At Davies Wealth Management, we understand that creating a solid financial plan is essential for achieving your long-term goals. A well-structured plan serves as your roadmap to financial success, guiding you through life’s ups and downs.

In this post, we’ll walk you through the key financial planning steps to help you build a robust strategy tailored to your unique situation. Whether you’re just starting out or looking to refine your existing plan, these practical tips will set you on the path to financial security.

Where Do You Stand Financially?

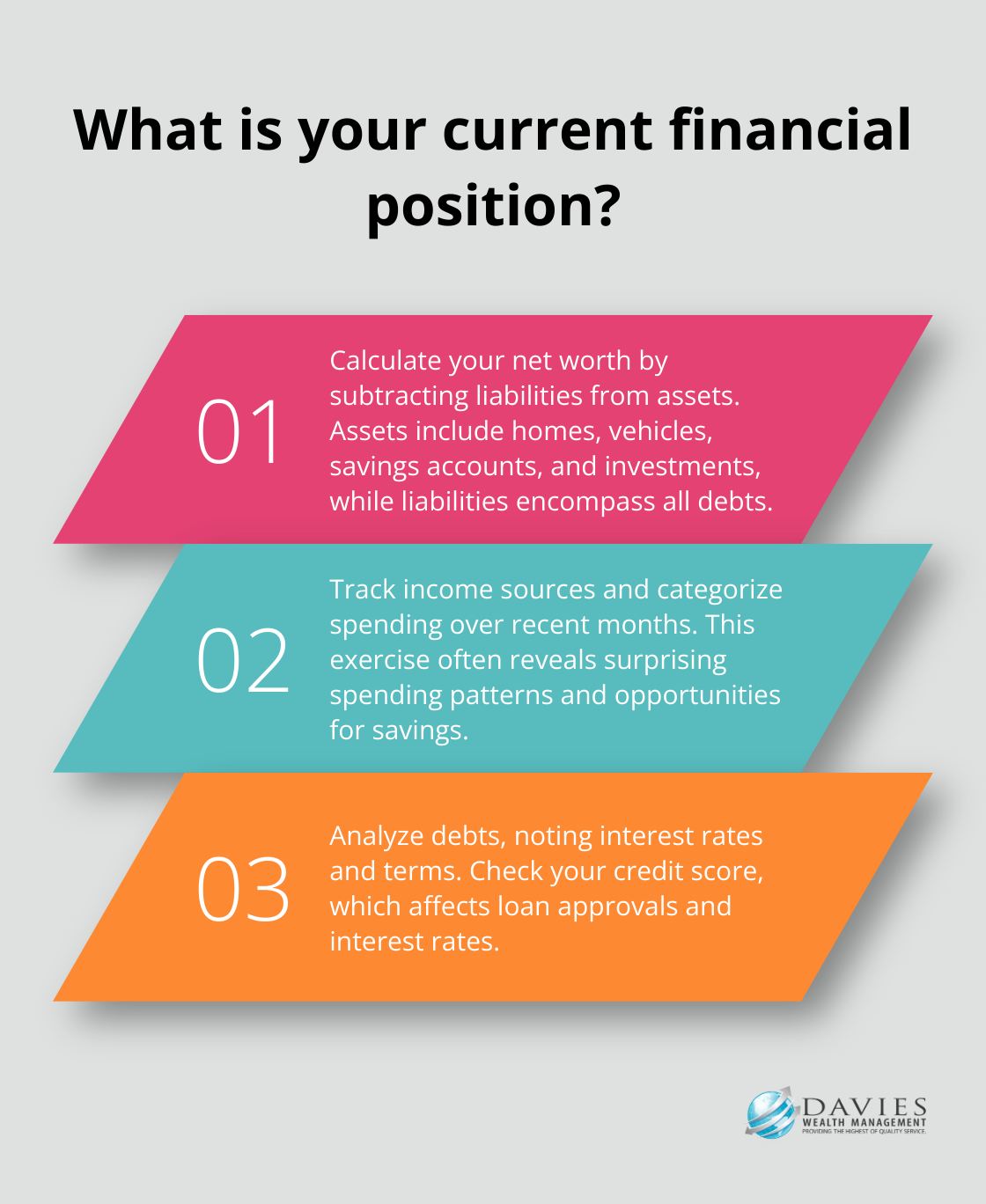

Taking Stock of Your Assets and Liabilities

Calculate your net worth to understand your current financial position. Net worth is calculated by subtracting all liabilities from all assets. An asset is anything owned that has monetary value, while liabilities are what you owe. Include everything from your home and vehicles to savings accounts and investments on the asset side. On the liability side, list all debts, including mortgages, car loans, student loans, and credit card balances. The resulting figure provides a snapshot of your financial health.

