At Davies Wealth Management, we understand the unique financial challenges millennials face in today’s economic landscape. From student loan debt to rising living costs, it can be daunting to think about investing for the future.

However, starting early and making informed investment decisions can significantly impact your long-term financial well-being. In this guide, we’ll provide practical investment advice for millennials to help you navigate the world of investing and build a secure financial future.

What Millennials Need to Know About Investing

Student Loan Debt: A Major Hurdle

The financial landscape for millennials differs significantly from previous generations. One of the most substantial challenges millennials face is the burden of student loan debt. 18.5 million Millennials have outstanding student loan debt, representing 39.9% of all borrowers. This debt often delays major life milestones and limits investment opportunities. However, it’s important to balance loan repayment with investing. Even small, consistent investments can produce significant returns over time due to compound interest.

The Gig Economy and Income Volatility

Many millennials work in the gig economy or have multiple income streams, which leads to income volatility. This unpredictability can make regular investing difficult. We suggest setting up automatic transfers to investment accounts, even if the amounts vary. This strategy ensures consistent investing regardless of income fluctuations.

The Power of Time in Investing

Starting to invest early is one of the most powerful financial moves millennials can make. The S&P 500 has historically returned about 10.13% annually since 1957. If a 25-year-old invests $500 monthly with this average return, they could potentially have over $1.6 million by age 65 (a clear illustration of the incredible power of compound interest over time).

Debunking Investment Myths

Many millennials believe they need a large sum to start investing or that investing is too risky. These are misconceptions. Many investment platforms now allow you to start with as little as $5. As for risk, while all investments carry some risk, a diversified portfolio can help mitigate it.

The Impact of Technology on Investing

Millennials have a significant advantage in the form of technology. Robo-advisors and investment apps have democratized investing, making it more accessible than ever. These platforms often have lower fees and lower minimum investment requirements, making them ideal for young investors just starting out.

The Importance of Financial Education

One of the biggest challenges millennials face is a lack of financial education. Financial literacy tends to be greatest in the areas of borrowing and saving across generations, but it tends to be lower among millennials. This knowledge gap can lead to poor financial decisions. We strongly encourage millennials to prioritize financial education, whether through online resources, books, or working with a financial advisor.

As we move forward, it’s essential to explore specific investment strategies tailored for millennials. These strategies will help you navigate the unique financial challenges you face and make the most of the opportunities available to your generation.

Smart Investing Strategies for Millennials

Leverage Technology for Investing

Technology has transformed investing for millennials. Robo-advisors like Betterment and Wealthfront provide low-cost, automated investment management. These platforms use algorithms to create and manage diversified portfolios based on your risk tolerance and financial goals. Many robo-advisors require minimal initial investments, which makes them accessible to new investors.

Investment apps such as Robinhood and Acorns have also gained popularity among millennials. These apps allow for fractional share investing, which means you can buy a portion of a stock rather than a whole share. This feature enables investing in high-priced stocks that might otherwise be out of reach.

