At Davies Wealth Management, we understand the critical role of finance planning and forecasting in achieving long-term financial success. These essential skills form the backbone of sound financial management for individuals and businesses alike.

In this comprehensive guide, we’ll explore the key strategies and tools needed to master financial planning and forecasting. From fundamental techniques to cutting-edge technologies, we’ll equip you with the knowledge to make informed financial decisions and secure your financial future.

Mastering Financial Planning and Forecasting Basics

Distinguishing Planning from Forecasting

Financial planning and forecasting are two distinct yet interconnected processes that form the foundation of sound financial management. Financial planning involves setting specific goals and outlining the steps to achieve them. It creates a roadmap for your financial future. Forecasting predicts future financial outcomes based on historical data and current trends.

For instance, when working with professional athletes, we create comprehensive financial plans that help them plan for a financially secure post-career life while enjoying the fruits of their labors today. This includes strategies for managing high-income years and preparing for post-career transitions. Forecasting projects potential earnings from contracts and endorsements, allowing us to adjust the plan as needed.

Core Elements of Effective Financial Planning

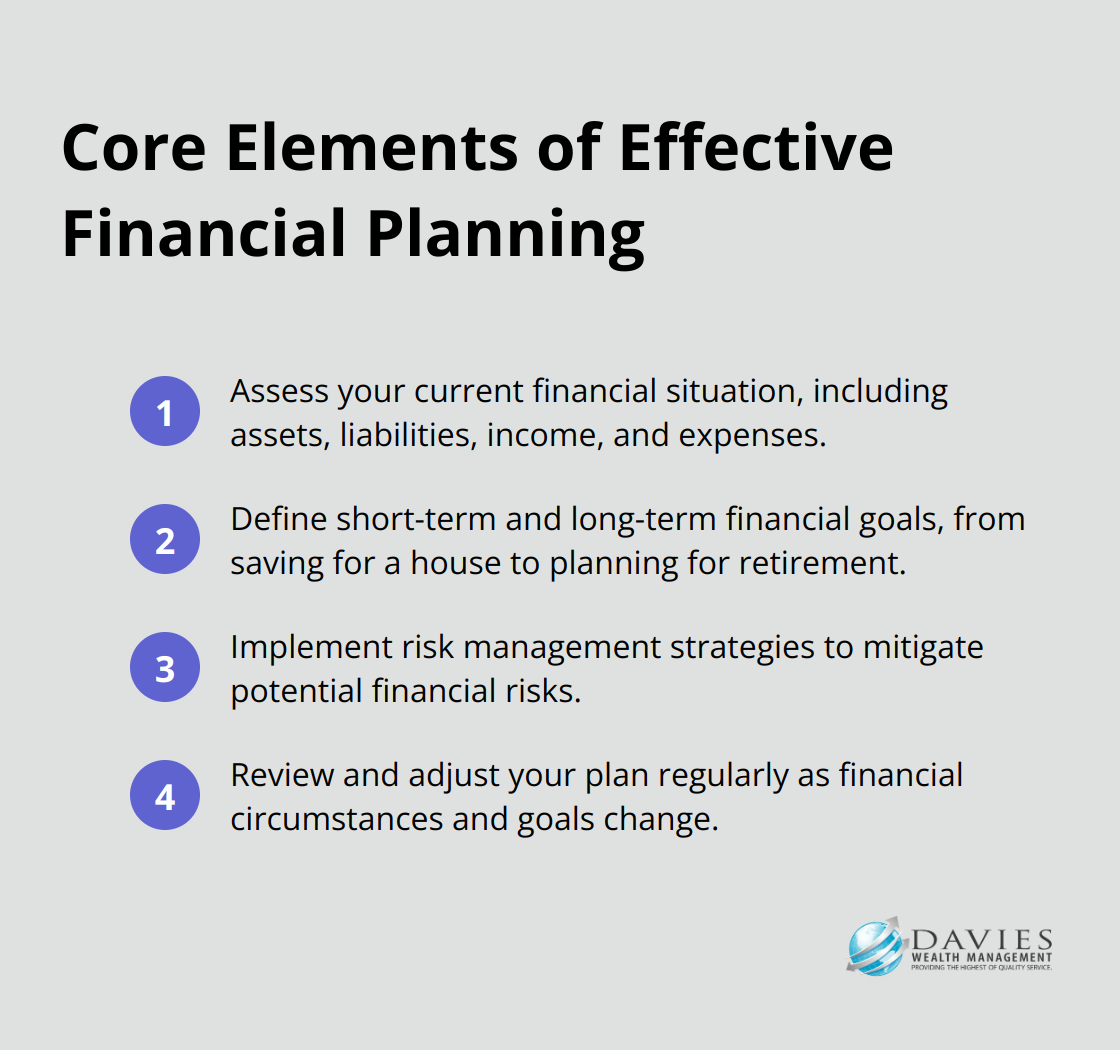

Effective financial planning encompasses several key components:

Proven Forecasting Techniques

Financial experts rely on several methodologies for accurate forecasting:

Time Series Analysis

Time series forecasting uses a model to predict future values based on previously observed values. It’s particularly useful in a wide range of applications, including predicting seasonal fluctuations in income or expenses.

