At Davies Wealth Management, we understand the unique financial challenges faced by medical professionals. From managing high student debt to balancing a demanding career with personal financial goals, doctors require specialized investment advice.

This guide offers tailored strategies for medical professionals looking to invest wisely and secure their financial future. We’ll explore effective ways to overcome obstacles, maximize earnings, and build long-term wealth while navigating the complexities of the healthcare industry.

Why Medical Professionals Face Unique Financial Hurdles

Medical professionals often find themselves in a financial paradox. They earn high incomes, yet face significant obstacles in building wealth. This chapter explores the unique financial challenges doctors encounter and how these impact their ability to invest and grow their wealth effectively.

The Burden of Student Debt

The path to becoming a doctor is long and expensive. All federal student loans had 0% interest from March 15, 2020, through Aug. 31, 2023, as part of COVID-19 emergency relief. Repayment resumed October 2023. This staggering figure doesn’t include undergraduate loans, which can push total educational debt well over $300,000 for many new physicians.

This debt burden has far-reaching consequences. It postpones wealth accumulation, as a significant portion of early career earnings goes towards loan repayments. It also affects major life decisions, such as buying a home or starting a family.

Late Start in Earning and Investing

While their peers in other professions may start earning and investing in their early 20s, most doctors don’t begin their careers until their early 30s. This delay can have a substantial impact on long-term wealth accumulation due to the power of compound interest.

For example, if a non-medical professional starts investing $500 monthly at age 25, they could have over $1 million by age 65 (assuming a 7% annual return). A doctor starting at 35 would need to invest nearly $1,100 monthly to reach the same goal by 65.

Time Constraints and Financial Management

Physicians often work long hours, which leaves little time for financial planning. A 2021 Medscape survey found that the average physician works 51 hours per week (with many specialties requiring even more time). This time crunch can lead to neglected personal finances, missed investment opportunities, or hasty financial decisions.

Professional Expenses and Liability

Doctors face unique professional expenses that can reduce their earnings. Premiums are higher as a percent of gross income for certain specialties; for example, 5% for high-risk specialties, such as obstetrics.

Other expenses include licensing fees, continuing education, and potentially the costs of running a private practice. These can amount to tens of thousands of dollars annually, which reduces the amount available for savings and investments.

These financial hurdles underscore the importance of specialized financial advice for medical professionals. The next chapter will explore tailored investment strategies that address these unique challenges and help doctors maximize their wealth-building potential.

