Financial planning for women is a critical yet often overlooked aspect of personal finance. At Davies Wealth Management, we recognize the unique challenges women face in their financial journeys.

From the persistent gender pay gap to career breaks for family responsibilities, women must navigate a complex financial landscape. This guide will equip you with essential strategies to take control of your financial future and build lasting wealth.

Why Women Face Unique Financial Challenges

Women’s financial journeys often differ significantly from men’s, presenting unique challenges that require tailored strategies. These challenges have a profound impact on long-term financial security.

The Persistent Gender Pay Gap

The gender pay gap remains a stubborn obstacle for women’s financial progress. According to the U.S. Bureau of Labor Statistics, women earn 83.6 percent of what men earn. This disparity compounds over time, potentially resulting in hundreds of thousands of dollars in lost earnings over a career.

To combat this, women should:

- Negotiate salaries aggressively, armed with market research and performance data.

- Seek out companies with transparent pay practices and a commitment to gender equity.

- Consider additional income streams or side hustles to bridge the gap.

Career Interruptions and Their Financial Impact

Women take career breaks for family responsibilities more often, which can significantly impact their earning potential and retirement savings. According to the Center for American Progress, some women lose upward of $1 million over the course of a 40-year career due to the gender wage gap.

To mitigate these effects, women should:

- Maintain professional skills and networks during career breaks.

- Explore flexible work arrangements or part-time opportunities.

- Maximize retirement contributions before and after career interruptions.

Planning for a Longer Retirement

Women generally live longer than men, which means they need to plan for extended retirement periods. The Social Security Administration reports that a woman turning 65 today can expect to live, on average, until age 86.6, compared to 84.1 for men. This longevity advantage becomes a financial challenge when coupled with lower lifetime earnings and potential career breaks.

To address this, women should:

- Start retirement savings early and maximize contributions.

- Consider long-term care insurance to protect against high healthcare costs in later years.

- Develop a sustainable withdrawal strategy that accounts for a potentially longer retirement.

The Confidence Gap in Financial Decision-Making

Research from Fidelity Investments shows that only 14% of women feel very confident in their ability to manage their finances. This lack of confidence can lead to missed investment opportunities and suboptimal financial decisions.

To boost financial confidence, women should:

- Seek out financial education resources and workshops.

- Work with a trusted financial advisor who understands their unique needs.

- Start small with investing and gradually increase their involvement as confidence grows.

These unique challenges require targeted strategies to help women build robust financial futures. Whether you’re a professional athlete navigating a short career span or a business owner balancing personal and professional finances, understanding these obstacles is the first step towards financial empowerment. In the next section, we’ll explore essential financial planning strategies tailored specifically for women to overcome these challenges and achieve long-term financial success.

Actionable Strategies for Women’s Financial Success

At Davies Wealth Management, we have developed a set of powerful strategies to help women overcome unique financial challenges and achieve long-term success. These actionable steps will empower you to take control of your finances and build a secure future.

