Financial planning for women presents unique challenges and opportunities. At Davies Wealth Management, we recognize the importance of tailored strategies that address the specific financial needs of women.

From navigating the gender pay gap to planning for longer life expectancies, women face distinct financial hurdles. This guide will equip you with essential tools and knowledge to take control of your financial future and achieve your long-term goals.

Why Women Face Unique Financial Challenges

The Persistent Gender Pay Gap

The gender pay gap remains a stubborn reality. Women should actively negotiate salaries, seek regular performance reviews, and pursue professional development opportunities to enhance their earning potential.

Caregiving Responsibilities and Career Interruptions

Women often shoulder the majority of caregiving responsibilities, whether for children or aging parents. A study by the National Women’s Law Center found that nearly 75% of part-time workers are women, many of whom have scaled back their careers to accommodate caregiving duties. These career interruptions can lead to reduced lifetime earnings and lower retirement savings. Women should explore flexible work arrangements, maintain professional networks during breaks, and consider long-term care insurance for aging parents to mitigate financial impacts.

Planning for Longevity

Women tend to live longer than men, which necessitates a more robust retirement strategy. This extended life expectancy means women need to plan for higher healthcare costs and a longer retirement period. Women should try to save for retirement, a benchmark that accounts for their potentially longer retirement years.

The Impact of Divorce

Divorce can have a significant financial impact on women. Women are likely to be financially worse off than men once the settlement agreement is signed. Women should prepare for potential financial challenges by maintaining financial independence and seeking professional advice during and after divorce proceedings.

Confidence in Financial Decision-Making

Many women report lower confidence in their financial decision-making compared to men. This hesitation can lead to missed opportunities for financial growth and security. Women should actively seek financial education, engage with financial professionals, and participate in investment decisions to build confidence and improve their financial outcomes.

As we move forward, we’ll explore essential financial planning strategies that address these unique challenges, empowering women to take control of their financial futures.

