At Davies Wealth Management, we understand the critical role of family governance in preserving wealth across generations.

Family governance provides a structured framework for managing family assets, making decisions, and maintaining harmony among family members.

Establishing effective governance practices can help safeguard your family’s financial legacy and ensure smooth transitions of wealth.

In this post, we’ll explore key strategies for creating and implementing robust family governance structures that stand the test of time.

What Is Family Governance?

The Essence of Family Governance

Family governance forms a structured system that guides decision-making, communication, and management of shared assets within families. At Davies Wealth Management, we’ve observed how effective family governance can serve as the cornerstone of long-term wealth preservation.

Family governance extends beyond money management; it encompasses relationship and expectation management. A well-designed governance structure typically includes:

- A family mission statement that articulates shared values and goals

- Clear decision-making processes for family financial matters

- Defined roles and responsibilities for family members

- Protocols for conflict resolution and communication

A study reveals that about 70% of wealthy families lose their fortune by the second generation. Effective family governance can help families avoid this fate.

Critical Elements for Success

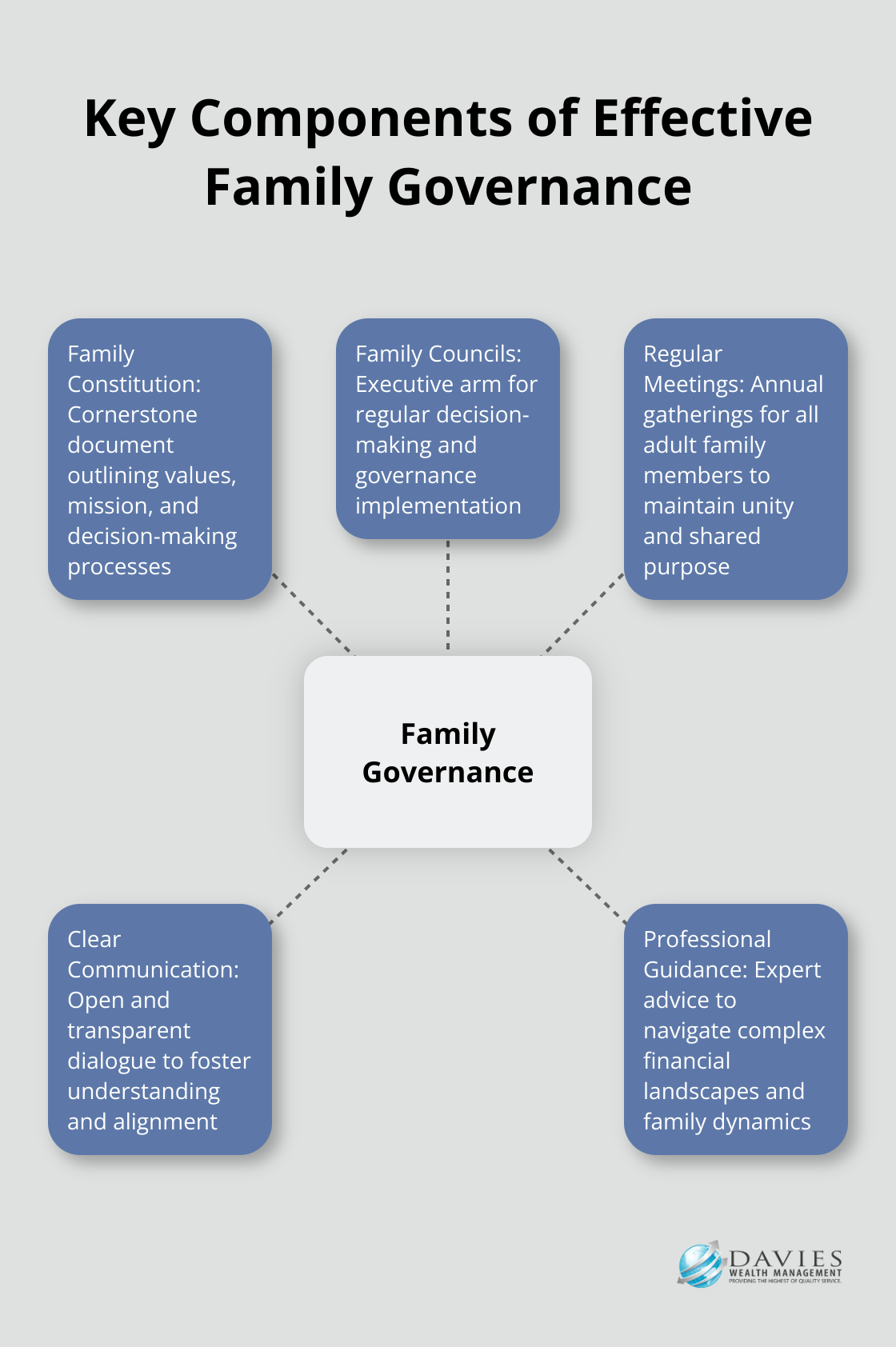

Successful family governance relies on several key components:

- Transparency: Open and honest communication about financial matters

- Education: Ongoing financial literacy programs for all family members

- Inclusivity: Involvement of multiple generations in decision-making processes

- Flexibility: Adaptation of governance structures as family dynamics change

Tangible Benefits of Family Governance

The implementation of strong family governance yields numerous benefits:

- Wealth Preservation: The 2019 UBS Global Family Office Report found that families with formal governance structures were more likely to preserve wealth across generations.

- Conflict Reduction: Clear protocols for decision-making and communication can minimize family disputes over financial matters.

- Aligned Purpose: A shared mission statement helps family members work towards common goals, enhancing both financial and emotional wealth.

The Role of Professional Guidance

While families can initiate governance structures on their own, professional guidance often proves invaluable. Wealth management firms (like Davies Wealth Management) can offer expertise in tailoring governance structures to a family’s unique needs and values. These professionals bring objectivity and experience to the table, helping families navigate complex financial landscapes and interpersonal dynamics.

As we move forward, we’ll explore the practical steps to establish a robust family governance system, starting with the creation of a family constitution. This foundational document will serve as the bedrock for your family’s financial decision-making and long-term wealth preservation strategy.

How to Create a Family Constitution

Defining Your Family’s Mission

A family constitution serves as the cornerstone of effective family governance. The creation of this document can transform family dynamics and secure financial legacies. The process starts with the articulation of your family’s core values and long-term objectives.

This process often reveals surprising insights. A study found that in the majority of cases (57%), the fifth generation of wealthy families had less wealth than they inherited and had a -2000% average accumulated wealth loss. Your mission statement should address this risk head-on.

Consider questions like: What does wealth mean to our family? How do we want to impact the world? What legacy do we wish to leave? These discussions can challenge family members, but they’re essential for alignment.

Outlining Governance Structures

The next step involves the detailing of how your family will make decisions. This includes:

- Voting procedures for major financial decisions

- Roles and responsibilities of family members

- Criteria for joining family businesses or boards

- Dispute resolution mechanisms

Specificity is key. For example, you might stipulate that investment decisions over $1 million require a 75% majority vote from adult family members.

Addressing Wealth Transfer and Education

Your constitution should outline how wealth will transfer between generations. This isn’t just about inheritance; it’s about the preparation of future generations to manage wealth responsibly.

Include plans for financial education. Your constitution can mandate regular financial literacy programs or mentorship programs to bridge this gap.

Drafting and Ratification Process

The creation of a family constitution is a collaborative effort. Here’s a practical approach:

- Form a drafting committee with representatives from different generations

- Hold a series of family meetings to discuss and debate key points

- Engage a neutral facilitator to manage discussions (your financial advisor can potentially fill this role)

- Circulate drafts for feedback

- Hold a formal ratification meeting

This is a living document. Plan for regular reviews – perhaps every 3-5 years – to ensure it remains relevant as your family evolves.

A well-crafted family constitution can yield significant benefits. Some families have seen a reduction in conflicts and an increase in collective investment returns within years of implementing their constitution.

The investment of time in this process now lays the groundwork for generations of financial success and family harmony. With a solid constitution in place, the next step is to implement family councils and meetings to bring your governance structure to life.

Implementing Family Councils and Meetings

The Power of Family Councils

Family councils act as the executive arm of your family governance structure. They typically consist of representatives from different branches or generations of the family. These councils meet regularly to discuss family matters, make decisions, and ensure adherence to the family constitution.

Family offices separate the family from its wealth, reducing the risk of irresponsible altruistic tendencies or wasteful financial behaviors. To set up an effective family council:

- Define clear roles and responsibilities for council members

- Establish term limits to ensure fresh perspectives

- Create subcommittees for specific areas (like investments or philanthropy)

- Set a regular meeting schedule, ideally quarterly

Organizing Productive Family Meetings

While family councils handle day-to-day governance, broader family meetings involve all adult family members. These meetings, often held annually, are essential for maintaining family unity and shared purpose.

To make these meetings productive:

- Set and distribute an agenda well in advance

- Assign roles like facilitator, timekeeper, and note-taker

- Include both business and social elements

- Provide updates on family investments and philanthropic activities

- Allow time for open discussion and Q&A

Fostering Effective Communication

Clear, open communication forms the lifeblood of family governance. Here are strategies to enhance communication within your family:

- Use technology wisely: Tools like secure family portals can keep everyone informed between meetings

- Practice active listening: Encourage family members to truly hear and understand each other’s perspectives

- Address conflicts promptly: Deal with disagreements respectfully and directly

- Celebrate successes: Acknowledge individual and family achievements to build positive momentum

Adapting to Change

Family governance requires commitment, flexibility, and a willingness to evolve as your family grows and changes. Try to review and update your governance structures periodically (every 3-5 years) to ensure they remain relevant and effective.

Seeking Professional Guidance

While families can implement governance structures on their own, professional guidance often proves invaluable. Family office consultants serve as strategic architects for complex wealth structures, helping families navigate complex financial landscapes and interpersonal dynamics. (If you’re considering professional guidance, Davies Wealth Management offers specialized services in this area.)

Final Thoughts

Family governance forms the foundation for multi-generational wealth preservation. A well-crafted family constitution guides future generations, aligning family values with financial goals. Family councils and regular meetings bring the governance structure to life, fostering open dialogue and collaborative decision-making.

Robust family governance yields substantial long-term benefits. Families who invest in these structures often experience smoother wealth transitions, fewer conflicts, and improved financial outcomes. Family governance also cultivates a sense of stewardship among family members, encouraging responsible wealth management for current and future generations.

At Davies Wealth Management, we understand the intricacies of family governance and its role in wealth preservation. Our team specializes in guiding families through the process of establishing effective governance structures. For personalized advice on implementing family governance strategies that align with your goals, visit Davies Wealth Management.

Leave a Reply