Tax strategies for business owners can significantly impact your company’s financial health and growth potential. At Davies Wealth Management, we understand the complexities of business taxation and its crucial role in your overall financial strategy.

This guide will walk you through essential tax structures, deduction strategies, and planning techniques to help you optimize your business’s tax position. By implementing these strategies, you can potentially reduce your tax burden and reinvest more capital into your business’s future.

Which Business Structure Is Right for You?

Selecting the appropriate business structure stands as a pivotal decision that will shape your tax obligations and overall financial strategy. At Davies Wealth Management, we guide our clients through this critical process, taking into account their specific circumstances and objectives.

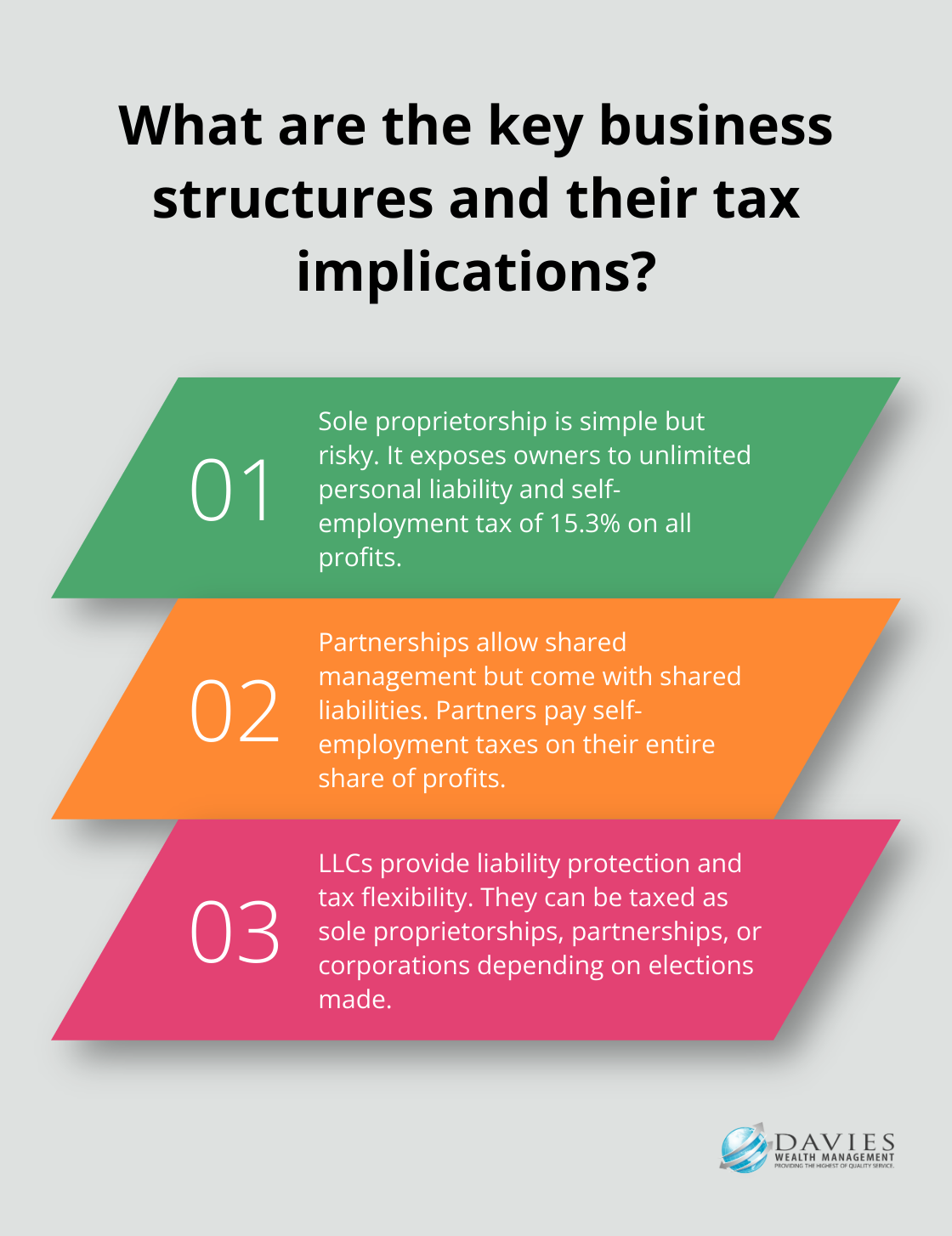

Sole Proprietorship: Simplicity with Risk

A sole proprietorship offers the easiest setup and complete control. However, it exposes you to unlimited personal liability and potentially higher tax rates. As your income increases, you’ll pay self-employment taxes on all profits. The self-employment tax is 15.3%, which is 12.4% for Social Security and 2.9% for Medicare.

Partnerships: Shared Responsibilities and Risks

Partnerships allow for shared management and resources but also come with shared liabilities. Each partner reports their share of profits on their personal tax returns. While this can lead to tax savings in some cases, partners must pay self-employment taxes on their entire share of profits (regardless of distributions).

Limited Liability Companies (LLCs): Flexibility Meets Protection

LLCs provide liability protection and tax flexibility. They can be taxed as sole proprietorships, partnerships, or corporations, depending on the number of members and elections made. This flexibility allows for potential tax savings and asset protection. For example, a single-member LLC can be taxed as a sole proprietorship while still maintaining liability protection.

Corporations: Complexity with Potential Advantages

Corporations, particularly S corporations, can offer significant tax advantages for some business owners. S corporations pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes, potentially reducing self-employment taxes.