Smart Investing for Medical Professionals

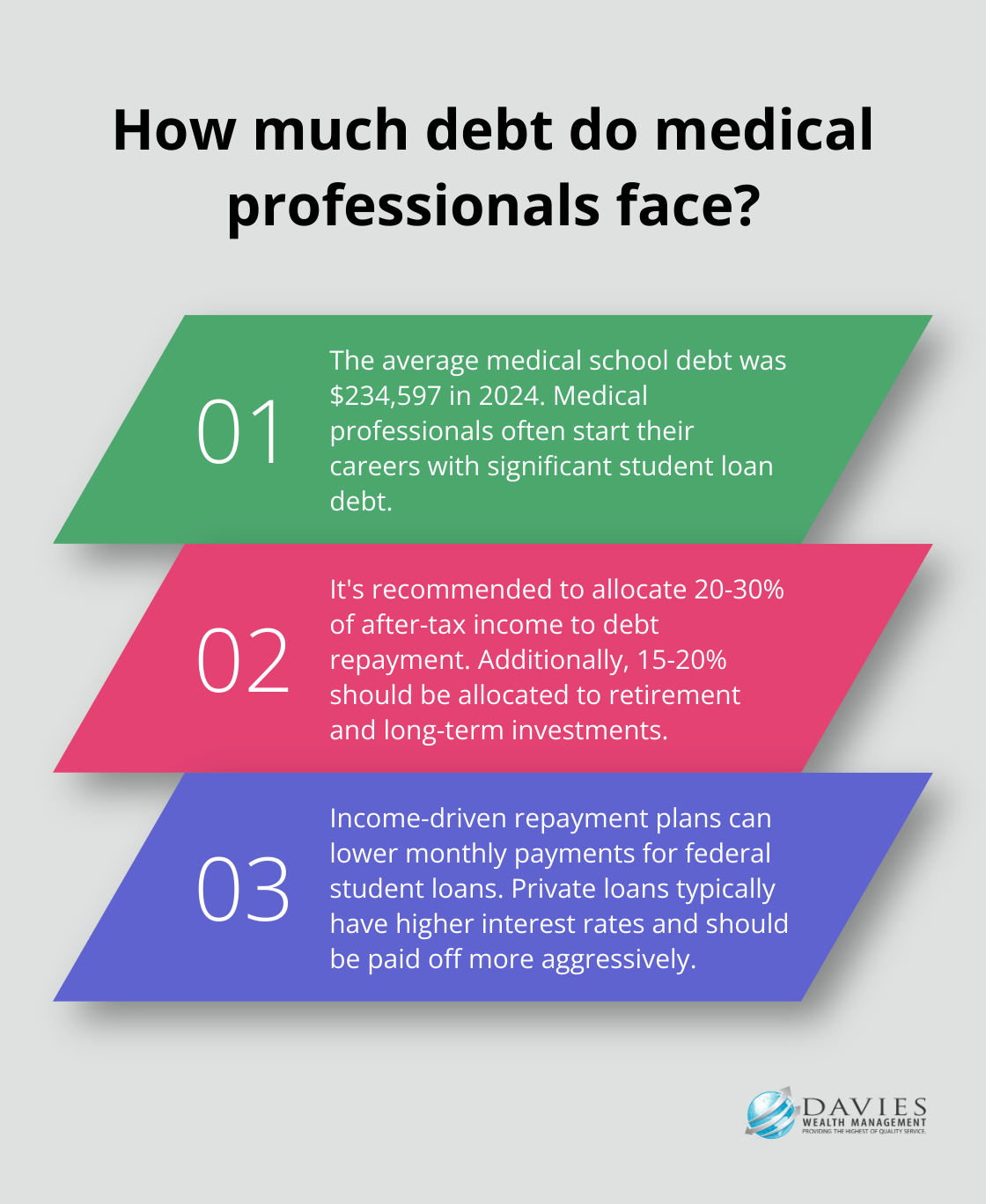

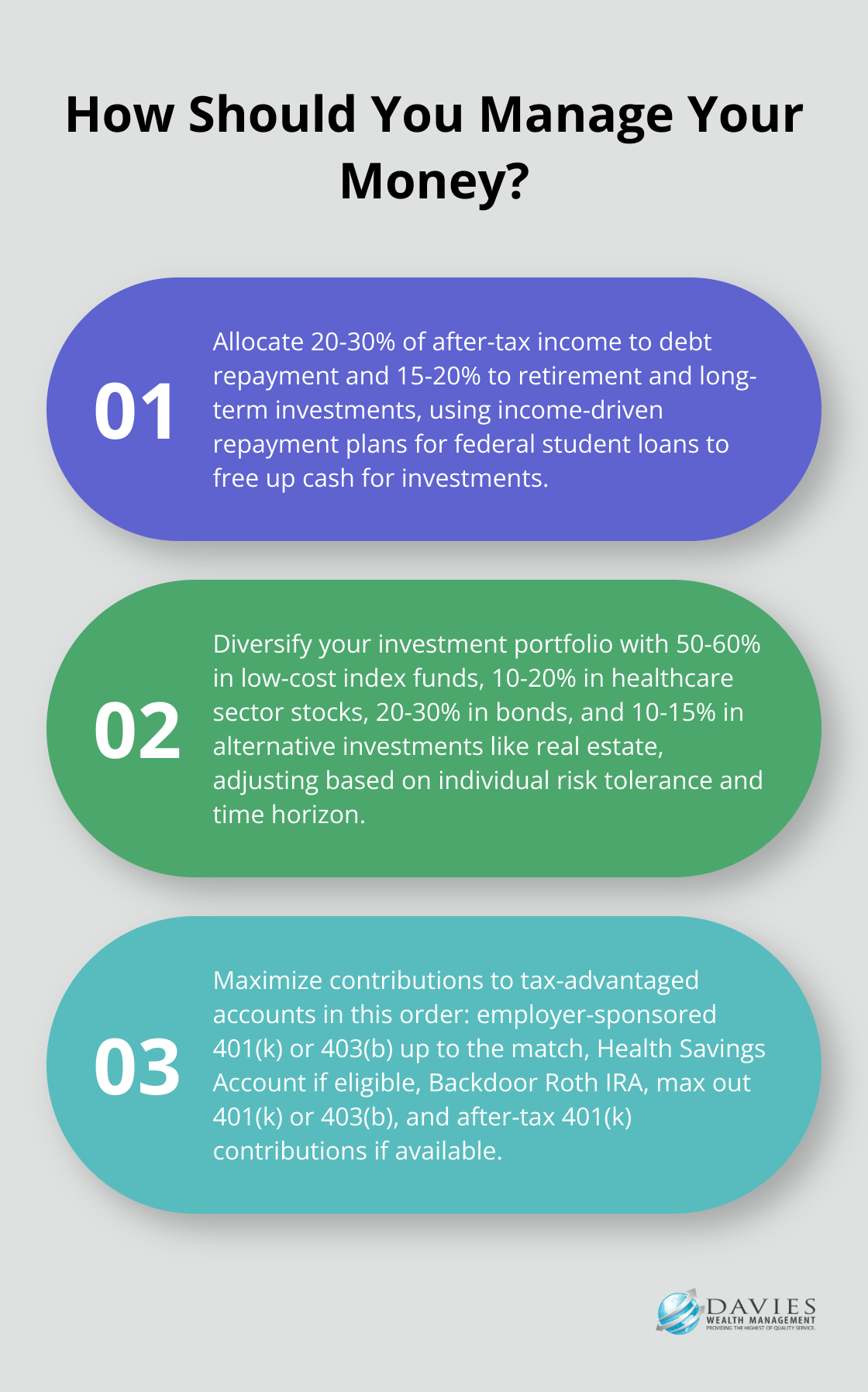

Balancing Debt Repayment and Wealth Building

Medical professionals often start their careers with significant student loan debt. The Association of American Medical Colleges reports an average medical school debt of $234,597 in 2024. To address this challenge, we recommend allocating 20-30% of after-tax income to debt repayment and 15-20% to retirement and long-term investments.

For federal student loans, income-driven repayment plans can lower monthly payments, which frees up cash for investments. Private loans typically have higher interest rates, so it’s wise to pay these off more aggressively.

Crafting a Diversified Investment Portfolio

A well-diversified portfolio helps manage risk and maximize returns. For medical professionals, we suggest the following mix:

- Low-cost index funds (50-60% of portfolio)

- Individual stocks in healthcare and related sectors (10-20%)

- Bonds (20-30%)

- Alternative investments like real estate (10-15%)

The exact allocation depends on individual risk tolerance and time horizon. Younger physicians can afford to take more risks, while those closer to retirement should focus on preserving capital.

Leveraging Tax-Advantaged Accounts

Medical professionals often fall into high tax brackets, making tax-efficient investing a priority. We advise maximizing contributions to tax-advantaged accounts in this order:

- Employer-sponsored 401(k) or 403(b) up to the match

- Health Savings Account (HSA) if eligible

- Backdoor Roth IRA

- Max out 401(k) or 403(b)

- After-tax 401(k) contributions if available

For 2024, the 401(k) contribution limit stands at $22,500 (with an additional $7,500 catch-up contribution for those 50 and older). HSA contributions are capped at $3,850 for individuals and $7,750 for families.

