In today’s digital age, our online lives have become as significant as our physical ones. At Davies Wealth Management, we’ve seen a growing need to address digital assets in estate planning.

Including digital assets in a will is no longer optional; it’s a necessity for protecting your online legacy and ensuring your digital wealth is properly managed after you’re gone.

This guide will walk you through the essential steps to safeguard your digital assets and incorporate them into your estate plan effectively.

What Are Digital Assets?

Defining Digital Assets

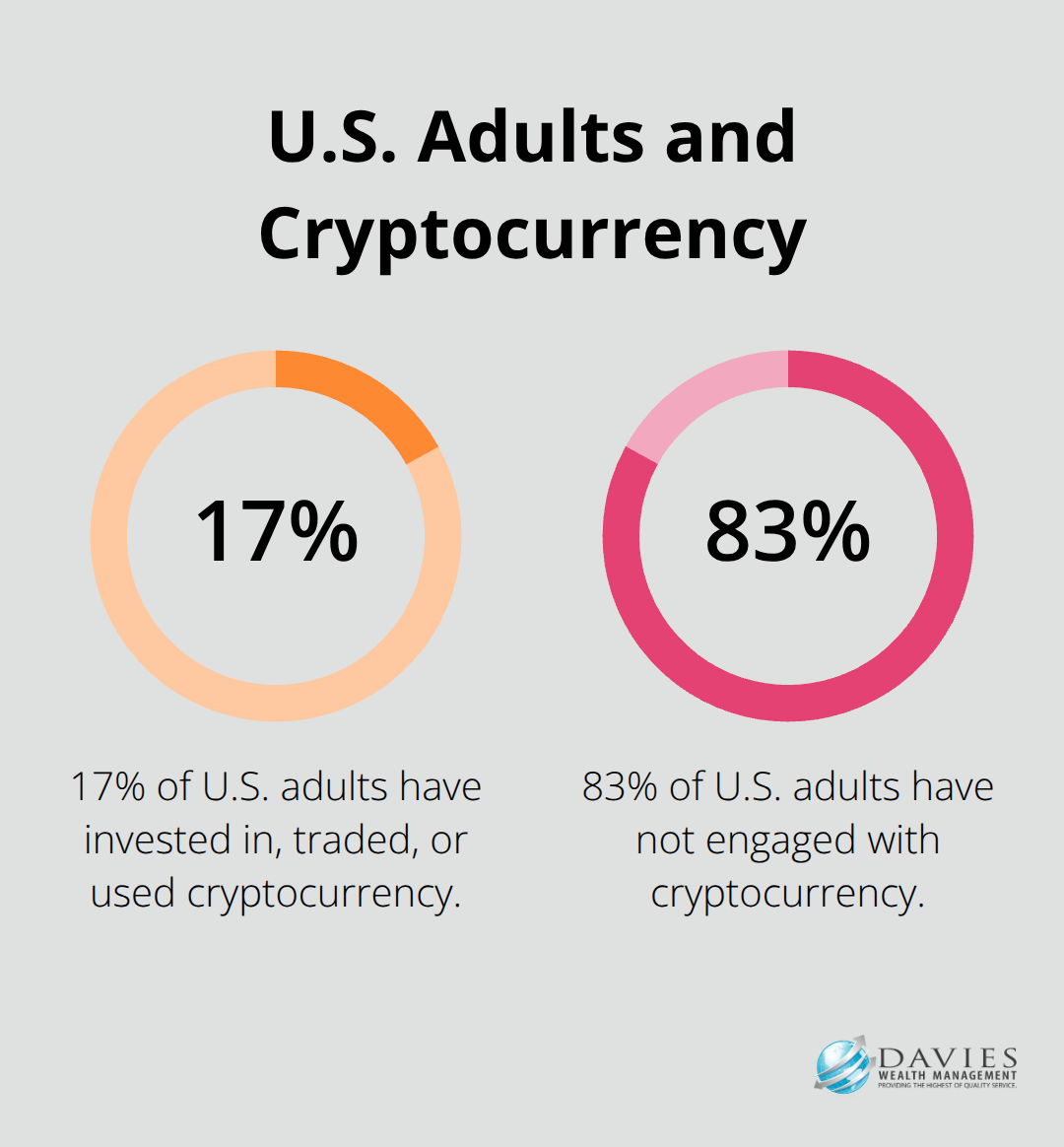

Digital assets include any content, account, or file stored digitally, either online or on a device. This encompasses everything from social media profiles to cryptocurrency holdings. A 2024 Pew Research Center study revealed that 17% of U.S. adults have ever invested in, traded or used a cryptocurrency, highlighting the growing importance of digital assets.

