Financial markets can wipe out decades of wealth in months. The 2022 bear market erased $7.6 trillion from US stock values, while inflation hit 9.1% – the highest in 40 years.

We at Davies Wealth Management see clients who wish they had built a financial risk management plan before crisis struck. Smart planning protects your assets when markets turn volatile.

What Financial Risks Threaten Your Wealth

Market Risk Destroys Investment Value

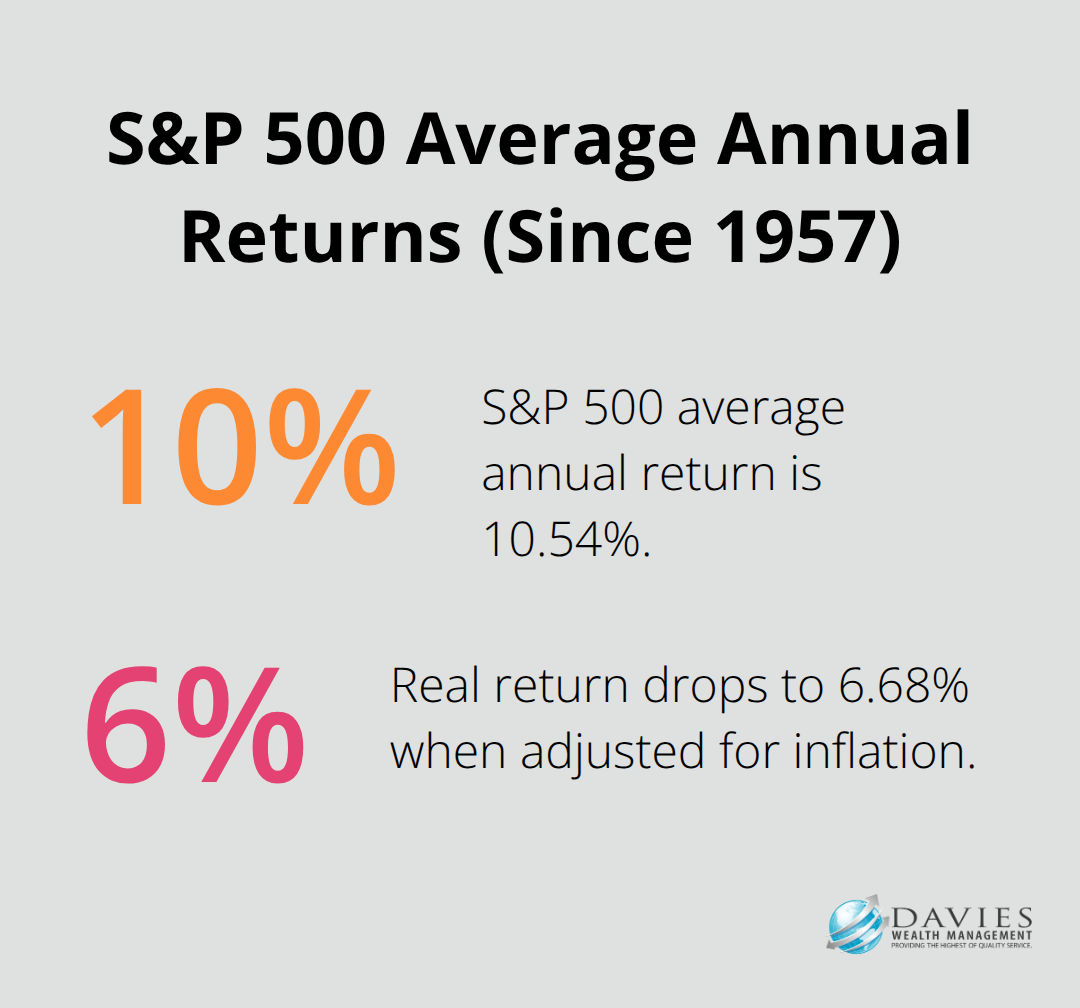

Market volatility represents the biggest threat to long-term wealth accumulation. The S&P 500 has delivered an average annual return of 10.54% since 1957, though when adjusted for inflation, the real return drops to 6.68%. Investors who concentrated assets in single sectors or growth stocks faced devastating losses.

