At Davies Wealth Management, we know that life can throw unexpected financial curveballs. That’s why having a finance contingency plan is essential for long-term financial stability.

A well-crafted plan acts as a safety net, protecting you from unforeseen circumstances and helping you navigate through financial storms.

In this post, we’ll guide you through the process of creating a robust finance contingency plan, ensuring you’re prepared for whatever the future may hold.

What Is a Finance Contingency Plan?

The Foundation of Financial Resilience

A finance contingency plan serves as a strategic roadmap to protect your financial well-being during unexpected events. At Davies Wealth Management, we consider this plan an essential component of a comprehensive financial strategy. It’s not just about maintaining a rainy day fund; it’s about creating a robust system that can withstand various financial shocks.

Financial stability doesn’t solely depend on the amount of money you have; it hinges on your ability to weather financial storms. A well-crafted contingency plan acts as a financial shock absorber, helping you maintain your lifestyle and meet obligations even when faced with unexpected challenges. Without such a plan, even high-income individuals can find themselves in precarious situations when confronted with sudden expenses or income loss.

Real-World Financial Risks

Let’s examine the real risks that necessitate a contingency plan. Job loss stands out as a prime example. The Bureau of Labor Statistics reports on the duration of unemployment, which can vary depending on economic conditions and individual circumstances. Medical emergencies present another significant risk. A study published in the American Journal of Public Health examined the relationship between medical debts, employment, and income, suggesting that medical issues can have significant financial impacts.

Customizing Your Plan

Financial risks vary greatly depending on your profession and life stage. For instance, professional athletes face unique challenges due to their short career spans and potential for career-ending injuries. A contingency plan for an athlete might include strategies for income diversification and long-term investment to ensure financial stability beyond their playing years.

For business owners, contingency planning might focus on maintaining cash flow during economic downturns or preparing for unexpected market shifts. The Bureau of Labor Statistics reports that survival rates for new business establishments vary from year to year due to several factors, including the business cycle, industry, and location. A solid contingency plan can make the difference between weathering a tough period and closing shop.

The Necessity of Preparedness

A finance contingency plan isn’t a luxury-it’s a necessity in today’s unpredictable world. Anticipating potential financial hurdles and preparing for them not only protects your wealth but also secures your peace of mind and future opportunities.

As we move forward, let’s explore the key components that form the backbone of a robust finance contingency plan. Understanding these elements will equip you with the tools to build a comprehensive safety net tailored to your unique financial situation.

Building Your Financial Safety Net

Emergency Fund: Your First Line of Defense

An emergency fund forms the cornerstone of any solid financial plan. Emergency savings can be used for large or small unplanned bills or payments that are not part of your routine monthly expenses. We recommend you save three to six months of living expenses in a readily accessible account. High-income earners or those with variable incomes (such as professional athletes) should try to aim for a 12-month cushion.

High-yield savings accounts offer the best combination of accessibility and growth for your emergency fund. As of August 2025, some online banks offer annual percentage yields (APYs) of up to 4.5% on savings accounts, significantly outpacing traditional brick-and-mortar banks.

