Financial planning is a critical skill for everyone, but women face unique challenges that require specific strategies. At Davies Wealth Management, we recognize the importance of tailored financial advice for women.

This guide explores the essential aspects of women and financial planning, addressing key issues like the gender pay gap, career breaks, and longer life expectancy. We’ll provide practical tips and resources to help women take control of their financial futures and achieve long-term financial success.

Why Women Face Unique Financial Challenges

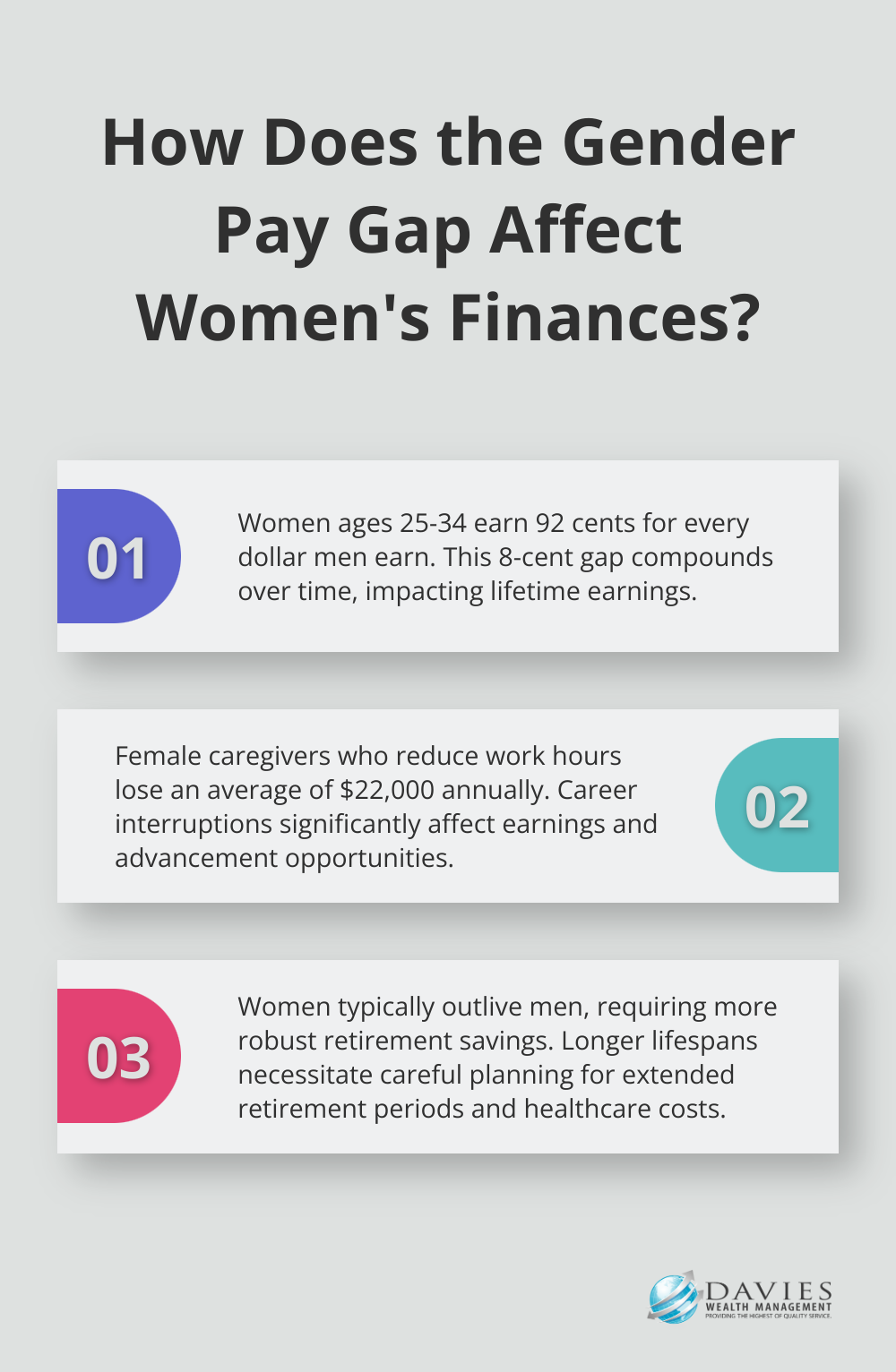

The Persistent Gender Pay Gap

The gender pay gap creates a significant obstacle for women’s financial progress. In 2022, women ages 25 to 34 earned an average of 92 cents for every dollar earned by a man in the same age group – an 8-cent gap. This disparity compounds over time, resulting in substantial differences in lifetime earnings and savings potential.

To combat this, women should negotiate salaries aggressively, seek regular pay reviews, and consider additional income streams or investments to bridge the gap. It’s also important to maximize employer-matched retirement contributions and explore tax-advantaged savings options to make every dollar count.

Career Interruptions and Caregiving Responsibilities

Women more often take career breaks for caregiving, whether for children, elderly parents, or other family members. These interruptions can significantly impact earnings and career advancement. The precise amount of lost income among female caregivers who adjust their working patterns ranges widely-from $22,000 annually for those who have reduced their work hours.

To mitigate this impact, women should maintain professional skills during breaks, consider part-time or flexible work arrangements, and explore options like long-term care insurance for aging parents. It’s also wise to factor potential career breaks into long-term financial plans, potentially increasing savings rates during working years to compensate for periods of reduced income.

Longevity and Retirement Planning

Women typically outlive men by several years, which means they need to plan for a longer retirement period. This extended lifespan necessitates more robust retirement savings and careful consideration of long-term healthcare costs.

Women should start retirement planning early and try to achieve higher savings rates. Delaying Social Security benefits to maximize monthly payments and exploring annuities or other guaranteed income sources can ensure financial stability throughout retirement. It’s also important to factor in potential healthcare costs, including long-term care expenses (which women are more likely to incur due to their longer life expectancy).

Understanding these unique challenges allows women to take proactive steps to secure their financial futures. The next chapter will explore essential financial planning strategies that address these specific issues, helping women build wealth, protect their assets, and achieve long-term financial success.

Practical Financial Strategies for Women

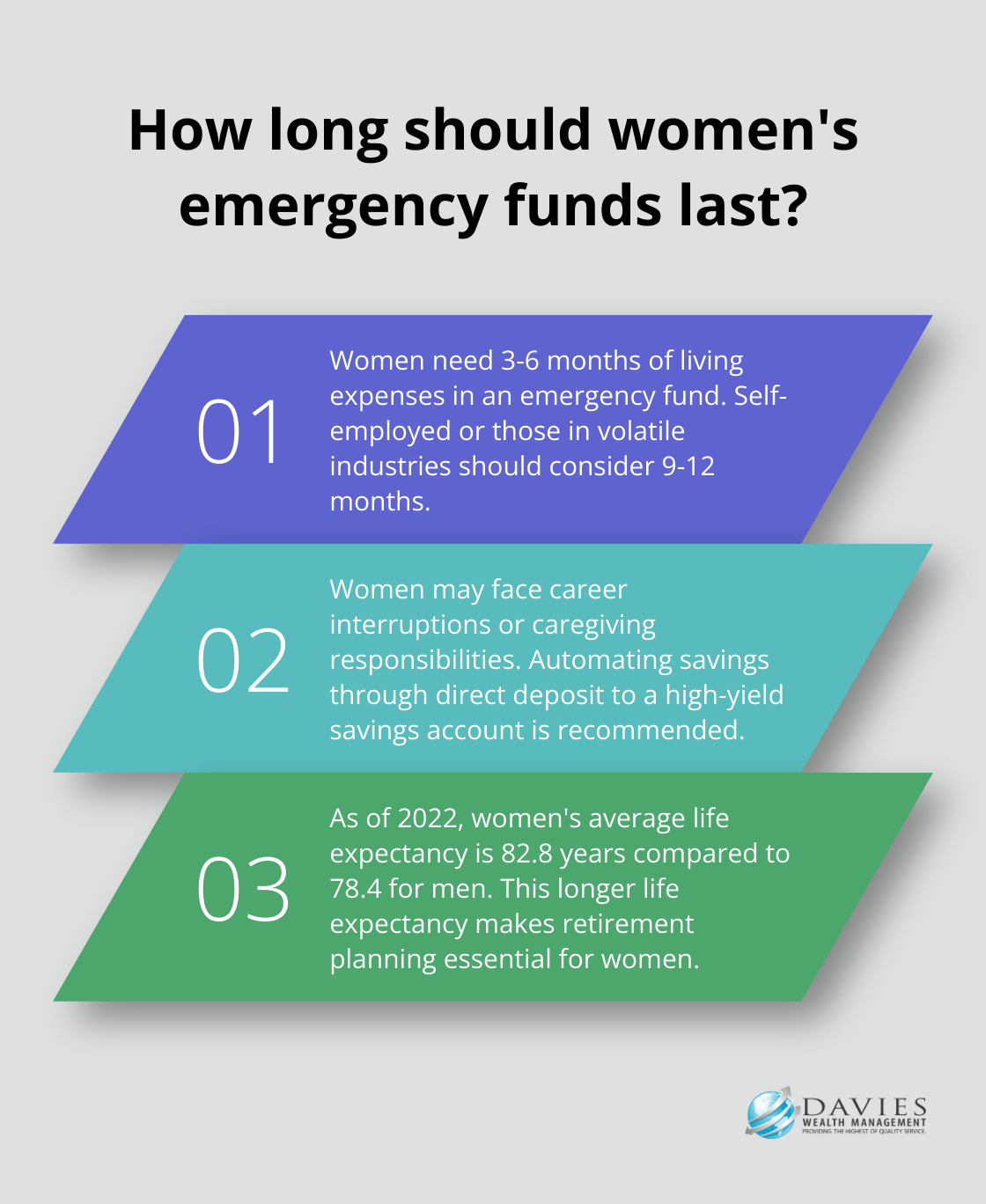

Building a Robust Emergency Fund

An emergency fund serves as your first line of defense against unexpected financial shocks. Women, who may face career interruptions or caregiving responsibilities, need this safety net. Try to save 3-6 months of living expenses in a readily accessible account. Self-employed individuals or those in volatile industries should consider extending this to 9-12 months.

To build your emergency fund efficiently, automate your savings. Set up a direct deposit from your paycheck to a high-yield savings account. Many online banks offer competitive interest rates, allowing your money to grow while remaining accessible.

Maximizing Retirement Savings

Women’s longer life expectancy makes retirement planning essential. As of 2022, the average life expectancy for women is 82.8 years, compared to 78.4 years for men. Maximize your contributions to tax-advantaged retirement accounts like 401(k)s and IRAs. If you’re over 50, take advantage of catch-up contributions. In 2025, you can contribute an additional $7,500 to your 401(k) and $1,000 to your IRA above the standard limits.

Diversification is key to long-term investment success. Consider a mix of low-cost index funds, which provide broad market exposure, and individual stocks or bonds that align with your risk tolerance and financial goals. If you’re unsure about investment strategies, seek advice from a financial advisor who specializes in women’s financial planning.

Developing a Comprehensive Insurance Strategy

Insurance is a critical component of financial planning that’s often overlooked. Women, who statistically live longer and may face higher healthcare costs, need a robust insurance strategy.

Start with health insurance. If you’re self-employed or between jobs, explore options on the health insurance marketplace. Consider a high-deductible health plan paired with a Health Savings Account (HSA) for tax advantages and long-term savings potential.

Life insurance is vital, especially if you have dependents. Term life insurance is often the most cost-effective option. A general rule of thumb is to have coverage equal to 10-15 times your annual income.

Don’t overlook disability insurance. This protects your income if you’re unable to work due to illness or injury. Many employers offer short-term disability, but consider supplementing with a long-term disability policy that covers 60-70% of your income.

