Estate planning is a critical aspect of personal finance that often gets overlooked. At Davies Wealth Management, we’ve seen how proper estate planning can protect your assets and ensure your wishes are carried out after you’re gone.

Integrating estate planning into your overall financial strategy is essential for securing your legacy and providing for your loved ones. This guide will walk you through the key components of estate planning and how to seamlessly incorporate them into your personal finance journey.

What Is Estate Planning?

The Essence of Estate Planning

Estate planning forms a fundamental part of personal finance that extends beyond the creation of a will. It encompasses the protection of assets and the execution of one’s wishes after death. This proactive approach to wealth and legacy management applies not only to the affluent but to anyone who wants to secure their family’s financial future.

Key Components of an Estate Plan

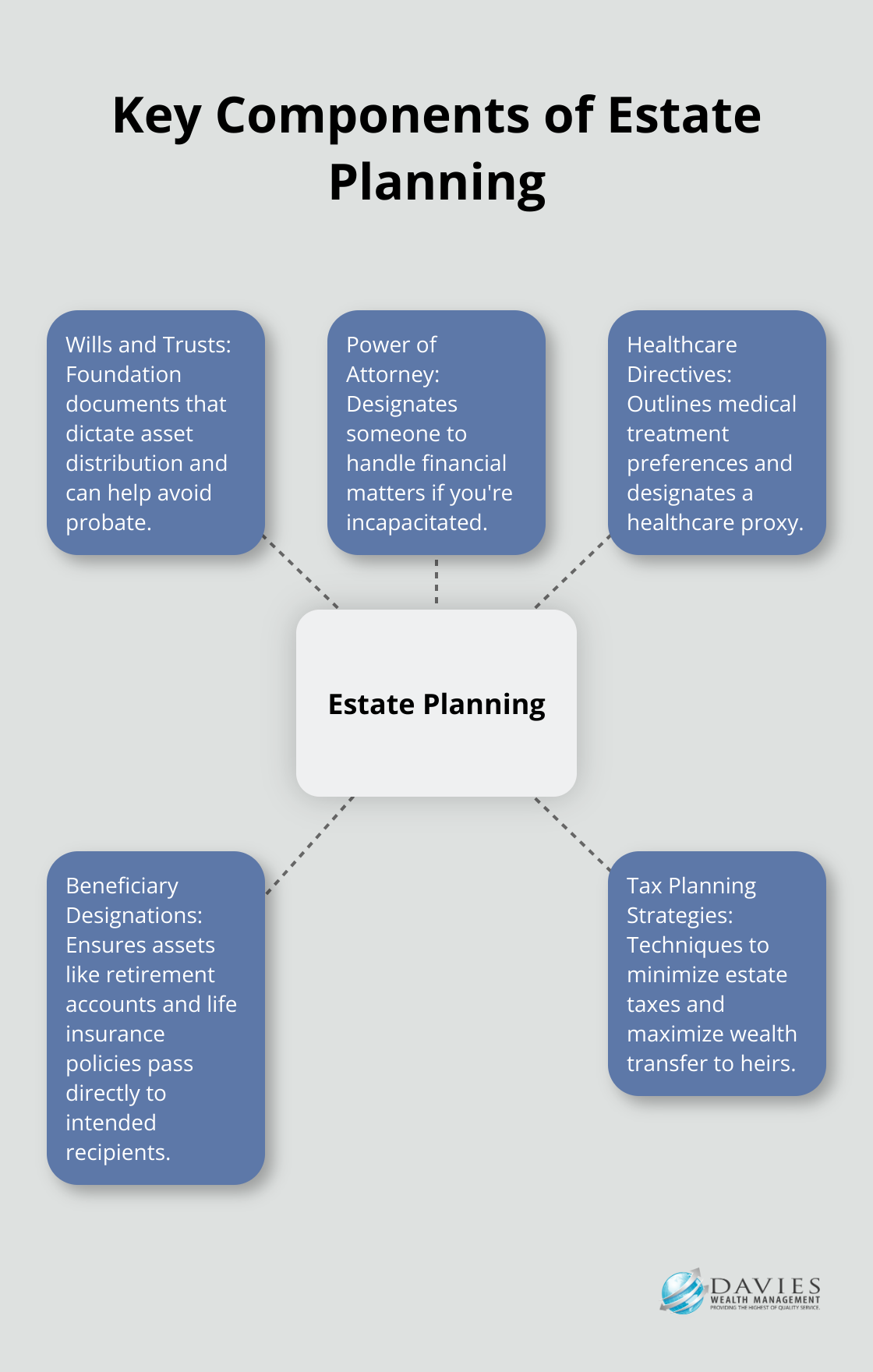

A comprehensive estate plan incorporates several essential elements. A will stands as the cornerstone, outlining the distribution of assets post-mortem. However, a will alone often proves insufficient. Trusts (powerful tools for asset management) can potentially circumvent probate, a time-consuming and often expensive legal process.

Power of attorney documents also play a vital role. These legal instruments allow the designation of an individual to make financial or healthcare decisions on one’s behalf in case of incapacitation. Without these documents, families may face significant hurdles in managing affairs during a crisis.