Create a Robust Budget and Savings Plan

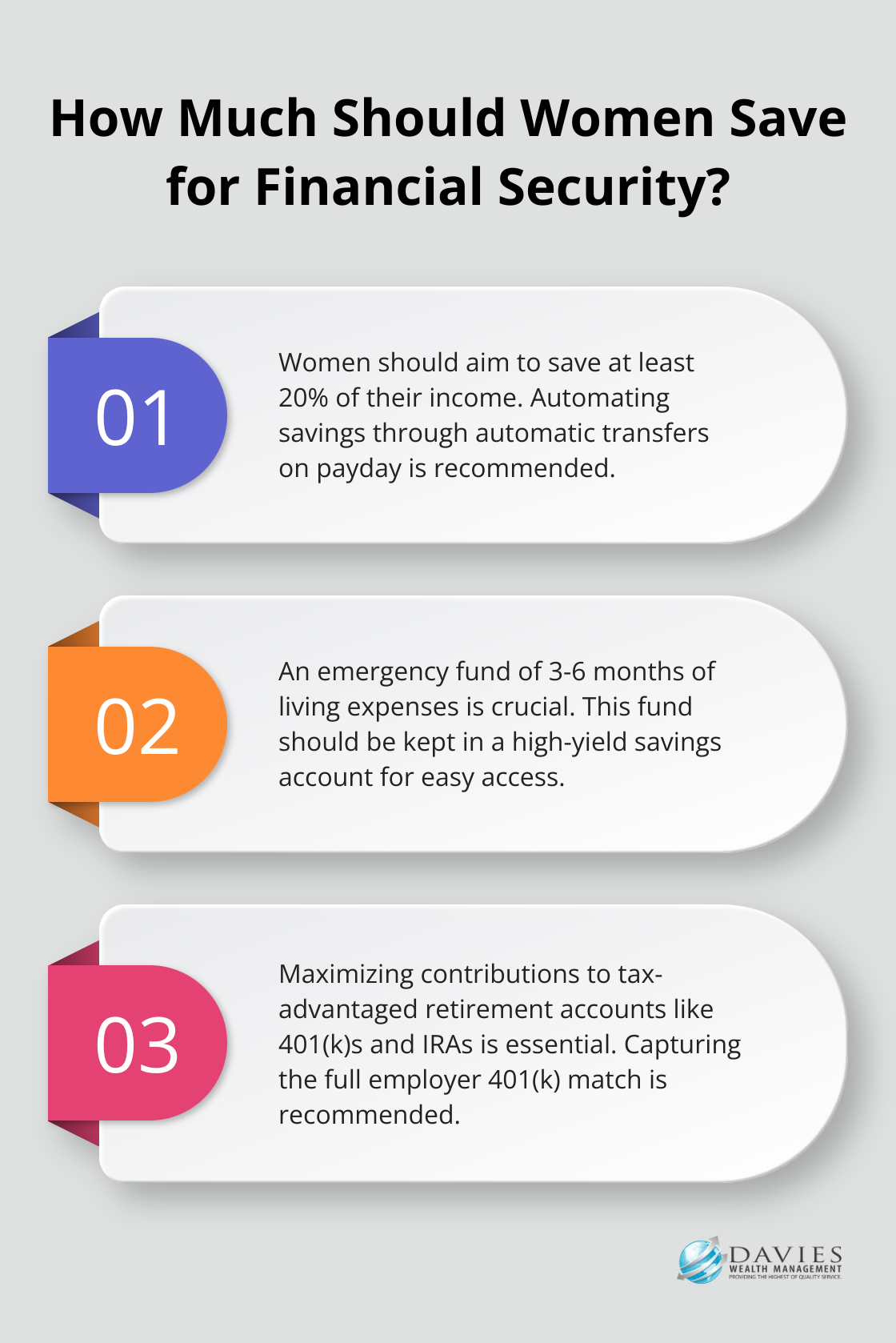

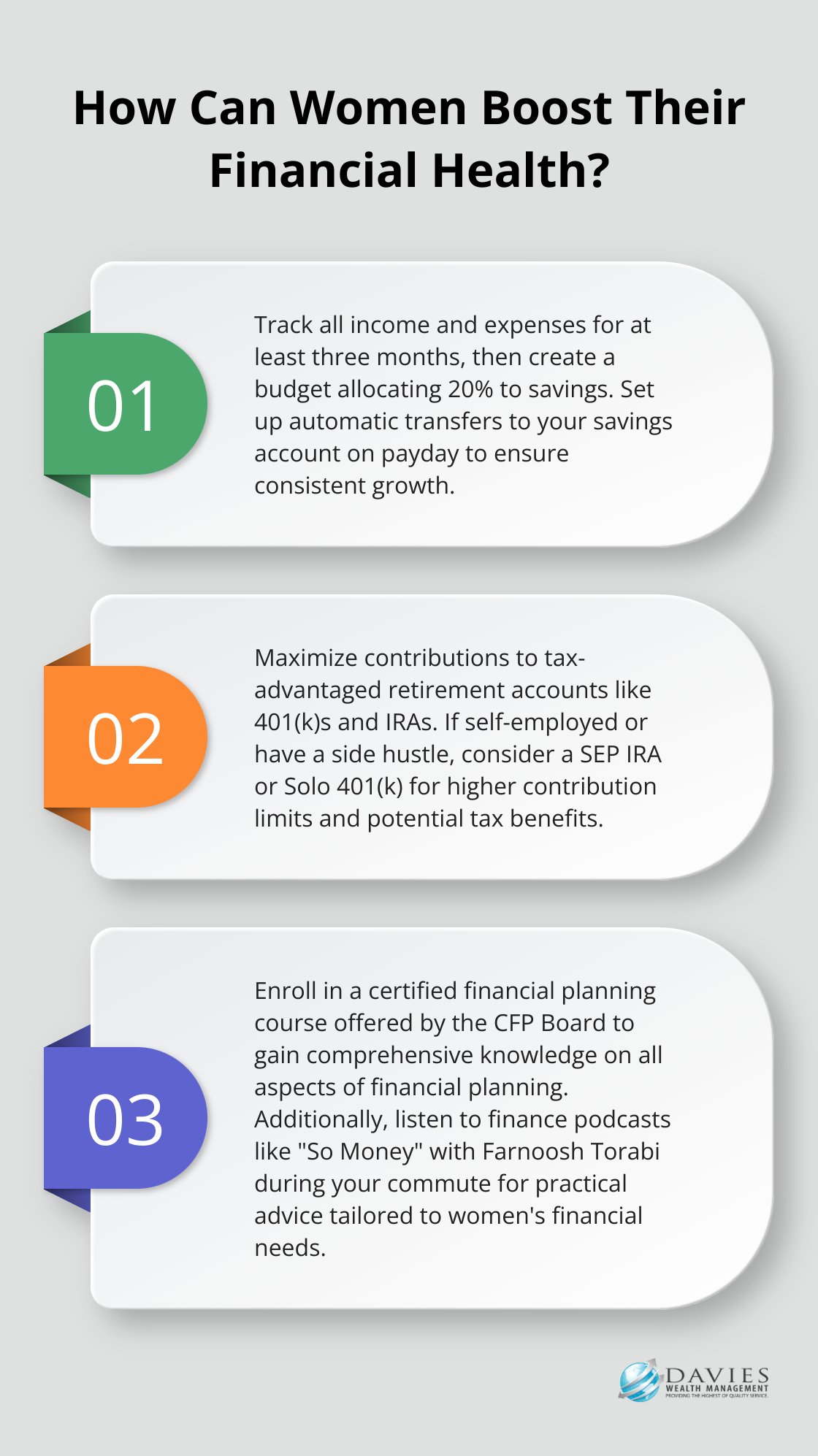

The foundation of financial success is a well-structured budget. Start by tracking all income and expenses for at least three months. Use this data to create a realistic budget that allocates funds to essential expenses, savings, and discretionary spending. Try to save at least 20% of your income, adjusting your lifestyle if necessary to meet this goal.

To supercharge your savings, automate the process. Set up automatic transfers to your savings account on payday. This “pay yourself first” approach ensures consistent savings growth. Consider using apps like Mint or YNAB (You Need A Budget) to streamline budget tracking and identify areas for potential savings.

Invest Strategically for Long-Term Growth

Investing is essential for building wealth over time. Start by educating yourself about different investment options. Books like “The Simple Path to Wealth” by J.L. Collins offer excellent introductions to investing principles.

Diversification is key to managing risk. Consider a mix of low-cost index funds (which offer broad market exposure) and individual stocks in sectors you understand well. If you’re new to investing, robo-advisors can provide a low-cost entry point with automated portfolio management.

For those seeking more personalized guidance, working with a financial advisor can be invaluable. A qualified advisor can create tailored investment strategies that align with your unique goals and risk tolerance.

Prioritize Retirement Savings

Women’s longer life expectancy makes retirement planning essential. Maximize contributions to tax-advantaged retirement accounts like 401(k)s and IRAs. If your employer offers a 401(k) match, contribute at least enough to capture the full match – it’s essentially free money.

