At Davies Wealth Management, we understand that navigating the complex world of business taxes can be overwhelming.

Implementing effective business tax savings strategies is crucial for maximizing your company’s financial health and growth potential.

This guide will explore key tactics to help you reduce your tax burden, from understanding deductions to leveraging credits and strategic planning.

What Business Expenses Can You Deduct?

Common Deductible Expenses

The IRS allows businesses to deduct ordinary and necessary expenses incurred during operations. These typically include office rent, employee salaries, utilities, and business-related travel. For example, small business owners who frequently travel for client meetings can deduct airfare, hotel costs, and even 50% of meal expenses.

A significant deduction often overlooked is the home office deduction. If you use a portion of your home exclusively for business, you can deduct $5 per square foot (up to 300 square feet), according to the IRS simplified method. This can result in a deduction of up to $1,500 annually.

Lesser-Known Deductions

While many businesses know common deductions, several lesser-known write-offs could provide substantial savings. The cost of business-related education and training for you or your employees is fully deductible. This includes courses, workshops, and even certain degree programs that maintain or improve skills needed in your current business.

Another often-overlooked deduction is bad debt. If your business operates on credit and a customer fails to pay, you can write off the uncollectible amount as a bad debt expense. However, this only applies if you have previously included the amount in your income or loaned out your cash.

The Importance of Documentation

Proper documentation forms the foundation of successful tax deductions. The IRS requires businesses to maintain accurate records to support claimed deductions. This means keeping detailed receipts, invoices, and logs for all business expenses.

For vehicle-related deductions, a mileage log is essential. The standard mileage rate for 2023 is 70 cents per mile driven for business use. Alternatively, you can deduct actual vehicle expenses, which might yield a larger deduction depending on your situation.

Streamlining Expense Tracking

We recommend using digital tools to simplify expense tracking. Many accounting software options can automatically categorize expenses and generate reports, making tax time less stressful and reducing the risk of overlooking potential deductions.

Tax laws change frequently, and what’s deductible one year may not be the next. It’s essential to stay informed or work with a professional who can guide you through the complexities of business tax deductions. Maximizing your deductions doesn’t just save money – it reinvests in your business’s growth and future success.

As we move forward, let’s explore how businesses can leverage tax credits to further reduce their tax burden and boost their bottom line.

Unlocking Business Tax Credits

Tax credits serve as powerful tools for businesses to reduce their tax liability directly. Unlike deductions, which lower taxable income, credits decrease the amount of tax owed, often providing more substantial benefits. At Davies Wealth Management, we help businesses identify and leverage these valuable opportunities.

Research and Development (R&D) Tax Credit

The R&D tax credit rewards businesses that invest in innovation. This credit was implemented to incentivize innovation throughout the economy, granting funding for companies to promote internal innovation.

To qualify for the R&D credit, your research activities must meet the IRS’s four-part test:

- Permitted purpose (creating new or improved products, processes, or software)

- Elimination of uncertainty

- Process of experimentation

- Technological in nature

Even businesses outside traditionally “high-tech” industries might qualify. For example, a food manufacturer developing new recipes or a construction company implementing novel building techniques could potentially claim this credit.

Work Opportunity Tax Credit (WOTC)

The WOTC encourages hiring individuals from certain target groups who have faced barriers to employment. These groups include veterans, ex-felons, and long-term unemployment recipients.

To claim the WOTC, businesses must obtain certification from their state workforce agency within 28 days of the employee’s start date. This process involves submitting IRS Form 8850 and ETA Form 9061.

