Financial markets can wipe out decades of wealth in months. The 2022 bear market erased $7.6 trillion from US stock values alone.

We at Davies Wealth Management see clients who lost 40% of their portfolios because they lacked a proper financial risk management plan. Smart investors protect their wealth before disaster strikes.

What Financial Risks Can Destroy Your Wealth

Market Risk Hits Hardest During Corrections

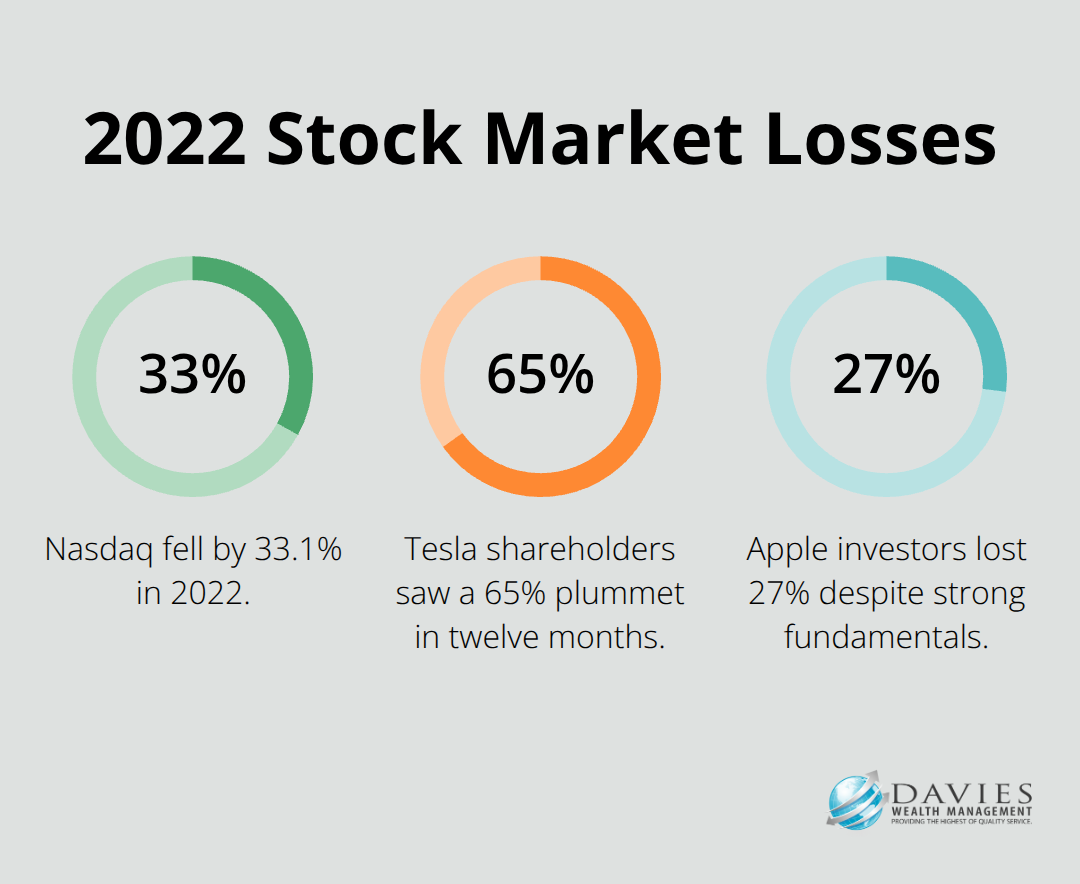

Market risk destroys more wealth than any other financial threat. The S&P 500 had the worst results since 2008 during 2022, while the Nasdaq fell 33.1%. Technology stocks lost over 60% of their value in some cases. Concentrated portfolios suffered the worst damage. Tesla shareholders watched their holdings plummet 65% in twelve months. Apple investors lost 27% despite the company’s strong fundamentals.

Volatility exposure multiplies during economic uncertainty. The VIX fear index spiked above 30 multiple times in 2022 (compared to its long-term average of 19.5). High-beta stocks amplified losses. Growth companies that traded at premium valuations collapsed fastest. Netflix dropped 51% while Amazon fell 49.9%.

Credit Risk Creates Permanent Capital Loss

Credit risk generates permanent losses that portfolios never recover from. Corporate bond defaults reached 3.4% during 2020 according to Moody’s data. High-yield bonds defaulted at 5.3% rates. Energy sector defaults hit 11.2% as oil prices crashed. Retail companies defaulted at 8.7% rates during pandemic lockdowns.

