At Davies Wealth Management, we understand that mastering finance planning and budgeting is essential for achieving financial success.

Many people find these tasks daunting, but with the right approach, they can become powerful tools for building wealth and security.

In this guide, we’ll break down the key elements of effective financial planning and budgeting, providing practical strategies you can implement today.

What Are the Foundations of Financial Planning?

Financial planning forms the cornerstone of a secure financial future. Let’s explore the key elements that constitute the bedrock of effective financial planning.

Set Clear Financial Goals

The first step in financial planning involves the definition of your objectives. These goals should follow the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of a vague “I want to save money,” a SMART goal states what you want to achieve with specific details. This clarity guides financial decisions and motivates you to stay on track.

Conduct a Financial Health Check

Before you move forward, you must know where you stand. This requires a thorough assessment of your current financial situation. Start by calculating your net worth. You can calculate your net worth by subtracting the value of all your liabilities (such as credit card debt) from the value of all your assets. Understanding your position provides valuable context for your financial planning.

Map Your Cash Flow

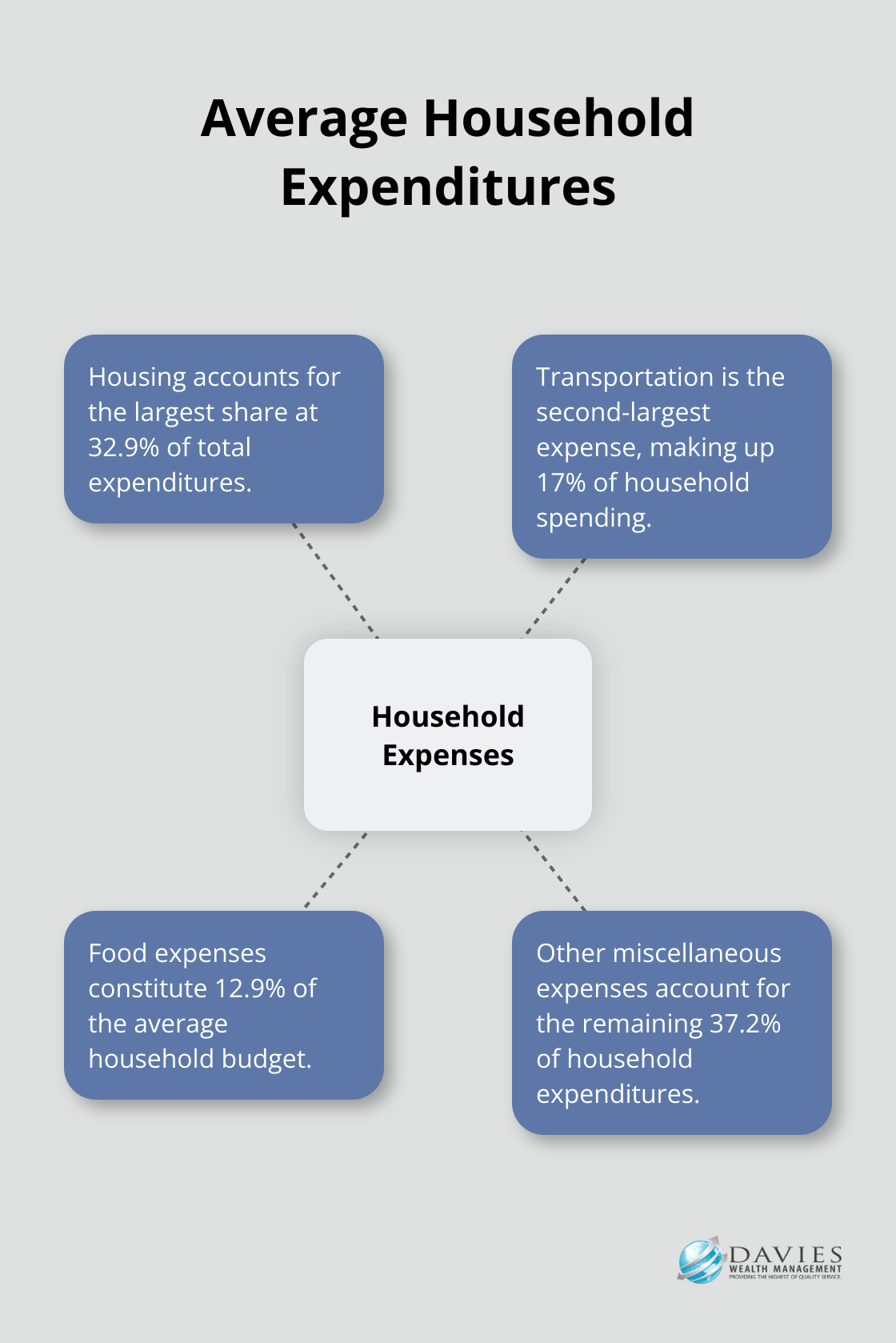

The identification of your income sources and expenses plays a crucial role in effective financial planning. List all your income streams, including salary, investments, and side hustles. Then, track your expenses for at least a month to get a clear picture of your spending habits. According to the Bureau of Labor Statistics, housing accounted for the largest share of total expenditures (32.9 percent), followed by transportation (17.0 percent), food (12.9 percent). How does your spending compare?

