At Davies Wealth Management, we understand that maximizing your investment returns isn’t just about choosing the right assets-it’s also about minimizing your tax burden.

Tax-efficient strategies can significantly impact your wealth accumulation over time, yet many investors overlook this crucial aspect of portfolio management.

In this post, we’ll explore how to implement effective tax-efficient investment strategies that can help you keep more of your hard-earned money working for you.

What Is Tax-Efficient Investing?

Definition and Importance

Tax-efficient investing is a strategy that minimizes the tax burden on your investment returns. This approach is essential for maximizing your wealth over time. Making tax-efficiency part of your investing strategy can help lower your tax bill and allow you to keep more of your money working for you instead of paying unnecessary taxes.

The Impact of Taxes on Returns

Taxes can substantially affect your investment returns. If you’re in the highest tax bracket, you could pay up to 37% in federal taxes on short-term capital gains and ordinary dividends. This means that for every $100 you earn from these investments, you might only keep $63 after taxes. Over time, this tax drag can significantly erode your wealth accumulation.

Empirical research has shown that tax-loss harvesting strategies in separately managed accounts can improve the post-tax returns of an investment portfolio.

Common Tax-Inefficient Mistakes

Many investors make tax-inefficient mistakes without realizing it. Here are some common pitfalls:

- Frequent trading: Every time you sell an investment for a profit, you trigger a taxable event. If you hold the investment for less than a year, you’ll pay short-term capital gains rates (typically higher than long-term rates).

- Ignoring asset location: Holding tax-inefficient investments (like high-yield bonds) in a taxable account can lead to unnecessary tax bills. These investments are often better suited for tax-advantaged accounts like IRAs or 401(k)s.

- Overlooking tax-efficient fund options: Some mutual funds and ETFs are designed to be more tax-efficient than others. Failing to consider these options can result in higher tax bills.

Implementing Tax-Efficient Strategies

To start implementing tax-efficient strategies, review your current portfolio. Look at the tax implications of your investments and consider ways to minimize your tax exposure. This might involve:

- Using tax-loss harvesting to offset capital gains with capital losses

- Investing in municipal bonds for tax-free income

- Utilizing index funds and ETFs (which tend to be more tax-efficient than actively managed funds)

Professional financial advisors (such as those at Davies Wealth Management) specialize in creating personalized, tax-efficient investment strategies. They understand that every investor’s situation is unique and tailor their approach to meet specific needs and goals. Whether you’re a professional athlete managing a short career span or a business owner planning for retirement, expert guidance can help you navigate the complexities of tax-efficient investing.

As we move forward, let’s explore some key tax-efficient investment strategies in more detail. These strategies will provide you with practical tools to optimize your portfolio’s tax efficiency and potentially boost your long-term returns.

Powerful Tax-Efficient Investment Strategies

At Davies Wealth Management, we have identified several potent strategies to enhance your portfolio’s tax efficiency. These approaches can significantly boost your after-tax returns and accelerate wealth accumulation.

Asset Location Optimization

Asset location is a critical yet often overlooked strategy. It involves the strategic placement of investments in accounts based on their tax characteristics. For instance, high-yield bonds (which generate regular taxable income) are better suited for tax-advantaged accounts like IRAs or 401(k)s. In contrast, growth stocks (which primarily appreciate in value) are more appropriate for taxable accounts where they can benefit from lower long-term capital gains rates.

A study by Vanguard found that proper asset location can add up to 0.75% in annual performance without increasing portfolio risk. This seemingly small percentage can compound to significant savings over time.

Tax-Loss Harvesting

Tax-loss harvesting is a powerful technique that involves the sale of investments at a loss to offset capital gains. This strategy can reduce your tax liability while maintaining your overall investment exposure. For example, if you sell a stock at a $10,000 loss, you can use that loss to offset $10,000 in capital gains, potentially saving thousands in taxes.

Betterment seems better suited for money that you are investing after-tax because they can do fancy tax-loss harvesting that can save you some money at tax time.