Market risk extends beyond stocks. Bond values plummeted as the Federal Reserve raised rates from 0.25% to 5.25% in 18 months. Real estate investment trusts declined 25% as higher rates made properties less attractive. Currency fluctuations add another layer of market risk (the British pound fell 20% against the dollar in 2022).

Credit Risk Destroys Cash Flow

Credit risk affects both borrowers and lenders in your portfolio. Corporate bond defaults reached 1.4% in 2023, with energy and retail companies leading failures. High-yield bonds carry default rates of 3-5% annually during economic stress.

Personal credit risk emerges when variable-rate debts consume larger portions of income. Credit card rates jumped from 16% to 21% as Fed rates increased. Home equity lines of credit and adjustable mortgages reset higher, which forces families into financial distress. Companies with weak balance sheets face refinancing challenges (this makes their bonds and stocks extremely risky investments).

Liquidity Risk Traps Your Money

Liquidity risk occurs when assets cannot convert to cash quickly without significant losses. Real estate typically requires 30-90 days to sell, often at discounted prices during market stress. Private equity and hedge funds impose lock-up periods where investors are prohibited from redeeming their shares for predetermined time frames.

Small-cap stocks and corporate bonds trade infrequently, which creates wide bid-ask spreads during market turmoil. Even money market funds can restrict withdrawals during banking crises, as seen with several funds in March 2023. Cash flow problems compound when multiple income sources dry up simultaneously – job loss, reduced business revenue, and declining investment income create perfect storms that force asset liquidation at the worst possible times.

Understanding these risks sets the foundation for your next step: evaluating your current financial position to identify vulnerabilities.

How Strong Is Your Financial Foundation

Your net worth calculation reveals only part of your financial picture. The Federal Reserve’s Survey of Consumer Finances shows the median American household holds $121,700 in total assets, yet 40% cannot cover a $400 emergency expense. This gap between assets and liquidity exposes dangerous vulnerabilities that risk management must address.