Consider opening a Roth IRA in addition to your workplace retirement plan. Roth contributions are made with after-tax dollars, but grow tax-free, providing valuable tax diversification in retirement.

For self-employed women or those with side hustles, a SEP IRA or Solo 401(k) can offer higher contribution limits and potential tax benefits. Consult with a financial advisor to determine the best retirement savings strategy for your situation.

Build a Robust Emergency Fund

An emergency fund is your financial safety net. Having an emergency savings fund can provide a financial safety net for unexpected costs and events, such as a job loss or medical expense. Try to save 3-6 months of living expenses in a high-yield savings account. This fund provides peace of mind and prevents you from derailing long-term financial goals when unexpected expenses arise.

To build your emergency fund quickly, consider temporary lifestyle adjustments. Cut non-essential expenses, sell unused items, or take on a side gig. Every dollar counts, so even small contributions add up over time.

Financial planning is an ongoing process. Regularly review and adjust your strategies as your life circumstances change. Whether you’re navigating a career transition, planning for a family, or approaching retirement, seeking professional advice can provide expert guidance tailored to your unique needs. The next section will explore how women can further empower themselves through financial education and networking opportunities.

Empowering Your Financial Intelligence

Maximize Online Learning Platforms

The internet provides numerous resources for financial education. Platforms like Coursera and edX offer free courses from top universities on topics ranging from personal finance to investment strategies. Yale University’s popular course on financial markets can deepen your understanding of economic principles.

For a more structured approach, enroll in a certified financial planning course. The CFP Board offers a comprehensive program that covers all aspects of financial planning (from retirement strategies to estate planning).

Utilize Podcasts and Books

Podcasts allow you to absorb financial knowledge during your commute or while multitasking. “So Money” with Farnoosh Torabi and “Her Money” with Jean Chatzky provide practical advice tailored to women’s financial needs. These podcasts often feature interviews with successful women in finance, offering real-world insights and inspiration.

For books, “Smart Women Finish Rich” by David Bach and “The Simple Path to Wealth” by J.L. Collins are essential reads. These books offer clear, actionable strategies for building wealth over time.

Seek Professional Financial Advice

While self-education is important, working with a financial advisor can accelerate your progress and help you avoid costly mistakes. A study by Vanguard found that working with a financial advisor can potentially increase returns by reallocating to higher-yielding investments or spending from the total return on their portfolio.

When selecting an advisor, look for someone who understands the unique challenges women face. Ask potential advisors about their experience working with women in similar life stages or professions. If you’re a professional athlete, consider specialized firms like Davies Wealth Management that address the complex financial needs of athletes (including managing irregular income and planning for post-career transitions).

Create a Financial Support Network

Connect with other financially-savvy women to gain invaluable support and motivation. Organizations like FWA connect a vibrant community of dynamic professionals and proactive institutions focused on development and empowerment to advance leadership growth.

Start a money circle with friends or colleagues. These informal groups meet regularly to discuss financial goals, share tips, and hold each other accountable. A study by the Financial Therapy Association found that participants in financial support groups were more likely to achieve their money goals.

Mentorship plays a key role in your financial journey. Find successful women in your industry or financial professionals who can provide guidance and share their experiences. Many professional organizations offer formal mentorship programs that connect you with experienced advisors.

Final Thoughts

Financial planning for women empowers personal and professional success. We explored unique challenges women face, from gender pay gaps to longer life expectancies, and provided strategies to overcome these obstacles. Women can control their financial futures through budgeting, strategic investing, retirement savings prioritization, and emergency fund creation.

Financial empowerment requires continuous learning and commitment. Each step taken today can lead to significant future gains. Our team at Davies Wealth Management understands the complexities of financial planning for women, especially those with unique circumstances (such as professional athletes).

We invite you to explore how our tailored wealth management solutions can help you navigate your financial journey confidently. Start by reviewing your current situation, setting clear goals, and seeking resources to enhance your financial knowledge. Your financial success story begins now.

Leave a Reply