Financial planning as a couple is a cornerstone of a strong, stable relationship. At Davies Wealth Management, we’ve seen how shared financial goals can bring partners closer together and set the stage for a prosperous future.

However, merging two financial lives isn’t always smooth sailing. This guide will walk you through the essential steps to master your finances as a team, ensuring you’re both on the same page and working towards common objectives.

How to Set Financial Goals as a Team

Start with Open Communication

Initiate an honest conversation about your individual and shared financial aspirations. This should include specific goals like buying a home, starting a family, retiring early, or traveling the world. Be precise about what these goals mean to each of you. For instance, if travel is a priority, discuss preferred destinations and frequency of trips.

Categorize Your Goals

After you identify your objectives, sort them into short-term (1-3 years), medium-term (3-10 years), and long-term (10+ years) goals. This creates a clear roadmap for your financial journey. Short-term goals might include paying off credit card debt or saving for a vacation, while long-term goals could focus on retirement savings or funding your children’s education.

Prioritize and Compromise

Not all goals will have equal importance to both partners. Rank your objectives based on mutual agreement. This process often requires compromise. For example, one partner might prioritize buying a home, while the other focuses on starting a business. Find a middle ground that satisfies both parties.

A Fidelity Investments study revealed that 47% of couples disagree on how much risk they are comfortable taking on in their investments. This statistic underscores the importance of finding common ground in your financial planning.

Create a Timeline and Set Milestones

For each goal, establish a realistic timeline and set specific milestones. This approach breaks down larger objectives into manageable steps. If your goal is to save $50,000 for a down payment on a house in five years, set annual savings targets of $10,000.

Review and Adjust Regularly

Financial goals aren’t set in stone. Life changes, and so should your objectives. Regularly reviewing and revisiting your financial goals helps in maintaining motivation and accountability. It allows both you and your spouse to stay engaged and make necessary adjustments.

We recommend starting with common goals and big-ticket goals first. Write them down and keep them visible so they remain top-of-mind.

Setting financial goals as a couple is an ongoing process that requires patience, understanding, and flexibility. As you work together and stay committed to your shared vision, you’ll strengthen your relationship and move closer to financial success. The next step in mastering financial planning as a couple involves creating a joint budget, which we’ll explore in the following section.

