Financial Planning and Analysis (FP&A) is the backbone of strategic decision-making in modern businesses. At Davies Wealth Management, we’ve seen firsthand how mastering FP&A can transform an organization’s financial performance and long-term success.

This comprehensive guide will equip you with the essential skills and knowledge needed to excel in financial planning and analysis. From fundamental concepts to advanced strategies, we’ll cover everything you need to become an FP&A expert and drive your business forward.

Understanding Financial Planning and Analysis

The Core of Strategic Financial Management

Financial Planning and Analysis (FP&A) forms the foundation of strategic financial management. It involves the analysis of a company’s financial performance, the prediction of future outcomes, and the alignment of financial strategies with overall business objectives. This process enables informed decisions that propel growth and profitability.

FP&A’s Strategic Impact

FP&A transcends traditional accounting practices. It transforms financial data into actionable insights. Next-level FP&A teams build more speed and flexibility into their own processes, which can trigger more efficient and effective operations.

FP&A professionals serve as financial advisors to leadership teams. They provide the financial context for strategic decisions, from product launches to market expansions. This guidance proves particularly valuable in volatile markets.

Essential Components of Effective FP&A

Successful FP&A relies on several critical elements:

- Budgeting and Forecasting: This involves the creation of detailed financial projections. The most effective forecasts adapt regularly to reflect changing market conditions. The annual budgeting process calculates the number of calendar days (including weekends) it takes to complete the annual budget.

- Financial Modeling: The construction of comprehensive models that simulate various scenarios is essential. These models should incorporate both internal data and external factors like market trends and economic indicators.

- Performance Analysis: Regular evaluation of financial performance against targets is crucial. This includes variance analysis to understand discrepancies between actual results and projections.

- Cash Flow Management: A clear picture of cash inflows and outflows is vital for financial health.

Tools That Enhance Modern FP&A

The right tools significantly boost FP&A capabilities:

- Advanced Analytics Software: Platforms like Tableau or Power BI enable deep data analysis and visualization. These tools process large datasets quickly, revealing trends and patterns that might otherwise remain hidden.

- Cloud-based Planning Systems: Solutions such as Anaplan or Adaptive Insights offer real-time collaboration and scenario modeling. They allow for more agile planning processes, which is crucial in today’s fast-paced business environment.

- Integrated ERP Systems: Enterprise Resource Planning systems that integrate financial data with other business functions provide a holistic view of the organization’s performance.