Insurance: Protecting What Matters Most

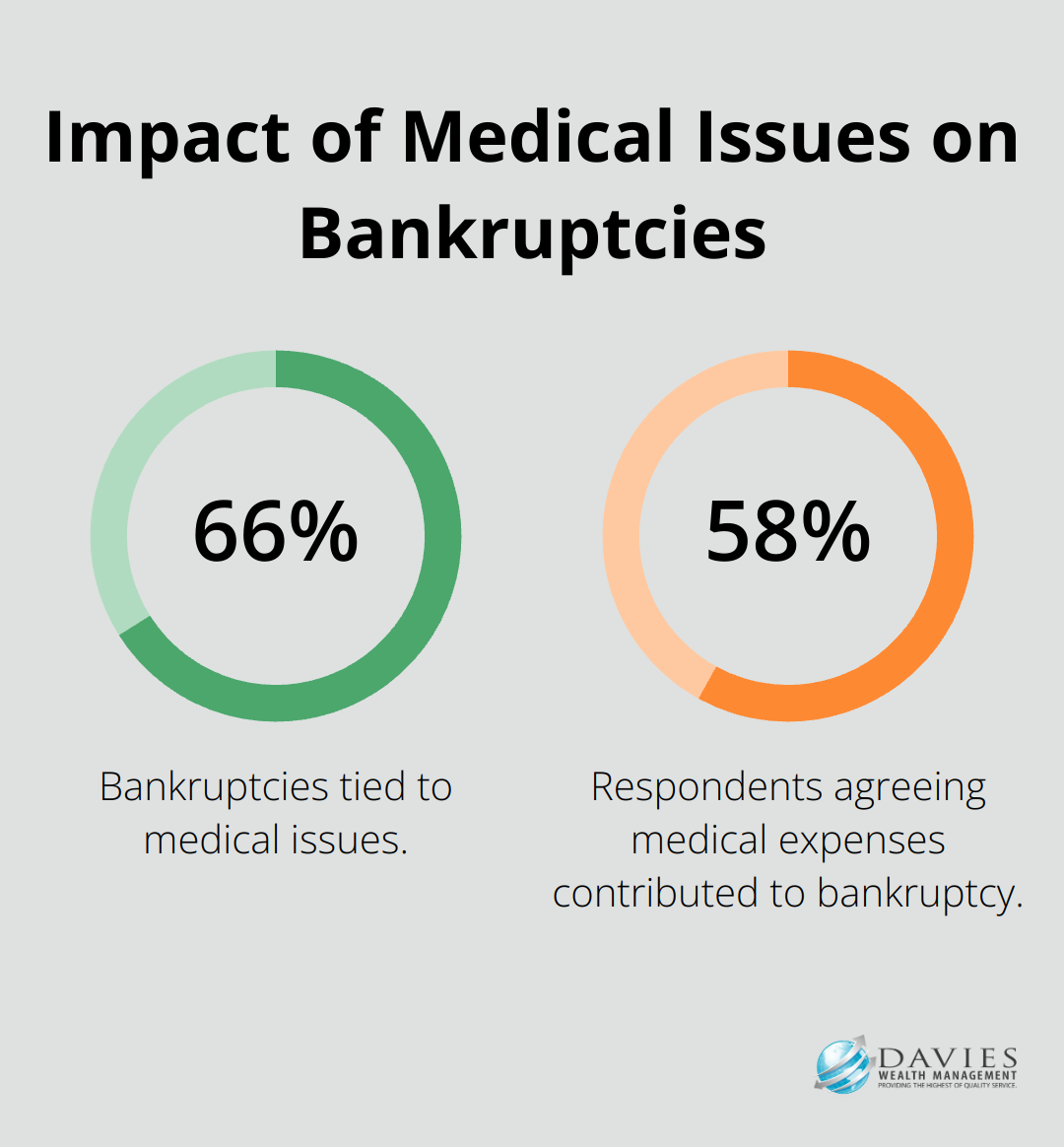

Comprehensive insurance coverage safeguards your financial future. Health insurance should top your priority list, given that medical bills lead to bankruptcy for many Americans. A study published in the American Journal of Public Health found that 66.5% of bankruptcies were tied to medical issues, with 58.5% of respondents agreeing that medical expenses contributed “very much” or “somewhat” to their bankruptcy.

Life insurance plays a critical role, especially for those with dependents. The general rule suggests coverage equal to 10-15 times your annual income. Professional athletes or high-income earners should consider policies with higher coverage limits and additional riders to protect against career-ending injuries or disabilities.

Disability insurance often gets overlooked but remains equally important. The Social Security Administration reports that in December 2021, 9,243,999 people received Social Security disability benefits, with 85.2% being disabled workers. Long-term disability insurance typically replaces 60-70% of your income if you can’t work due to illness or injury.

Income Diversification: Spreading Your Risk

Relying on a single income stream poses risks. We advise our clients to explore multiple income sources. This could include passive income from investments, rental properties, or side businesses. Professional athletes might leverage their personal brand for endorsements or develop skills for post-athletic careers.