Tracking Your Cash Flow

Review your income and expenses. Track all sources of income and categorize your spending over the past few months. This exercise often reveals surprising patterns. You might discover you spend more than you realize in certain areas, providing opportunities for immediate savings.

Understanding Your Debt Situation

Analyze your debt and credit score. List all your debts, noting interest rates and terms. Your credit score plays a significant role in your financial life, affecting everything from loan approvals to interest rates. If your score needs improvement, focus on paying bills on time and reducing credit card balances.

Evaluating Your Financial Safety Net

Take a hard look at your current savings and investments. How much do you have set aside for emergencies? Are your investments aligned with your goals and risk tolerance? According to a 2023 survey by the Federal Reserve, the share of adults who would cover a relatively small emergency expense using cash or its equivalent was unchanged from 2022 but down from 2021. Try to have at least three to six months of living expenses saved in an easily accessible account.

Preparing for the Next Steps

A thorough assessment of your current financial situation lays the groundwork for a robust financial plan. This clear-eyed view of your finances is essential for setting realistic goals and developing effective strategies to achieve them. With a solid understanding of where you stand financially, you’re now ready to move on to the next critical step: setting clear financial goals that will guide your journey towards financial success.

What Are Your Financial Goals?

Define Your Financial Objectives

At Davies Wealth Management, we know that setting long-term financial goals is important to help you save enough income for the retirement that you want. Without well-defined objectives, you can easily lose focus and drift off course. Start by categorizing your goals into short-term (1-3 years), medium-term (3-10 years), and long-term (10+ years) objectives.

Short-term goals might include paying off credit card debt or saving for a vacation. Medium-term goals could involve saving for a down payment on a house or starting a business. Long-term goals typically revolve around retirement planning or funding your children’s education.

For each goal, be specific. Instead of saying “save for retirement,” define how much you need to save and by when. For example, “accumulate $1.5 million in retirement savings by age 65.” This level of specificity makes your goals more tangible and easier to plan for.

Create SMART Financial Goals

To increase your chances of success, make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Let’s break this down:

- Specific: Clearly define what you want to achieve. “Save $20,000 for a down payment on a house” is more specific than “save for a house.”

- Measurable: Establish concrete criteria for measuring progress. In the above example, you can easily track your progress towards the $20,000 goal.

- Achievable: Set goals that challenge you but remain realistic given your current financial situation. If you’re earning $50,000 a year, saving $100,000 in one year might not be achievable.

- Relevant: Ensure your goals align with your values and long-term objectives. If homeownership isn’t a priority for you, saving for a down payment might not be relevant.

- Time-bound: Set a deadline for your goal. “Save $20,000 for a down payment in 3 years” gives you a clear timeframe to work towards.

Prioritize Your Financial Goals

Once you’ve defined your goals, it’s time to prioritize. Not all goals are created equal, and some may need to take precedence over others. For instance, building an emergency fund and paying off high-interest debt should typically rank higher than saving for a luxury vacation.

Consider using a goal-prioritization matrix. To create a project priority matrix, you first need to create a list of potential projects. Next, determine your selection criteria and their importance.

Account for Life Events

Your financial goals should flex enough to accommodate major life events. Marriage, having children, changing careers, or caring for aging parents can all significantly impact your financial plans.

Review your goals regularly and adjust them as needed. For example, if you plan to start a family, you might need to shift some of your savings from retirement to childcare expenses.

As you move forward in defining and prioritizing your financial goals, the next step involves developing and implementing strategies to achieve these objectives. This process will require careful planning and execution, which we’ll explore in the following section.

