Planning for retirement can be overwhelming, but creating a solid roadmap is essential for financial success. At Davies Wealth Management, we understand the importance of a well-structured retirement plan tailored to your unique goals and circumstances.

Our guide to retirement roadmap financial planning will help you navigate the complexities of preparing for your golden years. We’ll walk you through assessing your current situation, setting clear objectives, and developing effective strategies to secure your financial future.

Where Do You Stand Financially?

Net Worth Calculation

Your net worth serves as a key indicator of your financial health. It represents the difference between your assets (what you own) and your liabilities (what you owe). To calculate your net worth, list all your assets, including savings accounts, investments, real estate, and personal property. Then, subtract your total debts, such as mortgages, car loans, and credit card balances. This figure provides a snapshot of your overall financial position.

A 2022 Federal Reserve survey revealed that the median net worth of American households was $121,700. However, this figure varies significantly by age group. For example, households headed by individuals aged 35-44 had a median net worth of $91,300, while those 65-74 had a median of $266,400. Understanding where you fall in relation to these benchmarks can help you gauge your progress.

Income and Expense Review

A thorough review of your income and expenses is essential for retirement planning. Start by listing all sources of income, including salary, investments, and any side hustles. Next, track your expenses for at least three months to get an accurate picture of your spending habits. Categorize your expenses into fixed costs (like rent or mortgage payments) and variable costs (such as entertainment or dining out).

Many financial experts recommend the 50/30/20 budgeting rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. If your current spending doesn’t align with this guideline, you may need to adjust your habits to boost your retirement savings.

Retirement Account Evaluation

Assessing your existing retirement accounts and investments is vital for understanding your progress towards retirement goals. Review your 401(k), IRA, or other retirement account balances. According to Vanguard’s 2022 report, the average 401(k) balance was $141,542, but this varies widely based on age and income level.

Consider the asset allocation within these accounts. As you approach retirement, you may need to adjust your investment mix to balance growth potential with risk management. Many financial advisors suggest subtracting your age from 110 to determine the percentage of your portfolio that should be in stocks.

Investment Strategy Assessment

Evaluate your current investment strategy to ensure it aligns with your retirement goals. Consider factors such as risk tolerance, time horizon, and diversification. A well-balanced portfolio typically includes a mix of stocks, bonds, and other assets (such as real estate or commodities).

Try to rebalance your portfolio regularly to maintain your desired asset allocation. This process involves selling assets that have become overweighted and buying those that have become underweighted. Rebalancing helps manage risk and can potentially improve long-term returns.

Debt Analysis

Analyze your current debt situation, including mortgages, car loans, credit card balances, and any other outstanding loans. High-interest debt can significantly impact your ability to save for retirement. Prioritize paying off high-interest debt while maintaining contributions to your retirement accounts.

Consider strategies such as debt consolidation or refinancing to lower interest rates and potentially accelerate debt repayment. However, weigh the costs and benefits carefully before making any decisions.

With a clear understanding of your financial situation, you can now move on to setting clear retirement goals that align with your current circumstances and future aspirations.

What’s Your Ideal Retirement?

Envisioning Your Retirement Lifestyle

Picture your ideal retirement day. Do you see yourself exploring new countries, pursuing hobbies, or spending quality time with family? Your vision will significantly impact your financial needs. A 2024 AARP report found that 65% of those surveyed plan to travel, which requires substantial financial planning.

Consider your preferred retirement location. A National Association of Realtors report found that among the 58 and older age groups, the desire to be closer to friends and family was the top reason to purchase a home. Your location choice affects not just housing costs but also taxes, healthcare accessibility, and overall cost of living.

Calculating Your Retirement Expenses

After you outline your desired lifestyle, attach dollar figures to your dreams. A common rule of thumb suggests you’ll need about 80% of your pre-retirement income to maintain your standard of living. However, this can vary widely based on your plans.