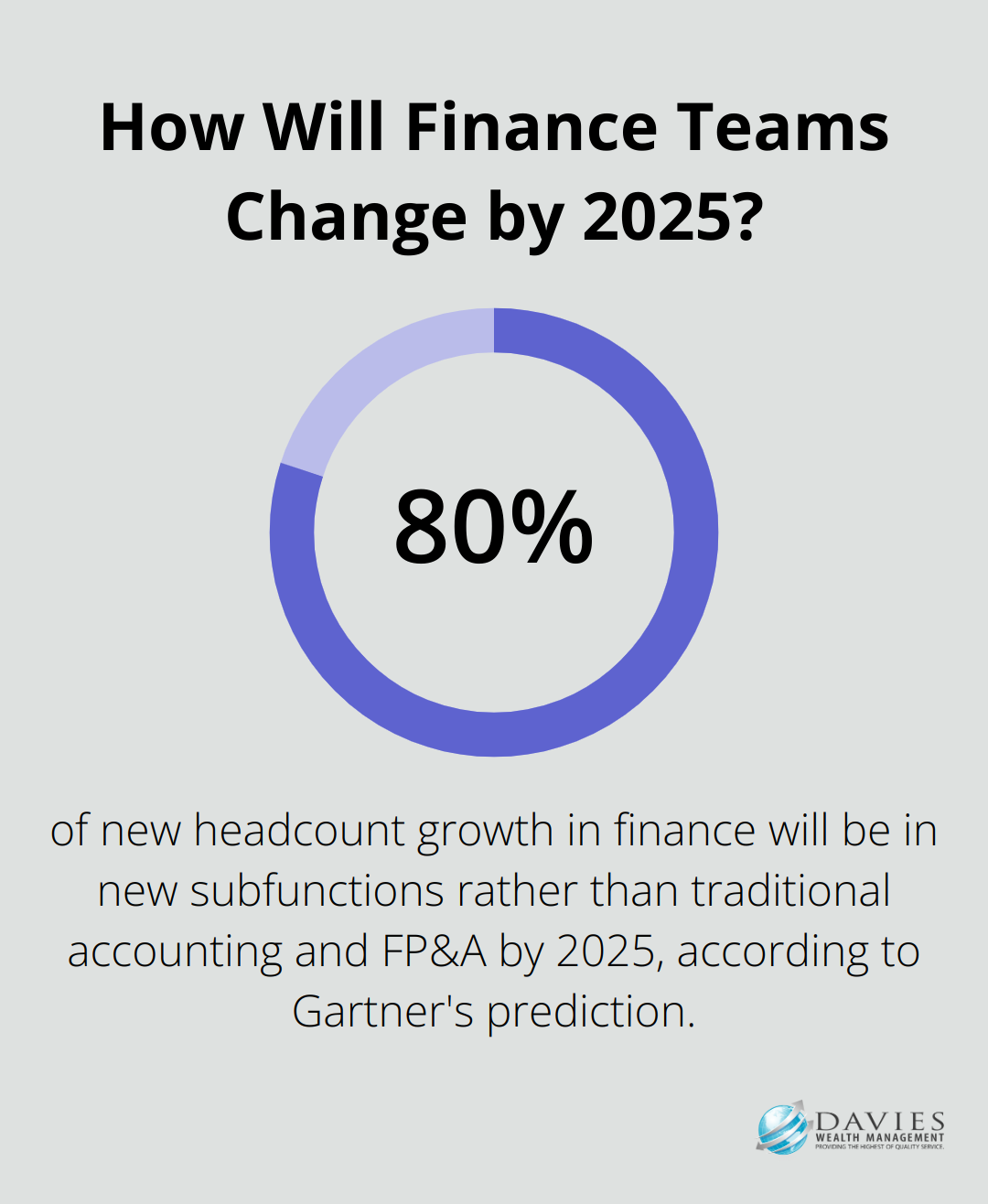

- Predictive Analytics: The use of machine learning algorithms can improve forecast accuracy. Gartner predicts that by 2025, 80% of new headcount growth in finance will be in new subfunctions rather than traditional accounting and FP&A, requiring new roles and structures.

The mastery of FP&A requires a combination of analytical skills, business acumen, and technological proficiency. These fundamental aspects transform financial planning processes, leading to more informed decisions and improved financial outcomes. As we move forward, we’ll explore the development of effective financial models and forecasts, which will further elevate your FP&A skills.

Crafting Robust Financial Models

Integrate Multiple Data Sources

Financial models serve as the foundation for effective FP&A. The first step in building a comprehensive model involves gathering data from various organizational sources. This includes historical financial statements, operational metrics, and market data. For instance, when working with professional athletes, financial advisors combine contract details, performance statistics, and endorsement potential to create a holistic financial picture.