Energy-Efficient Tax Credits

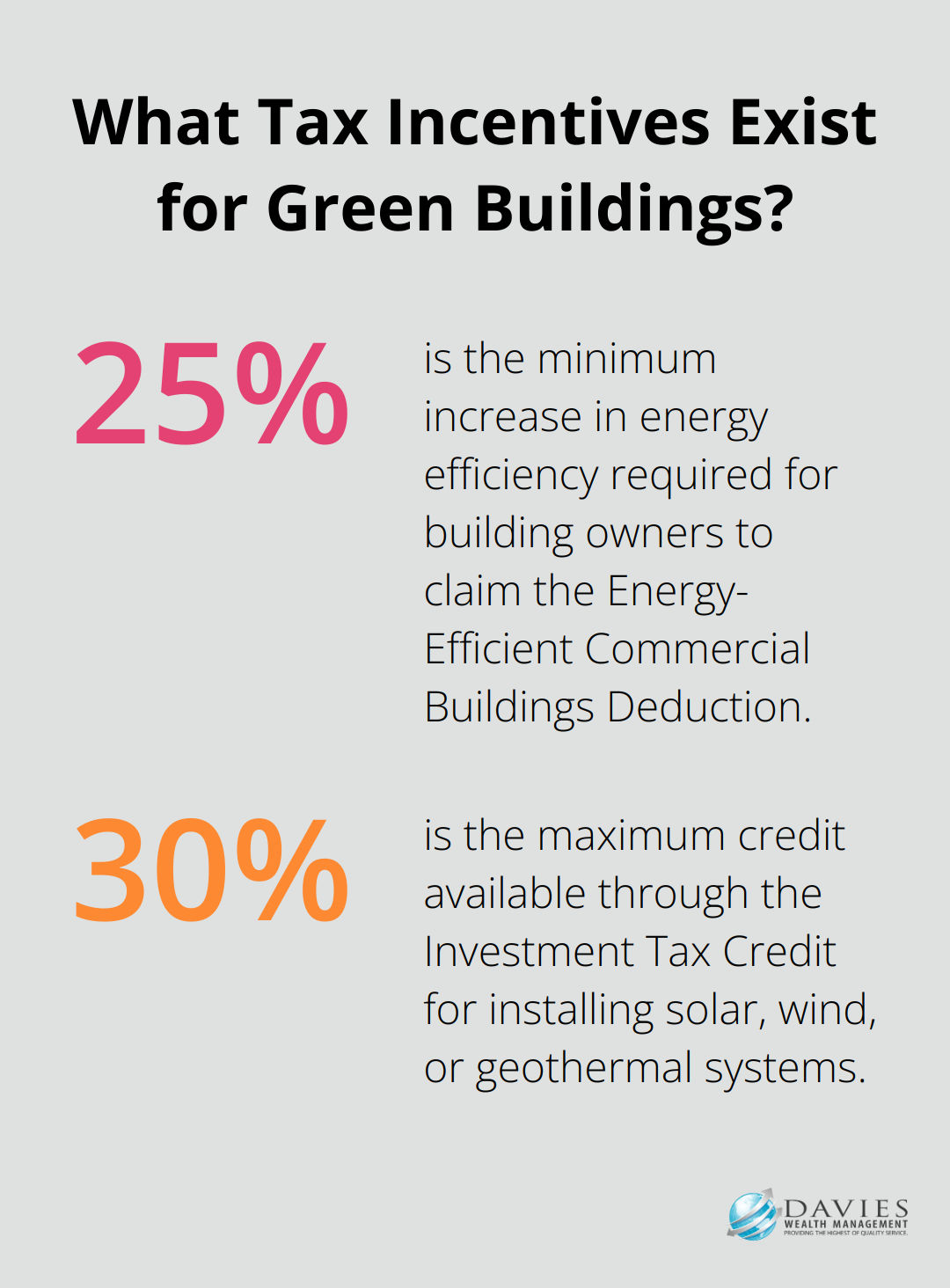

With increased focus on sustainability, energy-efficient tax credits have become more valuable. The Energy-Efficient Commercial Buildings Deduction (Section 179D) allows building owners who increase energy efficiency in building systems by at least 25% to claim a tax deduction.

For businesses investing in renewable energy, the Investment Tax Credit (ITC) offers a credit of up to 30% of the cost of installing solar, wind, or geothermal systems. This credit not only reduces tax liability but also accelerates the return on investment for these energy projects.