Create a Comprehensive Financial Inventory

A financial inventory lists all your financial accounts, assets, and liabilities in detail. This includes bank accounts, investment portfolios, retirement accounts, real estate, and debts. This process often reveals forgotten accounts or overlooked assets that can be better utilized in your financial plan.

Review and Adjust Regularly

Financial planning is not a one-time event but an ongoing process. As your life circumstances change, so should your financial plan. Regular reviews and adjustments keep your financial strategy aligned with your evolving goals and circumstances.

These principles apply universally, whether you’re a professional athlete managing a high but potentially short-term income, or a business owner planning for long-term growth. They form the basis upon which personalized financial strategies are built for diverse clientele.

Now that we’ve established the foundations of financial planning, let’s move on to the next critical step: developing an effective budget that aligns with your financial goals and current situation.

How to Create a Budget That Works

At Davies Wealth Management, we believe that a well-crafted budget is the foundation of financial success. It’s not just about restricting spending; it’s about making your money work for you. Let’s explore how to develop a budget that aligns with your financial goals and lifestyle.

Select the Right Budgeting Method

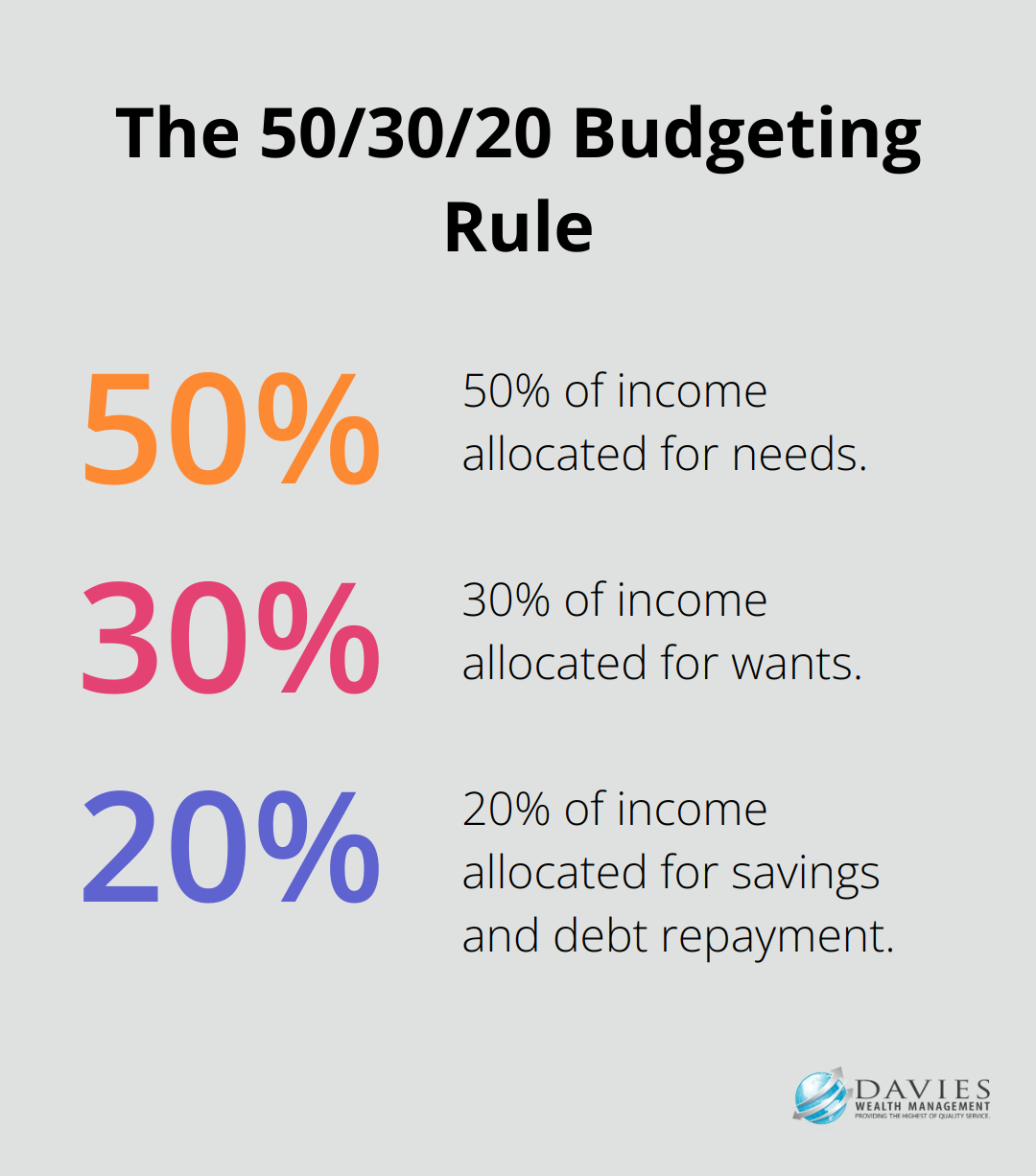

The key to successful budgeting is to find a method that suits your financial situation and personality. The 50/30/20 rule is a popular starting point (50% of income for needs, 30% for wants, and 20% for savings and debt repayment). However, this may not work for everyone. Some prefer a zero-based budget, which allocates every penny of your monthly income toward expenses, savings and debt payments. Others find success with the envelope system, using physical or digital envelopes to manage spending by category.

Track and Categorize Expenses

Accurate expense tracking is essential for effective budgeting. Start by reviewing your bank and credit card statements from the past few months. Categorize each expense and total them up. You might be surprised by what you find. A Gallup poll shows that nearly one in three Americans prepare a detailed household budget. You take a significant step towards financial control by joining this minority.

Set Realistic Spending Limits