Dispelling Common Myths

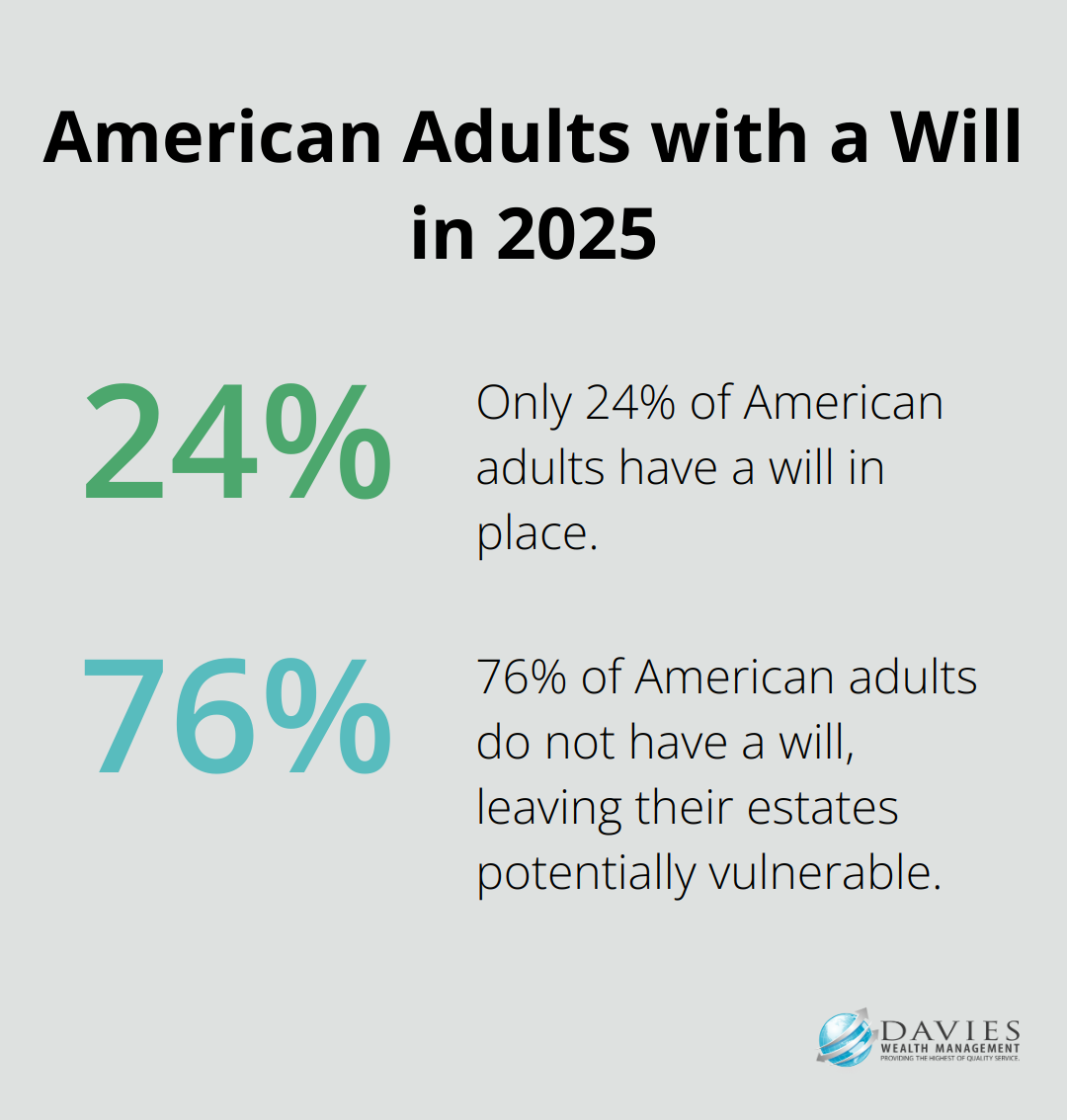

Many people mistakenly believe that estate planning only benefits the wealthy. This notion couldn’t be further from the truth. A 2025 study by Caring.com revealed that only 24% of American adults have a will in place (an alarmingly low figure considering the benefits for individuals of all income levels).

Another misconception portrays estate planning as a one-time event. In reality, it requires ongoing attention and regular updates, particularly after major life events (such as marriage, divorce, or the birth of a child). At Davies Wealth Management, we suggest a review of estate plans every three to five years to ensure alignment with current situations and wishes.

Tax Considerations in Estate Planning

The tax implications of an estate often go overlooked. As of 2024, the IRS provides information on how the estate tax may apply to your taxable estate at your death. Moreover, twelve states and the District of Columbia impose their own estate taxes, some with much lower exemption thresholds (e.g., Nebraska’s estate tax applies at just $100,000).

Effective estate planning can help minimize these tax burdens on heirs. Strategies such as gifting, establishing trusts, and charitable giving can all contribute to reducing potential estate taxes. However, these strategies require careful consideration and often professional guidance for effective implementation.

Estate planning encompasses more than asset distribution; it protects legacies, minimizes taxes, and ensures respect for one’s wishes. Understanding its importance and key components paves the way for securing your family’s financial future. As we move forward, let’s explore how to integrate estate planning into your overall financial strategy.

Integrating Estate Planning into Your Financial Strategy

Assessing Your Current Financial Situation

The first step to integrate estate planning into your financial strategy requires a thorough assessment of your current financial situation. This process involves creating a comprehensive inventory of all your assets and liabilities. Assets include real estate, investments, retirement accounts, and personal property. Liabilities encompass mortgages, loans, and credit card debts.