To maximize these credits, businesses should consider conducting an energy audit of their facilities and consulting with a tax professional experienced in green energy incentives.

Tax credits change frequently, and their availability may depend on specific business circumstances. Working with experienced professionals (like those at Davies Wealth Management) can help identify and apply for the most beneficial credits for your situation. The strategic use of these tax-saving tools can free up capital for reinvestment in business growth and long-term success.

As we move forward, let’s explore how strategic tax planning can further enhance your business’s financial position and support its growth objectives.

How Strategic Tax Planning Fuels Business Growth

Strategic tax planning serves as a powerful tool for business growth. Effective tax strategies can significantly impact a company’s bottom line and long-term success while ensuring compliance with legal requirements.

Timing Income and Expenses

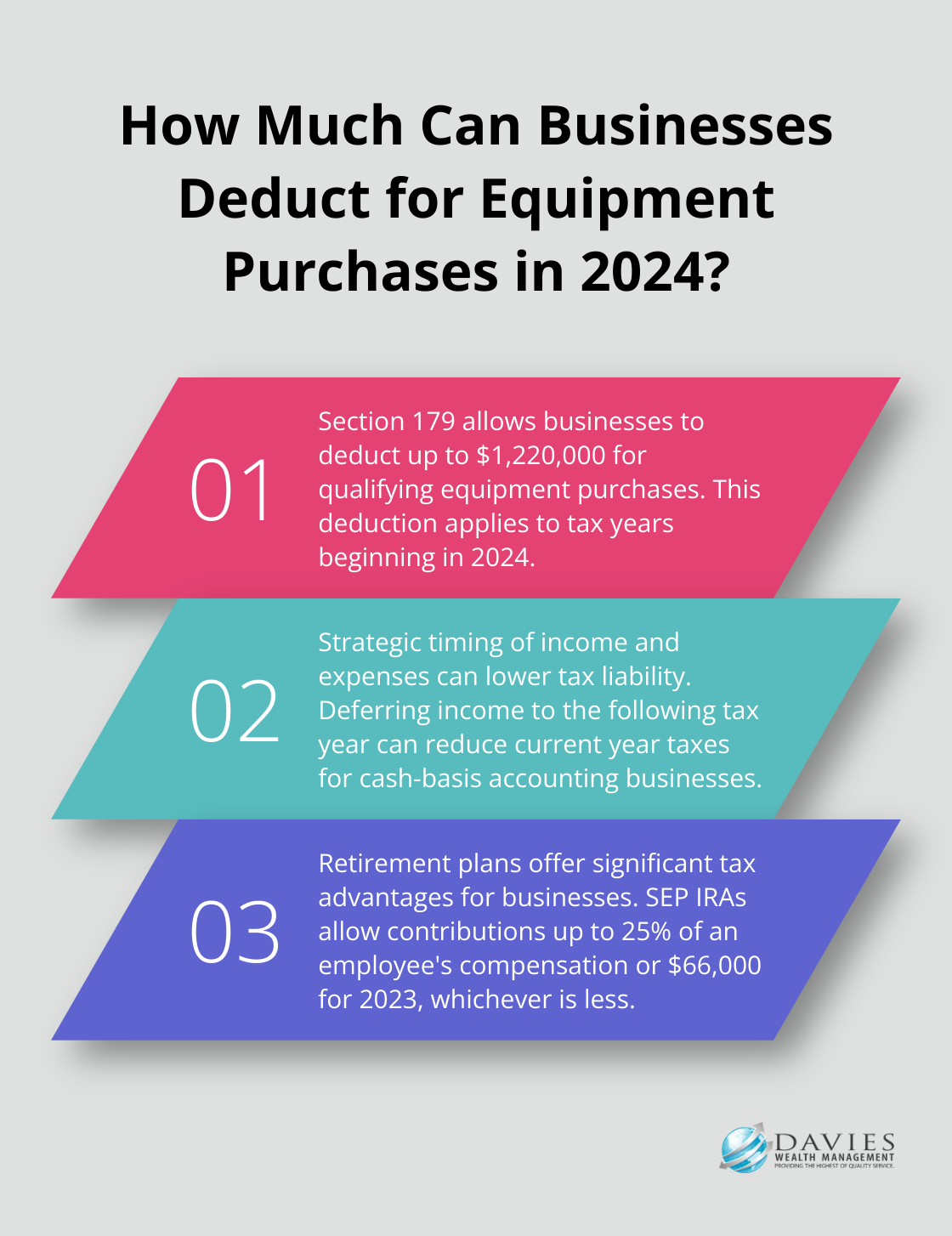

Careful timing of income and expenses stands as a key strategy. Businesses using cash-basis accounting can lower their current year’s tax liability by deferring income to the following tax year. This might involve delaying invoicing for services rendered in December until January. (However, businesses must avoid artificially manipulating income, as this could raise red flags with the IRS.)

Accelerating expenses can increase deductions for the current year. Purchasing necessary equipment or paying for next year’s subscriptions in December can boost deductions. The Section 179 deduction allows businesses to deduct up to $1,220,000 for tax years beginning in 2024 for qualifying equipment purchases, providing a significant tax advantage for those making substantial investments.

Selecting the Optimal Business Structure

Business structure plays a crucial role in tax obligations. While sole proprietorships and partnerships offer simplicity, they may not always provide the most tax-efficient options as a business grows.

S Corporations can provide tax benefits by allowing owners to pay themselves a reasonable salary and take additional profits as distributions, potentially reducing self-employment taxes. However, this structure comes with more complex reporting requirements and restrictions on ownership.

C Corporations, while facing double taxation on profits and dividends, can offer advantages for businesses planning to reinvest heavily in growth or those with high-income owners who can benefit from lower corporate tax rates.

