At Davies Wealth Management, we understand the critical role of financial planning in entrepreneurship. A well-crafted financial plan is the backbone of any successful startup.

It provides a roadmap for growth, helps secure funding, and guides decision-making throughout your business journey. In this post, we’ll walk you through the essential steps to create a robust financial plan for your startup, setting you on the path to success.

Understanding Your Startup’s Financial Needs

Assessing Initial Capital Requirements

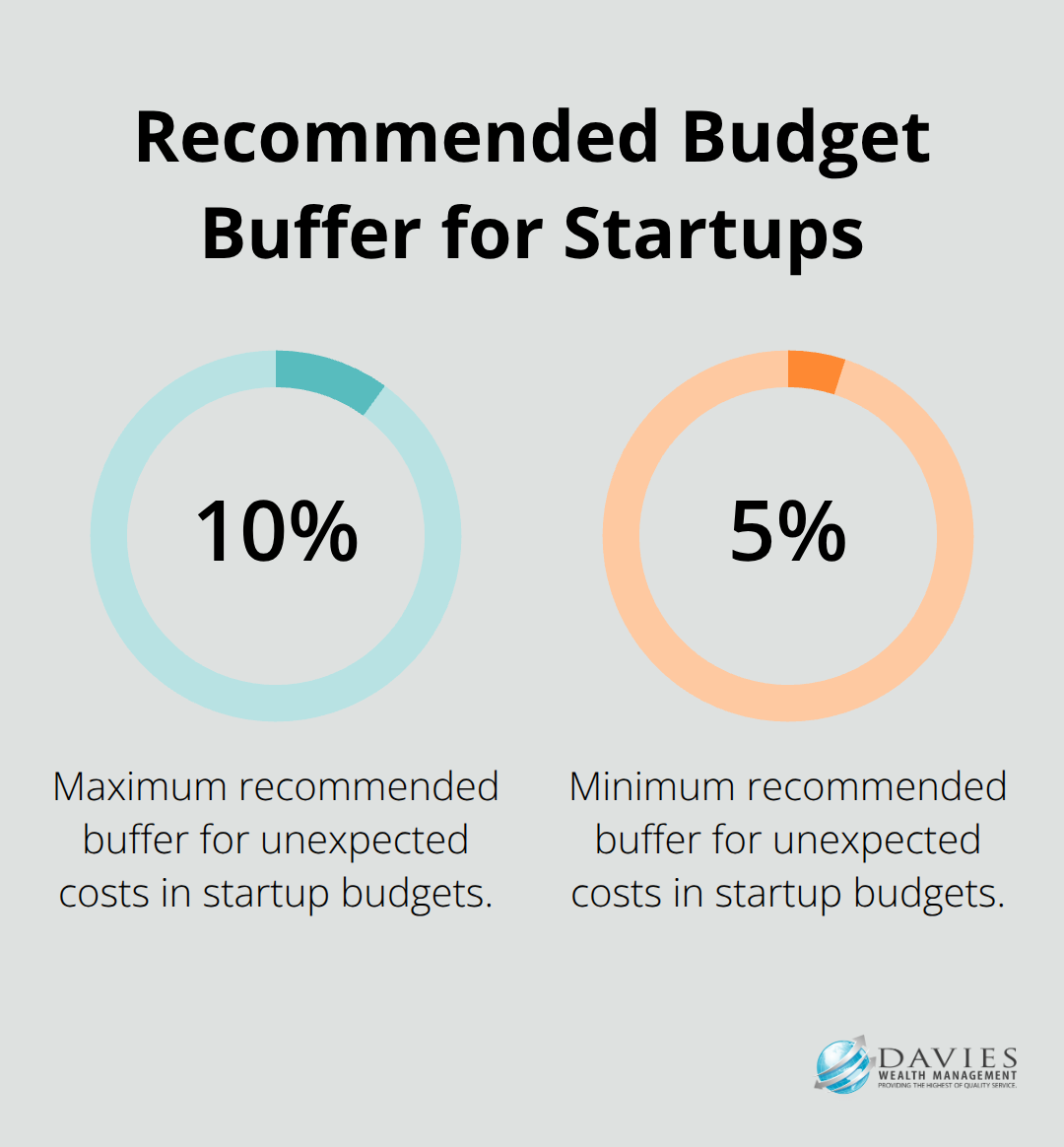

The first step in creating a solid financial plan for your startup involves calculating the money you need to launch. This calculation should include one-time costs (equipment, licenses, permits) and ongoing expenses for the initial months of operation. We recommend adding a 5-10% of your total budget to account for unexpected costs.

For example, a tech startup might require $50,000 for computer equipment, $10,000 for software licenses, and $40,000 for the first three months of operating expenses. With a 10% buffer, the total initial capital requirement would be $110,000.

Identifying Potential Revenue Streams

Your startup’s income generation goes beyond selling your primary product or service. Consider additional revenue streams such as:

- Subscription models

- Upselling or cross-selling opportunities

- Affiliate partnerships

- Licensing or franchising your brand

- Consulting services related to your expertise

A fitness app startup, for instance, could generate revenue from app subscriptions, in-app purchases, branded merchandise, and partnerships with fitness equipment manufacturers.

