a home, or starting a business all carry tax implications. New parents might qualify for the Child and Dependent Care Credit (worth up to $2,100 for two or more qualifying individuals).

Business owners can deduct many operational expenses, including health insurance premiums and vehicle use. These deductions can substantially reduce taxable income.

The Importance of Professional Guidance

Navigating complex tax situations requires expertise. A professional advisor can help you stay current with the latest tax laws and regulations, ensuring you take advantage of every possible tax-saving opportunity. Whether you’re a professional athlete dealing with complex income structures or a business owner looking to optimize your tax strategy, expert guidance can help you make informed decisions that align with your financial goals. High-net-worth individuals may lower their overall tax liability by itemizing deductions, as they may have more qualifying expenses that exceed the standard deduction.

As we move forward, let’s explore effective strategies to maximize your tax savings and optimize your financial situation. From leveraging retirement accounts to exploring real estate investments, the next section will cover a range of tactics to help you keep more of your hard-earned money.

Smart Tax Strategies That Work

At Davies Wealth Management, we’ve observed how implementing smart tax strategies can significantly boost our clients’ financial health. Let’s explore some powerful tactics that can help you keep more of your hard-earned money.

Supercharge Your Retirement Savings

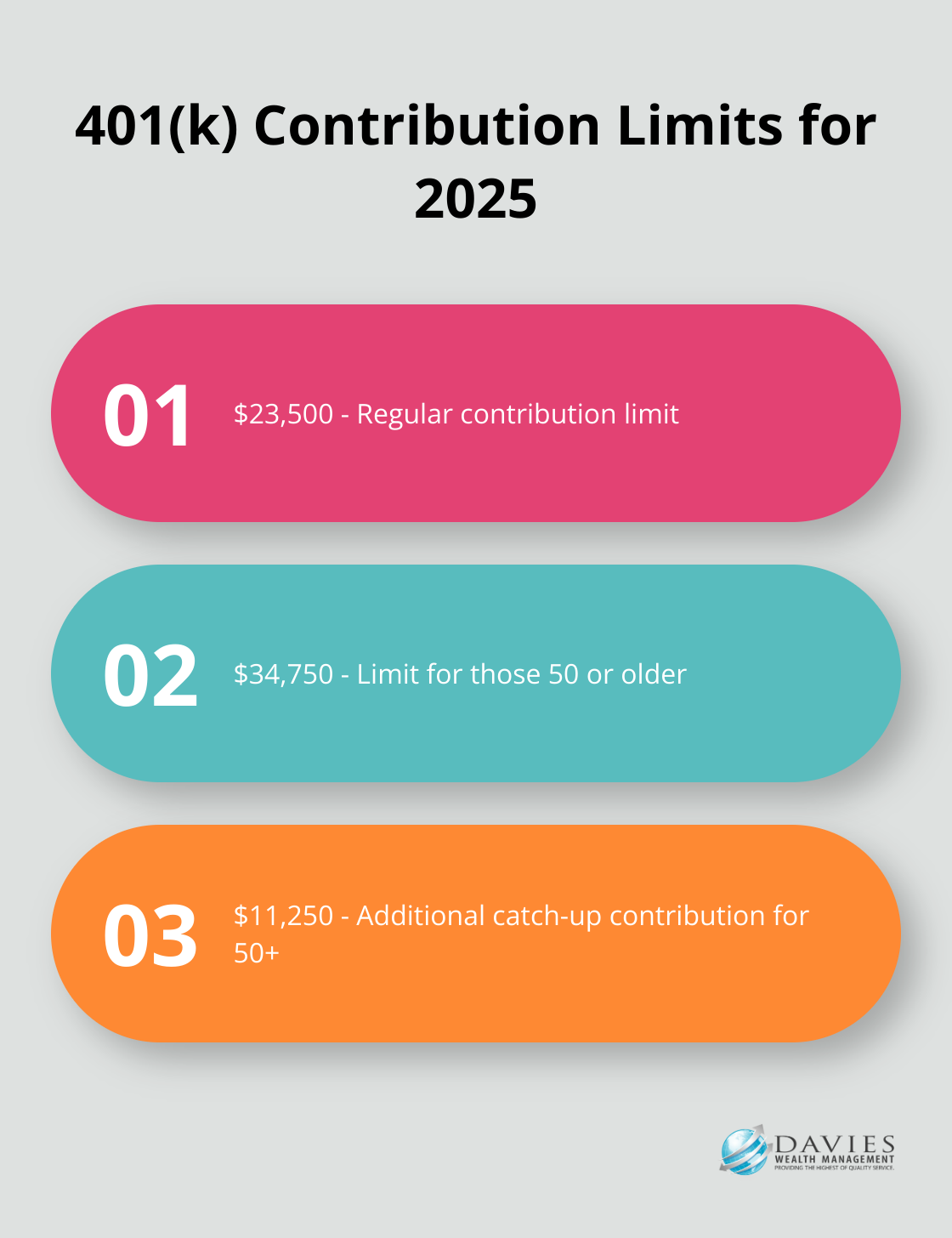

Maximizing your retirement account contributions reduces your taxable income effectively. For 2025, you can contribute up to $23,500 to your 401(k), or $34,750 if you’re 50 or older due to the higher catch-up contribution limit of $11,250. This action not only secures your future but also potentially lowers your tax bracket today. Self-employed individuals or those with side gigs should consider a SEP IRA, which allows contributions of up to 25% of net earnings from self-employment (up to $69,000 for 2025).

