At Davies Wealth Management, we understand the impact taxes can have on your investment returns. Tax-efficient investing strategies are essential for maximizing your wealth over time.

In this post, we’ll explore practical ways to implement these strategies and optimize your portfolio’s tax efficiency. You’ll learn how to keep more of your hard-earned money working for you, rather than going to the IRS.

What Is Tax-Efficient Investing?

Definition and Importance

Tax-efficient investing refers to strategies that minimize the tax burden on investment returns. This approach plays a vital role in long-term wealth accumulation. By reducing the amount paid in taxes, investors can keep more of their money invested and working for them.

The Impact of Taxes on Investment Returns

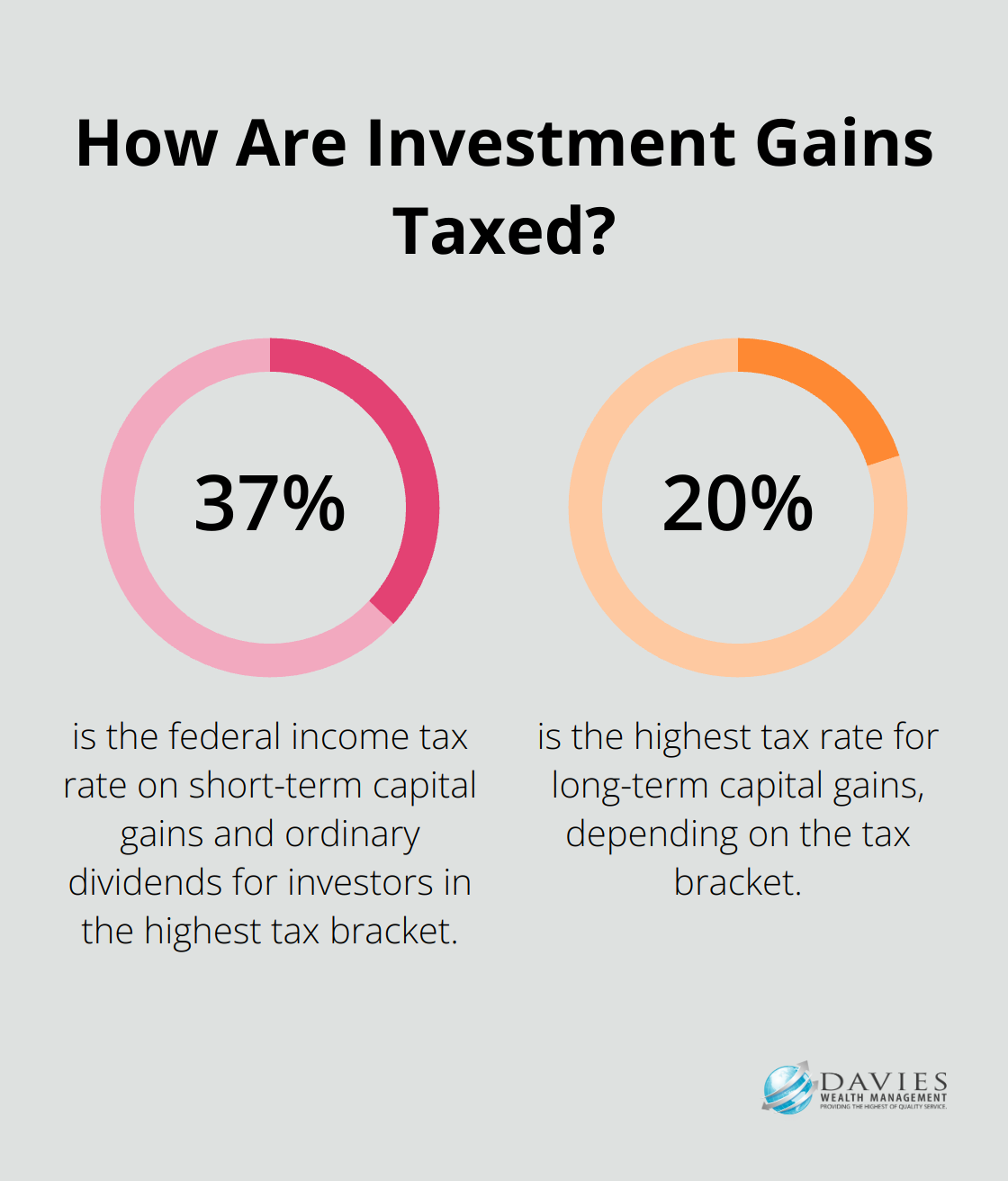

Taxes can significantly erode investment gains. For example, investors in the highest tax bracket could pay up to 37% in federal income tax on short-term capital gains and ordinary dividends. This means that for every $1,000 earned in investment income, $370 could be lost to taxes.

Long-term capital gains are taxed at lower rates (0%, 15%, or 20% depending on your tax bracket). However, this still takes a substantial bite out of returns. When state and local taxes are added, the impact becomes even more pronounced.

Effective Tax-Efficient Strategies

Hold Investments for Longer Periods

One effective strategy involves holding investments for longer periods. This approach allows investors to take advantage of lower long-term capital gains rates. For instance, holding a stock for more than a year before selling could potentially reduce the tax rate from 37% to 20% on the gains.

Utilize Tax-Advantaged Accounts

Another approach involves the use of tax-advantaged accounts. Contributing to an IRA, 401(k), or Roth IRA can provide tax benefits and are generally better for investments that lose more of their returns to taxes. In 2025, individuals can contribute up to $23,500 to a 401(k), or $30,500 if they’re 50 or older. This can result in significant tax savings, especially for high-income earners.

The Power of Tax-Efficient Investing

Implementing tax-efficient strategies can have a profound impact on wealth over time. Consider this example: An investment of $100,000 earning an 8% annual return over 30 years would grow to about $1,006,266 before taxes. However, if 25% of the gains are lost to taxes each year, the final balance would only be $574,349. That’s a difference of $431,917 – nearly half of the potential wealth!

By focusing on tax efficiency, investors can potentially keep a larger portion of their investment returns. This means more money stays invested, benefiting from compound growth over time. The result? A potentially larger nest egg for retirement, more funds for children’s education, or increased financial flexibility to pursue various goals.

As we move forward, we’ll explore specific tax-efficient investing strategies that can help maximize after-tax returns and build long-term wealth more effectively. These strategies form the foundation of a robust investment approach that considers both growth potential and tax implications.

Key Tax-Efficient Investing Strategies

At Davies Wealth Management, we have identified several key strategies that can significantly boost your after-tax returns. These approaches will help you keep more of your investment gains and build wealth more effectively over time.

Asset Location Optimization

Asset location optimization is one of the most powerful tax-efficient investing strategies. This strategy involves the strategic placement of different types of investments in the most tax-advantageous accounts. For example, investments that generate high taxable income (such as bonds or REITs) are often better suited for tax-advantaged accounts like IRAs or 401(k)s. Growth stocks or index funds that you plan to hold for the long term are typically more tax-efficient in taxable accounts.

A study by Vanguard found that proper asset location can add up to 0.75% in annual returns. Over time, this can translate to substantial wealth accumulation. On a $500,000 portfolio over 30 years, this could potentially add over $400,000 to your nest egg.

Tax-Loss Harvesting

Tax-loss harvesting is another powerful strategy that can help reduce your tax bill. This strategy involves selling investments that have declined in value to realize losses, which can then offset capital gains or up to $3,000 of ordinary income per year. Any excess losses can carry forward to future tax years.

Tax-loss harvesting can be a valuable tool for improving investor returns without increasing risk. While it’s difficult to put an exact number on the potential benefits, it can contribute to improved after-tax returns.

Leveraging Tax-Advantaged Accounts

Maximizing contributions to tax-advantaged accounts is a cornerstone of tax-efficient investing. In 2025, you can contribute up to $23,500 to a 401(k), or $30,500 if you’re 50 or older. For IRAs, the limits are $7,000, or $8,000 for those 50 and above.

Health Savings Accounts (HSAs) offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, individuals can contribute up to $4,150 to an HSA, while families can contribute up to $8,300.

Tax-Efficient Investment Vehicles

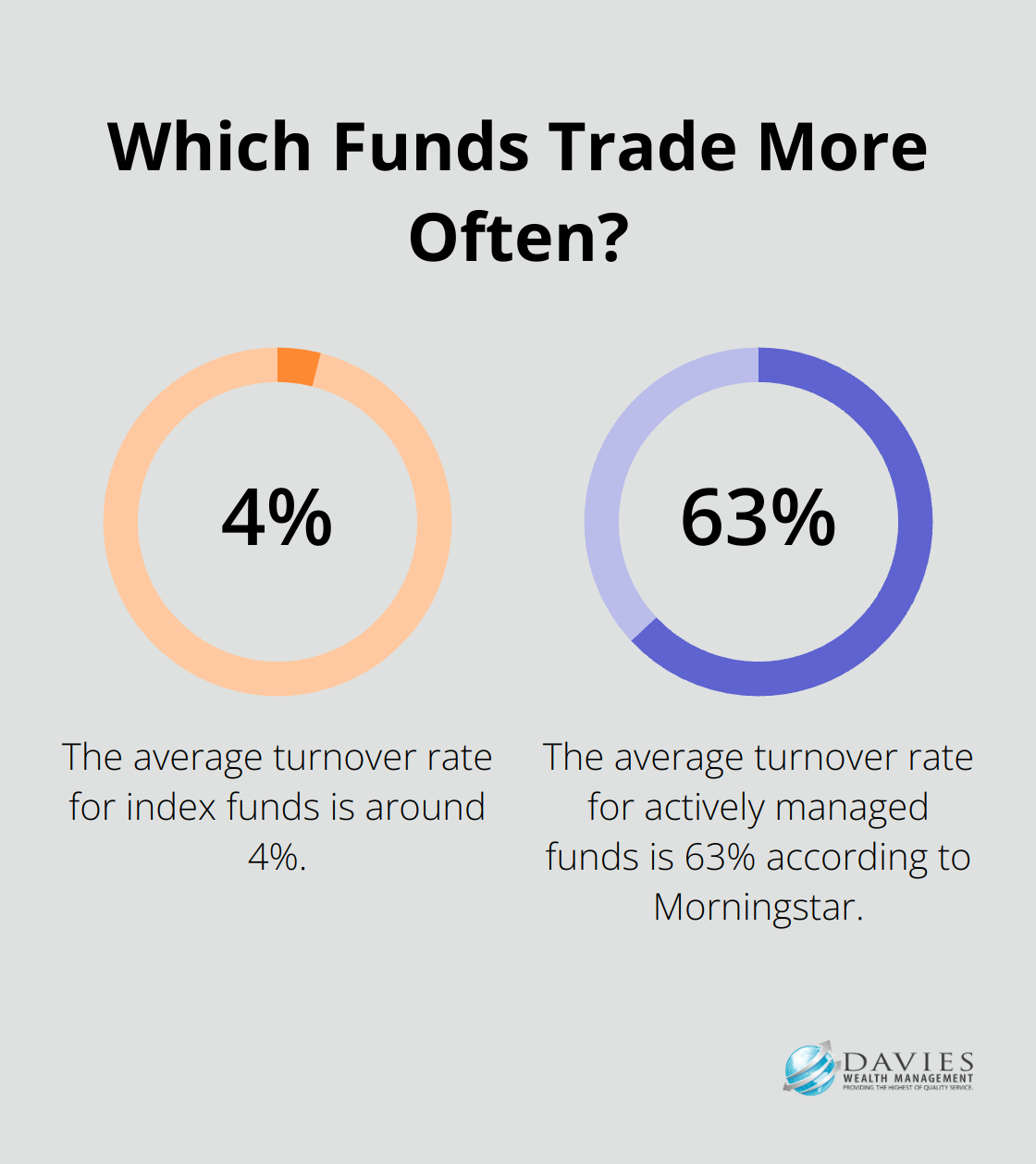

The choice of tax-efficient investment vehicles is crucial. Index funds and ETFs typically have lower turnover rates compared to actively managed funds, resulting in fewer taxable events. For instance, the average turnover rate for index funds is around 4%, compared to 63% for actively managed funds (according to Morningstar).

Municipal bonds can also play a role in a tax-efficient portfolio, especially for high-income investors. The interest from these bonds is typically exempt from federal taxes (and sometimes state and local taxes as well). Tax-equivalent yield calculators can help investors determine the potential benefits of municipal bonds based on their tax situation.

These strategies form the foundation of a robust, tax-efficient investment approach. However, their implementation requires careful consideration of your individual financial situation and goals. In the next section, we’ll explore how to effectively incorporate these strategies into your personal investment portfolio.

How to Implement Tax-Efficient Investing Strategies

Assess Your Current Tax Situation

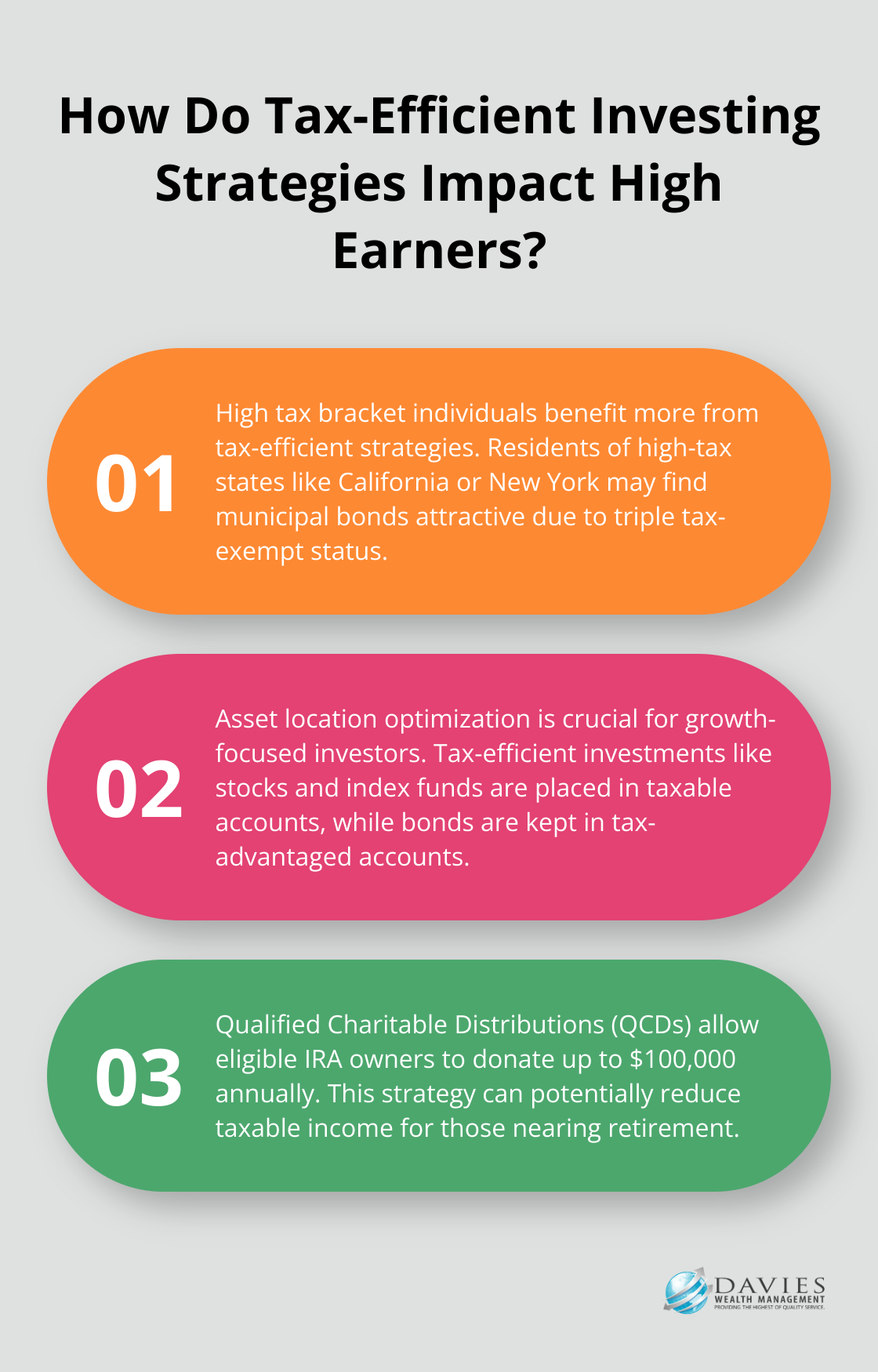

The first step to implement tax-efficient strategies is to thoroughly examine your current tax situation. This involves an analysis of your income sources, tax bracket, and potential deductions. For example, if you fall into a high tax bracket, you will likely benefit more from tax-efficient strategies than someone in a lower bracket.

Consider your state and local tax situation as well. Residents of high-tax states like California or New York might find municipal bonds from their home state particularly attractive due to their triple tax-exempt status (federal, state, and local).

Match Strategies to Your Investment Goals

After you assess your tax situation, match tax-efficient strategies with your specific investment goals. This alignment ensures that your tax strategy complements your overall financial objectives.

If you focus on growth with a long time horizon, prioritize strategies like asset location optimization. This might involve placing tax-efficient investments (e.g., stocks, index funds) in taxable accounts, while keeping bonds in tax-advantaged accounts to shield their higher ordinary income tax rates.

For those nearing retirement and prioritizing income, focus more on tax-efficient investing in retirement. This could include the use of Qualified Charitable Distributions (QCDs) from your IRA, which allow eligible IRA owners to donate up to $100,000 annually directly to charity (potentially reducing their taxable income).

Execute and Track Your Strategy

The implementation of tax-efficient strategies requires ongoing monitoring and adjustment. This is where a financial advisor can provide significant value. Sophisticated tools track the tax efficiency of portfolios and facilitate necessary adjustments.

Try to use tax-loss harvesting opportunities throughout the year, not just at year-end. Systematic loss harvesting in a direct indexing portfolio can help offset gains and reduce tax liability.

Regular portfolio rebalancing is another important aspect of maintaining tax efficiency. However, balance the need for rebalancing with potential tax implications. Use new contributions or withdrawals as opportunities to rebalance in a tax-efficient manner.

Keep Up with Tax Law Changes

Tax laws evolve constantly, and staying informed about these changes is essential for maintaining an effective tax-efficient investment strategy. The Tax Cuts and Jobs Act of 2017 made significant changes to the tax code, including lower individual tax rates and an increased standard deduction. However, many of these changes will expire after 2025, which could significantly impact tax-efficient investing strategies.

A proactive approach to monitoring these changes and adjusting strategies accordingly ensures that portfolios remain tax-efficient even as the tax landscape shifts.

Final Thoughts

Tax-efficient investing strategies can significantly boost your wealth over time. We explored key approaches like asset location optimization, tax-loss harvesting, and leveraging tax-advantaged accounts to reduce the impact of taxes on investment returns. These strategies require careful planning and ongoing management to align with your financial goals and adapt to changing tax laws.

At Davies Wealth Management, we specialize in helping clients navigate the complexities of tax-efficient investing. Our team provides personalized guidance to optimize your investment strategy for both growth and tax efficiency. We assist professionals, business owners, and individuals in making the most of their investments while minimizing tax burdens.

Take action today to implement tax-efficient investing strategies and set yourself on the path to long-term financial success. With the right approach and expert guidance, you can keep more of your money working for you. Contact us to learn how we can help you achieve your financial goals through tax-efficient investing.

Leave a Reply