At Davies Wealth Management, we understand that financial planning can seem overwhelming. However, creating a simple plan for your finances doesn’t have to be complicated.

A straightforward approach can set you on the path to financial success and peace of mind. In this post, we’ll guide you through the essential steps to create a simple financial plan that works for you.

Where Do You Stand Financially?

At Davies Wealth Management, we believe that understanding your current financial situation forms the foundation of any successful financial plan. You can’t chart a course for where you want to go without a clear picture of where you stand. Let’s explore how you can gain this essential insight.

Calculate Your Net Worth

Your net worth provides a snapshot of your financial health. It’s the difference between what you own (assets) and what you owe (liabilities). To calculate:

- List all your assets: bank accounts, investments, property, and valuable possessions.

- List all your debts: mortgages, loans, credit card balances, and other obligations.

- Subtract your liabilities from your assets.

The Federal Reserve conducts surveys that include information on families’ balance sheets, pensions, income, and demographic characteristics. This data provides insights into household net worth and financial situations.

Track Income and Expenses

Understanding your cash flow is vital. Use a spreadsheet or a budgeting app to record all income sources and every expense for at least a month. This exercise often reveals surprising spending patterns. A study found that tracking expenses can help students think critically about prioritizing financial goals, balancing expenses with income, and understanding daily financial decisions.

Categorize your expenses into necessities (housing, food, utilities) and discretionary spending (entertainment, dining out). Try to follow the 50/30/20 rule: 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment.

Review Your Credit

Your credit score and report are important indicators of your financial health. According to FICO, a good credit score ranges from 670 to 739. Request your free credit report from AnnualCreditReport.com and review it for errors or areas for improvement.

The Consumer Financial Protection Bureau has provided estimates of consumers with limited credit histories. If you’re in this group, consider building credit with a secured credit card or by becoming an authorized user on someone else’s account.

Assess Your Insurance Coverage

Adequate insurance coverage protects your financial well-being from unexpected events. Review your current policies (health, life, disability, home, auto) to ensure they meet your needs. Consider any gaps in coverage that could leave you vulnerable to financial setbacks.

Evaluate Your Retirement Savings

Take stock of your retirement accounts (401(k)s, IRAs) and assess whether you’re on track to meet your retirement goals.

With a clear understanding of your financial standing, you’re ready to set meaningful goals that will guide your financial journey. Let’s explore how to define and prioritize these objectives in the next section.

What Are Your Financial Goals?

At Davies Wealth Management, we believe that setting clear financial goals forms the cornerstone of a successful financial plan. Without well-defined objectives, you can lose focus and drift off course. Let’s explore how to establish meaningful financial goals that will guide your journey to financial success.

Define Your Financial Objectives

Start by reflecting on what you want to achieve financially in the short term (1-2 years), medium term (3-5 years), and long term (5+ years). Your goals might include paying off credit card debt, saving for a down payment on a house, or building a retirement nest egg. Be as specific as possible. Instead of “save more money,” try “save $10,000 for an emergency fund by December 2026.”