Estimating Operational Costs and Expenses

A detailed estimation of your ongoing operational costs is essential. These typically include:

- Rent and utilities

- Salaries and benefits

- Marketing and advertising

- Inventory and supplies

- Insurance and legal fees

- Technology and software costs

Break down each category into specific items. For marketing, don’t just budget for a general “marketing” expense – specify costs for social media advertising, content creation, and email marketing.

Understanding Industry Averages

The cost to start a business varies widely depending on your industry and business model. Tech startups often require significantly more capital due to high development costs and the need for rapid scaling.

Avoiding Common Pitfalls

Startups often underestimate their expenses. To avoid this pitfall, use financial modeling software to create detailed projections. These tools can help you account for various scenarios and provide a more accurate picture of your financial needs.

As we move forward to creating your financial projections, it’s important to note that understanding your startup’s financial needs is an ongoing process. Regular reassessment and adjustment of your financial plan are key to maintaining financial health and achieving long-term success.

How to Create Accurate Financial Projections

At Davies Wealth Management, we know that accurate financial projections form the cornerstone of a robust financial plan for your business. These projections act as a roadmap for your business’s financial future and prove essential for attracting investors and making informed decisions.

Develop a Sales Forecast

Start by creating a detailed sales forecast. Base this on market research, industry trends, and your startup’s unique value proposition. Maintain realism in your projections. A study by CB Insights reveals that 42% of startups fail due to a lack of market need, so ensure your sales forecast aligns with actual market demand.

For instance, if you launch a SaaS product, forecast your monthly recurring revenue (MRR) growth. Industry benchmarks suggest that top-performing SaaS startups try for 15-20% month-over-month growth in their early stages. However, your specific growth rate will depend on factors like your target market, pricing strategy, and customer acquisition costs.

Create a Cash Flow Statement

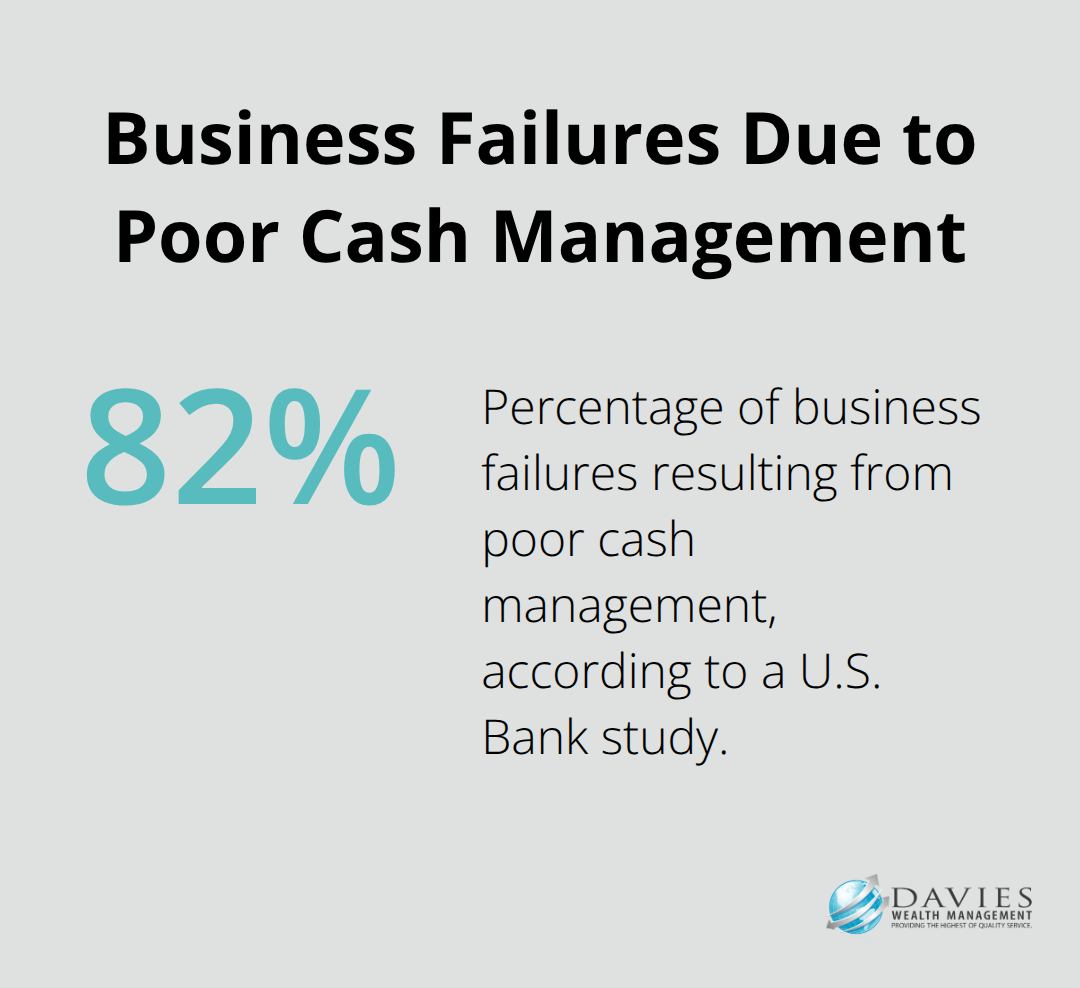

Your cash flow statement proves vital for understanding when and how money moves in and out of your business. It helps you anticipate cash shortages and plan for major expenses. A U.S. Bank study shows that 82% of business failures result from poor cash management.