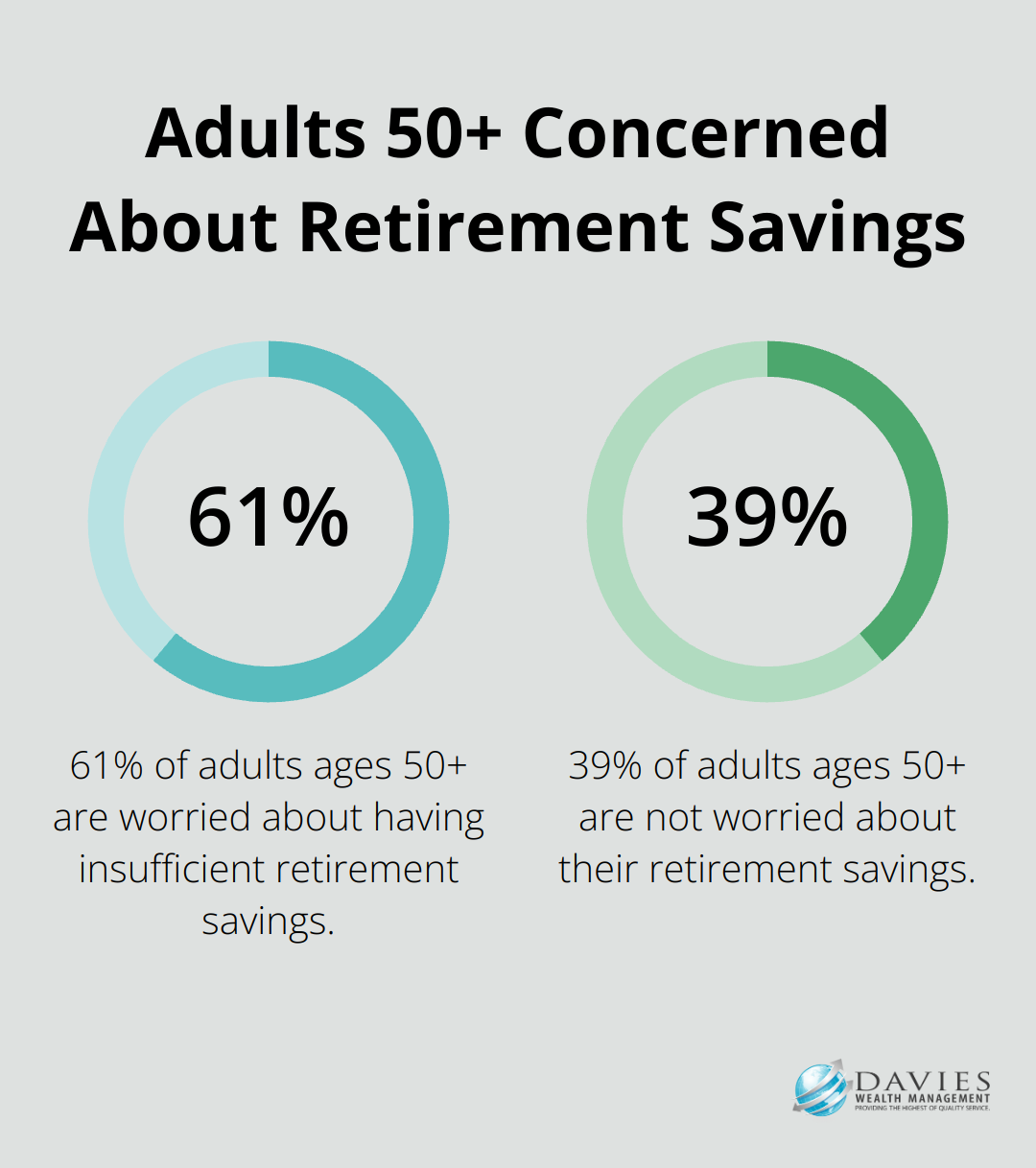

A complete financial inventory forms the foundation of your estate plan. It provides clarity on what you own and owe, enabling informed decisions about asset distribution and potential tax implications. A 2024 survey by the American Association of Retired Persons (AARP) revealed that 61% of adults ages 50+ are worried they will not have enough money to support themselves in retirement, highlighting the importance of this step.

Defining Estate Planning Objectives

After gaining a clear picture of your financial landscape, you must define your estate planning goals. These objectives should reflect your values, family dynamics, and long-term vision for your wealth. Common goals include:

- Providing for your spouse and children

- Supporting aging parents

- Leaving a legacy for future generations

- Minimizing estate taxes

- Protecting assets from creditors

- Supporting charitable causes

Prioritize these goals and discuss them with your family. Open communication prevents misunderstandings and conflicts in the future. Stepping into the vulnerabilities of generational wealth can foster intimacy and family harmony.

Aligning Estate Planning with Financial Goals

The final step to integrate estate planning into your financial strategy involves aligning your estate plan with your broader financial objectives. This step requires consideration of how your estate plan impacts your retirement planning, investment strategy, and tax planning.