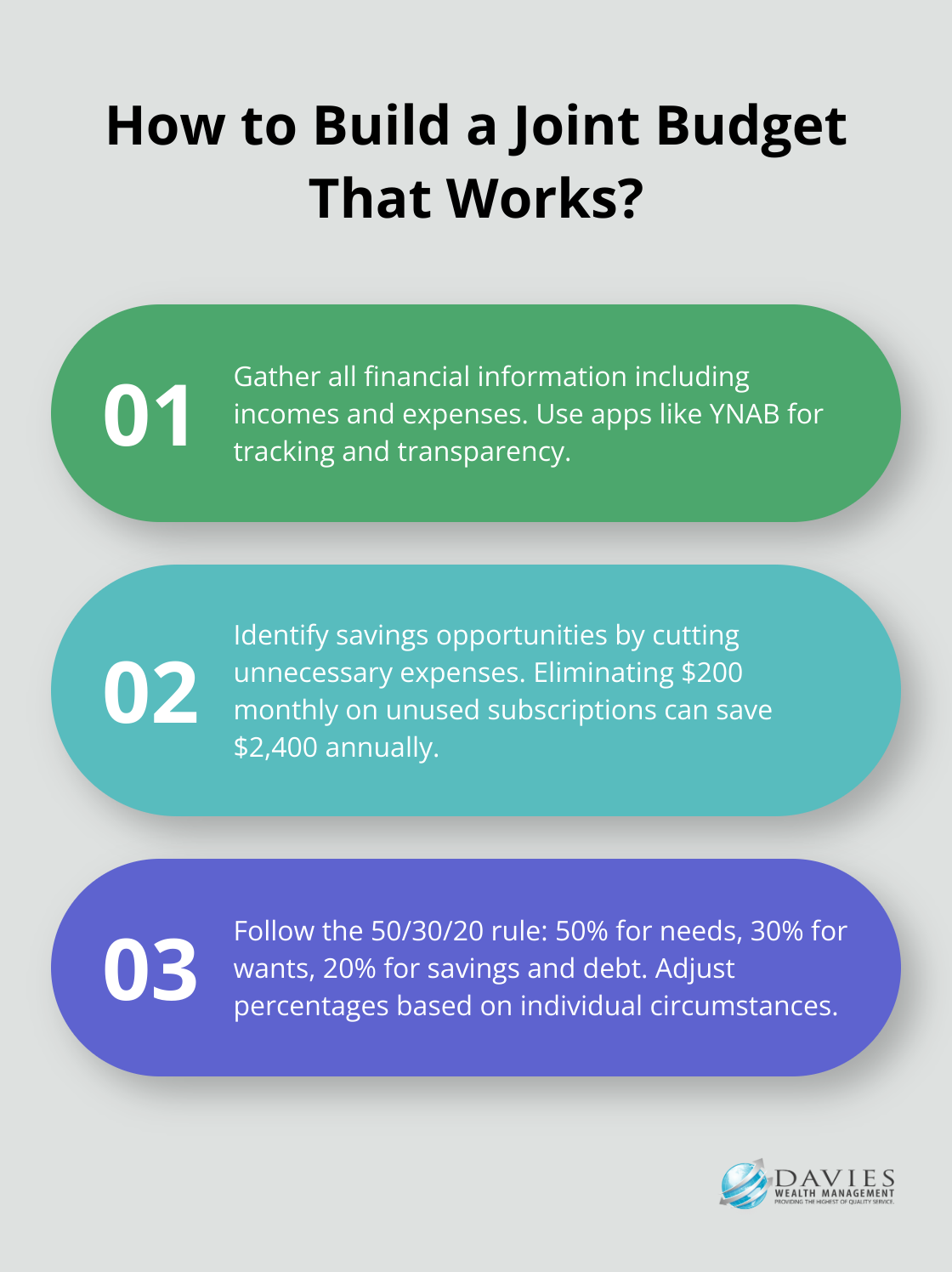

Building a Joint Budget That Works

Combine Your Financial Picture

Start by gathering all your financial information. This includes both partners’ incomes, fixed expenses (like rent, utilities, and loan payments), and variable expenses (such as groceries, entertainment, and personal care). Use a spreadsheet or a budgeting app to input this data. Many couples find apps like YNAB (You Need A Budget) helpful for tracking expenses and maintaining transparency. YNAB is considered amazing and well worth the price when you consider how much money and time it saves.

Identify Savings Opportunities

Once you have a clear view of your combined finances, look for areas where you can cut back. This doesn’t mean eliminating all discretionary spending, but rather finding a balance that allows you to save while still enjoying life. For example, you might discover you’re spending $200 monthly on subscription services you rarely use. Cutting these could free up $2,400 annually for your savings goals.

Allocate Funds Wisely

Now, it’s time to allocate your income. A popular method is the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. However, you should adjust these percentages based on your individual circumstances. For instance, if you’re aiming to buy a house in a competitive market, you might need to allocate more towards savings.