Regression Analysis

This powerful tool identifies relationships between different variables, allowing for more accurate predictions. For example, it can forecast how changes in market conditions might impact an athlete’s endorsement earnings.

Scenario Analysis

This technique creates multiple “what-if” scenarios to prepare for various potential outcomes. It helps clients prepare for different career scenarios, ensuring they’re financially ready for any eventuality.

Integrating Planning and Forecasting

The true power of financial management lies in the integration of planning and forecasting. While planning sets the direction, forecasting provides the insights needed to navigate the journey effectively. This combination allows for more informed decision-making and better financial outcomes.

Financial planners often develop a customized plan based on factors like income stability, investment horizon, lifestyle requirements, and even emotional considerations. This integrated approach ensures a comprehensive and personalized financial strategy.

As we move forward, we’ll explore how to build a robust financial planning process that incorporates these fundamental concepts and techniques. This process will serve as the foundation for achieving your financial goals and securing your financial future.

Investment strategies tailored to meet your unique financial objectives are crucial in this process, helping you unleash the power of your investments and work towards your financial goals.

How to Build a Robust Financial Planning Process

Set Clear, Measurable Financial Goals

The first step in any effective financial plan requires the establishment of clear, measurable goals. These goals should be specific, time-bound, and align with your personal values and life objectives. For example, instead of a vague goal like “save for retirement,” you should try to create something more concrete like “accumulate $2 million in retirement savings by age 60.”