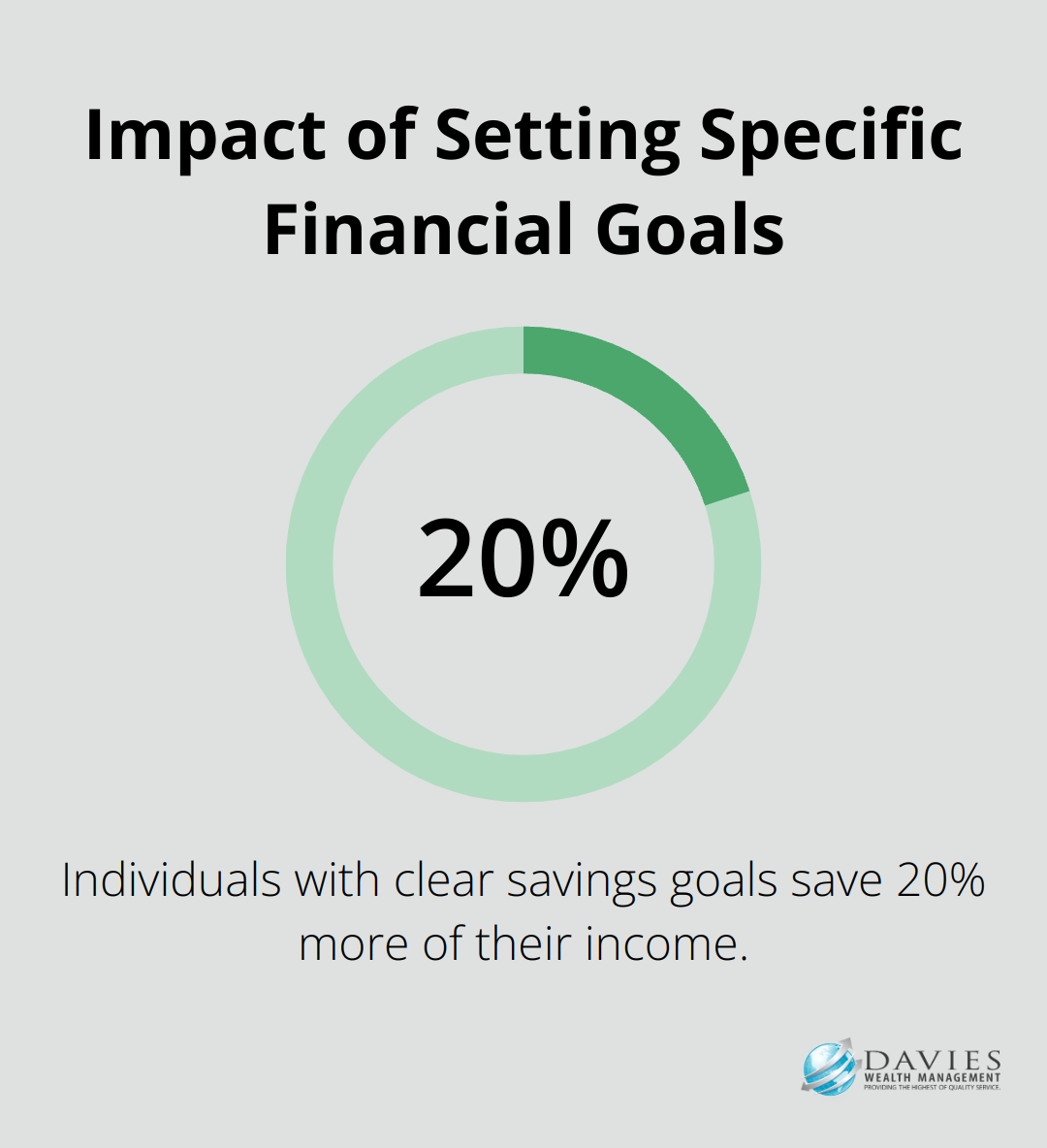

A study by the Consumer Financial Protection Bureau found that people who set specific financial goals are more likely to make progress towards achieving them. The study revealed that individuals with clear savings goals saved 20% more of their income compared to those without defined objectives.

Make Your Goals SMART

To increase your chances of success, make your financial goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, “I will contribute $500 monthly to my 401(k) starting next month” is a SMART goal. It’s specific (401(k) contribution), measurable ($500), achievable (based on your income), relevant (for retirement), and time-bound (monthly starting next month).

Prioritize Your Financial Goals

With your goals defined, it’s time to prioritize. Not all financial objectives carry equal weight or urgency. Consider factors like:

- Urgency: Which goals need immediate attention?

- Impact: Which goals will have the most significant effect on your financial well-being?

- Feasibility: Which goals are most realistic given your current situation?