Tax-Advantaged Accounts

Maximizing contributions to tax-advantaged accounts is a cornerstone of tax-efficient investing. In 2025, you can contribute up to $23,500 to a 401(k), or $30,500 if you’re 50 or older. For IRAs, the limits are $7,000, or $8,000 if you’re 50 or older.

Health Savings Accounts (HSAs) offer a unique triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, individuals can contribute up to $4,150, and families can contribute up to $8,300.

Municipal Bonds

Municipal bonds can serve as an excellent tool for tax-efficient investing, especially for high-income earners. Municipal bonds offer a way to invest in infrastructure, a sector where there are many funds being created for taxable or equity investments.

Index Funds and ETFs

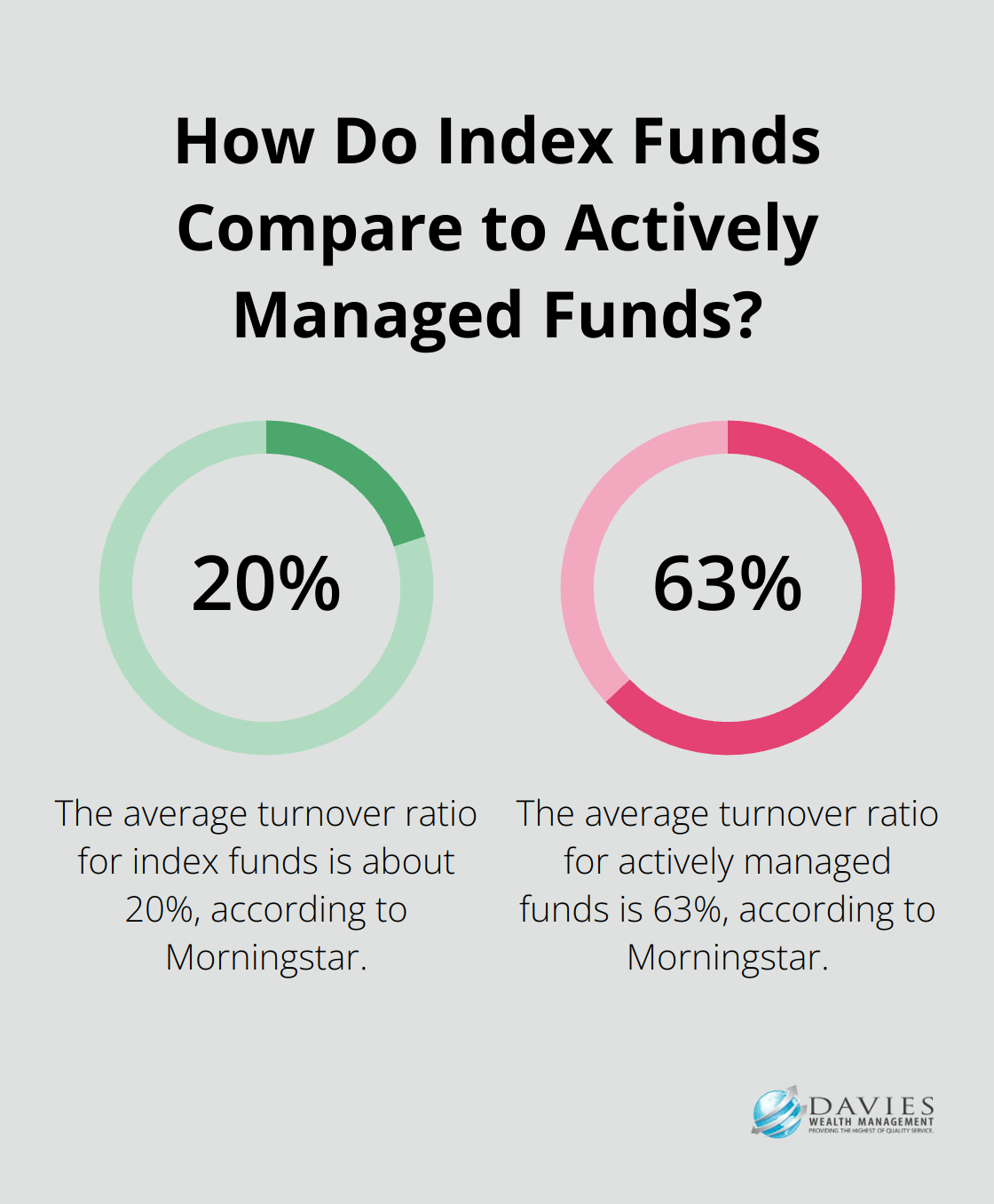

Index funds and ETFs are generally more tax-efficient than actively managed funds due to their lower turnover. According to Morningstar, the average turnover ratio for index funds is about 20%, compared to 63% for actively managed funds. This lower turnover results in fewer capital gains distributions, reducing your tax burden.

ETFs, in particular, offer additional tax advantages due to their unique structure. Unlike mutual funds, ETFs rarely distribute capital gains, making them an excellent choice for taxable accounts.

The implementation of these strategies requires careful planning and ongoing management. Professional financial advisors (such as those at Davies Wealth Management) specialize in creating personalized, tax-efficient investment plans tailored to unique financial situations and goals. Whether you’re a professional athlete managing a short career span or a business owner planning for retirement, expert guidance can help you navigate the complexities of tax-efficient investing and potentially save thousands in taxes over your investment lifetime.

Now that we’ve explored these powerful tax-efficient strategies, let’s examine how you can implement them in your own portfolio to maximize your after-tax returns.

How to Put Tax-Efficient Strategies into Action

Evaluate Your Current Portfolio

The first step to implement tax-efficient strategies involves an assessment of your current portfolio’s tax efficiency. This step requires an examination of each investment’s tax implications, including capital gains distributions, dividend yields, and turnover ratios. For example, if you hold high-yield bonds in a taxable account, you might pay unnecessary taxes on the interest income.

A Morningstar study found that investors in high-tax brackets could lose up to 2% of their returns annually due to taxes. This finding highlights the importance of a thorough portfolio review.

Develop a Personalized Plan