Diversification extends beyond multiple income streams; it ensures these streams don’t all share the same vulnerabilities. A mix of active and passive income provides stability during economic downturns or career transitions.

Debt Management: Minimizing Financial Vulnerabilities

Effective debt management ensures financial stability. High-interest debt (such as credit card balances) can quickly derail your financial plans. We recommend you prioritize debt repayment, starting with the highest interest rates first.

For those with multiple debts, debt consolidation options merit consideration. Personal loans or balance transfer credit cards can potentially lower your interest rates and simplify repayment. However, addressing the root causes of debt accumulation prevents future issues.

As we move forward, let’s explore the practical steps to develop and implement your personalized finance contingency plan. This process will help you transform these key components into a robust strategy tailored to your unique financial situation.

How to Create a Finance Contingency Plan

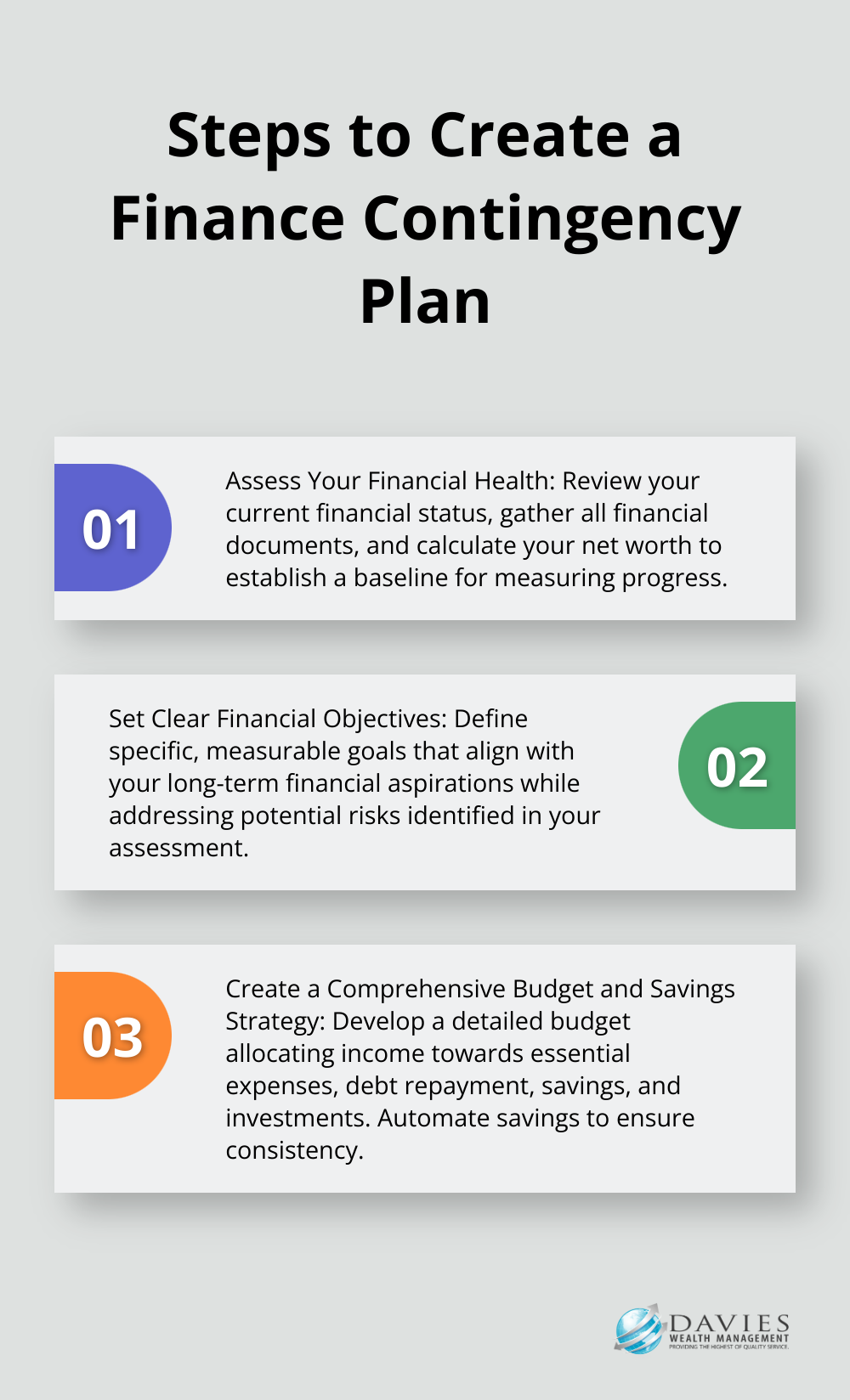

Assess Your Financial Health

The first step in creating your contingency plan involves a thorough review of your current financial status. Gather all your financial documents, including bank statements, investment portfolios, insurance policies, and debt records. Use financial tracking tools or spreadsheets to categorize your income sources and expenses. This will provide a clear picture of your cash flow and help identify areas where you might overspend or underutilize your resources.

Calculate your net worth by subtracting your total liabilities from your total assets. This figure serves as a baseline for measuring your financial progress over time. (The Federal Reserve’s Survey of Consumer Finances reported that between 2019 and 2022, real median family income rose a relatively modest 3 percent, though this varies significantly based on age, education, and other factors.)

Set Clear Financial Objectives

After understanding your financial situation, set specific, measurable goals. These goals should align with your long-term financial aspirations while addressing potential risks identified in your assessment.

For example, if you’re a professional athlete, your goals might include:

- Building a substantial emergency fund to cover living expenses during off-seasons or potential injuries

- Diversifying your income streams to prepare for retirement

- Investing in long-term, stable assets

Prioritize your goals based on urgency and importance. Short-term goals might include building an emergency fund or paying off high-interest debt, while long-term goals could focus on retirement planning or funding your children’s education.