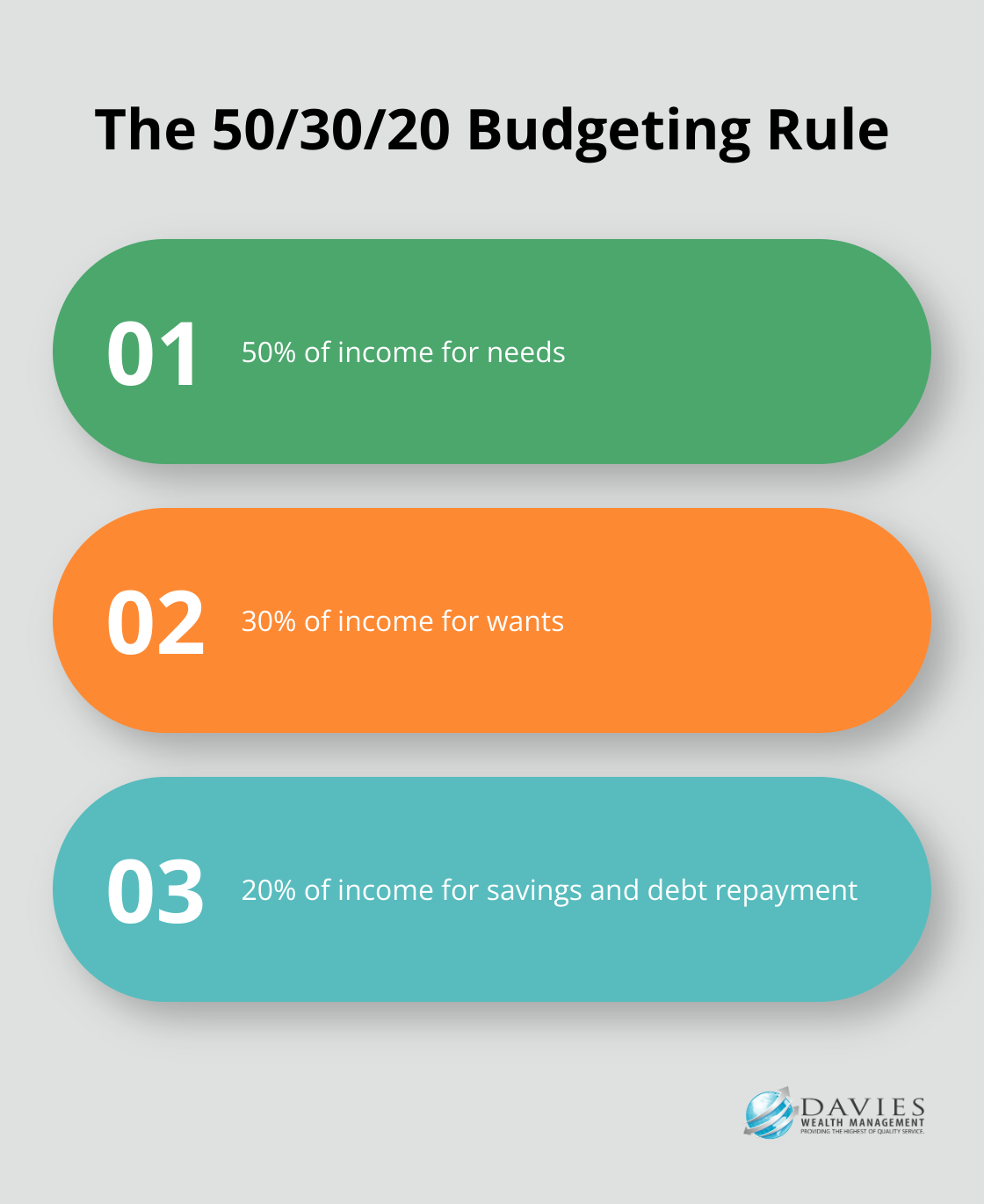

Balance Debt Repayment and Investing

For many millennials, student loan debt presents a significant financial challenge. However, it’s important to find a balance between debt repayment and investing. One effective strategy is the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Within that 20%, consider splitting your efforts between debt repayment and investing. For example, you might allocate 10% to extra debt payments and 10% to investments. This approach allows you to make progress on both fronts simultaneously.

It’s also worth exploring income-driven repayment plans for federal student loans. These plans can lower your monthly payments, which frees up more money for investing. However, be aware that this approach may increase the total amount you pay over the life of the loan due to accrued interest.

Embrace Sustainable Investing

Millennials increasingly want to align their investments with their values. Sustainable, responsible, and impact (SRI) investing allows you to support companies that prioritize environmental, social, and governance (ESG) factors.

A 2021 Morgan Stanley survey found that 99% of Millennials were interested in sustainable investing. This approach not only allows you to invest in line with your values but can also lead to strong returns. The MSCI KLD 400 Social Index (which tracks socially responsible companies) has outperformed the S&P 500 over the past decade.

