Creating a finance savings plan is a cornerstone of financial success. At Davies Wealth Management, we’ve seen how a well-structured savings strategy can transform our clients’ financial futures.

This guide will walk you through the essential steps to develop a robust savings plan tailored to your unique goals and circumstances. We’ll cover everything from assessing your current financial situation to implementing effective savings techniques that will set you on the path to financial prosperity.

What’s Your Financial Starting Point?

Calculating Your Net Worth

Your net worth provides a snapshot of your financial health. It’s the difference between what you own (assets) and what you owe (liabilities). To calculate your net worth:

- List your assets (what you own), estimate the value of each, and add up the total.

- List your liabilities (what you owe) and add up the outstanding balances.

- Subtract your total liabilities from your total assets.

This figure gives you a clear picture of where you stand financially and helps identify areas for improvement.

Tracking Income and Expenses

Understanding your cash flow is essential for effective financial planning. Start by documenting all sources of income, including salary, investments, and any side hustles. Next, track your expenses for at least a month. When tracking your expenses, you can separate your spending into three categories: needs, wants, and savings. This process often reveals surprising spending patterns and highlights areas where you can cut back.

Identifying Savings Opportunities

Once you have a clear view of your income and expenses, it’s time to spot potential savings. Look for areas where you’re overspending or where costs can be reduced. For instance, you might find that you’re paying for subscriptions you rarely use or spending more on dining out than you realized.

Consider negotiating better rates for services like insurance or utilities. Even small reductions can add up over time. If you’re carrying high-interest debt, prioritize paying it off as quickly as possible to reduce interest payments and free up more money for savings.

Regular Financial Check-ups

Assessing your financial situation isn’t a one-time task. We recommend revisiting this process regularly (at least every six months) to ensure you’re staying on track and adapting to any changes in your financial life. A clear and current understanding of your finances will equip you to make informed decisions and progress towards your savings goals.

With a solid grasp of your current financial situation, you’re now ready to set clear financial goals that will guide your savings journey. Let’s explore how to define and prioritize these objectives in the next section.

What Are Your Financial Objectives?

Define Your Financial Aspirations

At Davies Wealth Management, we know that financial goals form the bedrock of a successful savings plan. Without well-defined objectives, you might lose focus and motivation. Start by identifying your short-term and long-term financial objectives. Short-term goals might include building an emergency fund or saving for a vacation, while long-term goals could involve saving for retirement or your children’s education. Be specific about what you want to achieve and by when.

Instead of a vague goal like “save more money,” try for something concrete like “save $10,000 for a down payment on a house within two years.” This level of specificity makes your goal tangible and easier to work towards.

Prioritize Your Financial Goals

Once you’ve listed your goals, it’s time to prioritize. Consider both the importance and urgency of each objective. A study found that when these studies first started appearing in the early 2000s, around 2 to 3 percent of firms auto-enrolled their workers in retirement savings. This statistic underscores the importance of prioritizing long-term goals like retirement savings, even when short-term needs feel more pressing.

We often advise our clients to balance their short-term and long-term goals. While it’s important to address immediate financial needs, neglecting long-term objectives can lead to significant challenges down the road.