Create a Comprehensive Budget and Savings Strategy

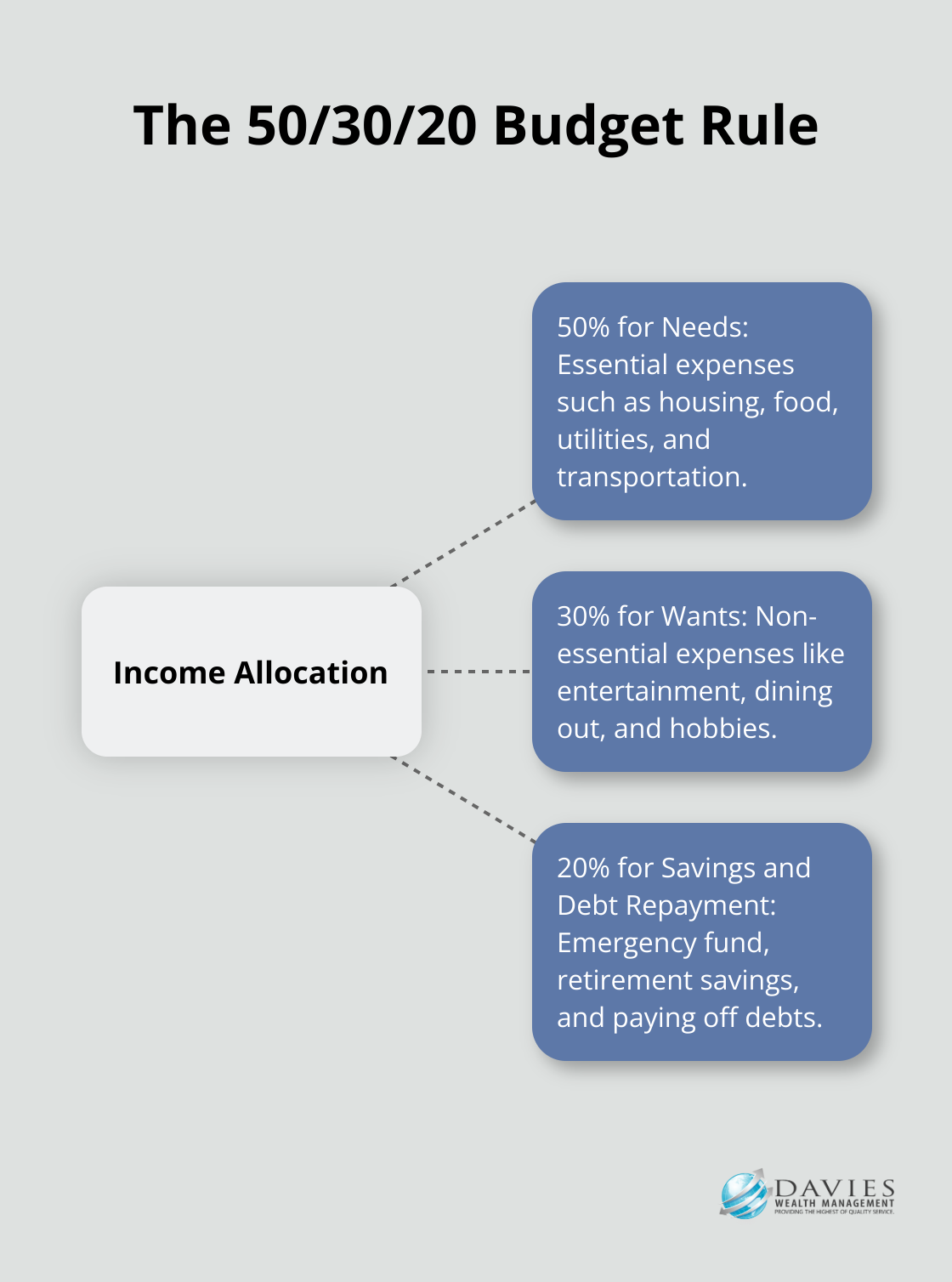

With your goals in place, develop a detailed budget that allocates your income towards essential expenses, debt repayment, savings, and investments. The 50/30/20 rule can serve as a starting point: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

However, high-income earners or those with variable incomes may need to adjust these percentages. Professional athletes might try to save a much higher percentage during their peak earning years to compensate for shorter career spans.

Automate your savings to ensure consistency. Set up automatic transfers to your emergency fund, retirement accounts, and other savings goals immediately after receiving your income. This “pay yourself first” approach helps prioritize savings and reduces the temptation to overspend.

Conduct Regular Financial Check-ups

Your finance contingency plan should evolve with your changing circumstances and financial landscape. Schedule regular reviews of your plan, ideally quarterly, to assess your progress and make necessary adjustments.

During these reviews, evaluate your budget adherence, progress towards savings goals, and the performance of your investments. Consider factors like changes in income, new financial obligations, or shifts in the economic environment that might impact your plan.

Use these check-ups to rebalance your investment portfolio if needed. Rebalancing is typically accomplished by selling outperforming assets and using the proceeds to invest in opportunities in another asset class. This helps maintain your desired risk level and can improve long-term returns.

Seek Professional Guidance

While creating a finance contingency plan is possible on your own, seeking professional advice can provide valuable insights and expertise. A wealth advisor can help you navigate complex financial situations, optimize your investment strategy, and ensure your plan aligns with your long-term goals.

If you’re a professional athlete or high-income earner with unique financial challenges, consider working with a specialized financial advisor who understands the intricacies of your situation. Davies Wealth Management, for example, offers tailored financial planning strategies for professional athletes, addressing the complexities of short career spans, fluctuating income, and potential earnings from endorsements and contracts.

Final Thoughts

A finance contingency plan protects your financial future from unexpected challenges. It requires regular assessment and adjustment to remain effective as your life circumstances change. You must take action today to create your plan, starting with an evaluation of your current financial situation and setting clear goals.

Professional guidance can provide valuable insights for complex financial decisions. At Davies Wealth Management, we offer personalized advice to help individuals build, protect, and grow their wealth. Our team specializes in creating comprehensive financial strategies that address unique needs and challenges.

A solid finance contingency plan will equip you to face the future with confidence. It ensures you have a robust financial safety net in place, ready for whatever financial challenges may arise. Start planning now to secure your financial well-being for tomorrow.

Leave a Reply