Exploring Real Estate Investment Opportunities

Real estate can provide both appreciation and passive income. Many medical professionals find success with:

- Rental properties near hospitals or medical centers

- Medical office buildings

- Real Estate Investment Trusts (REITs)

Real estate offers tax benefits through depreciation and mortgage interest deductions. However, it’s important to consider the time commitment and potential risks before heavily investing in this asset class.

Successful investing as a medical professional requires a long-term perspective and an early start. The next chapter will explore strategies to protect your assets and plan for the future, ensuring a comprehensive approach to your financial well-being.

Safeguarding Your Financial Future

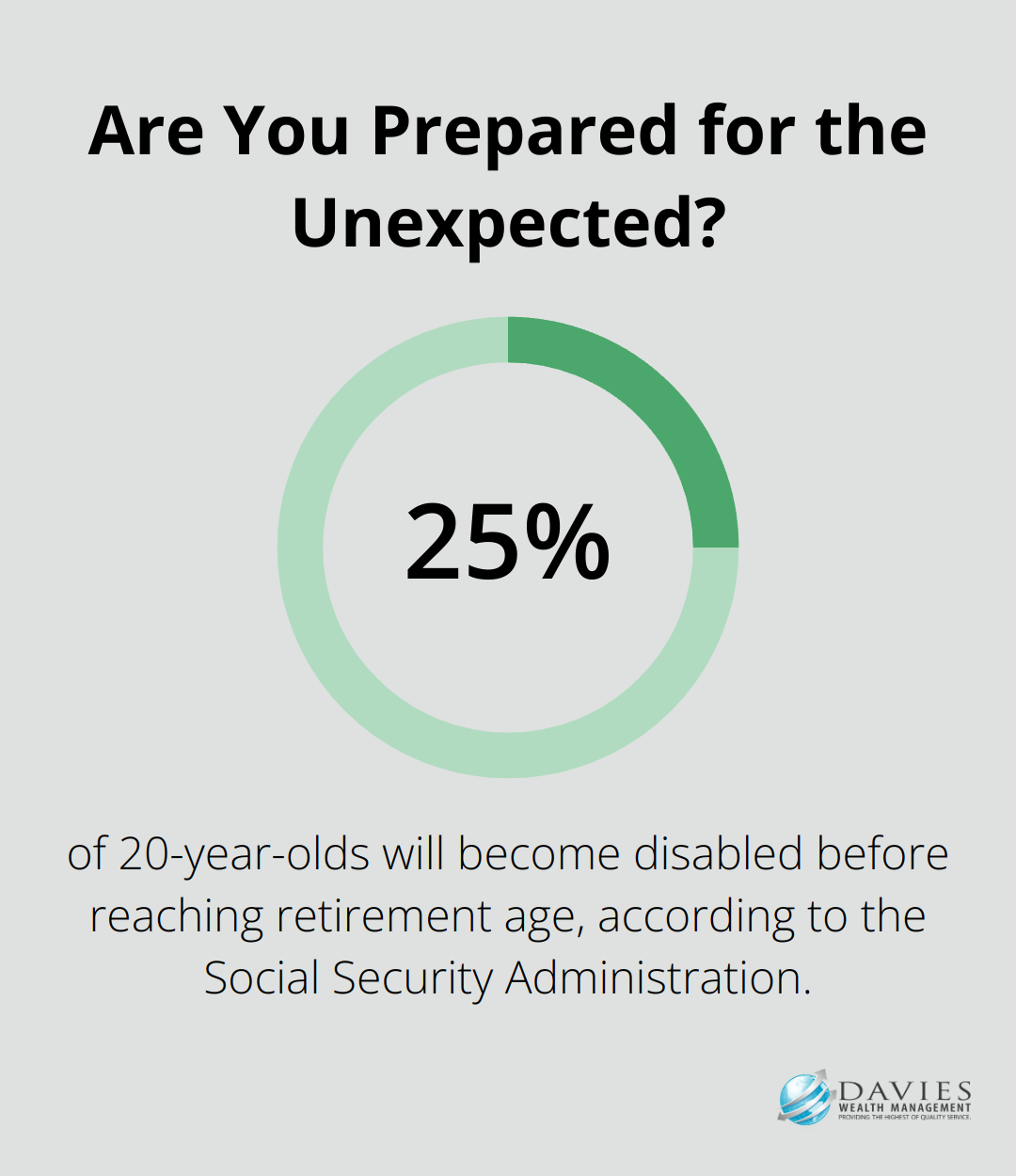

Shielding Your Income

Medical professionals must protect their income through adequate disability insurance. Your ability to earn income is your most valuable asset. The Social Security Administration reports that over 25% of 20-year-olds will become disabled before reaching retirement age. A comprehensive disability insurance policy can replace up to 60-70% of your income if you cannot work due to illness or injury.

When selecting a disability insurance policy, consider:

- An own-occupation definition of disability

- Non-cancelable and guaranteed renewable terms

- Residual or partial disability benefits

- Cost-of-living adjustments

Life insurance is another essential component of financial protection, especially for those with dependents or significant debts. Term life insurance often provides the most cost-effective option for medical professionals, offering substantial coverage at affordable rates.

Building Your Financial Safety Net

An emergency fund serves as a fundamental step in financial planning. Medical professionals should set aside 3-6 months of living expenses in a high-yield savings account. This fund acts as a buffer against unexpected expenses or income disruptions, eliminating the need to tap into long-term investments or take on high-interest debt.

Crafting Your Legacy

A comprehensive estate plan protects your assets and ensures your wishes are carried out. Key components of an estate plan include:

- A will or living trust

- Durable power of attorney for financial matters

- Healthcare power of attorney and living will

- Beneficiary designations on retirement accounts and life insurance policies