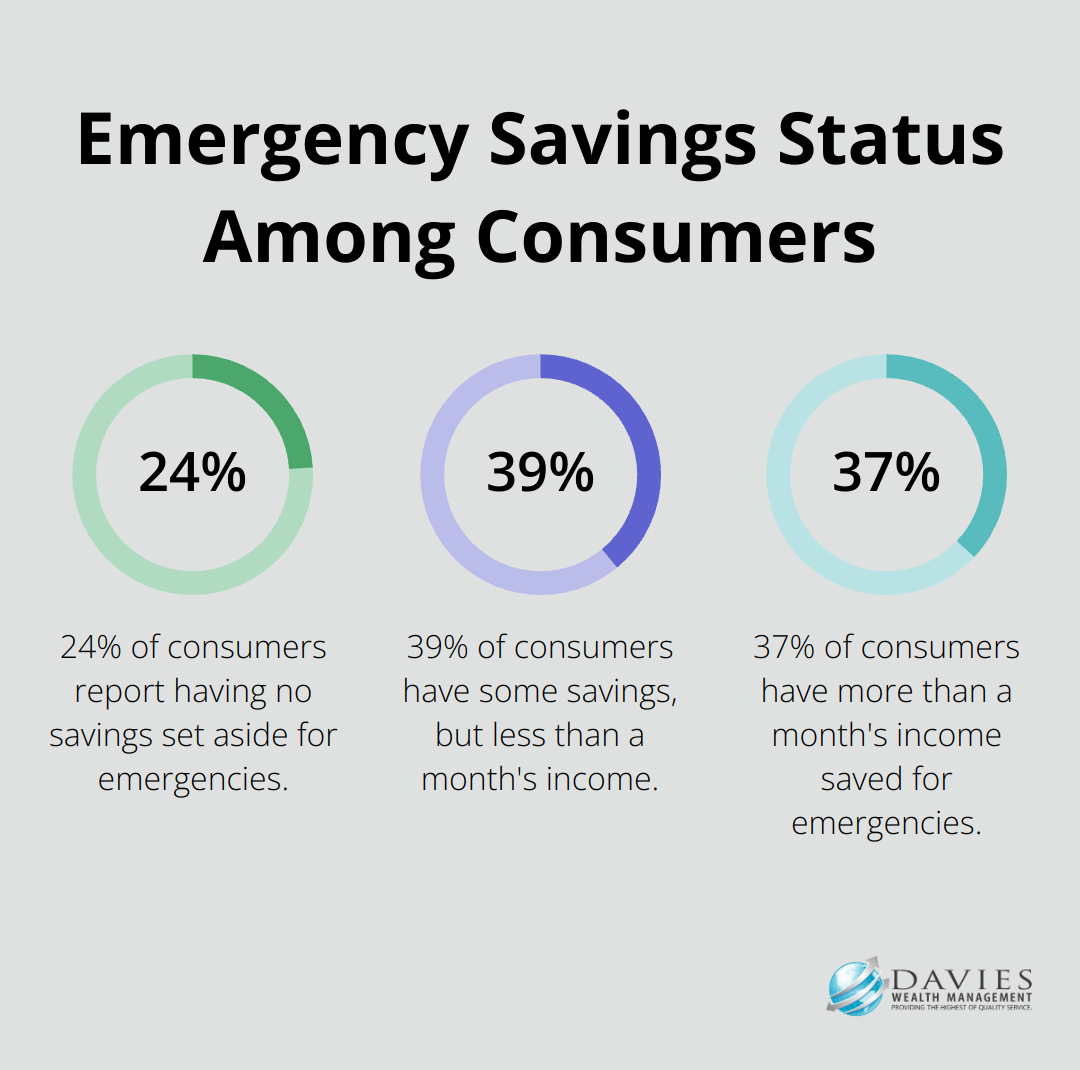

A survey by the Consumer Financial Protection Bureau found that nearly a quarter (24 percent) of consumers report having no savings set aside for emergencies, while 39 percent have some but less than a month’s income. This underscores the importance of prioritizing emergency savings alongside other financial goals.

Align Goals with Life Stages

Your financial goals should evolve as you progress through different life stages. For instance, a recent graduate might focus on student loan repayment and building credit, while a mid-career professional might prioritize maxing out retirement contributions and college savings for children.

Professional athletes face unique financial challenges. At Davies Wealth Management, we specialize in helping clients, including athletes, align their financial goals with their unique life circumstances. This might include creating a plan to manage variable income during playing years and prepare for a career transition.

Setting financial goals is not a one-time event. You should regularly review and adjust your objectives as your life circumstances change. With clear, prioritized financial goals in place, you’re ready to take the next step: developing and implementing a strategy to achieve these goals. Let’s explore how to create an effective financial strategy in the next section.

How to Execute Your Financial Strategy

At Davies Wealth Management, we know that creating a financial strategy is only half the battle. The real challenge lies in execution. Here’s how you can put your plan into action and make meaningful progress towards your financial goals.

Create a Realistic Budget

A budget serves as your financial roadmap. Start by categorizing your expenses and allocating your income accordingly. The 50/30/20 rule provides a good starting point: 50% for needs, 30% for wants, and 20% for savings and debt repayment. However, adjust these percentages based on your unique situation and goals.