Turn Losses into Tax Advantages

Tax-loss harvesting can turn market downturns into tax benefits. Selling underperforming investments offsets capital gains and potentially reduces your taxable income by up to $3,000 per year. Any excess losses carry forward to future tax years. This strategy requires careful timing and consideration of wash sale rules, so consulting with a financial advisor before implementation is wise.

Leverage Health Savings Accounts

Health Savings Accounts (HSAs) offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. For 2025, you can contribute up to $4,300 for individual coverage or $8,550 for family coverage. Those 55 and older can contribute an additional $1,000. Unlike Flexible Spending Accounts, HSA funds roll over year to year, making them an excellent vehicle for long-term healthcare savings.

Strategic Charitable Giving

Charitable donations can significantly reduce your tax bill while supporting causes you care about. Consider bunching your donations into a single year to exceed the standard deduction threshold. For those over 70½, Qualified Charitable Distributions (QCDs) allow you to donate up to $108,000 directly from your IRA to qualified charities in 2025, satisfying your Required Minimum Distribution without increasing your taxable income.

Real Estate as a Tax Shield

Real estate investments can offer substantial tax benefits. Rental property owners can deduct mortgage interest, property taxes, and depreciation, potentially creating paper losses that offset other income. The 1031 exchange allows you to defer capital gains taxes when selling an investment property by reinvesting the proceeds into a like-kind property. For primary residences, you can exclude up to $250,000 ($500,000 for married couples) of capital gains from the sale if you’ve lived in the home for two of the past five years.

These strategies offer powerful ways to optimize your tax situation, but they require careful planning and execution. The next section will explore how working with a financial advisor can help you navigate these complex strategies and create a personalized tax optimization plan tailored to your unique financial situation.

Why Professional Tax Planning Matters

The Value of Expert Guidance

Professional tax planning transforms financial landscapes. The complexity of tax laws, coupled with frequent changes, makes it challenging for individuals to navigate the tax system alone. Research shows that individuals who practice systematic financial planning and effective tax management enjoy greater financial stability. Expert guidance becomes invaluable in this context.

Proactive Tax Planning: Beyond Annual Filing

Professional tax planning involves more than just filing taxes each year. It requires a comprehensive strategy that considers your entire financial picture. A study by the Government Accountability Office found that 2.1 million taxpayers overpaid their taxes by $1.75 billion in a single year due to overlooked deductions and credits. Professional tax planning helps you avoid such costly mistakes.

Strategies for High-Net-Worth Individuals

High-net-worth individuals face unique tax challenges. The Tax Foundation reports that the share of income taxes paid by the top 1 percent increased from 33.2 percent in 2001 to 40.4 percent in 2022. This statistic underscores the need for sophisticated tax strategies. These may include:

- Advanced charitable giving strategies (such as donor-advised funds or private foundations)

- Tax-efficient investment strategies, including asset location optimization

- Estate planning techniques to minimize estate and gift taxes

Specialized Approach for Professional Athletes

Professional athletes face distinct financial challenges, including short career spans and fluctuating income. The NFL Players Association states that the average NFL career lasts just 3.3 years. This brief window of high earnings requires careful tax planning. Specialized tax planning for athletes includes:

- Multi-state tax planning for athletes who play in various jurisdictions

- Structuring endorsement deals and other income sources for optimal tax efficiency

- Retirement planning strategies that account for early career peaks

Long-Term Impact of Expert Tax Planning

The benefits of professional tax planning extend far beyond a single tax year. A study by Vanguard found that working with a financial advisor can potentially increase returns by about 3% per year. While this includes various factors, tax-efficient strategies play a significant role. Over time, this can translate to substantial wealth accumulation.

Final Thoughts

The best tax-saving strategies can significantly impact your financial well-being. From maximizing retirement account contributions to leveraging Health Savings Accounts and exploring real estate investments, these tactics offer powerful ways to optimize your tax situation. Proactive tax planning plays a vital role in long-term financial success, allowing you to make informed decisions that align with your financial goals.

Tax laws remain complex and ever-changing, which makes professional guidance invaluable. At Davies Wealth Management, we specialize in helping individuals, families, and businesses achieve their financial objectives through tailored wealth management solutions. Our expertise extends to serving professional athletes, addressing their unique financial challenges with personalized strategies.

Take the next step in optimizing your tax situation by scheduling a consultation with a financial advisor. With the right strategies and professional support, you can confidently build, protect, and transfer your wealth while minimizing your tax burden. Our team stands ready to provide the expert guidance you need to implement effective tax-saving strategies and secure your financial future.

Leave a Reply