Individual credit exposure comes from money you lend, bonds you hold, or bank stocks you own. Regional banks collapsed in 2023 when commercial real estate loans soured. Silicon Valley Bank failed in 48 hours. First Republic Bank lost 97% of its value before regulators seized it. Credit Suisse shareholders lost everything when UBS acquired the bank for $3.2 billion.

Liquidity Risk Traps Investors During Crisis

Liquidity risk prevents investors from access to their money when they need it most. At least 215 investment funds suspended redemptions in March 2020. Private equity funds extended lock-up periods. Cryptocurrency exchanges halted withdrawals during market stress. FTX customers lost $8 billion when the exchange collapsed overnight.

Cash flow challenges force asset sales at terrible prices. Margin calls liquidate positions at market lows. Leveraged investors face forced sales during downturns. Business owners cannot access credit lines when banks tighten standards (especially during recessions). Emergency expenses arrive at the worst possible moments when investment accounts show massive losses.

Your next step involves a thorough assessment of where these risks currently exist in your financial situation.

Where Are Your Financial Weak Spots

Most investors have no idea how concentrated their portfolios actually are. We regularly audit client portfolios and find 60% of their wealth tied up in just three positions. Technology workers hold 80% of their net worth in company stock and tech sector funds. Real estate agents put everything into property investments. Healthcare professionals load up on healthcare REITs and pharma stocks. The 2022 tech crash proved this approach destroys wealth fast.