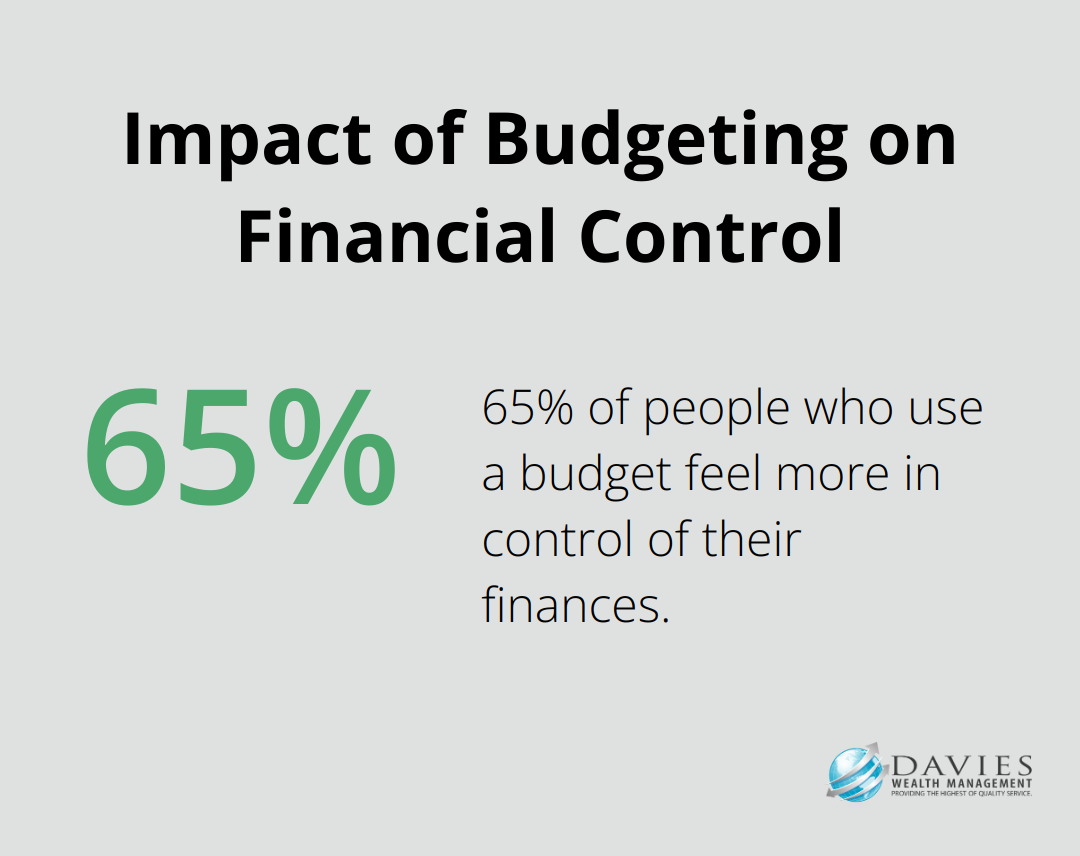

Use budgeting apps or spreadsheets to track your spending. A study by the National Foundation for Credit Counseling found that 65% of people who use a budget feel more in control of their finances. A budget doesn’t restrict you; it empowers you to make informed choices.

Build Your Financial Safety Net

An emergency fund provides financial stability. Research suggests that individuals who struggle to recover from a financial shock have less savings to help protect against a future emergency. Try to save 3-6 months of living expenses. Start small if necessary – even $500 can make a difference in an emergency.

Set up automatic transfers to your emergency fund each payday. This “pay yourself first” approach ensures you consistently build your safety net.

Tackle High-Interest Debt

High-interest debt, particularly credit card debt, can derail your financial progress. Focus on paying off these debts aggressively. The avalanche method – paying off the highest interest debt first – can reduce your long-term costs the most. However, paying down multiple debts can be challenging.

Invest for Your Future

Investing is key to building long-term wealth. If your employer offers a 401(k) match, contribute at least enough to get the full match – it’s essentially free money. Beyond that, consider opening an IRA for additional tax-advantaged retirement savings.

For those new to investing, low-cost index funds can serve as an excellent starting point. They are well-diversified investments with minimal fees and offer broad market exposure.

Consistency is key in investing. Regular contributions, even small ones, can compound significantly over time. A $500 monthly investment growing at 7% annually could potentially grow to over $1 million in 40 years.

Executing your financial strategy requires discipline and persistence. But with each step, you build a stronger financial foundation.

Final Thoughts

A simple plan for finance empowers you to take control of your financial future. You will assess your current situation, set clear objectives, and implement effective strategies. This approach allows you to create a realistic budget, build an emergency fund, tackle high-interest debt, and invest wisely for long-term growth.

Life circumstances change, and your financial plan should adapt accordingly. We recommend you review and adjust your plan regularly to ensure it aligns with your evolving goals and priorities. This proactive approach will help you stay on track and make informed decisions about your financial future.

At Davies Wealth Management, we specialize in providing personalized financial guidance tailored to your unique situation. Our team can help you navigate your financial journey with confidence, whether you’re a professional athlete facing specific challenges or an individual looking to secure your financial future. We invite you to reach out and discover how we can support your financial goals.

Leave a Reply