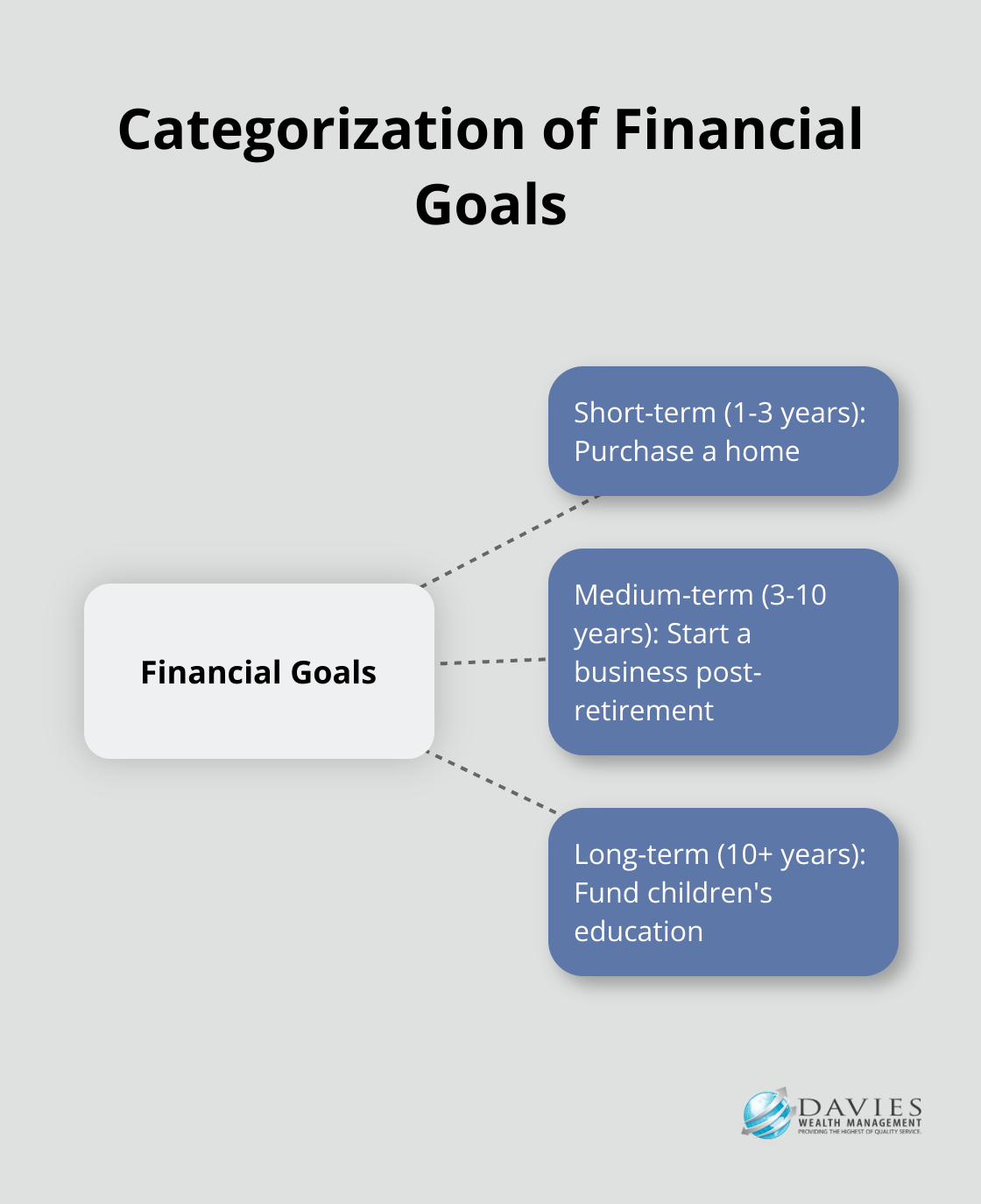

We recommend the categorization of your goals into short-term (1-3 years), medium-term (3-10 years), and long-term (10+ years) objectives. This approach allows for better prioritization and resource allocation.

Develop Comprehensive Budgets and Cash Flow Projections

After you establish your goals, the next important step involves the creation of detailed budgets and cash flow projections. These tools provide a clear picture of your current financial situation and help forecast future financial needs.

Start by tracking all income sources and expenses for at least three months. This data will form the basis of your budget. Include both fixed costs (like mortgage payments) and variable expenses (such as entertainment). For athletes or individuals with fluctuating incomes, we recommend the use of a percentage-based budget rather than fixed dollar amounts.

Cash flow projections should extend several years into the future, accounting for expected changes in income and expenses. These projections are particularly important for athletes who may have high-earning years followed by significant income drops post-retirement.

Implement Rolling Forecasts for Increased Accuracy

Traditional annual budgets can quickly become outdated in today’s fast-paced financial environment. That’s why we advocate the implementation of rolling forecasts. This approach involves regular updates to your financial projections based on the most recent data and market conditions.

For example, instead of creating a static 12-month budget at the start of the year, you might update your forecast every quarter, always maintaining a 12-month outlook. This method allows for more agile decision-making and helps you stay on track with your financial goals.

Rolling forecasts are especially beneficial for professional athletes who may need to adjust their financial strategies based on performance, injuries, or new contract negotiations. They also prove valuable for business owners or individuals in industries with cyclical or unpredictable income patterns.

Utilize Professional Guidance

While self-education in financial planning is valuable, the complexity of financial markets and regulations often necessitates professional guidance. A qualified financial advisor can provide expert insights, help you avoid common pitfalls, and tailor strategies to your unique situation.

Professional advisors bring a wealth of experience and can offer perspectives you might not have considered. They can also help you navigate complex financial products and tax implications, ensuring your financial plan is both comprehensive and optimized for your specific circumstances.

The next step in mastering finance planning and forecasting involves the leverage of technology to enhance your financial planning process. Modern tools and software can significantly streamline your efforts and provide more accurate, real-time insights into your financial situation.