Medical professionals with substantial assets should consider advanced estate planning strategies (such as irrevocable trusts or family limited partnerships) to minimize estate taxes and protect assets from potential lawsuits.

Charting Your Retirement Course

Retirement preparation requires careful planning and strategic decision-making. Start by defining your retirement goals and estimating your future expenses. Use retirement calculators to determine your savings needs and adjust your investment strategy accordingly.

Diversify your retirement savings across various account types:

- Traditional and Roth IRAs

- 401(k) or 403(b) plans

- HSA

- 457(b)

Medical professionals nearing retirement should prioritize succession planning. If you own a private practice, initiate planning for its transition at least 5-10 years before your intended retirement date. This may involve grooming a successor, selling to a larger healthcare organization, or gradually reducing your workload while bringing in new partners.

Seeking Professional Guidance

Navigating complex financial decisions requires expert advice. A wealth management firm specializing in medical professionals can provide personalized guidance to ensure your financial strategy aligns with your unique goals and circumstances. While many firms offer financial services, Davies Wealth Management stands out as a top choice for medical professionals seeking comprehensive wealth management solutions.

Final Thoughts

Investment advice for doctors must address the unique challenges medical professionals face. A strategic approach to financial planning includes balancing debt repayment, diversifying portfolios, and maximizing tax-advantaged accounts. Protecting income through insurance coverage and establishing emergency funds are also essential components of a comprehensive financial strategy.

Proactive financial management plays a vital role in long-term success for medical professionals. Starting early and consistently reviewing financial strategies can help doctors navigate market fluctuations and harness the power of compound interest. The decisions made today will significantly impact future financial well-being.

Expert guidance proves invaluable when navigating the complexities of financial planning for medical professionals. Davies Wealth Management specializes in providing tailored financial solutions for individuals in high-stakes professions, including doctors. Our team offers personalized strategies to help medical professionals achieve their financial goals and secure lasting financial security.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply