At Davies Wealth Management, we understand the importance of building lasting financial security. A perpetual wealth strategy offers a powerful approach to achieving long-term financial success.

This comprehensive method goes beyond traditional wealth management, focusing on sustainable growth and generational wealth transfer. In this post, we’ll explore how to implement a perpetual wealth strategy that can secure your financial future for years to come.

What Is a Perpetual Wealth Strategy?

The Foundation of Perpetual Wealth

A perpetual wealth strategy represents a comprehensive approach to financial planning. This strategy focuses on the creation of sustainable, long-term wealth that passes down through generations. The core aim of this strategy is to build and maintain wealth indefinitely, rather than simply accumulate assets for a specific retirement date or short-term goal.

The foundation of a perpetual wealth strategy emphasizes consistent growth, risk management, and efficient wealth transfer. Unlike traditional wealth management approaches (which often prioritize short-term gains or rigid retirement timelines), a perpetual wealth strategy takes a more holistic view of your financial life.

This approach typically involves a mix of investment vehicles, including stocks, bonds, real estate, and whole life insurance policies. Whole life insurance plays a particularly important role as it provides both a death benefit and the accumulation of cash value that policyholders can access during their lifetime. This flexibility allows for greater financial maneuverability and can serve as a cornerstone for building generational wealth.

Breaking Away from Traditional Models

Traditional wealth management often relies heavily on market-dependent investments and tax-deferred retirement accounts. While these can be effective tools, they also come with limitations. For example, 401(k)s and IRAs can lead to unexpected tax liabilities and restrict access to funds when you need them most.

A perpetual wealth strategy, in contrast, emphasizes liquidity and tax efficiency. The utilization of tools like high-cash-value whole life insurance policies allows individuals to build a balanced wealth strategy that supports cash flow, protection, and long-term financial independence. This approach provides protection against market volatility while maintaining accessibility to funds for investment opportunities or unexpected expenses.