Asset Quality Determines Risk Exposure

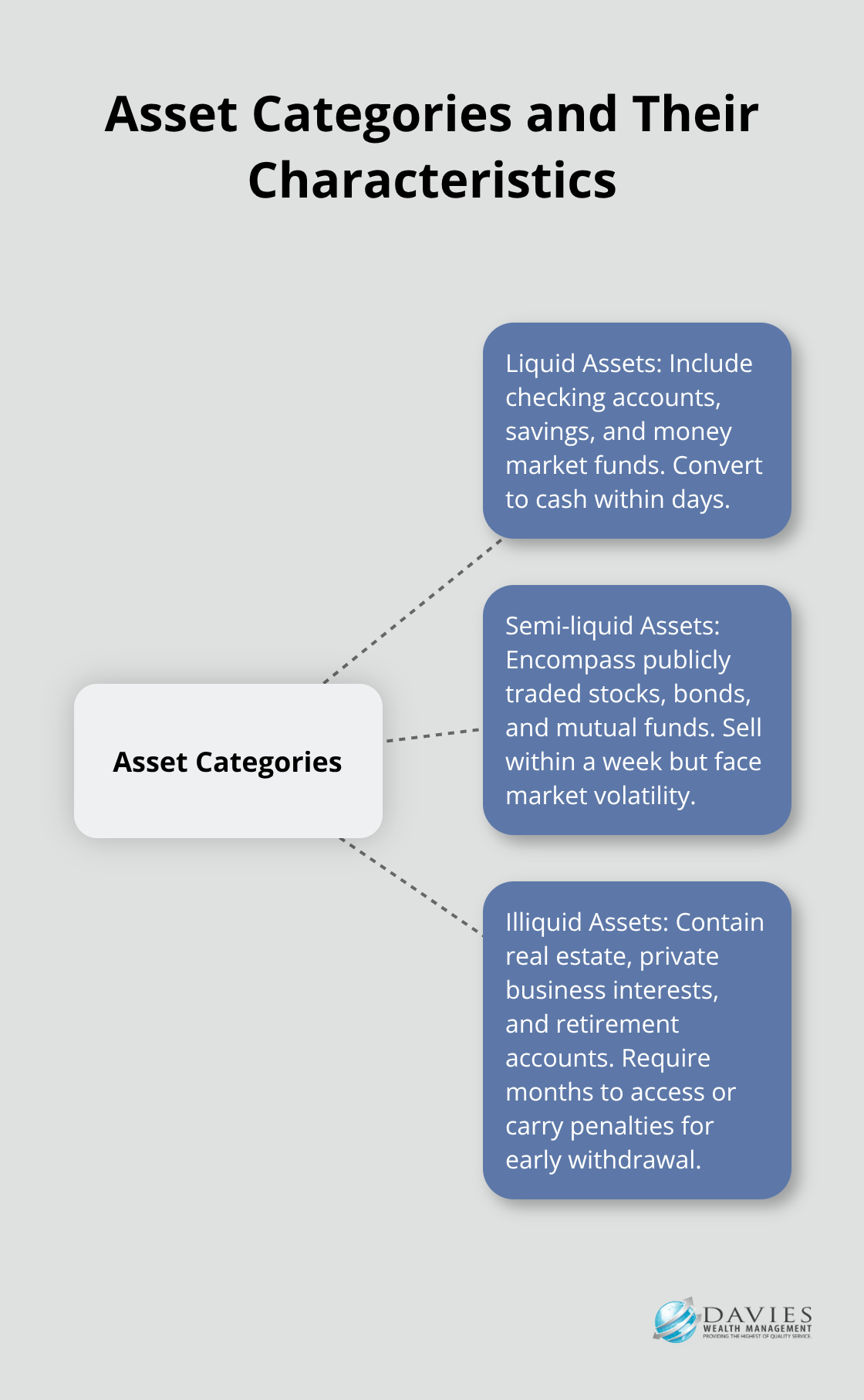

Assets fall into three categories that determine your risk profile. Liquid assets include checking accounts, savings, and money market funds that convert to cash within days. Semi-liquid assets encompass publicly traded stocks, bonds, and mutual funds that sell within a week but face market volatility. Illiquid assets contain real estate, private business interests, and retirement accounts that require months to access or carry penalties for early withdrawal. The Consumer Expenditure Survey reports households with 90% of assets in illiquid investments face three times higher financial stress during economic downturns.

Income Diversification Prevents Financial Collapse

Single income sources create massive risk exposure that most people ignore. Most workers depend primarily on employment income, while only a small percentage generate substantial passive income streams. Professionals who earn $100,000 annually often live paycheck-to-paycheck because fixed expenses consume 85-95% of take-home pay. Variable expenses like healthcare, car repairs, and home maintenance add unpredictability that destroys budgets. Multiple income streams through rental properties, dividend-paying stocks, or side businesses reduce dependence on single employers.

Risk Tolerance Must Match Reality

Your emotional reaction to portfolio losses determines your true risk tolerance, not questionnaires or age formulas. Market declines cause many investors to panic-sell at losses according to research analysis. Risk capacity differs from risk tolerance – high earners with stable jobs can weather market volatility better than retirees on fixed incomes. Debt payments above 36% of gross income severely limit risk capacity regardless of investment knowledge. Your investment strategy must match your lowest risk threshold between emotional tolerance and financial capacity.