Practical Steps for Financial Empowerment

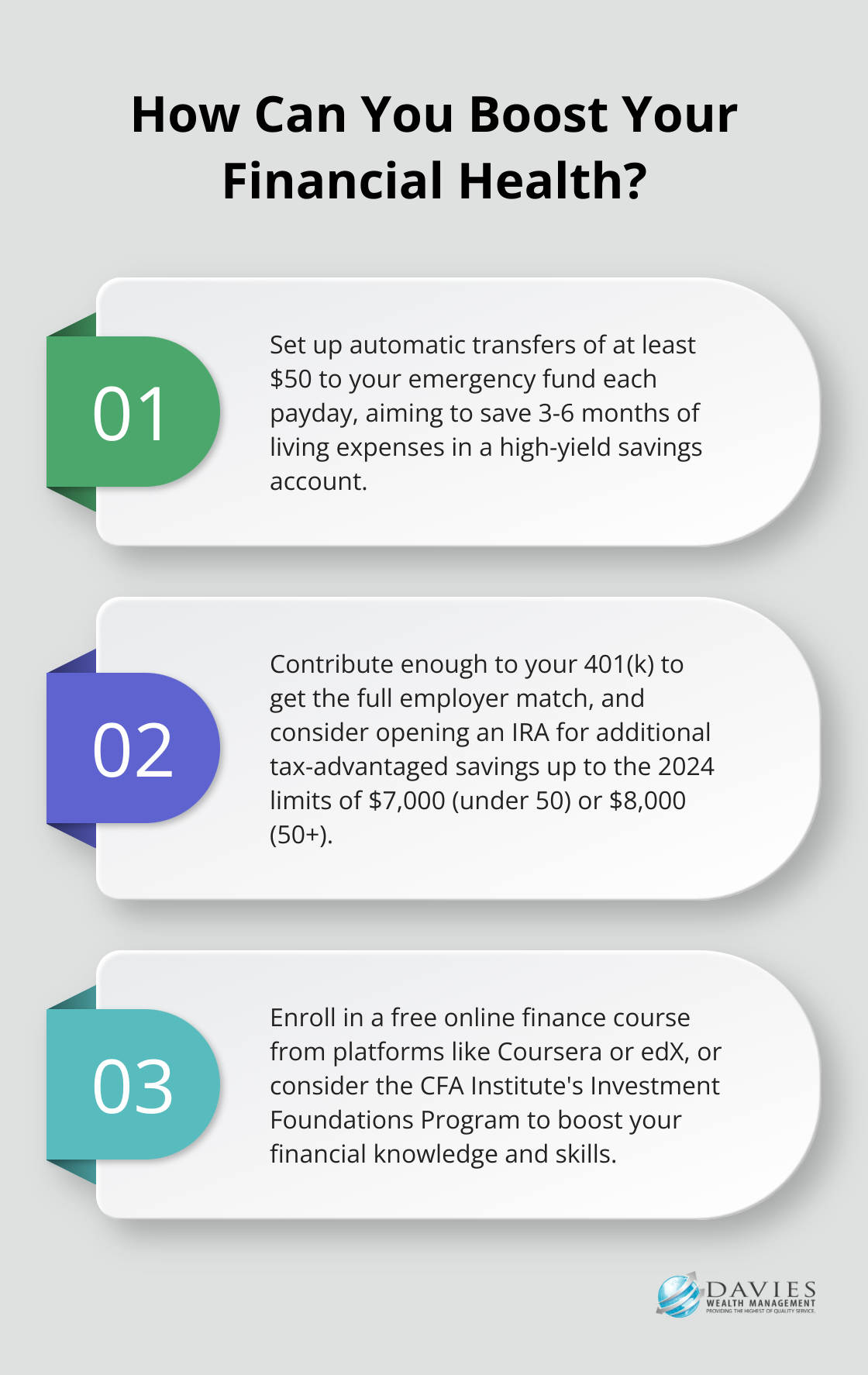

Build a Robust Emergency Fund

Start your financial journey by establishing a solid emergency fund. Try to save three to six months of living expenses in a high-yield savings account. A 2024 Bankrate survey revealed that 62% of Americans feel behind on emergency savings, while only 1 in 5 has increased savings this year. Don’t become part of that statistic. Set up automatic transfers to your emergency fund each payday (even if it’s just $50 to start). As your income grows, increase your contributions.

Maximize Retirement Savings

Take full advantage of employer-sponsored retirement plans like 401(k)s. If your employer offers a match, contribute at least enough to get the full match-it’s free money. For 2024, you can contribute up to $23,000 to a 401(k) if you’re under 50, and $30,500 if you’re 50 or older. Beyond that, consider opening an IRA for additional tax-advantaged savings. The 2024 IRA contribution limit is $7,000 if you’re under 50, and $8,000 if you’re 50 or older.

Diversify your investments across different asset classes to balance risk and potential returns. A common starting point is the “110 minus your age” rule for stock allocation. For example, if you’re 30, consider allocating about 80% to stocks and 20% to bonds. Adjust based on your risk tolerance and goals.

Develop a Comprehensive Insurance Strategy

Protect your financial future with adequate insurance coverage. Start with health insurance-medical debt is a leading cause of bankruptcy in the U.S. If you have dependents, consider term life insurance. A general rule of thumb suggests coverage equal to 10-15 times your annual income.

Don’t overlook disability insurance. One in four 20-year-olds will become disabled before reaching retirement age. Many employers offer short-term disability insurance, but consider supplementing with long-term disability coverage to protect your income if you’re unable to work for an extended period.

Create an Effective Debt Management Plan

Attack high-interest debt aggressively. Credit card rates averaged 20.74% in 2024, making it essential to pay off balances quickly. Consider the debt avalanche method: focus on paying off the highest-interest debt first while making minimum payments on others. Once you’ve paid off the highest-interest debt, move to the next highest, and so on.

For lower-interest debts like mortgages or student loans, weigh the benefits of early payoff against potential investment returns. If your mortgage rate is 4% but you could earn 7% in the stock market over the long term, it might make more sense to invest extra funds rather than pay down the mortgage early.

These strategies provide concrete steps toward financial security and independence. Financial planning is an ongoing process that requires regular review and adjustment as your life circumstances change. The next chapter will explore how to further empower yourself through financial education and professional guidance.