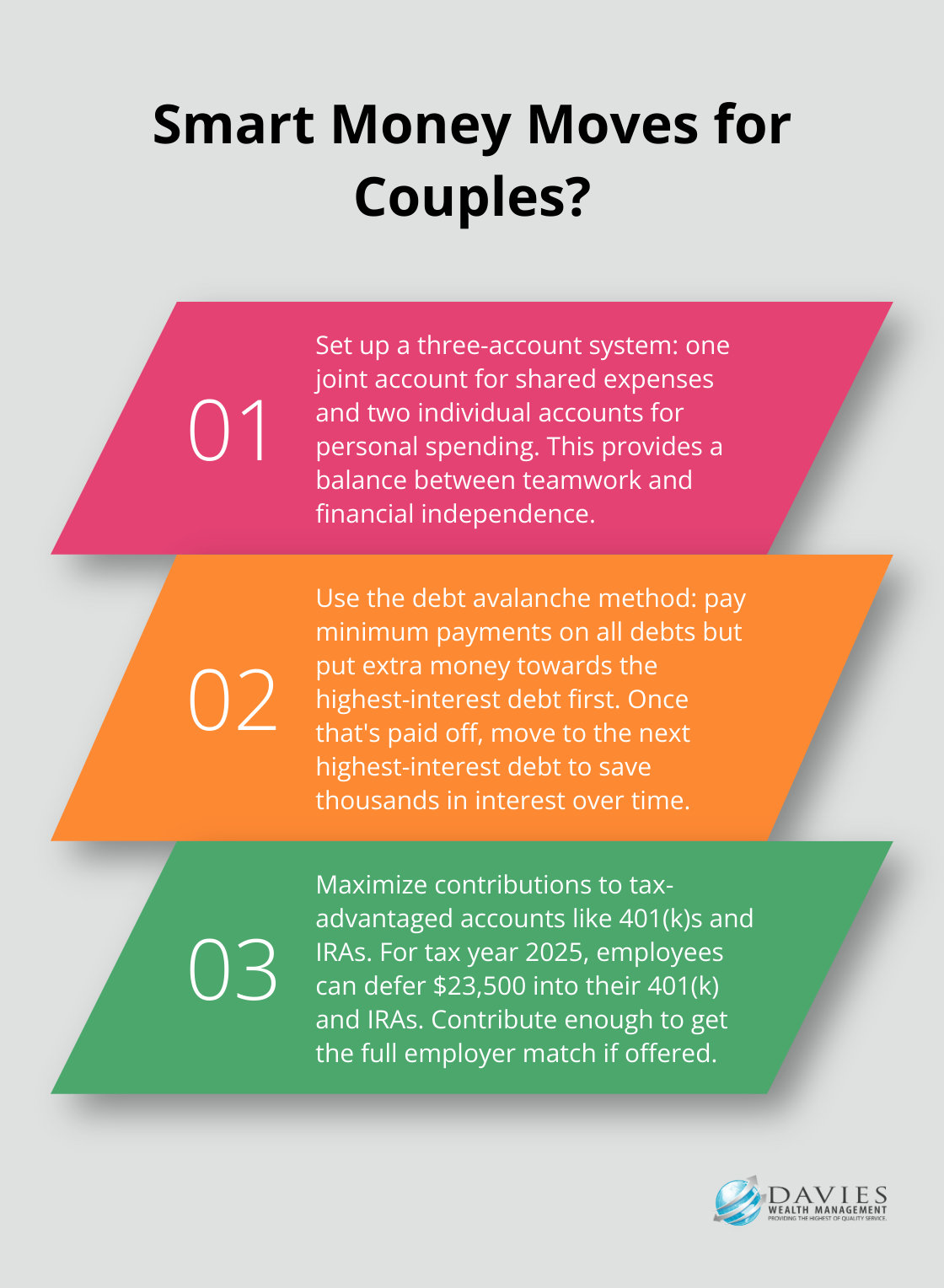

Don’t forget to budget for both shared and individual expenses. Many couples find success with a three-account system: one joint account for shared expenses and two individual accounts for personal spending. This approach provides a balance between teamwork and financial independence.

Set Up Automatic Transfers

Automate your budget as much as possible. Set up automatic transfers to your savings accounts and for bill payments. This reduces the risk of missed payments and ensures you’re consistently working towards your financial goals.

Plan for Irregular Expenses

Don’t forget to account for irregular expenses like car maintenance, holiday gifts, or annual insurance premiums. Set aside a small amount each month for these costs to avoid financial stress when they arise. For example, if you spend $1,200 annually on holiday gifts, budget $100 monthly into a dedicated savings account.

Creating a joint budget takes time and effort, but it’s a powerful tool for achieving your financial goals as a couple. A budget is not about restriction, but about making intentional choices with your money. As you move forward in your financial planning journey, the next step is to tackle debt and investments as a team. Let’s explore how you can effectively manage these aspects of your financial life together.