Break down your anticipated expenses into categories:

- Essential expenses (housing, food, healthcare)

- Lifestyle expenses (travel, hobbies, entertainment)

- Legacy goals (inheritance, charitable giving)

Don’t overlook inflation. The U.S. Bureau of Labor Statistics reports that prices for urban consumers increased 14.3% from 2019 to 2023. This trend will likely continue, eroding purchasing power over time.

Pinpointing Your Retirement Age

Your target retirement age significantly impacts your financial strategy. The Social Security Administration reports that the full retirement age for those born in 1960 or later is 67. However, you can start receiving reduced benefits as early as 62 or delay until 70 for increased benefits.

Consider the financial implications of early retirement. Conversely, working a few extra years can substantially boost your retirement savings and Social Security benefits.

Adjusting Your Plans

Your retirement vision may evolve over time. Regular reassessment of your goals allows you to adapt your financial strategy accordingly. Factors such as changes in health, family circumstances, or economic conditions may necessitate adjustments to your retirement timeline or lifestyle expectations.

As you define your ideal retirement, the next step involves developing a robust savings strategy to turn your vision into reality. This includes maximizing contributions to tax-advantaged accounts, diversifying your investment portfolio, and planning for potential healthcare costs.

How to Supercharge Your Retirement Savings

Maximize Tax-Advantaged Accounts

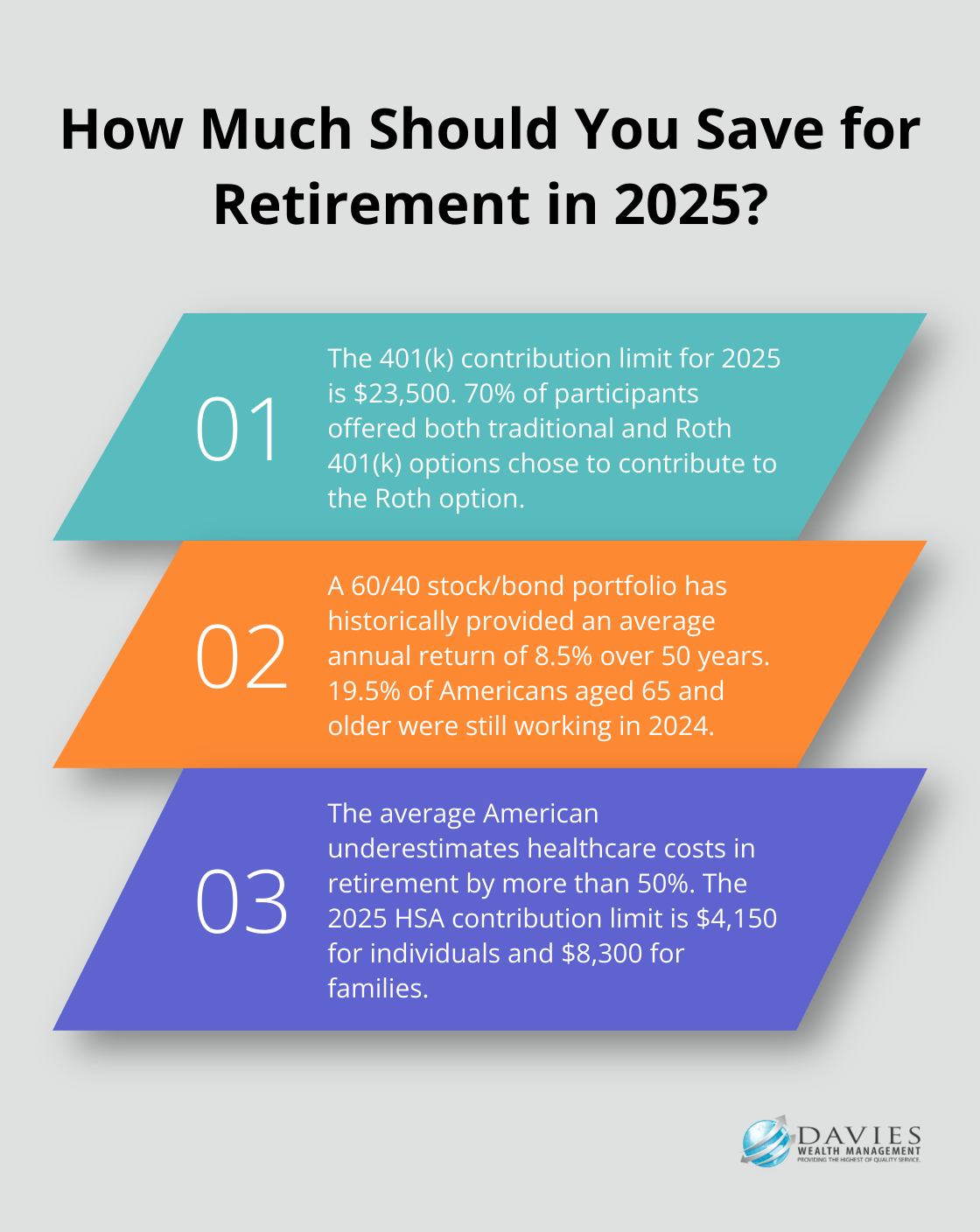

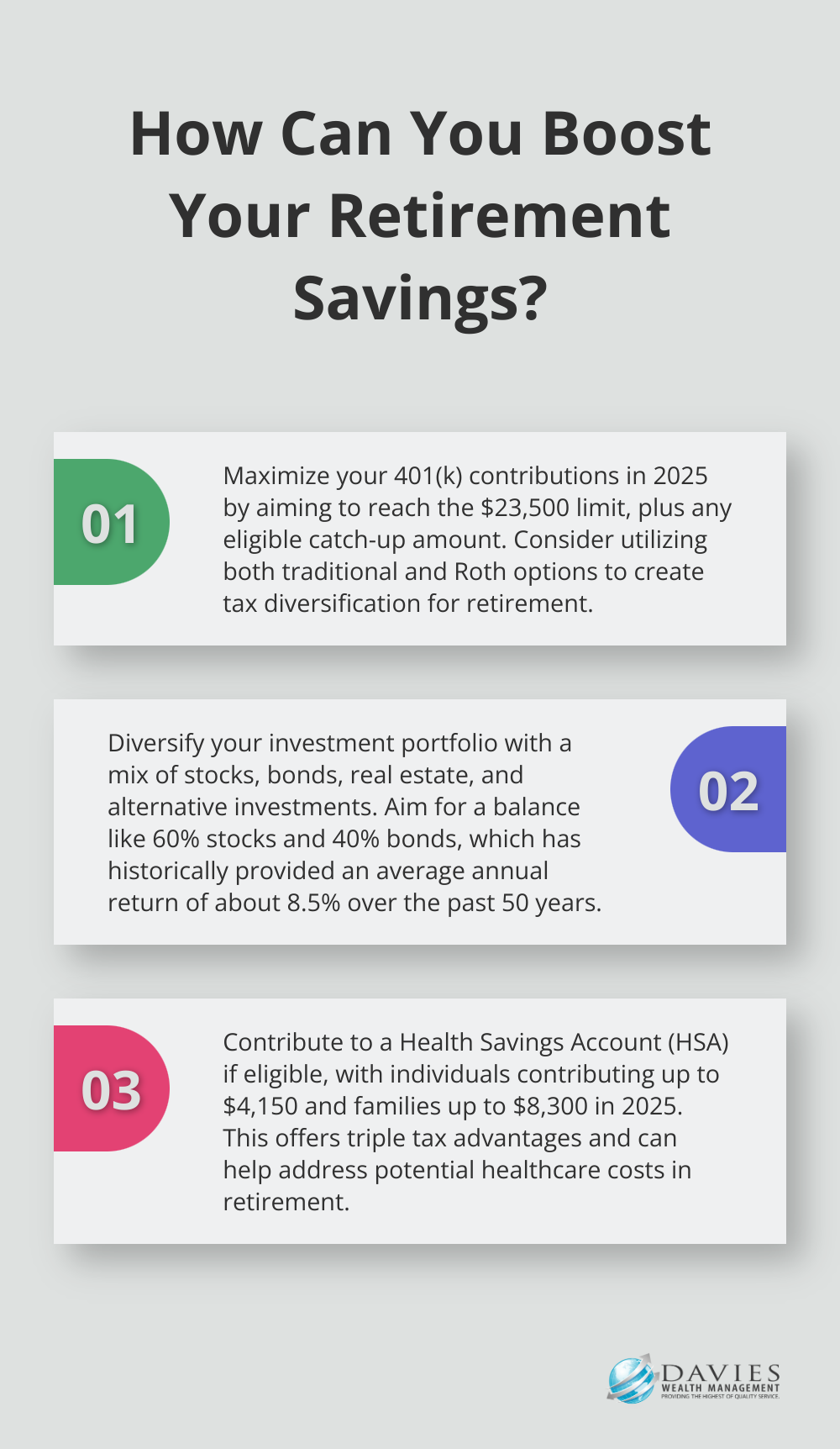

One of the most effective ways to boost your retirement savings is to maximize contributions to tax-advantaged accounts. For 2025, try to increase your contribution rate to get as close to the $23,500 limit (with any extra eligible catch-up amount) as you can afford.

Consider using both traditional and Roth accounts to create tax diversification in retirement. Traditional accounts offer immediate tax deductions, while Roth accounts provide tax-free withdrawals in retirement. A study by Vanguard found that 70% of their participants who were offered both traditional and Roth 401(k) options chose to contribute to the Roth option, highlighting its growing popularity.

Build a Diversified Investment Portfolio

Diversification is key to managing risk and potentially improving returns over the long term. A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and potentially alternative investments. The specific allocation depends on your risk tolerance, time horizon, and financial goals.

According to a 2024 Morningstar report, a portfolio with 60% stocks and 40% bonds has historically provided an average annual return of about 8.5% over the past 50 years. However, past performance doesn’t guarantee future results, and it’s essential to regularly rebalance your portfolio to maintain your desired asset allocation.

Explore Additional Income Streams

Diversifying your income sources can provide financial stability in retirement. Consider developing passive income streams such as rental properties, dividend-paying stocks, or creating online courses based on your expertise. The Bureau of Labor Statistics reports that 19.5% of Americans aged 65 and older were still working in 2024, indicating a trend towards extended careers or part-time work in retirement.

For professional athletes and high-income earners, specialized strategies to maximize and protect wealth (including tax-efficient investment vehicles and personalized financial planning) can be particularly beneficial.

Plan for Healthcare Costs

Healthcare expenses often represent a significant portion of retirement spending. Recent Fidelity research finds the average American estimates costs will be about $75,000- less than half of Fidelity’s calculation.