C corporations face double taxation on profits and dividends but offer lower corporate tax rates and more options for fringe benefits. They often suit businesses that plan to reinvest profits or seek outside investment.

Factors to Consider in Your Decision

Your choice of business structure should reflect your current situation and future goals. Consider these key factors:

- Liability protection

- Tax implications

- Growth plans

- Ease of setup and maintenance

- Flexibility for future changes

While general guidelines help, every business is unique. Professional advice proves invaluable in making this important choice. Davies Wealth Management specializes in helping business owners navigate these complex decisions. Our team provides personalized guidance, considering your specific circumstances, to help you select the most advantageous business structure for your needs.

As you weigh your options for business structure, it’s equally important to consider effective tax deduction strategies that can further optimize your financial position. Let’s explore some key approaches to maximizing your tax deductions and minimizing your overall tax burden.

How to Maximize Tax Deductions for Your Business

Effective tax deduction strategies can significantly impact your business’s bottom line. Understanding and leveraging available deductions will reduce your taxable income and allow you to reinvest more capital into your company’s growth.

Common Business Expenses You Can Deduct

The IRS allows businesses to deduct ordinary and necessary expenses incurred in the course of operations. These can include:

- Office rent

- Utilities

- Supplies

- Travel costs

If you use your personal vehicle for business purposes, you can deduct 65.5 cents per mile driven in 2023 (according to the IRS standard mileage rate).

Home office deductions can also provide substantial tax savings. If you use a portion of your home exclusively for business, you may qualify to deduct a percentage of your mortgage interest, property taxes, and utilities. The IRS offers a simplified method allowing a deduction of $5 per square foot of home office space (up to 300 square feet).

Maximizing Depreciation and Section 179 Deductions

Depreciation allows businesses to deduct the cost of assets over time, but Section 179 of the tax code offers an opportunity to accelerate these deductions. For the 2025 tax year, businesses can deduct up to $1,250,000 in qualifying equipment purchases under Section 179. This can include:

- Machinery

- Vehicles

- Computers

- Certain improvements to commercial buildings

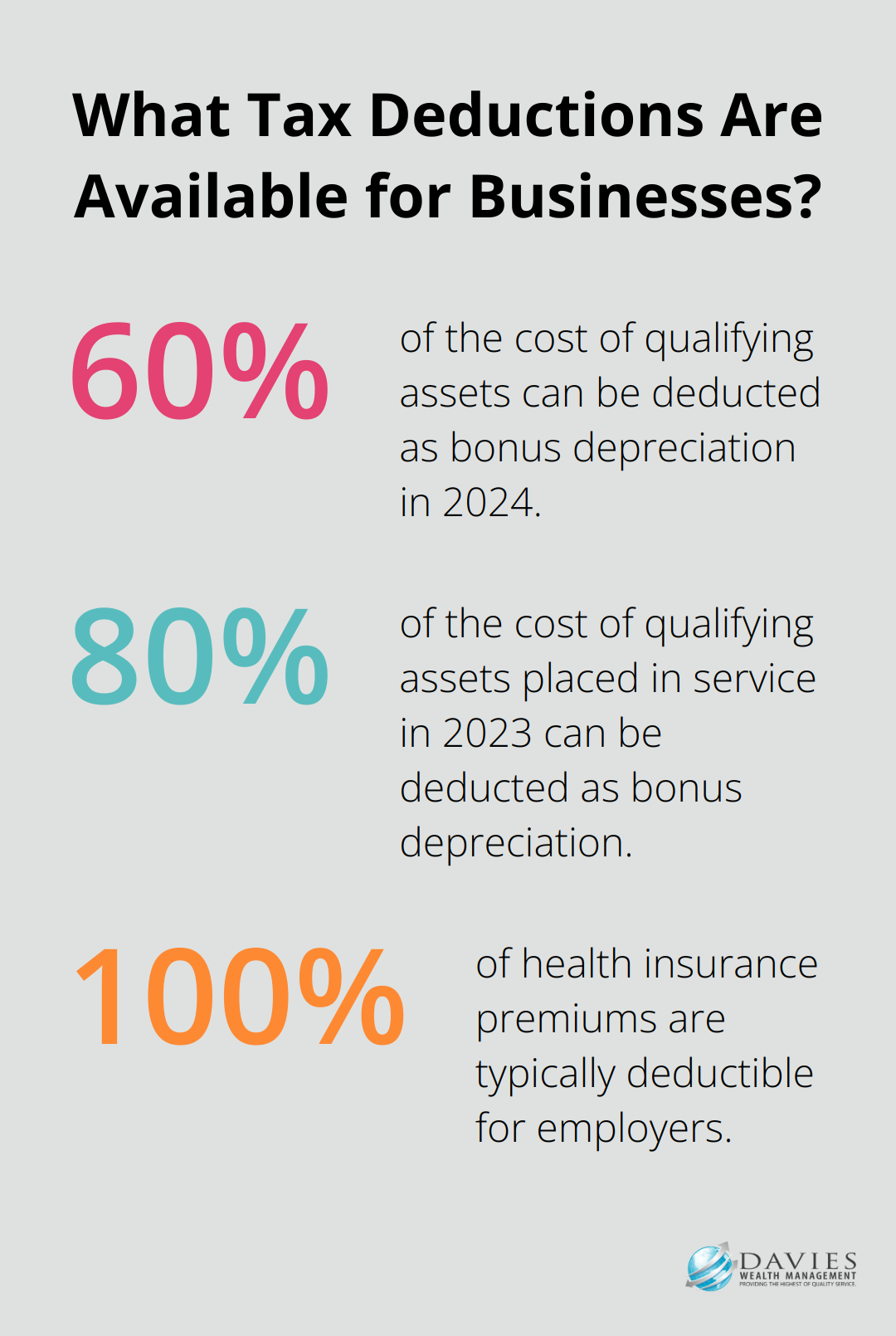

Bonus depreciation is another powerful tool. While it’s being phased out, businesses can still deduct 80% of the cost of qualifying assets placed in service in 2023. This percentage will decrease to 60% in 2024 and 40% in 2025, so it’s important to plan major purchases strategically.

Optimizing Employee Benefits and Retirement Plans

Offering competitive employee benefits not only helps attract and retain talent but can also provide significant tax advantages. Health insurance premiums, for instance, are typically 100% deductible for employers. Additionally, contributions to employee retirement plans like 401(k)s are tax-deductible for the business.