Types of Digital Assets

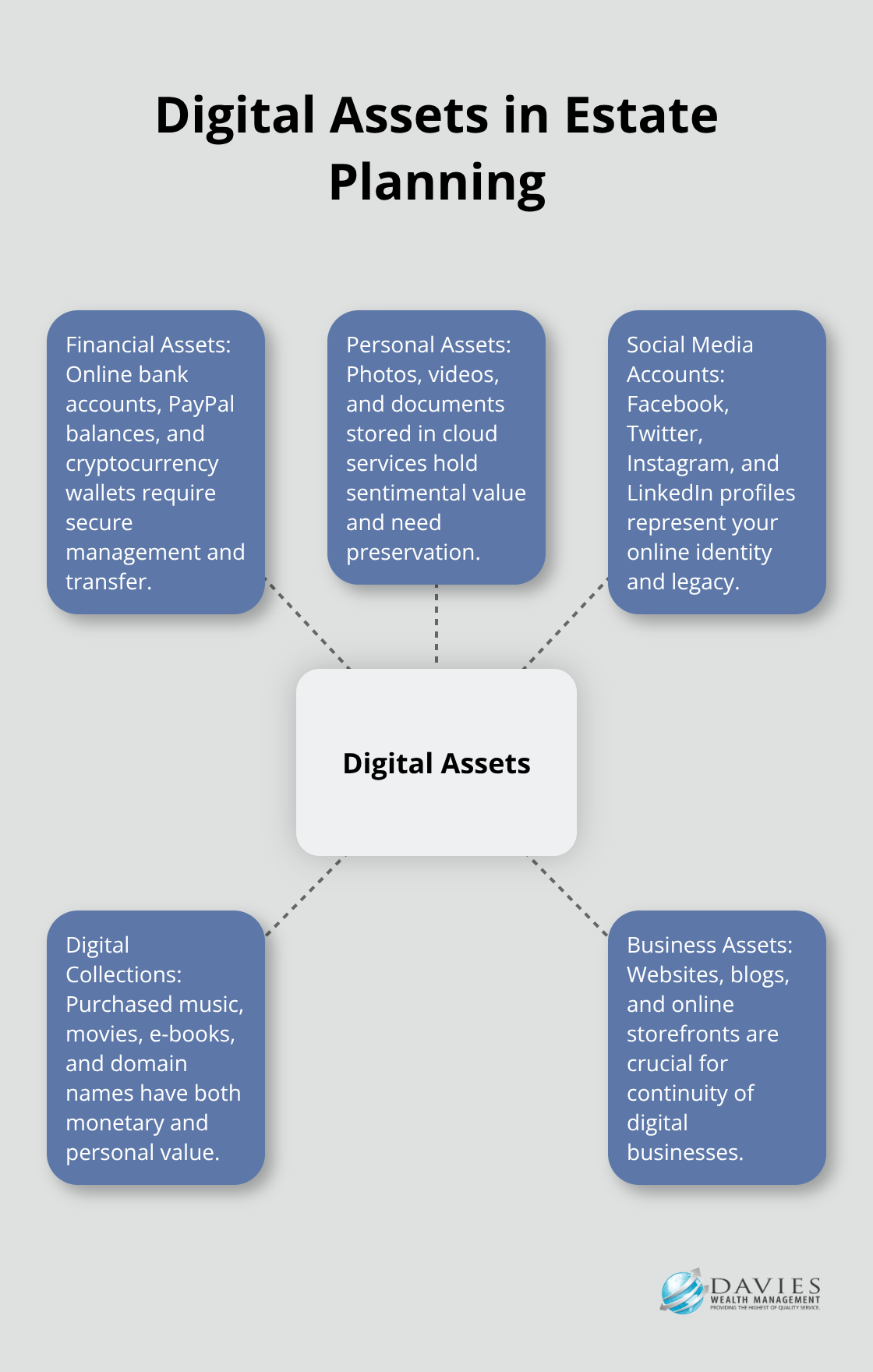

The spectrum of digital assets continues to expand. Here are some common types:

- Financial assets: Online bank accounts, PayPal balances, and cryptocurrency wallets.

- Personal assets: Photos, videos, and documents stored in cloud services.

- Social media accounts: Facebook, Twitter, Instagram, and LinkedIn profiles.

- Digital collections: Purchased music, movies, e-books, and domain names.

- Business assets: Websites, blogs, and online storefronts.

The Importance of Digital Assets in Estate Planning

Including digital assets in your will protects more than just valuable items; it safeguards your digital legacy. Many Americans have not considered what will happen to their digital assets after death. This oversight can lead to significant problems for heirs.