To address these potential expenses, consider contributing to a Health Savings Account (HSA) if you’re eligible. HSAs offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. For 2025, individuals can contribute up to $4,150, while families can contribute up to $8,300.

Long-term care insurance is another important consideration. The U.S. Department of Health and Human Services reports that someone turning 65 today has a 70% chance of needing some type of long-term care services in their lifetime. Purchasing a policy in your 50s or early 60s can help manage these potential costs.

Final Thoughts

Creating a comprehensive retirement roadmap financial plan marks a vital step toward achieving financial success in your golden years. We assess your current financial situation, set clear goals, and develop a robust savings strategy to lay the foundation for a secure and fulfilling retirement. Our team at Davies Wealth Management specializes in providing personalized advice tailored to your unique circumstances and goals.

We help you create a comprehensive retirement roadmap that addresses all aspects of your financial life, from investment management to tax-efficient strategies and estate planning. Our experts assist you in building, protecting, and transferring your wealth with confidence (whether you’re a professional athlete with unique financial challenges or an individual looking to secure your retirement). We strive to turn your retirement dreams into reality through careful planning and strategic decision-making.

Don’t leave your financial future to chance. Take control of your retirement planning today and partner with Davies Wealth Management to secure your financial future. Our team stands ready to guide you through the complexities of retirement planning and help you achieve your long-term financial goals.

Leave a Reply