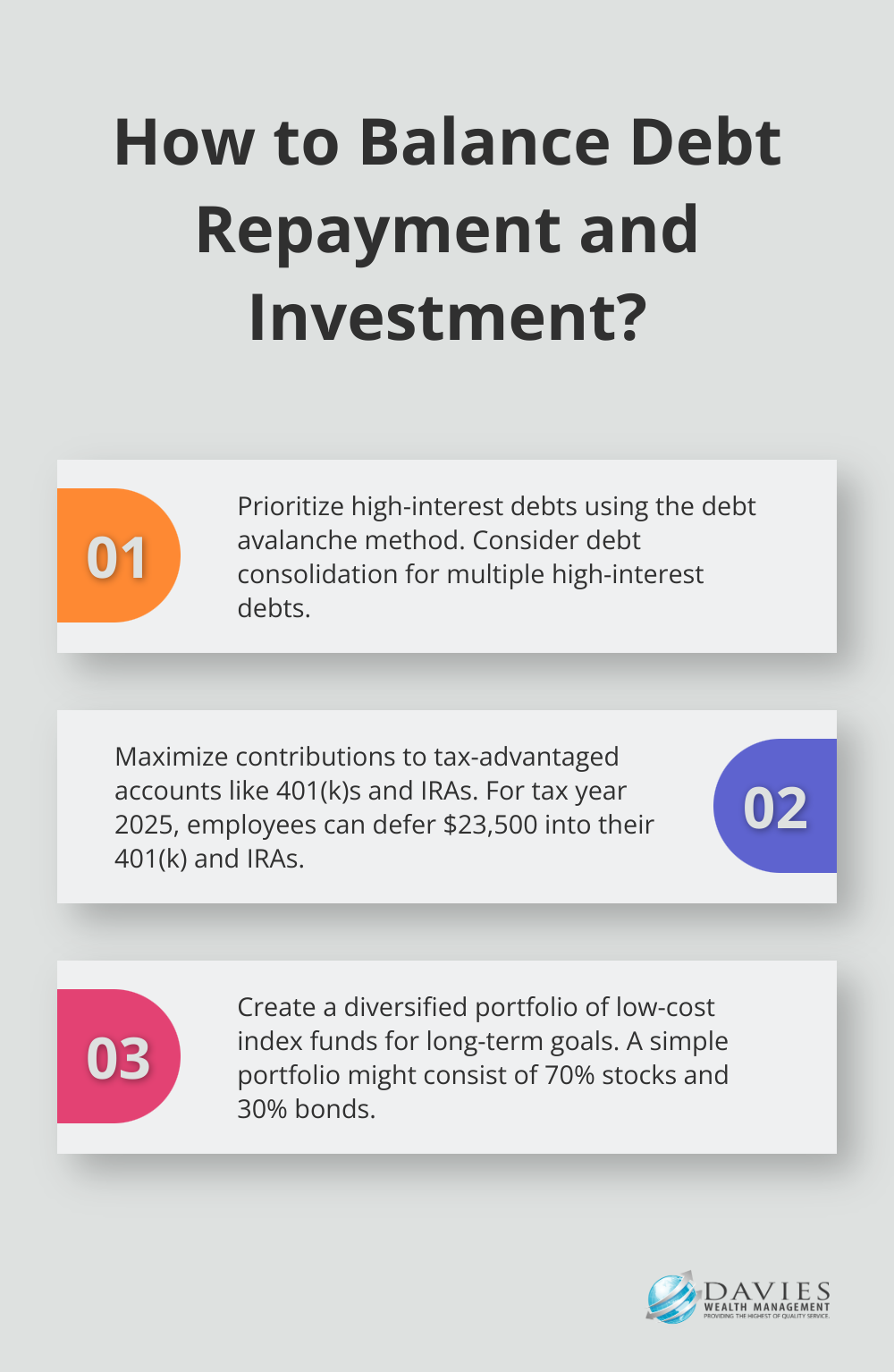

Tackling Debt and Investments Together

Conquer Debt as a Team

List all your debts, including credit cards, student loans, and mortgages. Prioritize high-interest debts, as these cost you the most over time. For example, if you have a credit card with an 18% interest rate and a student loan at 5%, focus on the credit card debt first.

Use the debt avalanche method: pay minimum payments on all debts but put extra money towards the highest-interest debt. Once that’s paid off, move to the next highest-interest debt. This approach can save you thousands in interest over time.

Consider debt consolidation. If you have multiple high-interest debts, you might benefit from consolidating them into a single, lower-interest loan. This can simplify your payments and potentially reduce the total interest you pay.

Create a Unified Investment Strategy

Align your investment strategy with your shared goals. If you’re saving for a house in five years, your investment approach should be more conservative than if you’re saving for retirement in 30 years.

Start by maximizing contributions to tax-advantaged accounts like 401(k)s and IRAs. For tax year 2025, employees can defer $23,500 into their 401(k) and IRAs. If your employer offers a 401(k) match, contribute enough to get the full match – it’s essentially free money.

For longer-term goals, consider a diversified portfolio of low-cost index funds. These provide broad market exposure and have lower fees than actively managed funds. A simple portfolio might consist of 70% stocks and 30% bonds, adjusted based on your risk tolerance and time horizon.

Balance Risk Tolerance

Partners often have different risk tolerances. One might prefer aggressive stock investments, while the other favors the stability of bonds. Finding a middle ground is important.

Use a risk tolerance questionnaire (many financial institutions offer these online). Both partners should complete the questionnaire separately, then compare results and discuss any differences.

Create a blended portfolio that reflects both partners’ risk tolerances. For instance, if one partner has a high risk tolerance and the other is more conservative, you might agree on a moderate-risk portfolio.

Review your investment strategy regularly. Life changes, such as having children or nearing retirement, can significantly impact your risk tolerance and investment goals.

At Davies Wealth Management, we understand the complexities of managing debt and investments as a couple. Our team can provide personalized guidance to help you navigate these financial decisions together, ensuring a strong foundation for your shared financial future.

Final Thoughts

Financial planning as a couple strengthens relationships and builds a stable future. Open communication, compromise, and adaptability form the cornerstone of successful joint financial management. Regular reassessment of goals, budgets, and investment strategies keeps couples aligned with their shared vision.

Complex financial situations often require expert guidance. Davies Wealth Management offers tailored solutions for couples navigating their financial journey together. Our experienced advisors provide valuable insights to help make informed decisions about shared financial futures.

Commitment to financial goals deepens partnerships beyond money management. It creates a life based on shared values and aspirations. With dedication and the right support, couples can master their finances and create a prosperous future together.

Leave a Reply