Failure to plan for digital assets can result in:

- Lost access to important accounts

- Potential financial losses

- Risk of identity theft

For example, if heirs can’t access a cryptocurrency wallet, those assets could vanish forever. Similarly, without proper instructions, cherished family photos stored in the cloud might become inaccessible.

Strategies for Digital Asset Management

To address these complex issues, we recommend creating a comprehensive inventory of your digital assets and providing clear instructions for their management in your estate plan. This approach ensures that your digital legacy remains protected and your wishes respected, even in the digital realm.

As we move forward, it’s essential to understand the specific steps you can take to include digital assets in your will. The next section will outline a practical approach to this process, ensuring you leave no digital stone unturned.

How to Protect Your Digital Legacy

At Davies Wealth Management, we understand the importance of safeguarding digital assets. The process may appear complex, but with a strategic approach, you can protect your digital legacy effectively. Here’s how to include your digital assets in your will:

Create a Comprehensive Digital Inventory

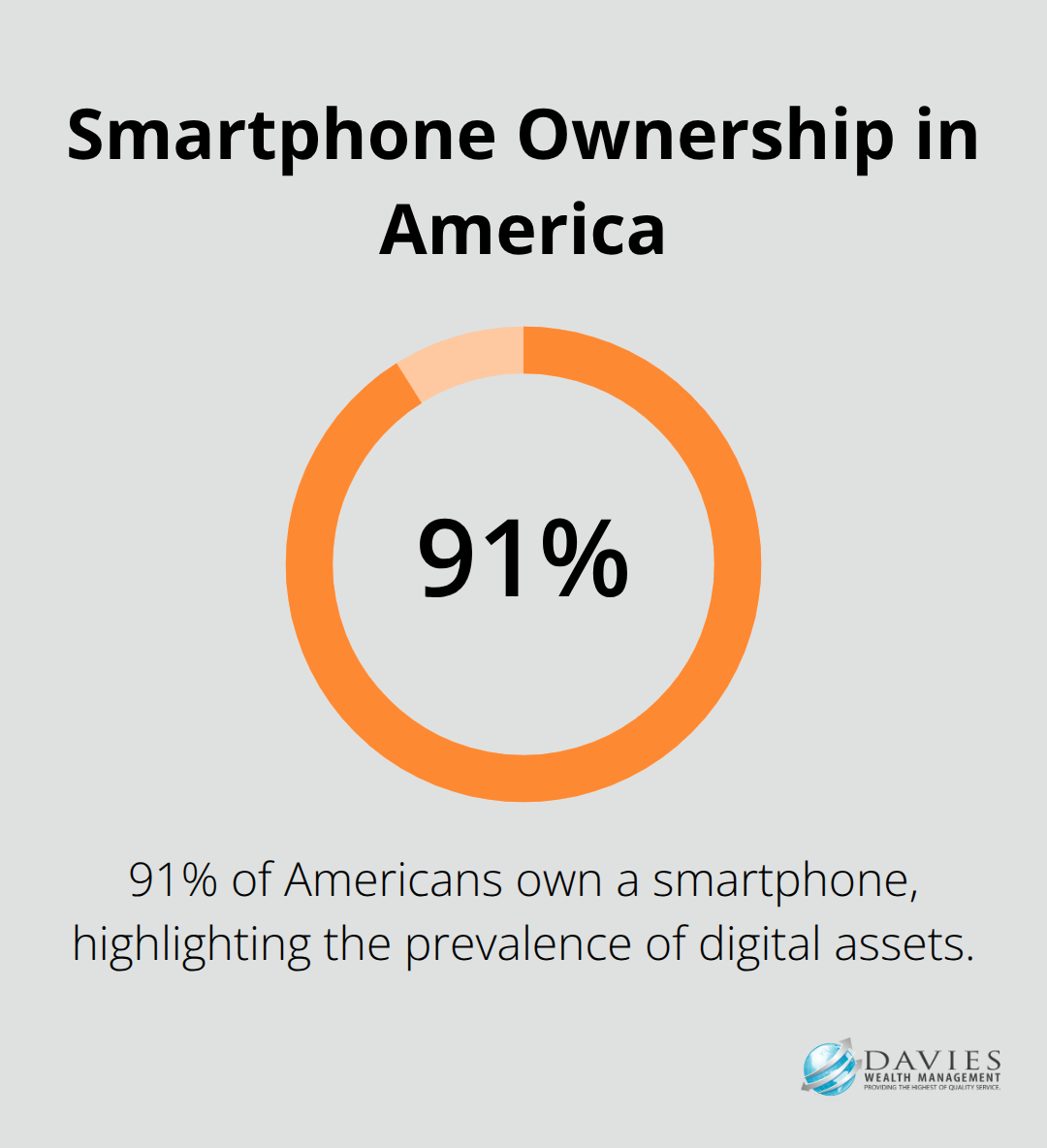

Start by listing all your digital assets. This includes social media accounts, email, cryptocurrency wallets, and online banking. Don’t overlook digital files stored on your devices or in the cloud. A 2024 study by the Pew Research Center found that 91% of Americans own a smartphone, highlighting the prevalence of digital assets in our lives.