Long-Term Benefits for Families

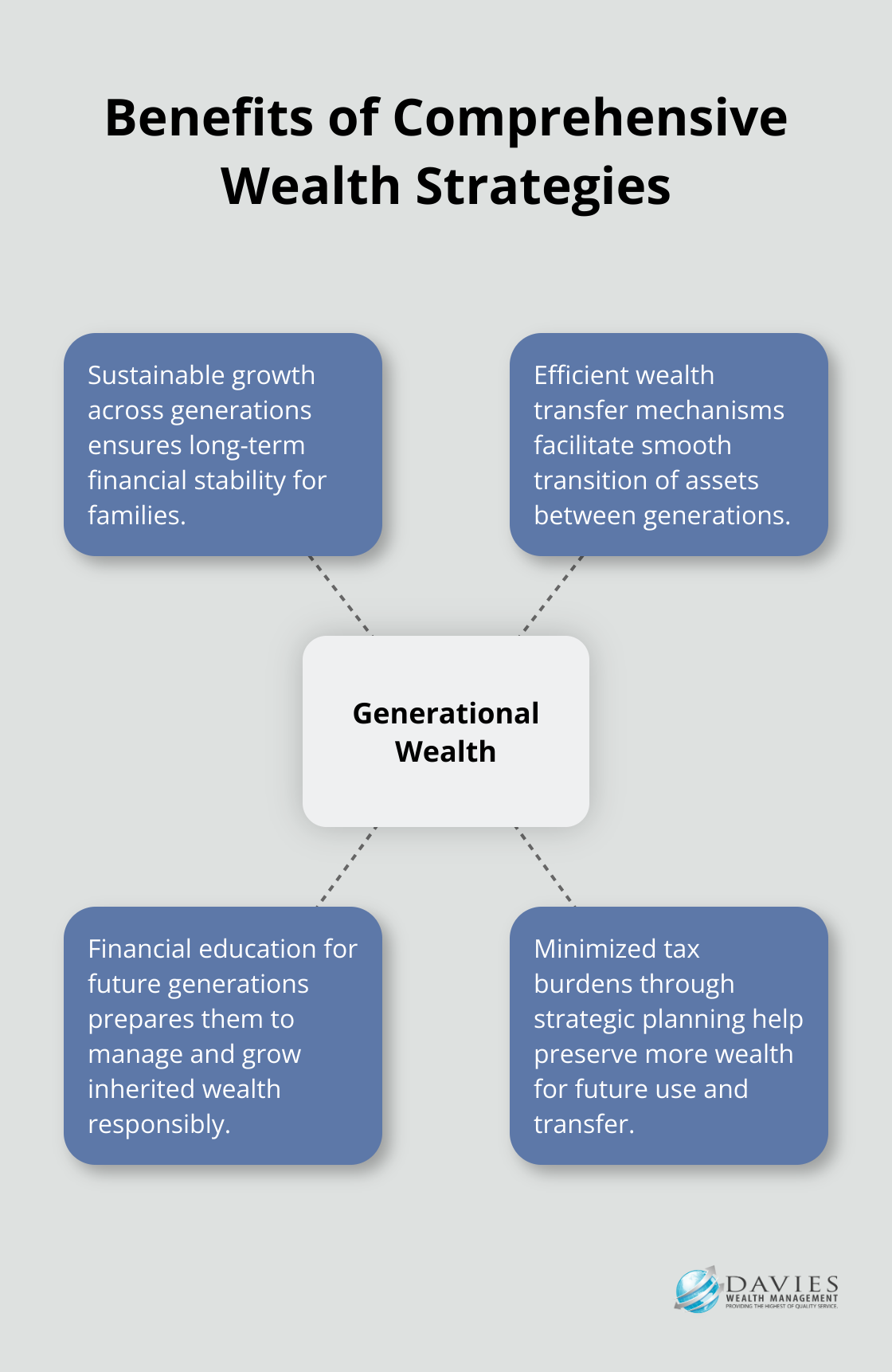

The implementation of a perpetual wealth strategy offers significant long-term benefits, particularly for families looking to create lasting financial security. The focus on stable, predictable growth and efficient wealth transfer mechanisms allows families to:

- Create a financial legacy that spans generations

- Minimize tax burdens through strategic planning

- Maintain greater control over their wealth

- Provide financial education and resources for future generations

Studies show that families who implement comprehensive wealth strategies tend to maintain their wealth across multiple generations more effectively than those who don’t. This success partly stems from the emphasis on financial education and the creation of sustainable wealth-building habits that pass down to children and grandchildren.

The Role of Professional Guidance

The implementation of a perpetual wealth strategy requires careful planning and expert knowledge. Professional financial advisors (such as those at Davies Wealth Management) play a crucial role in tailoring these strategies to individual needs and goals. They help navigate complex financial landscapes, optimize tax strategies, and ensure the strategy aligns with long-term objectives.

As we move forward, we’ll explore the key components that make up a robust perpetual wealth strategy and how you can start implementing these principles in your own financial planning.

Key Components of a Perpetual Wealth Strategy

Strategic Asset Allocation

The foundation of any effective wealth strategy rests on well-planned asset allocation. This approach spreads investments across various asset classes to balance risk and reward. Vanguard’s model portfolio allocation strategies can help you build diversified portfolios that match your risk tolerance and investment goals. We recommend a mix of stocks, bonds, real estate, and alternative investments tailored to your financial objectives.

For instance, a growth-oriented investor might allocate 70% to stocks, 20% to bonds, and 10% to real estate and alternatives. A more conservative approach might reverse these percentages. The optimal balance aligns with your long-term objectives.

Tax-Efficient Wealth Building

Preserving and growing wealth over time requires the minimization of tax liabilities. Various tax-efficient strategies include Roth IRA conversions, tax loss harvesting, and the use of municipal bonds for tax-free income.

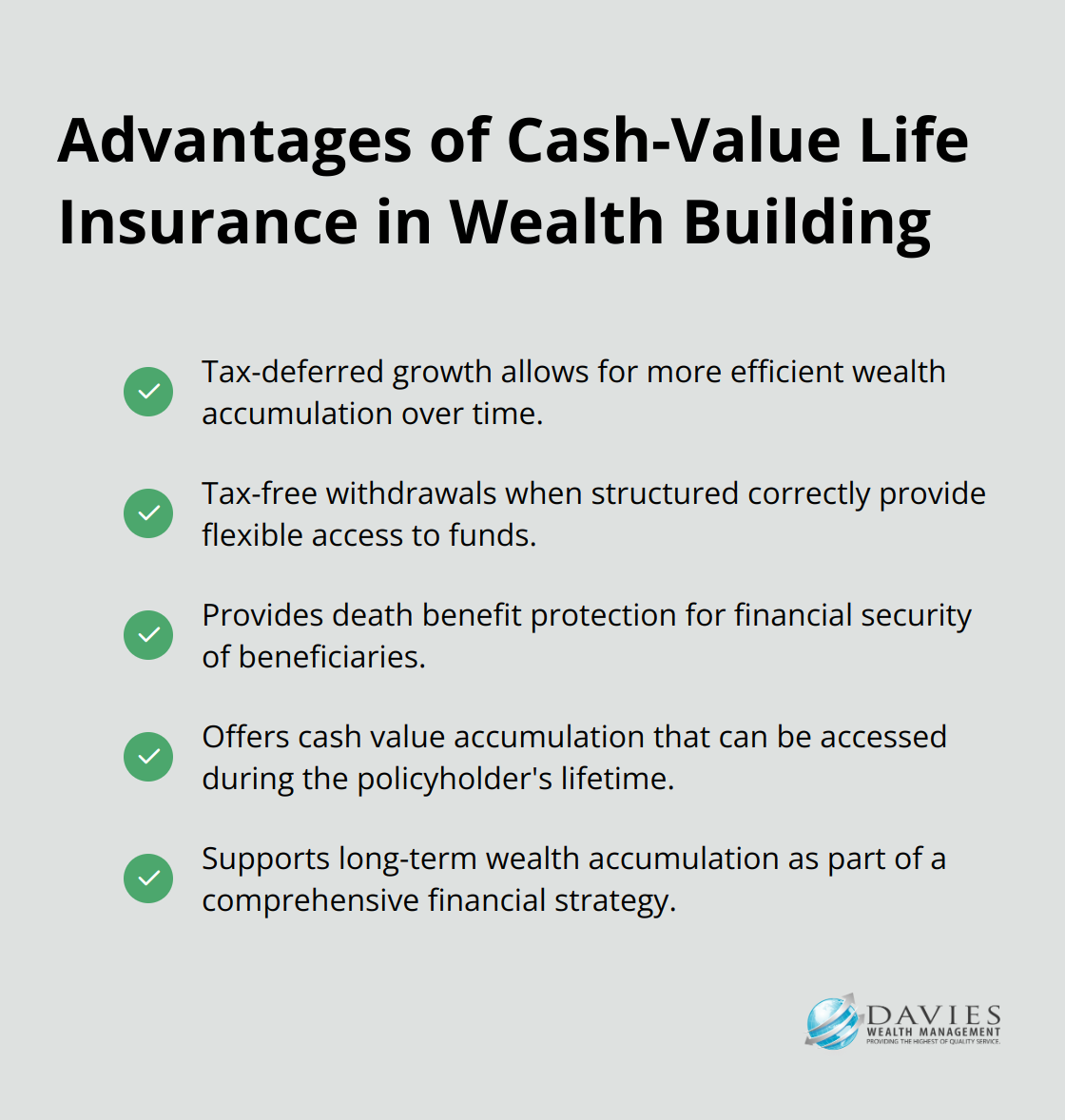

Cash-value life insurance policies offer a powerful tool for tax-efficient wealth building. In some circumstances, these policies are used by individuals as an accumulation tool. They provide tax-deferred growth and tax-free withdrawals when structured correctly, making them an attractive option for long-term wealth accumulation.

Generational Wealth Transfer

Effective estate planning ensures the continuation of wealth benefits for future generations. Strategies include the establishment of trusts, creation of family limited partnerships, and implementation of gifting strategies to minimize estate taxes and facilitate smooth wealth transfers.

Family offices can play a crucial role in navigating the $124 trillion generational wealth transfer. They can implement strategies for estate and tax planning to help preserve wealth across generations. To combat wealth loss trends, we emphasize the education of younger family members about financial responsibility and their early involvement in the wealth management process.

Comprehensive Risk Management

The protection of wealth holds equal importance to its growth. A multi-faceted risk management strategy includes:

- Proper insurance coverage (life, disability, long-term care)

- Diversification across asset classes and geographies

- Regular portfolio rebalancing

- Establishment of an emergency fund

For professional athletes, specialized risk management solutions address unique challenges like career-ending injuries or sudden income loss. A tailored approach ensures protection against various potential threats to your wealth.

Continuous Monitoring and Adjustment

The implementation of these key components requires expertise and ongoing management. Regular review and adjustment of your strategy ensure its alignment with changing market conditions and personal circumstances. This proactive approach allows for timely modifications to your wealth strategy, maximizing its effectiveness over the long term.

As we move forward, we will explore the practical steps to implement your personalized perpetual wealth strategy, taking into account your unique financial situation and goals.

How to Put a Perpetual Wealth Strategy into Action

Conduct a Thorough Financial Assessment

The first step to implement your perpetual wealth strategy is to evaluate your current financial situation comprehensively. This assessment should include a detailed analysis of your assets, liabilities, income streams, and expenses. We recommend financial planning software like Personal Capital or Mint to aggregate your financial data and gain a clear picture of your net worth.

This assessment will help you identify gaps in your current financial plan. You might discover an overexposure to a particular asset class or inadequate insurance coverage. A TIAA study found that only 20% of Gen Z are saving for retirement, highlighting the importance of this initial assessment.

Define Your Long-Term Financial Objectives

After understanding your current financial position, define your long-term financial goals. These objectives should be specific, measurable, achievable, relevant, and time-bound (SMART). Examples include:

- Accumulate $5 million in investable assets by age 60

- Generate $200,000 in annual passive income by retirement

- Transfer $10 million in wealth to the next generation tax-efficiently

Prioritize these goals and understand how they align with your values and life aspirations. A Schwab survey found that 96% of Americans with a written financial plan feel confident that they will reach their financial goals, compared to only 36% of Americans who have a written financial plan.

Develop a Tailored Investment Strategy

With clear goals in place, develop a customized investment plan that aligns with your objectives and risk tolerance. This plan should incorporate key components of a perpetual wealth strategy, including strategic asset allocation, tax-efficient wealth building, and risk management.

For high-income professional athletes with short career spans, the investment strategy might focus on maximizing tax-efficient savings during peak earning years and building a diversified portfolio of income-producing assets for long-term financial security.

We often recommend incorporating alternative investments like private equity or real estate into our clients’ portfolios. According to a McKinsey report, alternative investments are expected to reach $17 trillion in assets under management by 2025, offering potential for enhanced returns and diversification.

Implement Your Strategy

Executing your perpetual wealth strategy involves implementing the investment plan, setting up necessary legal structures (such as trusts for wealth transfer), and putting appropriate insurance policies in place. This process requires coordination among various financial professionals, including investment advisors, tax specialists, and estate planning attorneys.

Monitor and Adjust Regularly

Regular monitoring and adjustment of your strategy are essential. We recommend quarterly reviews of your investment portfolio and annual comprehensive financial check-ups. These reviews allow for timely adjustments based on changes in your personal circumstances, market conditions, or tax laws.

A Vanguard study found that working with a financial advisor can potentially add about 3% in net returns for clients (with a significant portion of this value coming from behavioral coaching and helping clients stick to their long-term plans during market volatility).

Final Thoughts

A perpetual wealth strategy offers a powerful approach to secure your financial future and create lasting prosperity. This comprehensive method focuses on sustainable growth, tax efficiency, and effective wealth transfer mechanisms. Professional guidance proves essential to optimize your strategy and ensure it aligns with your objectives as market conditions and personal circumstances evolve.

We at Davies Wealth Management specialize in creating personalized perpetual wealth strategies that address the unique needs of our clients (including professional athletes facing distinct financial challenges). Our expertise helps navigate the complexities of financial markets, tax laws, and estate planning to build a robust foundation for generational wealth.

The journey to financial security requires regular monitoring and adjustments. Take action now to implement a well-designed perpetual wealth strategy. You’ll lay the groundwork for lasting financial success that can benefit your family for years to come. Contact a qualified financial advisor today to start building your legacy.

Leave a Reply