Leveraging Retirement Plans

Implementing a robust retirement plan not only helps attract and retain talent but also offers significant tax advantages. For small businesses, a Simplified Employee Pension (SEP) IRA allows for contributions of up to 25% of an employee’s compensation or $66,000 for 2023 (whichever is less). These contributions are tax-deductible for the business and grow tax-deferred for employees.

For larger businesses, 401(k) plans with employer matching can provide substantial tax benefits. In 2023, employees can contribute up to $22,500 (with an additional $7,500 catch-up contribution for those 50 and older), reducing their taxable income. Employer contributions are tax-deductible, lowering the company’s tax liability.

Staying Informed on Tax Law Changes

Tax laws change frequently, and staying informed proves essential for effective tax planning. The SECURE Act 2.0, passed in 2022, was designed to make it easier and more affordable for small businesses to offer employer-sponsored retirement plans.

Working with Tax Professionals

Tax laws are complex and ever-changing. Working with experienced professionals ensures that your tax strategy aligns with your business goals and complies with current regulations. While many firms offer tax planning services, Davies Wealth Management stands out as a top choice for comprehensive financial advice that integrates tax planning with overall wealth management strategies.

Final Thoughts

Effective business tax savings strategies reduce tax burdens and create growth opportunities. Companies must explore deductions, credits, and strategic planning to maximize financial health. Proper documentation and streamlined expense tracking play vital roles in capitalizing on these benefits.

Strategic tax planning involves careful income and expense timing, appropriate business structure selection, and retirement plan utilization. These approaches not only lower current tax liabilities but also position companies for long-term financial success. The complex, ever-changing nature of tax laws necessitates expert guidance to ensure compliance and maximize advantages.

Davies Wealth Management specializes in comprehensive financial strategies that integrate tax planning with overall wealth management. We help businesses and individuals achieve their financial goals through proactive tax planning (an investment in your company’s future). Our expertise allows clients to focus on growth, innovation, and long-term success while we handle the intricacies of tax optimization.

Leave a Reply