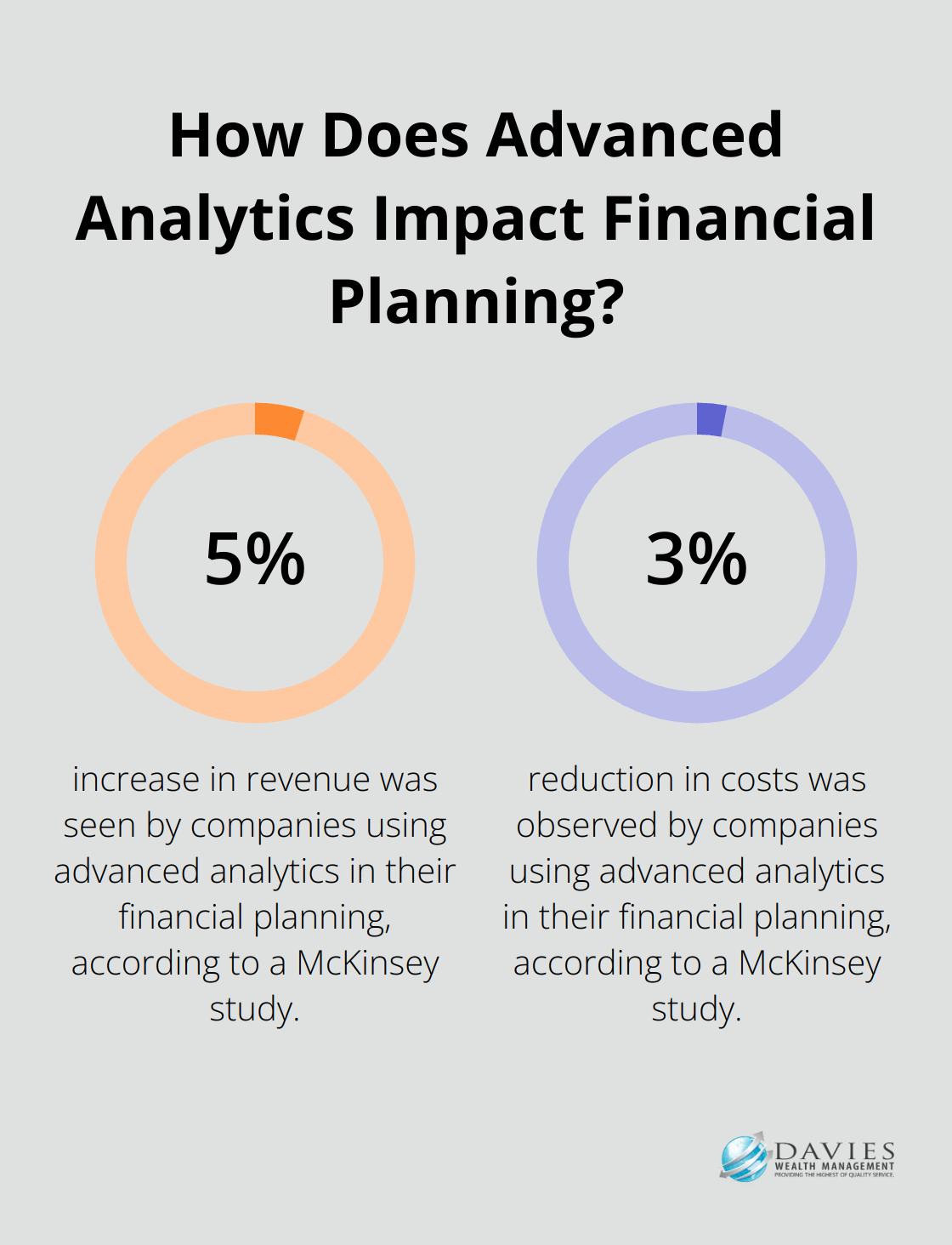

A robust model incorporates both quantitative and qualitative factors. While numbers play a vital role, the impact of industry trends, regulatory changes, or shifts in consumer behavior cannot be overlooked. A study by McKinsey found that companies using advanced analytics in their financial planning saw a 5% increase in revenue and a 3% reduction in costs.

Master Advanced Forecasting Techniques

Simple trend analysis no longer suffices in today’s complex financial landscape. Implementation of sophisticated forecasting methods such as regression analysis, time series modeling, and Monte Carlo simulations provides more accurate projections and helps quantify uncertainty.

For example, when forecasting an athlete’s future earnings, regression analysis correlates performance metrics with salary trends across the league. This approach enables more informed decisions about contract negotiations and long-term financial planning.

Embrace Scenario Planning

Static models fall short in today’s volatile business environment. Scenario planning and sensitivity analysis are essential tools for financial modeling. They help businesses forecast more accurately and reduce risk by stress-testing assumptions and preparing for various potential outcomes.

A practical approach involves the development of three scenarios: base case, optimistic case, and pessimistic case. For each scenario, identification of key drivers and their potential ranges proves invaluable. This method has shown particular effectiveness in the sports industry, where injuries or changes in team dynamics can dramatically impact financial outcomes.