Many mutual funds and ETFs now focus on sustainable investing. For example, the iShares ESG Aware MSCI USA ETF (ESGU) offers exposure to companies with positive ESG characteristics while maintaining a risk and return profile similar to the broader U.S. equity market.

Diversify Your Portfolio

Diversification remains a key principle of smart investing. As a millennial investor, you should consider spreading your investments across different asset classes (such as stocks, bonds, and real estate) and sectors. This strategy can help mitigate risk and potentially improve returns over the long term.

Exchange-traded funds (ETFs) offer an easy way to diversify your portfolio. These investment vehicles allow you to invest in a basket of securities, providing instant diversification at a low cost. For example, you could invest in a broad market ETF that tracks the S&P 500, giving you exposure to 500 of the largest U.S. companies in a single investment.

As we move forward, it’s important to understand the different asset classes available to millennial investors and how they can contribute to a well-rounded investment portfolio. Let’s explore these options in more detail in the next section.

Building Your Millennial Investment Portfolio

Diversifying Across Asset Classes

A well-structured investment portfolio forms the foundation for long-term financial success. As a millennial investor, you can leverage time and diverse asset classes to build wealth. Smart investing involves spreading your investments across different asset classes to manage risk and potentially enhance returns.

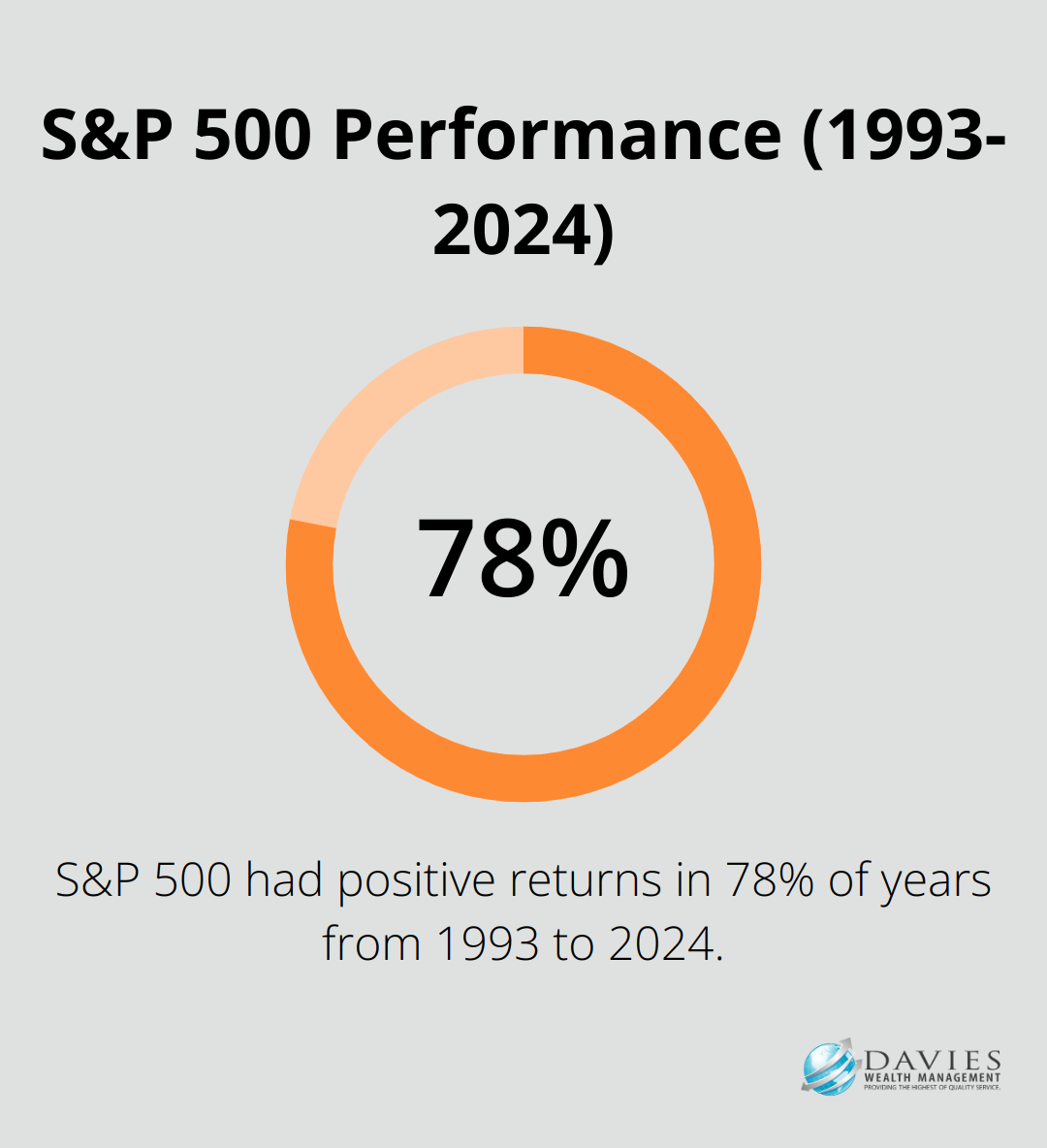

Stocks offer high return potential but come with higher volatility. The S&P 500 index had a positive return during 25 of the 32 years (78%) between 1993 and 2024. However, past performance doesn’t guarantee future results.

Bonds typically offer lower returns but provide portfolio stability. As of April 2023, 10-year Treasury bonds yield around 3.5%. While this may seem low compared to stocks, bonds can act as a buffer during market downturns.

Real estate investment trusts (REITs) provide exposure to the property market without direct real estate ownership. The FTSE Nareit All Equity REITs Index has delivered returns over the past 25 years.

Alternative investments, such as commodities or private equity, can further diversify your portfolio. These assets often move independently of traditional stocks and bonds, potentially reducing overall portfolio risk.

Harnessing Compound Interest

Time is one of your greatest assets as a millennial. Compound interest allows even small, regular investments to grow significantly over time. For example, if you invest $500 monthly starting at age 25 (assuming an 8% annual return), you could potentially have over $1.5 million by age 65.