For example, if you aim to retire early, your estate plan should account for a potentially longer retirement period and the need for more liquid assets. If you focus on wealth accumulation, your estate plan might incorporate strategies like irrevocable life insurance trusts to provide liquidity for estate taxes while allowing your investment portfolio to grow.

Tax planning represents another critical area where estate planning and financial strategy intersect. Strategies such as gifting, establishing charitable trusts, or creating family limited partnerships can help reduce your taxable estate while aligning with your broader financial goals.

Many financial advisors (including those at Davies Wealth Management) use sophisticated financial modeling tools to project how different estate planning strategies might impact your overall financial picture. This approach allows for data-driven recommendations that balance your current needs with your long-term estate planning objectives.

The integration of estate planning into your financial strategy requires a holistic approach that considers all aspects of your financial life. As we move forward, we will explore the essential tools and techniques that form the backbone of a comprehensive estate plan.

Essential Estate Planning Tools and Techniques

Wills and Trusts: The Foundation of Estate Planning

A will stands as the primary document in estate planning, dictating how your assets should be distributed after your death. However, a will alone often proves insufficient. Trusts offer additional benefits, such as avoiding probate and providing more control over asset distribution.

A 2024 Gallup poll revealed that only 46% of Americans have a will. This statistic underscores the urgent need for more widespread estate planning. We recommend that all individuals, regardless of wealth level, have at least a basic will in place.

Trusts come in various forms, each serving different purposes. A revocable living trust allows you to maintain control of your assets during your lifetime while providing for smooth asset transfer upon death. Irrevocable trusts can offer tax benefits and asset protection.

Power of Attorney and Healthcare Directives

Power of attorney documents and healthcare directives are essential for managing your affairs if you become incapacitated. A financial power of attorney allows a designated individual to handle your financial matters, while a healthcare power of attorney (often combined with a living will) outlines your medical treatment preferences.

A study by the American Bar Association found that only 33% of Americans have advance directives in place. This gap leaves many families unprepared for medical emergencies. We strongly advise addressing this aspect of estate planning promptly.

Beneficiary Designations and Asset Titling

Proper beneficiary designations and asset titling are often overlooked aspects of estate planning. These designations typically supersede instructions in a will, making them critical to ensuring your assets are distributed according to your wishes.

For example, retirement accounts and life insurance policies pass to named beneficiaries, bypassing the probate process. Regular review and updates of these designations are essential, especially after major life events (such as marriage, divorce, or the birth of a child).

Asset titling also plays a significant role in estate planning. Joint ownership with rights of survivorship allows assets to pass directly to the surviving owner without going through probate.

Tax Planning Strategies for Wealth Transfer

Effective tax planning is integral to preserving wealth for future generations. The lifetime gift/estate tax exemption is $13.99 million in 2025, but this figure is projected to be $7 million in 2026 unless Congress takes action.

Several strategies can help minimize estate taxes. Annual gifting allows you to transfer up to $17,000 per recipient in 2024 without incurring gift taxes. Over time, this can significantly reduce the size of your taxable estate.

Charitable remainder trusts offer another tax-efficient option, providing income during your lifetime while benefiting a charity upon your death. This strategy can result in income tax deductions and potentially reduce estate taxes.

We work closely with tax professionals to develop comprehensive strategies that align with our clients’ estate planning goals and overall financial objectives. Proactive tax planning is essential for preserving wealth and maximizing the legacy you leave behind.

Final Thoughts

Estate planning forms an essential part of personal finance. It protects your assets and ensures your wishes are carried out after death. We recommend you start by assessing your financial situation and defining clear goals for your wealth distribution.

Professional guidance proves invaluable when creating a comprehensive estate plan. Experts can help you navigate complex legal documents and tax strategies (such as trusts and power of attorney). Regular reviews and updates of your plan will keep it aligned with your changing life circumstances and financial objectives.

At Davies Wealth Management, we specialize in estate planning for personal finance. Our team offers tailored solutions to secure your financial legacy and provide peace of mind for you and your loved ones. Take the first step towards a robust estate plan today.

Leave a Reply