Implementing Smart Debt Management

Effective debt management is crucial for building wealth. Start by prioritizing high-interest debt, typically credit card balances. Consider using the debt avalanche method: focus on paying off the highest-interest debt first while making minimum payments on others.

For student loans, explore income-driven repayment plans if you struggle with payments. These can cap your monthly payment at a percentage of your discretionary income. If you work in public service, look into loan forgiveness programs.

If you’re a homeowner, consider refinancing your mortgage if rates have dropped since you originally financed. Even a 0.5% reduction in your interest rate can lead to significant savings over the life of your loan.

These practical financial strategies provide a solid foundation for women to build financial resilience and achieve long-term success. However, implementing these strategies effectively often requires ongoing education and support. In the next chapter, we’ll explore how women can empower themselves through financial education and professional guidance.

Empowering Your Financial Future Through Education

The Foundation of Financial Literacy

Financial literacy forms the bedrock of successful wealth management. Studies indicate that individuals with higher financial literacy save more for retirement, maintain emergency funds, and make smarter investment decisions. This significant difference highlights the importance of continuous financial education.

To enhance your financial knowledge, consider these practical steps:

- Read financial books and reputable online resources (Investopedia and the Financial Industry Regulatory Authority offer comprehensive educational materials).

- Attend financial workshops or webinars (many local libraries, community centers, and financial institutions provide free sessions on various financial topics).

- Use financial apps and tools (apps like Mint or Personal Capital help track spending, set budgets, and provide an overview of your financial situation).

- Take online courses (platforms such as Coursera and edX offer financial courses from top universities, often at low or no cost).

The Value of Professional Expertise

While self-education proves valuable, collaboration with a financial advisor can accelerate your financial growth significantly. This added value stems from personalized strategies, behavioral coaching, and expert navigation of complex financial landscapes.

When seeking professional advice, consider these factors:

- Look for credentials (Certified Financial Planners have undergone rigorous training and adhere to strict ethical standards).

- Understand fee structures (some advisors charge a percentage of assets under management, while others charge flat fees or hourly rates).

- Seek specialization (if you have unique circumstances, such as being a professional athlete or business owner, look for advisors with relevant expertise).

- Check references and reviews (ask for client references and research online reviews to assess an advisor’s reputation and track record).

Adapting to Financial Evolution

The financial world evolves constantly, with new investment products, tax laws, and economic trends emerging regularly. Commit to ongoing education to stay ahead of these changes. Subscribe to financial newsletters, follow reputable financial experts on social media, and review your financial plan with your advisor regularly.

Tailored Solutions for Unique Circumstances

For individuals with specific financial needs (such as professional athletes facing unique financial challenges), specialized advice becomes essential. Experts in these areas can help navigate complex financial decisions, from managing fluctuating income to planning for life after a sports career.

Tools for Financial Empowerment

Utilize various resources to enhance your financial knowledge:

- Financial calculators (help project savings growth, estimate mortgage payments, or analyze investment returns).

- Budgeting software (assists in tracking expenses and identifying areas for potential savings).

- Investment simulators (allow practice in making investment decisions without risking real money).

- Financial podcasts (provide insights from experts on various financial topics during your commute or workout).

Final Thoughts

Women face unique financial challenges, but they can overcome these obstacles and achieve long-term financial success with the right strategies and knowledge. We explored critical aspects of women and financial planning, from addressing the gender pay gap to planning for a longer retirement. The key to financial empowerment lies in taking proactive steps, such as building a robust emergency fund and maximizing retirement savings through tax-advantaged accounts and diversified investments.

Education plays a pivotal role in financial success. Women can expand their financial knowledge through books, courses, and reputable online resources to make informed decisions about their money. Collaboration with a financial advisor provides personalized guidance and helps navigate complex financial landscapes.

At Davies Wealth Management, we understand the unique financial needs of women. Our team offers tailored wealth management solutions to help you build, protect, and transfer your wealth with confidence. We encourage you to take control of your financial future (leveraging the strategies and resources discussed in this guide).

Leave a Reply