To maximize compound interest benefits, automate your investments. Many brokerages allow you to set up automatic monthly contributions to your investment accounts. This approach, known as dollar-cost averaging, can help smooth out market volatility and ensure consistent investing regardless of market conditions.

Managing Portfolio Risk

While diversification is a key risk management strategy, it’s not the only tool available. Consider these additional strategies:

- Asset Allocation: Adjust the mix of stocks, bonds, and other assets based on your risk tolerance and investment timeline. Younger investors can generally afford to take on more risk, gradually shifting to a more conservative allocation as they approach retirement.

- Regular Rebalancing: Periodically sell some of your best-performing assets and buy more of the underperforming ones to maintain your target allocation.

- Emergency Fund: Establish an emergency fund covering 3-6 months of expenses before investing heavily. This can prevent you from selling investments at inopportune times to cover unexpected costs.

- Investment Research: Stay informed about your investments and the broader market. Understanding basic economic indicators and company fundamentals can help you make more informed investment decisions.

- Professional Guidance: Work with a financial advisor who can provide personalized advice based on your specific situation. Davies Wealth Management specializes in creating tailored investment strategies for millennials, taking into account your unique financial goals and circumstances.

Final Thoughts

Investing wisely as a millennial secures your future and builds long-term wealth. You can set yourself up for financial success by using technology, balancing debt repayment with investment goals, and diversifying your portfolio. The power of compound interest works in your favor when you start investing early, allowing even small, consistent investments to grow significantly over time.

Self-education is important, but seeking professional investment advice for millennials can provide valuable insights. At Davies Wealth Management, we create tailored investment strategies for millennials, considering your unique financial situation, goals, and risk tolerance. Our team can help you develop a comprehensive financial plan that aligns with your values and long-term objectives.

The time to start investing is now. Don’t wait for the “perfect” moment or until you have a large sum of money. Begin with what you have, stay consistent, and adjust your strategy as your financial situation evolves. Your future self will thank you for the smart financial decisions you make today.

Leave a Reply