Portfolio Concentration Creates Maximum Risk

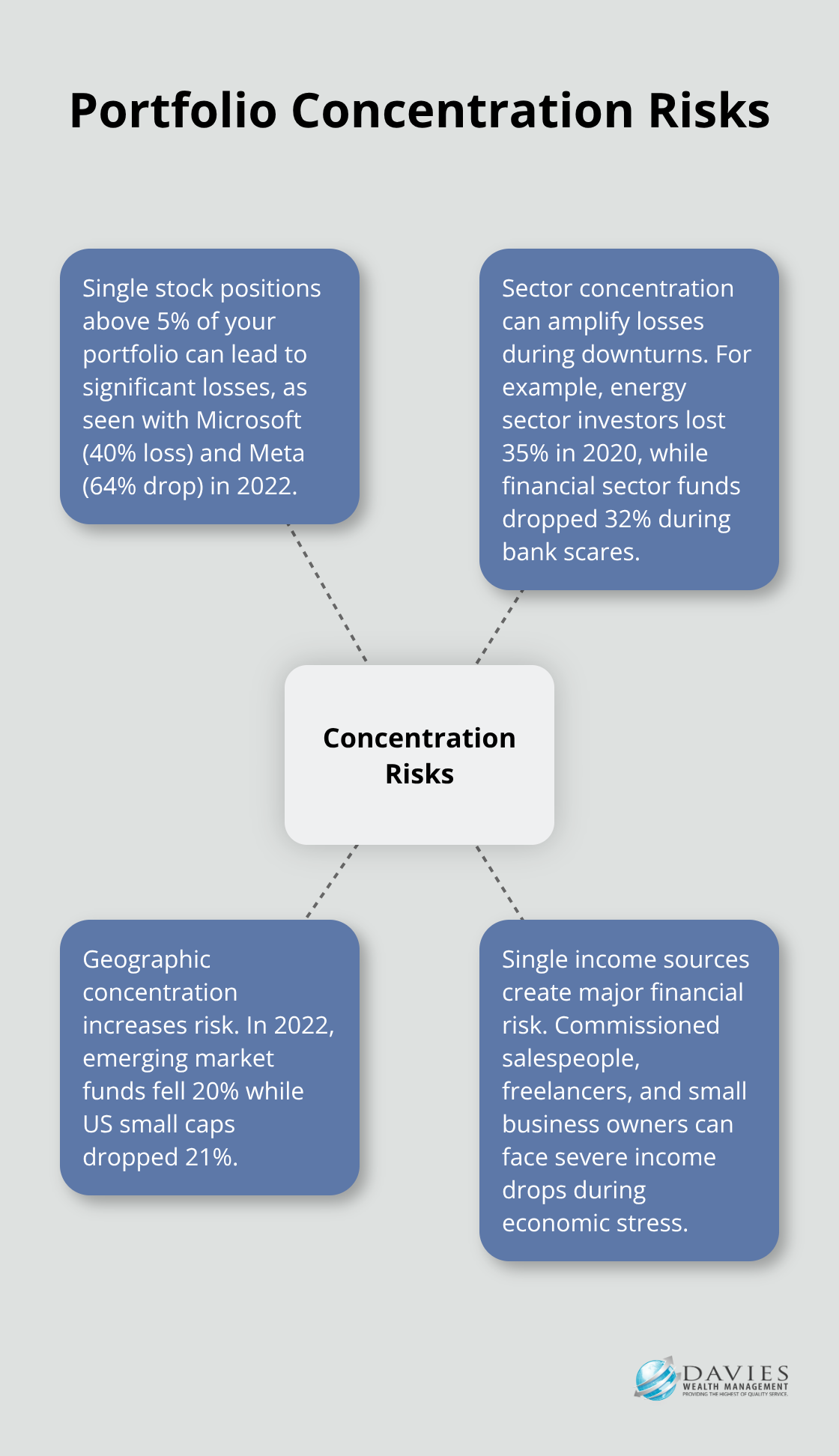

Single stock positions above 5% of your portfolio spell trouble. Microsoft employees who held company stock watched 40% losses in 2022. Meta workers saw 64% drops. Your 401k likely holds too much company stock if you work for a public company. Sector concentration kills returns during downturns. Energy sector investors lost 35% in 2020. Financial sector funds dropped 32% during bank scares.

Geographic concentration amplifies risk too. Emerging market funds fell 20% in 2022 while US small caps dropped 21%. Count your positions by sector, geography, and individual holdings. Anything above 10% in one category needs immediate attention.

Income Streams Determine Financial Survival

Single income sources create the biggest financial risk most people ignore. Commissioned salespeople lose everything during recessions. Freelancers face 40% income drops when clients cut budgets. Small business owners watch revenue disappear overnight during economic stress. The pandemic eliminated 22 million jobs in two months. Gig economy workers lost 60% of their income when demand crashed.

Professional athletes face career-ending injuries that stop million-dollar salaries instantly (which is why we specialize in helping athletes plan for these scenarios). Multiple income streams provide protection. Rental properties generated steady cash during 2020 lockdowns. Dividend stocks paid out $511 billion in 2022 despite market chaos.

Insurance Gaps Leave Families Exposed

Most people carry inadequate life insurance coverage. Financial experts recommend 10-12 times annual income in coverage. The average American holds just 3.2 times their salary according to LIMRA research. Disability insurance gaps create bigger problems. Social Security disability pays maximum $3,627 monthly in 2023. That covers basic expenses for few families.

Long-term care services have increased costs significantly according to recent surveys. Medicare covers almost none of these expenses. Professional liability insurance protects high-income earners from lawsuit risks. Doctors face average malpractice premiums of $12,000-$25,000 annually. The protection pays for itself when claims reach $2 million averages.

Insurance solutions for high-net-worth individuals provide additional asset protection strategies beyond basic coverage.

Once you identify these weak spots, you can build specific strategies to protect your wealth from each threat.