Small businesses with fewer than 100 employees can benefit from a tax credit of up to $5,000 per year, for three years, for the ordinary and necessary costs of starting a SEP, SIMPLE IRA, or qualified plan.

Strategic Timing of Income and Expenses

The timing of income recognition and expense payments can significantly impact your tax liability. Depending on your business structure and accounting method, you may want to:

- Defer income to the next tax year (if you expect to be in a lower tax bracket)

- Accelerate expenses into the current year (to reduce taxable income)

- Prepay certain expenses (such as insurance premiums or rent) to increase deductions in the current year

These strategies require careful planning and consideration of your overall financial situation. Professional advice can help you navigate these decisions effectively.

As you implement these tax deduction strategies, it’s important to also consider broader tax planning techniques that can support your business growth. The next section will explore how to leverage tax planning for long-term business success and financial stability.

How Tax Planning Fuels Business Growth

Tax planning serves as a powerful tool for driving business growth. Strategic tax planning frees up capital for reinvestment, reduces overall tax burdens, and creates opportunities for expansion. Here’s how you can leverage tax planning to fuel your business growth:

Strategic Timing of Income and Expenses

The timing of income recognition and expense incurrence significantly impacts tax liability. For cash basis operations, consider accelerating expenses into the current year and deferring income to the next year if you anticipate a lower tax bracket. This strategy lowers your current year’s taxable income.

For example, making a major equipment purchase before year-end allows you to take advantage of Section 179 deductions or bonus depreciation in the current tax year. Similarly, delaying client billing until January pushes that income into the next tax year.

This strategy isn’t universal. If you expect a higher tax bracket next year, the opposite approach might benefit you more. Always consider your overall financial picture and consult a tax professional before making these decisions.

Business Credits and Incentives

The tax code offers numerous credits and incentives to encourage certain business activities. These can significantly reduce your tax liability, freeing up capital for growth initiatives.