Leverage Technology for Dynamic Modeling

Advanced financial modeling software creates dynamic, interconnected models. Tools like Anaplan or Oracle Hyperion allow for real-time updates and collaborative modeling. This proves particularly useful when working with clients across different time zones or when rapid decision-making becomes necessary.

Implementation of version control and audit trails in the modeling process ensures transparency and allows for tracking changes over time (which is essential for maintaining accuracy and credibility in financial projections).

Validate and Refine Continuously

No financial model achieves perfection from the start. Regular comparison of projections against actual results and refinement of assumptions accordingly improves forecast accuracy over time. Quarterly reviews of financial models, adjusting for new market data, client feedback, and emerging trends, can help maintain high forecast accuracy rates for long-term financial plans.

The development of these robust financial models not only predicts outcomes but also drives strategic decision-making. The next step in mastering FP&A involves translating these models into actionable insights that guide organizations towards financial success.

How Data Drives Financial Decisions

The Power of Advanced Analytics

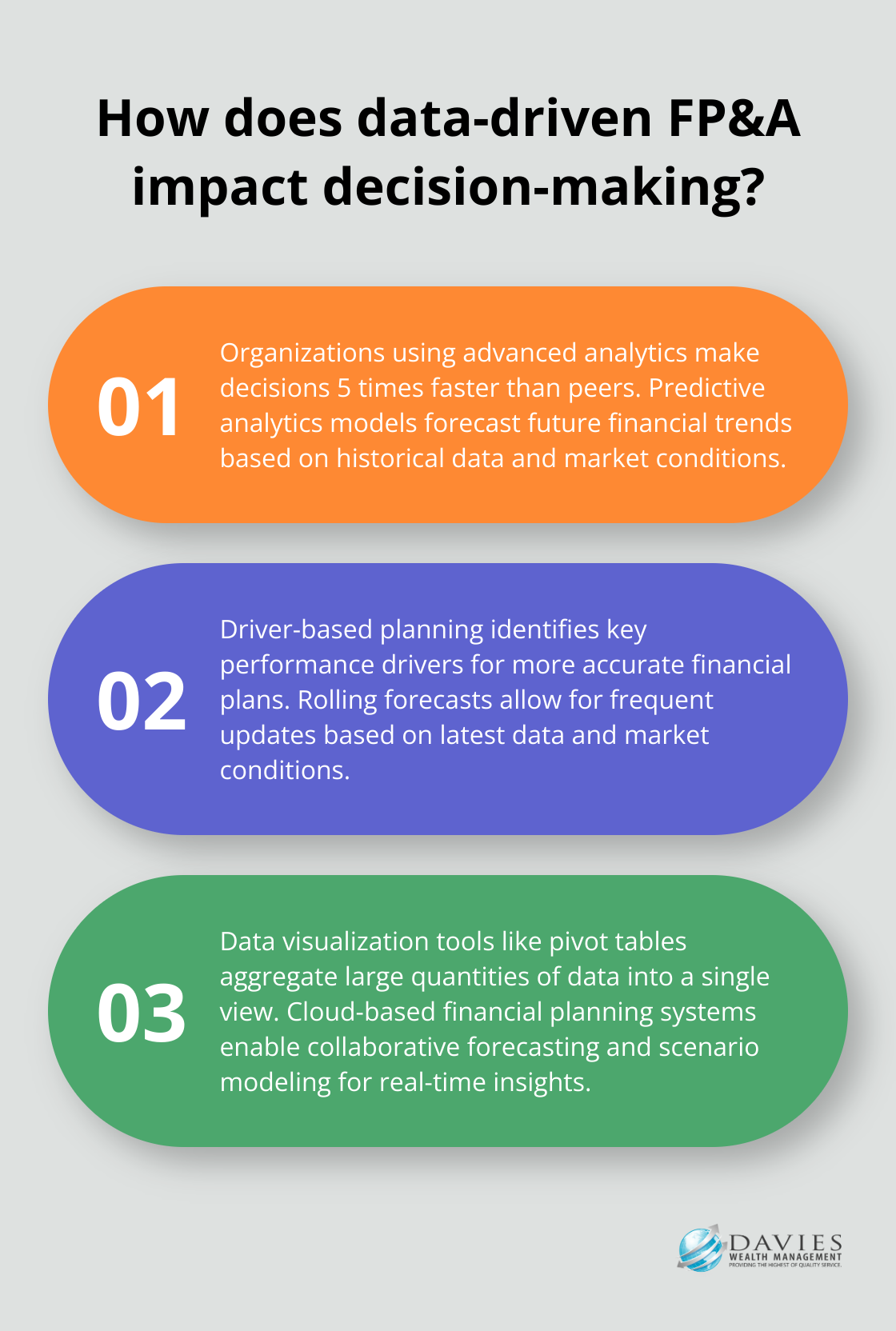

Financial Planning and Analysis (FP&A) teams can transform their decision-making processes by embracing advanced analytics. A study by Deloitte reveals that organizations using advanced analytics in their FP&A processes make decisions five times faster than their peers.

Predictive analytics models stand out as an effective strategy. These models forecast future financial trends based on historical data, market conditions, and other relevant factors. For professional athletes, predictive models estimate future earnings potential, considering performance statistics, injury history, and league-wide salary trends.

Prescriptive analytics offers another powerful tool. It not only predicts outcomes but also suggests actions to achieve desired results. For instance, it can recommend optimal resource allocation strategies to maximize ROI across different business units or investment portfolios.

Aligning Financial Planning with Business Strategy

To drive real value, FP&A must align closely with overall business strategy. This alignment ensures that financial decisions support and accelerate the company’s strategic objectives.

Driver-based planning provides a practical approach. This method identifies key performance drivers and builds financial models around them. For a professional athlete, key drivers might include performance metrics, endorsement deals, and career longevity. Focusing on these drivers creates more accurate and actionable financial plans.

Rolling forecasts offer another effective strategy. Instead of relying solely on annual budgets, rolling forecasts allow for more frequent updates based on the latest data and market conditions. This agility proves particularly important in today’s fast-paced business environment.