Professional Athletes Face Unique Challenges

Professional athletes encounter distinct financial vulnerabilities that amplify standard risks. Short career spans mean most athletes earn peak income for only 5-15 years, while fluctuating contract values create unpredictable cash flows. Endorsement deals can disappear overnight due to performance or reputation issues. Career-ending injuries eliminate future earnings without warning, which makes traditional retirement planning inadequate for athletic careers.

These financial realities demand sophisticated risk management strategies that address both immediate protection needs and long-term wealth building goals.

How Do You Build Bulletproof Financial Protection

Portfolio Diversification Prevents Catastrophic Losses

Asset allocation across uncorrelated investments forms the foundation of risk reduction. The classic 60/40 stock-bond portfolio failed during 2022 when both asset classes declined simultaneously. Modern diversification requires geographic spread across US, international developed, and emerging markets plus alternative investments. Real estate investment trusts, commodities, and Treasury Inflation-Protected Securities provide inflation hedges that traditional portfolios lack.

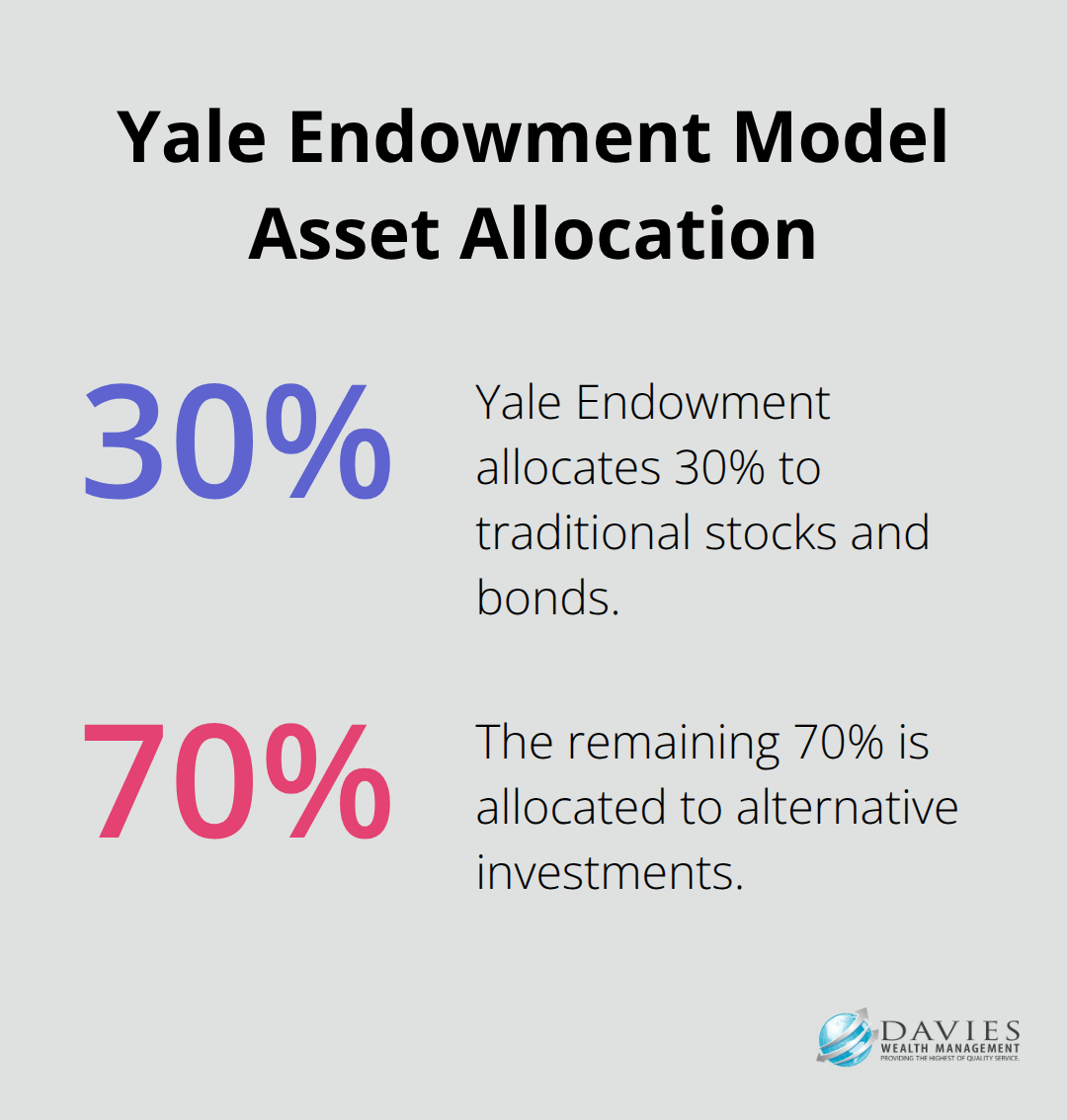

The Yale Endowment model allocates only 30% to traditional stocks and bonds while achieving superior long-term returns through alternatives. Quarterly rebalancing forces you to sell high-performing assets and buy underperforming ones, which captures gains and reduces concentration risk. Never hold more than 5% of your portfolio in any single stock, including employer shares that create dangerous concentration.

Emergency Funds Create Financial Stability

Six months of expenses in high-yield savings accounts provides the minimum emergency cushion, though volatile income requires 12 months of coverage. Marcus by Goldman Sachs and Ally Bank offer rates above 4.5% on savings accounts that maintain purchasing power against inflation. These accounts protect you from forced asset sales during market downturns or income disruptions.

Professional athletes face unique cash flow challenges that demand larger emergency reserves. Career-ending injuries can eliminate future earnings without warning, while contract negotiations create income gaps between seasons.

Insurance Coverage Protects Against Major Losses