After you assess your portfolio, create a personalized tax-efficient investment plan. This plan should align with your financial goals, risk tolerance, and tax situation. For instance, if you’re in a high tax bracket, you might benefit from an increased allocation to municipal bonds or tax-managed funds.

Direct indexing involves purchasing the individual stocks that make up an index, allowing for customized tax management. This strategy provides the benefits of a tax-efficient investment plan.

Balance Efficiency and Goals

While tax efficiency holds importance, it shouldn’t supersede your overall investment goals. For example, an overweight of your portfolio towards municipal bonds for tax purposes might lead to suboptimal returns if it doesn’t align with your risk tolerance or income needs.

According to Vanguard’s research, proper utilization of asset location strategies can add up to 0.75% to an investor’s average annual returns.

Seek Professional Guidance

The implementation of these strategies requires expertise and ongoing management. Financial advisors specialize in the creation of personalized, tax-efficient investment plans tailored to unique financial situations. Whether you’re a professional athlete who manages a short career span or a business owner who plans for retirement, expert guidance can help you navigate the complexities of tax-efficient investing.

Regular Review and Adjustment

Tax laws and regulations change frequently. What’s tax-efficient today might not be tomorrow. This reality necessitates regular reviews and adjustments to your strategy. With the right approach and expert guidance, you can make tax efficiency work for you, which keeps more of your hard-earned money invested and growing over time.

Final Thoughts

Tax-efficient strategies can significantly boost wealth accumulation over time. Asset location optimization, tax-loss harvesting, and tax-advantaged accounts help investors keep more money working for them. Municipal bonds and tax-efficient vehicles like index funds and ETFs further enhance portfolio tax efficiency.

Tax-efficient investing requires regular portfolio review and adjustment as tax laws change and financial situations evolve. What works today may not be optimal tomorrow, making ongoing management essential for successful tax-efficient investing. Investors should balance tax efficiency with overall investment goals and risk tolerance.

At Davies Wealth Management, we create personalized, tax-efficient investment plans tailored to unique financial situations and goals. Our expertise serves professional athletes, business owners, and individuals who want to optimize their financial future. We can help you navigate these complexities to maximize your after-tax returns and secure your financial future.

Leave a Reply