How Do You Build Bulletproof Financial Protection

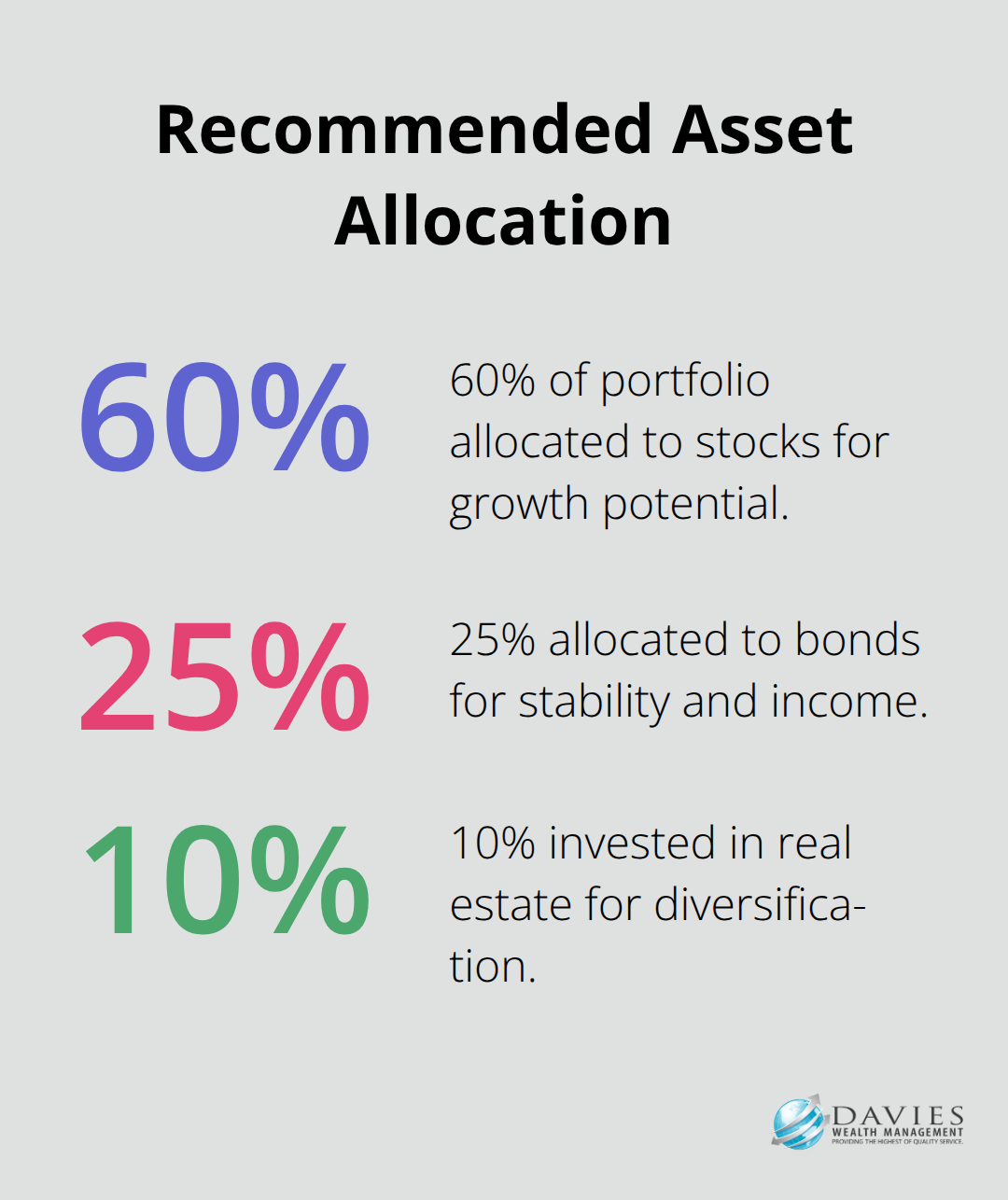

Asset allocation across multiple classes provides the foundation for wealth protection. We recommend 60% stocks, 25% bonds, 10% real estate, and 5% commodities for most investors. International allocation reduces single-country risk. Research shows portfolios with 40% international exposure historically reduced volatility of the equity allocation within a portfolio.

Spread Risk Across Asset Classes

Alternative investments like REITs generated 9.5% annual returns from 1972-2021 according to NAREIT data. Commodity ETFs protect against inflation spikes that destroyed bond values in 2022. Real estate investment trusts offer monthly dividends and inflation protection. Precious metals hedge against currency debasement during economic crisis periods.

Stock market concentration kills portfolios during sector crashes. Technology funds lost 33% in 2022 while energy stocks gained 59%. Geographic allocation matters too. European stocks outperformed US markets during dollar strength periods. Emerging market exposure provides growth potential (though with higher volatility risks).

Emergency Funds Must Cover Real Expenses

Traditional advice suggests three to six months of expenses in cash. We demand twelve months minimum for high earners and business owners. Job searches can take significant time according to Bureau of Labor Statistics data. Self-employed individuals need 18 months of expenses saved.

High-yield accounts at Marcus or Ally pay 4.5% annually in 2023. Money market funds offer similar yields with daily liquidity. Certificate deposits lock rates but reduce flexibility during emergencies. Treasury bills provide government-backed safety with competitive yields above 5% in current markets.

Insurance Coverage Eliminates Catastrophic Risk

Term life insurance costs $500 annually for $1 million coverage for healthy 35-year-olds. Whole life policies cost 10-15 times more with poor investment returns that average 2-4% annually. Disability insurance replaces 60-70% of income until age 65. Own-occupation coverage protects professionals who cannot perform their specific job duties.

Umbrella liability policies provide $1-5 million coverage for $200-800 annually. These policies protect against lawsuit judgments that exceed homeowner and auto coverage limits. Professional liability insurance shields doctors, lawyers, and consultants from malpractice claims that average $2 million settlements.

Building bulletproof financial protection requires a comprehensive financial risk management plan that addresses all potential threats to your wealth through diversification, adequate reserves, and proper insurance coverage.

Final Thoughts

Your financial risk management plan demands immediate action. Calculate your exact portfolio concentration across sectors and individual positions today. Document every income source and identify single points of failure within the next 30 days.

Market conditions shift rapidly and catch unprepared investors off guard. The 2022 bear market destroyed portfolios with outdated allocation models. Update your strategy annually after major life changes like job transitions, marriage, or inheritance (quarterly rebalances maintain target percentages).

Professional guidance accelerates wealth protection for individuals, families, and businesses. We at Davies Wealth Management provide personalized strategies that protect current wealth while securing long-term financial futures. Contact Davies Wealth Management to develop comprehensive risk assessment solutions tailored to your specific situation. Financial markets will test your preparation, but proper risk management transforms market volatility from wealth destroyer into manageable challenge.

Leave a Reply