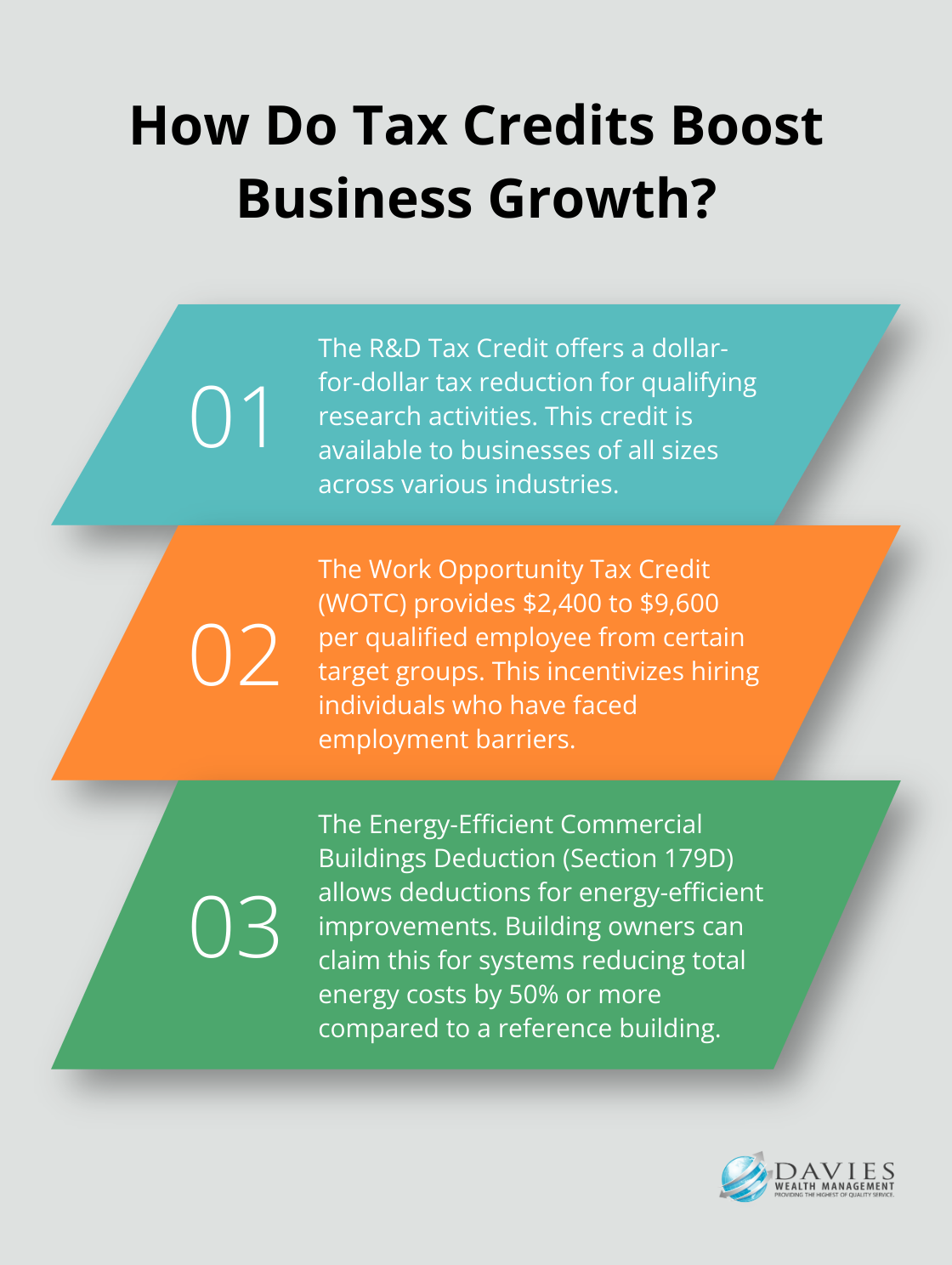

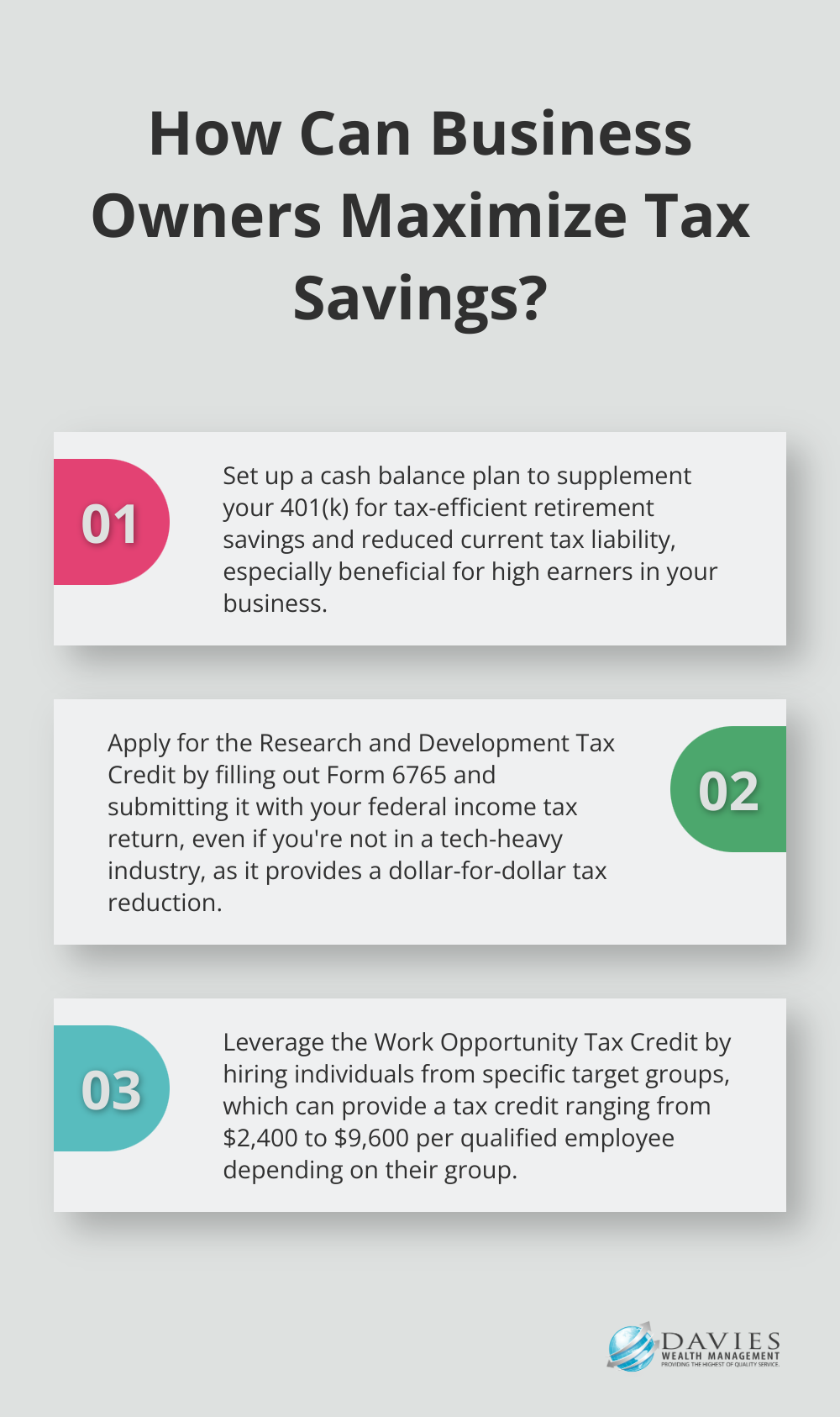

The Research and Development (R&D) Tax Credit provides a dollar-for-dollar reduction in your tax bill for qualifying research activities. Many businesses overlook this credit, assuming it’s only for large corporations or tech companies. However, it’s available to businesses of all sizes across various industries. To apply for the credit, fill out Form 6765 and submit it with your business’s federal income tax return.

The Work Opportunity Tax Credit (WOTC) incentivizes hiring individuals from certain target groups who have consistently faced employment barriers. The credit ranges from $2,400 to $9,600 per qualified employee (depending on the specific target group).

Energy-efficient improvements to your business property can also yield tax benefits. The Energy-Efficient Commercial Buildings Deduction (Section 179D) allows building owners to claim a tax deduction for installing qualifying systems that reduce the building’s total energy and power costs by 50% or more compared to a reference building.

Tax-Efficient Investment Strategy

A tax-efficient investment strategy significantly impacts your business’s long-term growth. This involves choosing investments with strong return potential and considering the tax implications of those investments.

One approach focuses on investments that generate long-term capital gains rather than short-term gains or ordinary income. Long-term capital gains typically incur lower tax rates than short-term gains or ordinary income.