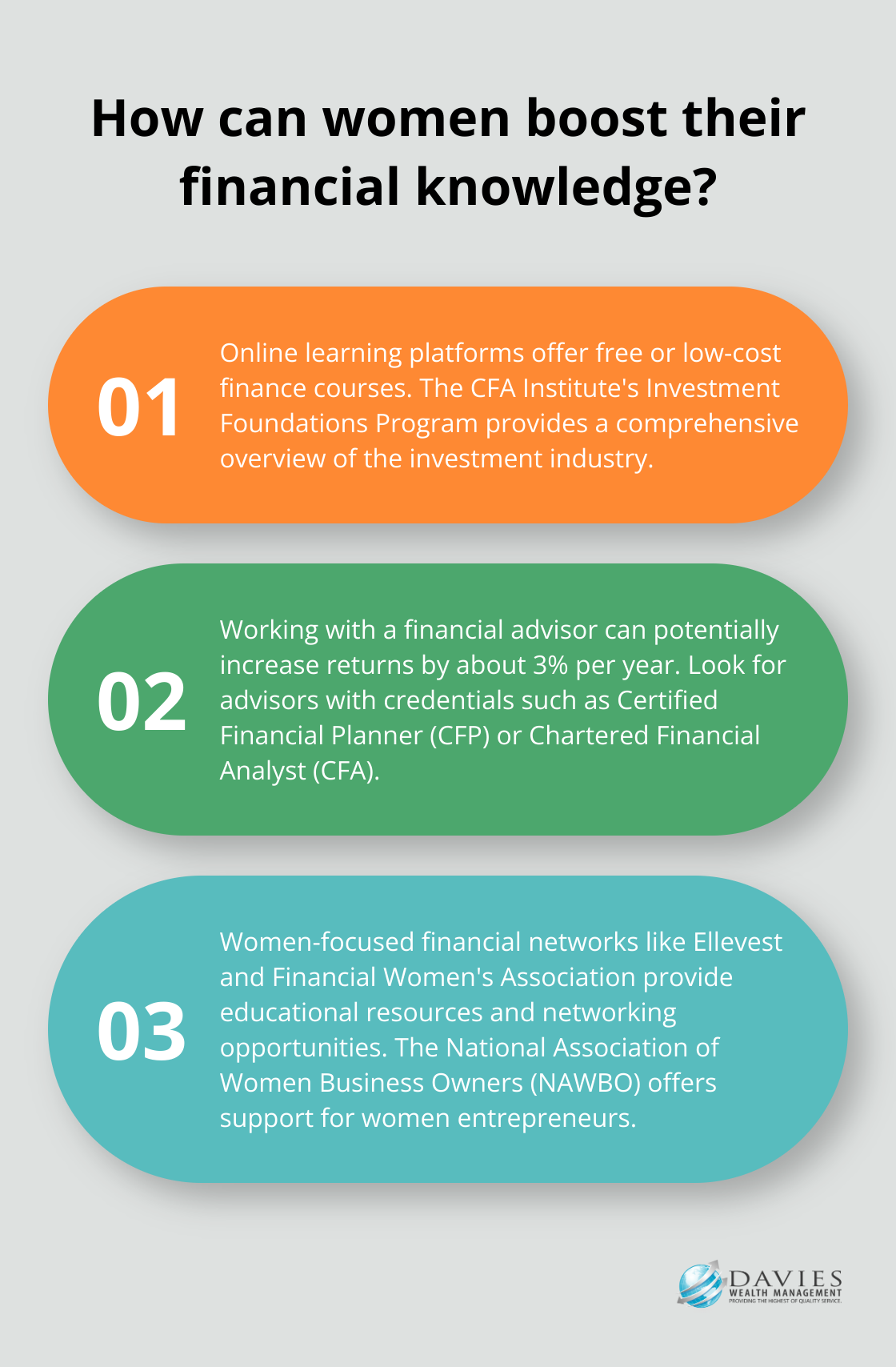

How Women Can Boost Their Financial Knowledge

Leverage Online Learning Platforms

The internet provides numerous financial education resources. Platforms like Coursera and edX offer free or low-cost courses from top universities on topics ranging from personal finance to investment strategies. These online courses can help you learn finance skills and concepts to advance your career today.

The CFA Institute’s Investment Foundations Program serves as another valuable resource. This self-study course provides a comprehensive overview of the investment industry and acts as an excellent starting point for those who want to understand financial markets and instruments.

Seek Professional Financial Advice

While self-education is important, working with a financial advisor can provide personalized guidance tailored to your specific situation. A study by Vanguard found that working with a financial advisor can potentially increase returns by about 3% per year. When you select an advisor, look for credentials such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). A CFP is a financial advisor who’s passed strict requirements for certification, including holding a bachelor’s degree.

Davies Wealth Management offers complimentary initial consultations to discuss your financial goals and how our expertise can help you achieve them. Our advisors create comprehensive financial plans that address the unique challenges women face (such as planning for career breaks and longer life expectancies).

Join Women-Focused Financial Networks

Networking with other women in finance can provide valuable insights and support. Organizations like Ellevest and the Financial Women’s Association offer memberships that include access to educational resources, networking events, and mentorship opportunities.

The National Association of Women Business Owners (NAWBO) serves as another excellent resource, particularly for entrepreneurs. NAWBO provides educational programs, networking events, and advocacy for women-owned businesses.

Attend Financial Workshops and Seminars

Participating in financial workshops and seminars can enhance your knowledge and provide opportunities to learn from experts in the field. Many financial institutions, community centers, and universities offer these events (often at low or no cost). These sessions cover topics such as budgeting, investing, retirement planning, and estate planning.

Read Financial Literature

Expand your financial knowledge through books, magazines, and reputable financial websites. Some recommended reads include “Smart Women Finish Rich” by David Bach, “Rich Woman” by Kim Kiyosaki, and “The Intelligent Investor” by Benjamin Graham. Regularly reading financial publications like The Wall Street Journal or Forbes can help you stay informed about current market trends and economic news.

Final Thoughts

Financial planning for women requires active engagement and a tailored approach. Women face unique challenges, from the gender pay gap to balancing career and caregiving responsibilities. We advocate for building emergency funds, maximizing retirement savings, and developing comprehensive insurance strategies to secure your financial future.

Education plays a vital role in financial empowerment. We encourage you to utilize online resources, attend workshops, and seek professional guidance when needed. Davies Wealth Management offers personalized advice to address the specific financial needs of women, including professional athletes with distinct financial challenges.

Financial planning for women is an ongoing process that evolves with your life circumstances. We urge you to start now, regardless of your current financial situation. Your commitment to financial well-being today will shape a secure and independent future tomorrow.

Leave a Reply