Establish Clear Access Procedures

For each digital asset, detail the access methods. Document usernames, passwords, and any two-factor authentication processes. Exercise caution when storing this sensitive information. Consider using a secure password manager and provide access instructions to your executor.

Select a Tech-Savvy Digital Executor

Choose a trustworthy individual who is comfortable with technology to manage your digital estate. Name this person in your will and grant them clear authority to handle your digital assets.

Provide Specific Instructions

Clearly state what should happen to each digital asset. Do you want your social media accounts memorialized or deleted? Should your cryptocurrency transfer to a specific heir? Be as detailed as possible to avoid confusion or potential conflicts among your beneficiaries.

Stay Informed About Legal Developments

Digital asset laws continue to evolve. The Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) has been adopted by most states as a means of directing how to manage someone’s digital assets after their death. Work with professionals who stay current with these legal developments to ensure your digital estate plan remains effective and compliant.

As we move forward, it’s essential to understand the legal considerations that come into play when including digital assets in your will. The next section will explore these legal aspects in detail, helping you navigate the complexities of digital asset inheritance.

Navigating the Legal Landscape of Digital Assets

State and Federal Legislation

The Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) serves as the primary legislation governing digital assets in most U.S. states. With the passing of RUFADAA, executors can access the deceased’s digital accounts and assets following their death. However, its implementation varies by state. California’s version of RUFADAA, for example, differs from New York’s, which affects how digital assets are handled after death.

Federal laws also impact access to digital assets. The Stored Communications Act limits service providers from disclosing the contents of electronic communications without the account holder’s consent. To navigate these legal intricacies, we recommend working with an estate planning attorney who specializes in digital assets.

Terms of Service Agreements

Many online platforms have their own policies regarding account access after death. Facebook allows users to designate a legacy contact, while Google offers an Inactive Account Manager. However, these policies can conflict with your will or state laws. To address this, you should explicitly state in your will that you give your executor permission to access your digital accounts, overriding any terms of service agreements.

Challenges in Digital Asset Management

The rapid pace of technological change presents a significant challenge. New types of digital assets emerge constantly, potentially rendering your estate plan outdated. We advise our clients to review and update their digital asset inventory annually.

The international nature of many digital assets also creates hurdles. Cryptocurrencies, for instance, operate on decentralized networks that aren’t bound by national laws. To address this, you should consider creating a digital asset trust that outlines specific instructions for managing these assets.

Privacy concerns also present challenges. Some digital assets may contain sensitive personal or financial information. We recommend creating a detailed access guide for your executor, specifying which assets should be preserved and which should be deleted to protect your privacy.

Volatility and Estate Planning

The value of certain digital assets can be volatile. Cryptocurrencies and NFTs can fluctuate wildly in value, potentially affecting estate taxes. To mitigate this risk, you should include a clause in your will that allows your executor to make decisions based on the current market value of these assets.

Understanding these legal considerations and taking proactive steps will ensure your digital assets are properly managed and distributed according to your wishes. The digital asset landscape continues to evolve, so staying informed and regularly updating your estate plan is essential.

Final Thoughts

Including digital assets in a will protects your online legacy and ensures proper management of your digital wealth after death. You should create a comprehensive inventory of your digital assets, establish clear access procedures, and select a tech-savvy executor to manage your digital estate. The legal landscape surrounding digital inheritance continues to evolve, so you must stay informed and update your estate plan regularly.

Digital asset management requires an ongoing commitment to keep pace with technological advancements and new types of digital assets. We recommend you review your digital asset inventory annually to maintain its accuracy and completeness. This proactive approach will help safeguard your entire estate (both physical and digital) for future generations.

Davies Wealth Management can help you navigate the complexities of modern estate planning, including the incorporation of digital assets in your will. Our team of experts will work with you to create a comprehensive plan that addresses all aspects of your estate. Don’t leave your digital legacy to chance; take action today to secure your digital assets and provide peace of mind for your loved ones.

Leave a Reply