Turning Goals into Action

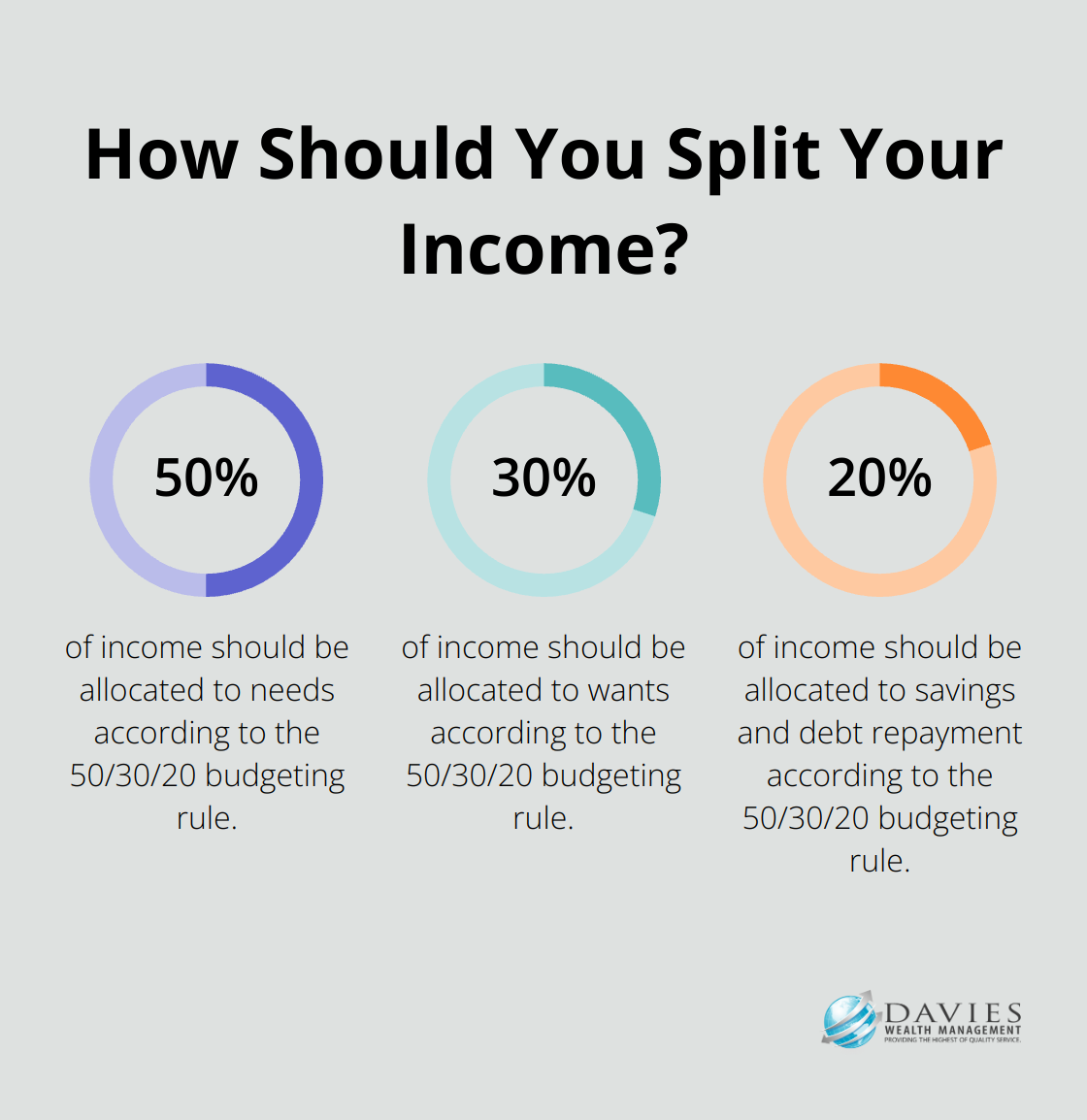

Create a Realistic Budget

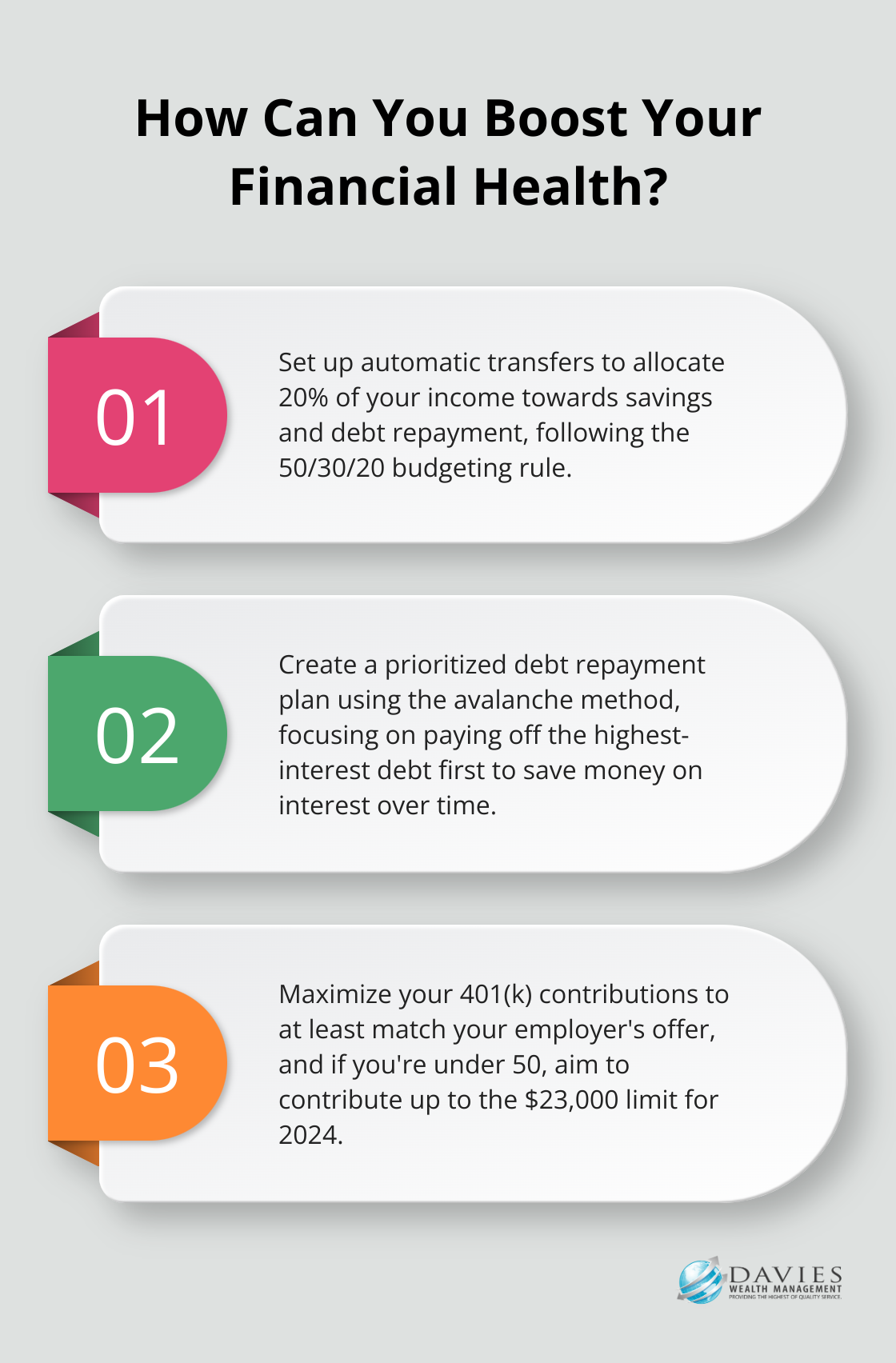

The foundation of any solid financial strategy is a well-crafted budget. Start by categorizing your expenses into fixed (rent, utilities) and variable (entertainment, dining out) costs. Try to allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This 50/30/20 rule provides a simple framework for budgeting.

Use budgeting apps like Mint or YNAB to track your spending automatically. These tools can help you identify areas where you overspend and opportunities to cut back. A budget isn’t about restriction; it aligns your spending with your priorities.

Build Financial Security

An emergency fund is essential for financial stability. Try to save 3-6 months of living expenses in a high-yield savings account. Start small if necessary – even $500 can cover minor emergencies.

If you have high-interest debt, tackle it aggressively. The avalanche method (paying off the highest-interest debt first) can save you the most money in interest over time. For those who need psychological wins, the snowball method (paying off the smallest debts first) can provide motivation through quick victories.

Secure Your Future

Maximize retirement contributions for long-term financial security. If your employer offers a 401(k) match, contribute at least enough to get the full match – it’s essentially free money. For 2024, you can contribute up to $23,000 to a 401(k) if you’re under 50, and $30,500 if you’re 50 or older.

Diversification is important for managing investment risk. A mix of stocks, bonds, and other assets can help balance potential returns with your risk tolerance. Consider low-cost index funds for broad market exposure. If you’re unsure about your investment strategy, consult with a financial advisor (Davies Wealth Management offers personalized guidance tailored to your goals and risk profile).