When creating your cash flow statement, consider:

- The timing of customer payments

- Seasonal fluctuations in sales

- Large one-time expenses (like equipment purchases)

- Regular operating expenses

Use tools like QuickBooks or Xero to automate this process and get real-time insights into your cash position.

Build a Profit and Loss Statement

Your profit and loss (P&L) statement, also known as an income statement, provides a snapshot of your startup’s financial performance over a specific period. It shows your revenues, costs, and expenses to calculate your net profit or loss.

When building your P&L, categorize your expenses meticulously. This will help you identify areas where you can potentially cut costs. For instance, many startups overspend on marketing in their early stages. Many businesses use a percentage of revenues as a guide for their marketing budget, but there’s no hard and fast answer to how much it should be.

Prepare a Balance Sheet

Your balance sheet provides a snapshot of your startup’s financial position at a specific point in time. It lists your assets, liabilities, and equity. This document holds particular importance for potential investors as it gives them a clear picture of your startup’s financial health.

When preparing your balance sheet, pay close attention to your debt-to-equity ratio. This ratio indicates how much of your startup’s financing comes from debt versus equity. While no universal ideal ratio exists, a lower ratio generally indicates less risk. However, some debt can benefit growth if managed properly.

Financial projections should not remain static. They should evolve as living documents that you regularly review and adjust based on actual performance and changing market conditions. We at Davies Wealth Management recommend revisiting your projections at least quarterly to ensure they remain accurate and useful for financial planning and analysis. As we move forward, let’s explore how to secure funding for your startup using these well-crafted financial projections.

How to Fund Your Startup

Bootstrapping: The Self-Funded Approach

Bootstrapping offers benefits like cost control and a lower barrier to entry but also brings significant risks, such as financial exposure. If you choose this route, consider these strategies:

- Start with a minimal viable product (MVP) to reduce initial costs

- Reinvest all early profits back into the business

- Use personal assets wisely (e.g., a home equity line of credit)

Many successful companies, like MailChimp and GitHub, started as bootstrapped ventures before accepting outside investment.

Angel Investors: Early-Stage Funding

Angel investors provide early-stage funding, typically ranging from $25,000 to $100,000. These individuals often bring valuable industry experience and connections along with their capital. To attract angel investors:

- Network actively in your industry and attend startup events

- Prepare a clear, concise pitch that demonstrates your startup’s potential

- Be ready to give up some equity in exchange for funding and expertise

In the US, 63,000 angel investors actively funded startups in 2023, reflecting an 8% increase from 2022.

Venture Capital: Fueling Rapid Growth

Venture capital (VC) firms typically invest larger amounts, often millions of dollars, in startups with high growth potential. From 2010 to 2019, investors deployed $761 billion into 87,000+ venture-backed companies across 94,000+ financings. To secure VC funding:

- Develop a scalable business model with clear market potential

- Create a detailed financial model showing projected growth and profitability

- Be prepared for rigorous due diligence and potentially significant equity dilution

VC funding can accelerate growth, but it’s not suitable for all startups. For high-net-worth individuals, venture capital allocation is typically limited to 5-10% of their total portfolio.

Crafting a Compelling Pitch Deck

A well-crafted pitch deck is essential, regardless of your chosen funding source. Your pitch deck should:

- Clearly articulate your value proposition and market opportunity

- Showcase your team’s expertise and ability to execute

- Present realistic financial projections and funding requirements

Keep your pitch deck concise, ideally 10-15 slides. According to DocSend’s Startup Index, investors spend an average of 3 minutes and 44 seconds reviewing a pitch deck.

We at Davies Wealth Management recommend a thorough evaluation of each funding option and its long-term implications for your business before making a decision. The best funding source for your startup depends on your specific business model, growth plans, and personal goals as an entrepreneur. For some clients with high risk tolerance, we might recommend private equity investments in promising startups.

Final Thoughts

A solid financial plan forms the foundation of successful entrepreneurship. We explored essential components, from initial capital requirements to securing funding for growth. Your financial plan will guide business decisions and help you navigate entrepreneurial challenges. We recommend you review and adjust your projections and overall financial strategy at least quarterly to align with business realities and market conditions.

Financial plan entrepreneurship often benefits from professional expertise. At Davies Wealth Management, we offer tailored financial advice to entrepreneurs and business owners. Our team can help refine your financial projections, explore funding options, and develop strategies to maximize your startup’s financial health (visit our website for more information).

A robust financial plan is a powerful tool to make informed decisions, attract investors, and drive your startup towards long-term success. It requires time and effort, but sets a strong foundation for your entrepreneurial journey. Regular updates and professional guidance will help you stay on track and achieve your business goals.

Leave a Reply