Once you’ve categorized your expenses, it’s time to set spending limits. Be realistic – drastic cuts are often unsustainable. Instead, try small, consistent reductions in non-essential categories. For example, if you spend $500 monthly on dining out, try to reduce it to $400. This 20% cut is significant yet achievable.

Prioritize Savings and Investments

We emphasize the importance of paying yourself first. Include a savings category in your budget and aim to save an amount that feels comfortable to you. Plan on eventually increasing your savings amount to up to 20% of your income. This includes retirement contributions, emergency fund savings, and investments for long-term goals.

Leverage Technology for Budget Management

In today’s digital age, numerous tools can simplify budget management. Apps like Mint or YNAB (You Need A Budget) offer features like automatic expense categorization, bill reminders, and investment tracking. These tools provide real-time insights into your financial health, making it easier to stick to your budget.

Budgeting is a skill that improves with practice. Don’t feel discouraged if you don’t get it right immediately. Review and adjust your budget regularly as your financial situation and goals evolve. With persistence and the right strategies, you’ll master the art of budgeting. Now, let’s move on to explore effective strategies for successful financial management that complement your budgeting efforts.

How to Maximize Your Financial Success

At Davies Wealth Management, we believe successful financial management extends beyond budgeting. It involves strategic decisions that optimize your financial health and set you up for long-term prosperity. Let’s explore key strategies to help you maximize your financial success.

Build a Robust Emergency Fund

An emergency fund forms a critical component of financial stability. Try to save 3-6 months of living expenses in a readily accessible account. A Federal Reserve report indicates that 68 percent of households could come up with $400 to cover an emergency in late 2021-the largest share since 2013. A solid emergency fund prepares you for unexpected events and reduces financial stress.

Eliminate High-Interest Debt

High-interest debt, particularly credit card debt, can significantly hinder your financial progress. The average credit card interest rate in the U.S. stands at around 16.65% (according to the Federal Reserve). Prioritize paying off high-interest debt before focusing on other financial goals. Consider the debt avalanche method: pay off the highest interest debt first while making minimum payments on others. This method focuses on saving the most on interest.