Protect Your Assets

Don’t overlook insurance in your financial plan. Adequate health, life, and disability insurance can protect you and your family from financial devastation in case of unexpected events. Review your coverage annually to ensure it keeps pace with your changing needs.

Optimize Your Taxes

Tax planning is an often-overlooked aspect of financial strategy. Utilize tax-advantaged accounts like HSAs and IRAs to reduce your tax burden. If you’re self-employed or have a complex tax situation, work with a tax professional to identify additional savings opportunities.

Your financial plan is a living document. Review it at least annually or whenever you experience significant life changes. This regular assessment ensures your strategy remains aligned with your goals and adapts to changing circumstances.

Final Thoughts

Creating a solid financial plan requires several key financial planning steps. You must assess your current situation, set clear objectives, and implement strategies to reach those goals. Your life circumstances, goals, and the economic landscape will change over time, so you should review and adjust your plan regularly.

Professional advice can provide valuable insights and expertise in navigating complex financial landscapes. At Davies Wealth Management, we offer personalized guidance on investment management, retirement planning, tax strategies, and estate planning (including unique expertise for professional athletes).

Davies Wealth Management stands ready to help you build, protect, and transfer your wealth with confidence. Our experienced professionals provide the knowledge and support needed to make informed decisions and stay on track towards your financial goals. A well-crafted financial plan serves as your roadmap to long-term financial security and success.

Leave a Reply