How Technology Enhances Your Financial Planning

The Power of Financial Planning Software

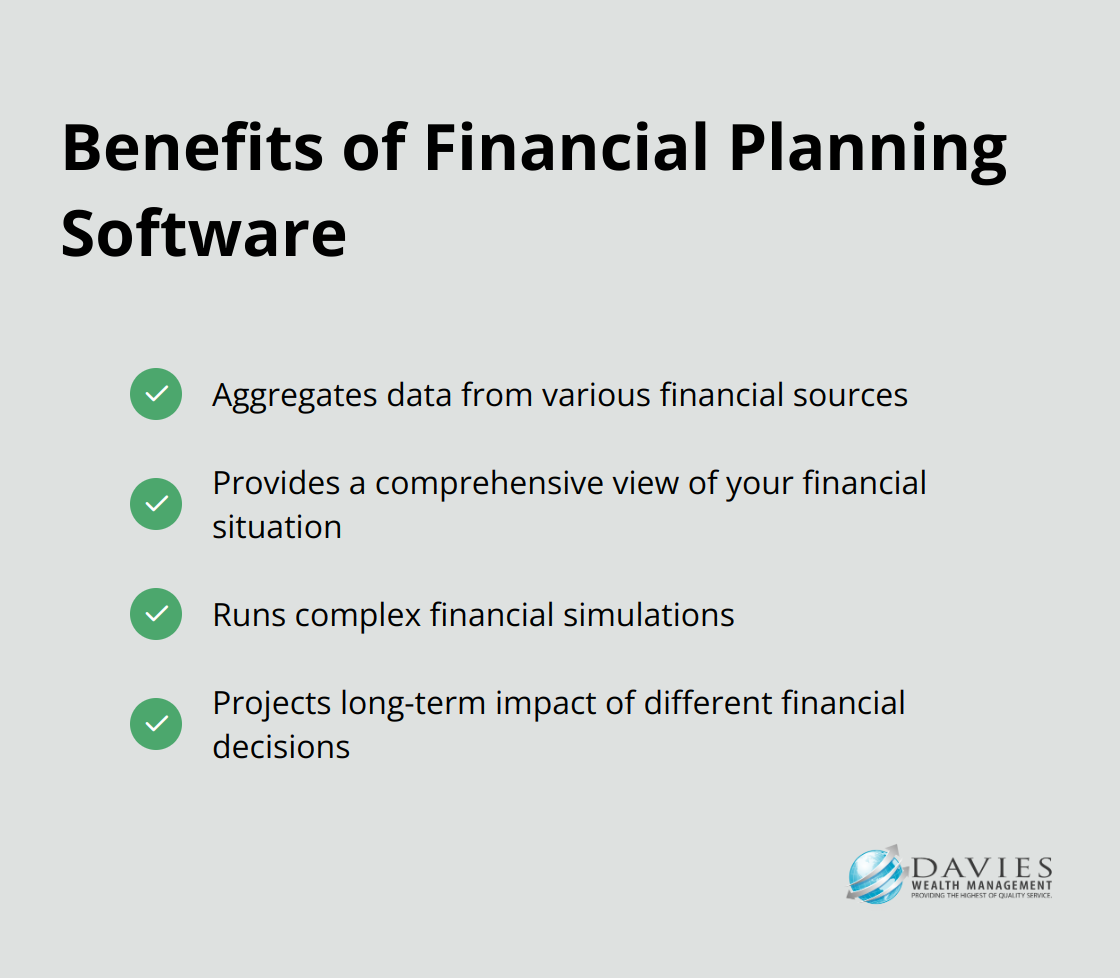

Modern financial planning software revolutionizes the way we manage finances. These tools aggregate data from various sources (bank accounts, investment portfolios, credit cards) to provide a comprehensive view of your financial situation. Boldin offers comprehensive financial planning and the option to get occasional advice from a pro, while MaxiFi is best for DIY planners.

One key advantage of these tools is their ability to run complex financial simulations. They project the long-term impact of different financial decisions, helping you make more informed choices. For example, you can see how a 1% increase in your monthly savings could affect your retirement nest egg over 30 years.

The Potential of Data Analytics

Data analytics and business intelligence tools now offer unprecedented insights into financial trends and patterns. These powerful technologies are accessible to individual investors and financial advisors alike.

Essential BI tools can help you discover insights to make important business decisions. This proves particularly valuable for professional athletes who need to understand the complex interplay between their career performance, endorsement deals, and long-term financial stability.

Real-Time Insights Through Automated Reporting

The days of waiting for quarterly statements to understand your financial position are over. Modern financial planning tools offer automated reporting and dashboard creation, providing real-time insights into your financial health.

These dashboards display the metrics that matter most to you. For a professional athlete, this might include current contract value, endorsement income, investment performance, and projected post-career earnings. Having this information readily available allows for more agile decision-making and helps you stay on track with your financial goals.

Financial reporting tools help finance teams make smarter decisions at every level. Automated alerts can notify you of important financial events or milestones. You could set up an alert for when your investment portfolio reaches a certain value or when you approach your budget limit in a specific category.

The Human Touch in Technology-Driven Planning

While technology greatly enhances financial planning, it doesn’t replace the need for human expertise. The most effective approach combines sophisticated technology with the nuanced understanding and personalized guidance of experienced financial advisors.

At Davies Wealth Management, we integrate these technological advancements into our financial planning process. Our team leverages these tools effectively, ensuring that our clients benefit from the most advanced financial planning techniques available.

Final Thoughts

Finance planning and forecasting require dedication and continuous adaptation. We at Davies Wealth Management combine industry knowledge with advanced tools to deliver tailored financial strategies. Our team understands the unique needs of professional athletes and high-net-worth individuals, providing personalized solutions to navigate wealth management complexities.

Professional guidance can significantly enhance your chances of financial success. Whether you aim to secure a post-career financial future or build long-term wealth, experienced advisors offer invaluable insights and support. Our comprehensive approach addresses your specific needs and helps you navigate the intricacies of wealth management.

Mastering finance planning and forecasting empowers you to confidently navigate your financial future. You will achieve lasting financial success through the application of sound principles and techniques (such as those outlined in this guide). Stay informed about market trends and remain committed to your financial goals for optimal results.

Leave a Reply