Tax-advantaged investment vehicles like municipal bonds often exempt interest from federal taxes and sometimes state and local taxes. While yields might be lower than corporate bonds, the tax savings can make them more attractive on an after-tax basis.

For businesses with excess cash, setting up a cash balance plan provides a tax-efficient way to save for retirement while reducing current tax liability. These plans bridge the retirement savings gap left when employers offer only a 401(k), offering a strategic solution for high earners.

The tax landscape changes constantly, making professional guidance invaluable. Working with experienced advisors helps ensure you make the most of available opportunities while staying compliant with tax laws.

Final Thoughts

Effective tax strategies for business owners require careful planning and expert guidance. Davies Wealth Management specializes in helping business owners navigate complex tax landscapes. We provide personalized advice tailored to your unique business situation and develop comprehensive tax strategies that align with your overall financial goals.

Our team offers more than just tax advice. We deliver holistic financial planning services that encompass investment management, retirement planning, and estate planning. Our approach ensures that your tax strategy integrates seamlessly with your broader financial objectives (creating a robust foundation for long-term success).

Davies Wealth Management stands as your dedicated ally in your journey towards financial success. We stay up-to-date with the latest tax laws and strategies, ensuring you’re always prepared for whatever challenges and opportunities lie ahead. Contact us today to optimize your tax strategies and secure your financial future.

Leave a Reply