Effective Communication of Financial Insights

Even the most sophisticated analysis holds little value if not communicated effectively to decision-makers. FP&A professionals must excel at translating complex financial data into clear, actionable insights.

Data visualization serves as an effective technique. Tools like pivot tables aggregate large quantities of data into a single view, making it easier for stakeholders to grasp key trends and insights. When presenting long-term financial projections to a professional athlete, visual timelines often illustrate potential earnings, savings, and investment growth over their career and beyond.

Tailoring communication to your audience also proves essential. While a CFO might appreciate detailed financial models, a CEO or board member might prefer high-level summaries focused on strategic implications. Understanding your audience and adapting your communication style accordingly can significantly enhance the impact of your financial insights.

Leveraging Technology for Real-Time Insights

Modern FP&A relies heavily on technology to provide real-time insights. Cloud-based financial planning systems (such as Anaplan or Adaptive Insights) enable collaborative forecasting and scenario modeling. These tools allow FP&A teams to respond quickly to changing market conditions and provide up-to-date insights to decision-makers.

Artificial Intelligence (AI) and Machine Learning (ML) also play an increasingly important role in FP&A. These technologies help drive insights for data analytics, performance measurement, predictions and forecasting, real-time calculations, and customer servicing.

Final Thoughts

Financial Planning and Analysis (FP&A) mastery requires dedication, continuous learning, and adaptability. Organizations that excel in FP&A navigate market uncertainties better, capitalize on opportunities, and mitigate risks effectively. They make faster, more informed decisions based on real-time data and sophisticated forecasting models.

To enhance FP&A skills, professionals should deepen their understanding of financial modeling techniques and forecasting methodologies. They need to familiarize themselves with the latest FP&A technologies and tools, such as advanced analytics platforms and cloud-based planning systems. Developing strong data analysis skills will help extract meaningful insights from complex financial information.

At Davies Wealth Management, we understand the critical role that robust financial planning and analysis plays in achieving long-term financial goals. Our team of experts provides tailored financial solutions, including comprehensive FP&A services for individuals, businesses, and professional athletes. We help our clients navigate the complexities of financial management and make informed decisions to secure their financial future.

Leave a Reply