Invest for Long-Term Growth

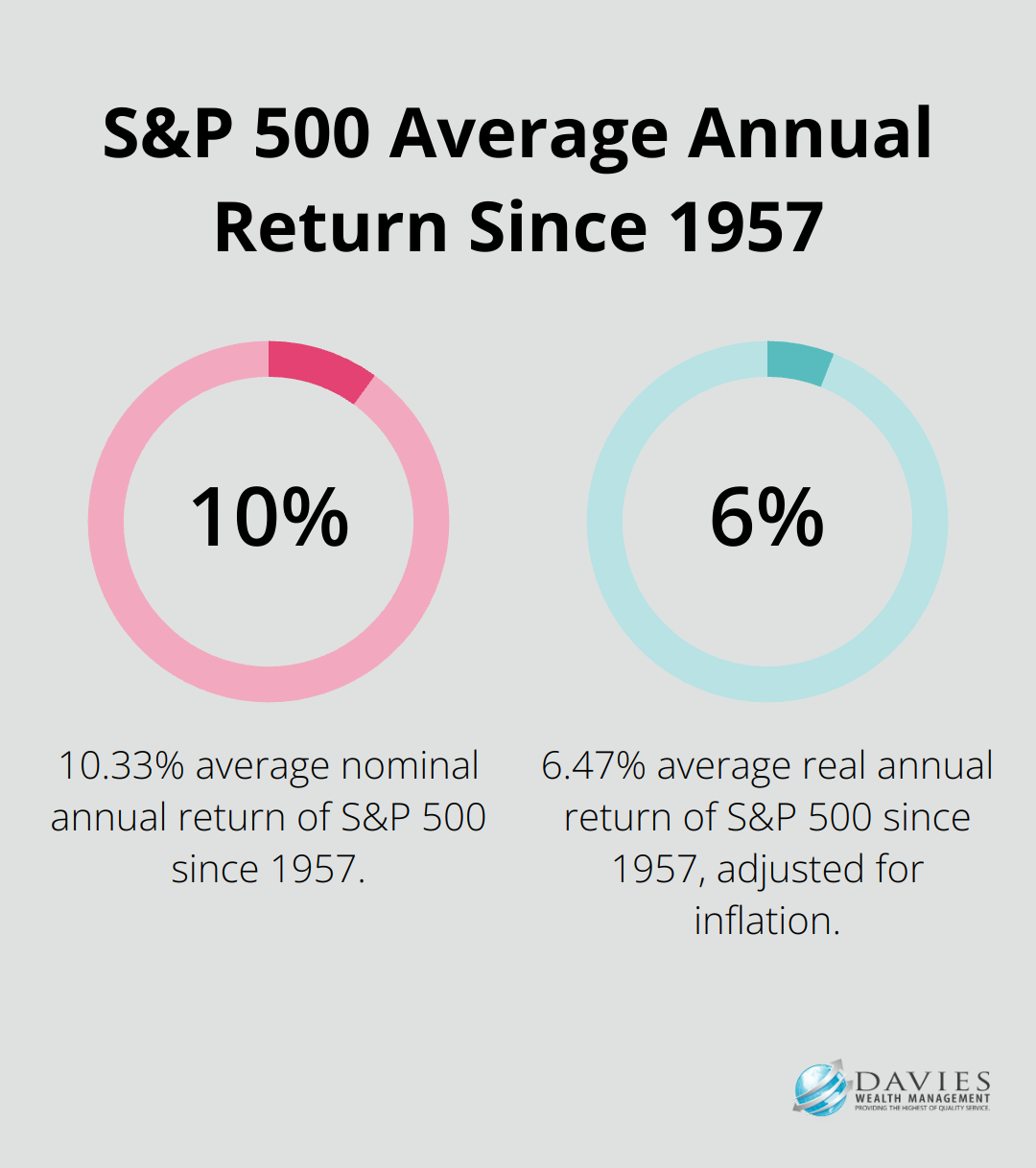

Investing serves as a powerful tool for wealth building over time. While short-term market volatility exists, historically, the stock market has provided strong returns over longer periods. For instance, the S&P 500 has delivered an average annual return of 10.33% since 1957, but when adjusted for inflation, the real return drops to 6.47%. Diversify your investments across different asset classes to manage risk and potentially enhance returns.

Optimize Your Tax Strategy

Tax optimization often gets overlooked in financial management. Strategies like maximizing contributions to tax-advantaged accounts (e.g., 401(k)s, IRAs), harvesting tax losses, and considering Roth conversions can significantly impact your long-term wealth. Contributing the maximum to your 401(k) ($22,500 for 2023 if you’re under 50) could save you thousands in taxes each year.

Conduct Regular Financial Check-Ups

Your financial situation and goals will evolve over time, and so should your financial plan. Review your financial plan at least annually, or when you experience significant life changes (such as marriage, having children, or changing jobs). This regular assessment ensures your financial strategies remain aligned with your current situation and future goals.

Final Thoughts

Finance planning and budgeting require dedication and consistency. You must understand your unique circumstances, set clear goals, and regularly assess your financial health. These actions will equip you to navigate financial challenges and seize opportunities effectively.

We encourage you to start your financial journey today. Every action you take brings you closer to your financial goals. At Davies Wealth Management, we provide personalized advice and comprehensive wealth management solutions tailored to your needs.

Take control of your financial future now. With the right tools and support (including our expert guidance), you can build a secure and prosperous financial life. Your path to financial mastery begins today – embrace it with confidence.

Leave a Reply