Term life insurance costs $200-400 annually for healthy 35-year-olds who seek $1 million coverage. Disability insurance replaces 60-70% of income if injuries prevent work, while umbrella policies provide $1-5 million liability protection for $300-600 yearly. Health Savings Accounts offer triple tax benefits through deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses.

Professional athletes need specialized disability coverage that protects against career-ending injuries specific to their sports. Standard policies often exclude sports-related injuries, which leaves athletes vulnerable to their greatest risk.

Tax-Efficient Strategies Maximize Wealth Retention

Roth IRA conversions during market downturns lock in tax-free growth when asset values recover. Converting $50,000 when stocks decline 20% costs $12,000 in taxes but generates tax-free returns on the eventual recovery. Tax-loss harvesting reduces your taxable income by up to $3,000 annually while maintaining market exposure through similar securities.

Municipal bonds from your state provide tax-free income that often exceeds taxable bond yields for high earners. Asset location strategies place tax-inefficient investments in retirement accounts while they hold tax-efficient index funds in taxable accounts (this approach can boost after-tax returns by 0.5-1% annually according to Vanguard research).

Final Thoughts

Your financial risk management plan requires immediate action, not perfect market conditions. Calculate your true net worth and identify concentration risks in your portfolio today. Open a high-yield savings account and fund it with three months of expenses within 60 days. Review your insurance coverage gaps and purchase term life and disability policies before health issues arise.

Market conditions change quarterly, which demands regular plan updates. Rebalance your portfolio every three months to maintain target allocations. Review your emergency fund size annually as expenses increase with inflation (tax law changes require strategy adjustments that can save thousands in unnecessary payments).

Complex financial situations demand professional expertise that individual investors cannot replicate. Professional athletes face unique challenges with short career spans and fluctuating contract income that require specialized approaches. We at Davies Wealth Management specialize in comprehensive wealth management solutions for individuals, families, and professional athletes who need sophisticated financial risk management plans. Your financial security depends on action today rather than waiting for perfect conditions that never arrive.

Leave a Reply