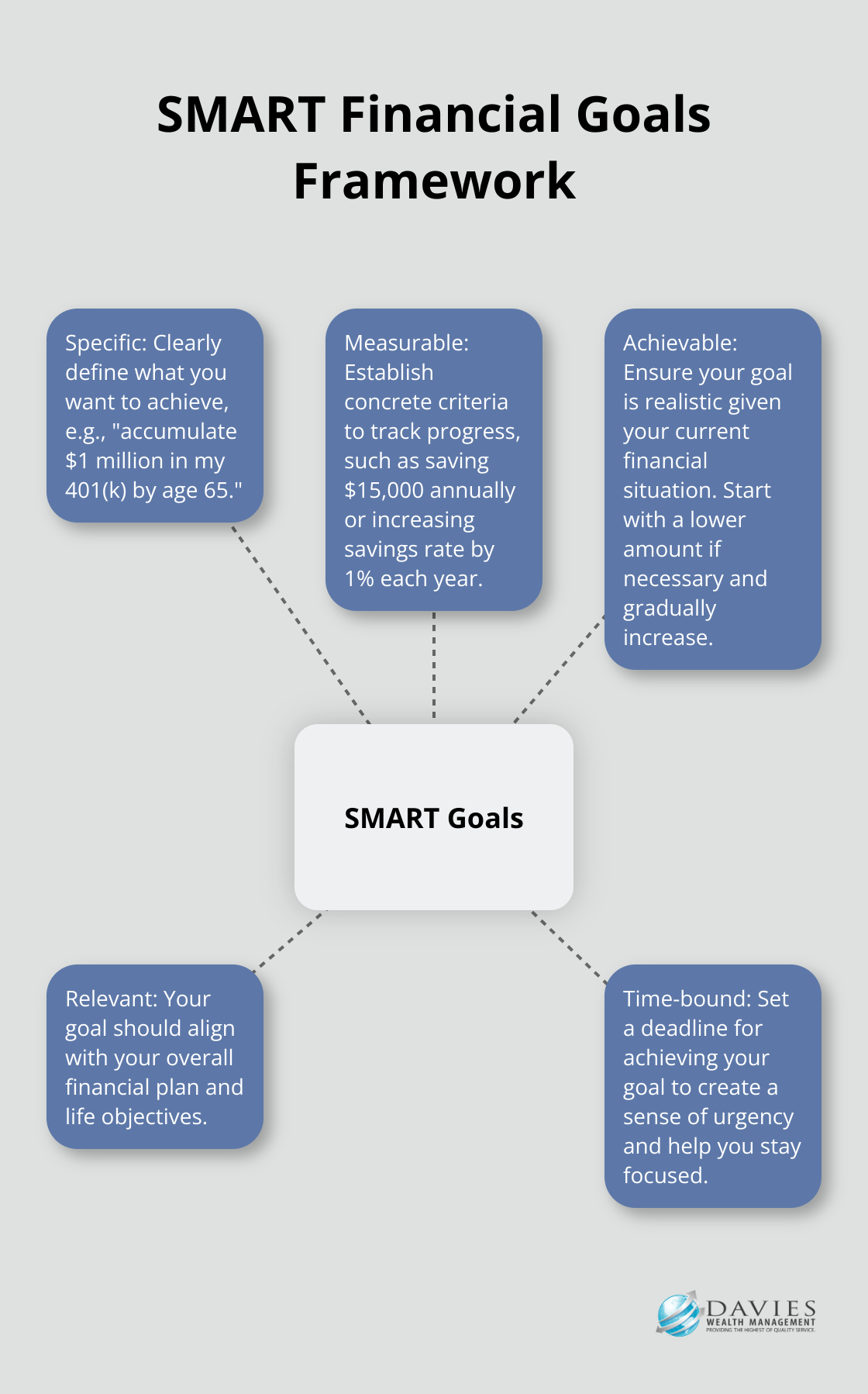

Create SMART Financial Goals

To increase your chances of success, transform your financial objectives into SMART goals (Specific, Measurable, Achievable, Relevant, and Time-bound). Let’s break down each component:

Specific: Clearly define what you want to achieve. Instead of “save for retirement,” specify “accumulate $1 million in my 401(k) by age 65.”

Measurable: Establish concrete criteria to track your progress. For the retirement goal, you might set a target to save $15,000 annually or increase your savings rate by 1% each year.

Achievable: Ensure your goal is realistic given your current financial situation. If saving $15,000 annually isn’t feasible right now, start with a lower amount and gradually increase it.

Relevant: Your goal should align with your overall financial plan and life objectives. For instance, if you plan to start a business, saving for a down payment on a house might not be the most relevant goal at the moment.

Time-bound: Set a deadline for achieving your goal. This creates a sense of urgency and helps you stay focused. For example, “save $30,000 for a home down payment within three years.”

Review and Adjust Your Goals

Your financial goals aren’t set in stone. Life circumstances change, and your objectives should evolve accordingly. We recommend reviewing your financial plan at least annually to ensure they remain aligned with your current situation and future aspirations.

With your financial goals clearly defined and prioritized, you’re ready to develop and implement a savings strategy that will turn these objectives into reality. In the next section, we’ll explore effective techniques to maximize your savings potential and accelerate your progress towards financial success.

How to Maximize Your Savings

At Davies Wealth Management, we’ve observed how a well-executed savings strategy transforms our clients’ financial futures. Let’s explore practical ways to supercharge your savings efforts and turn your financial goals into reality.

Leverage High-Yield Savings Accounts

One of the most effective ways to boost your savings is to utilize high-yield savings accounts. These accounts typically offer interest rates significantly higher than traditional savings accounts. As of August 2025, the top savings rate is 4.35 percent offered by Peak Bank, which is around seven times the current national average of 0.59 percent.

Automate Your Savings

Automation serves as a powerful tool in your savings arsenal. Set up automatic transfers from your checking account to your savings account on payday. This “pay yourself first” approach ensures that you consistently save before you have a chance to spend the money elsewhere.

Recent evidence suggests that automating savings can have positive impacts on financial outcomes. Research has shown correlations between savings automation and improved financial health.

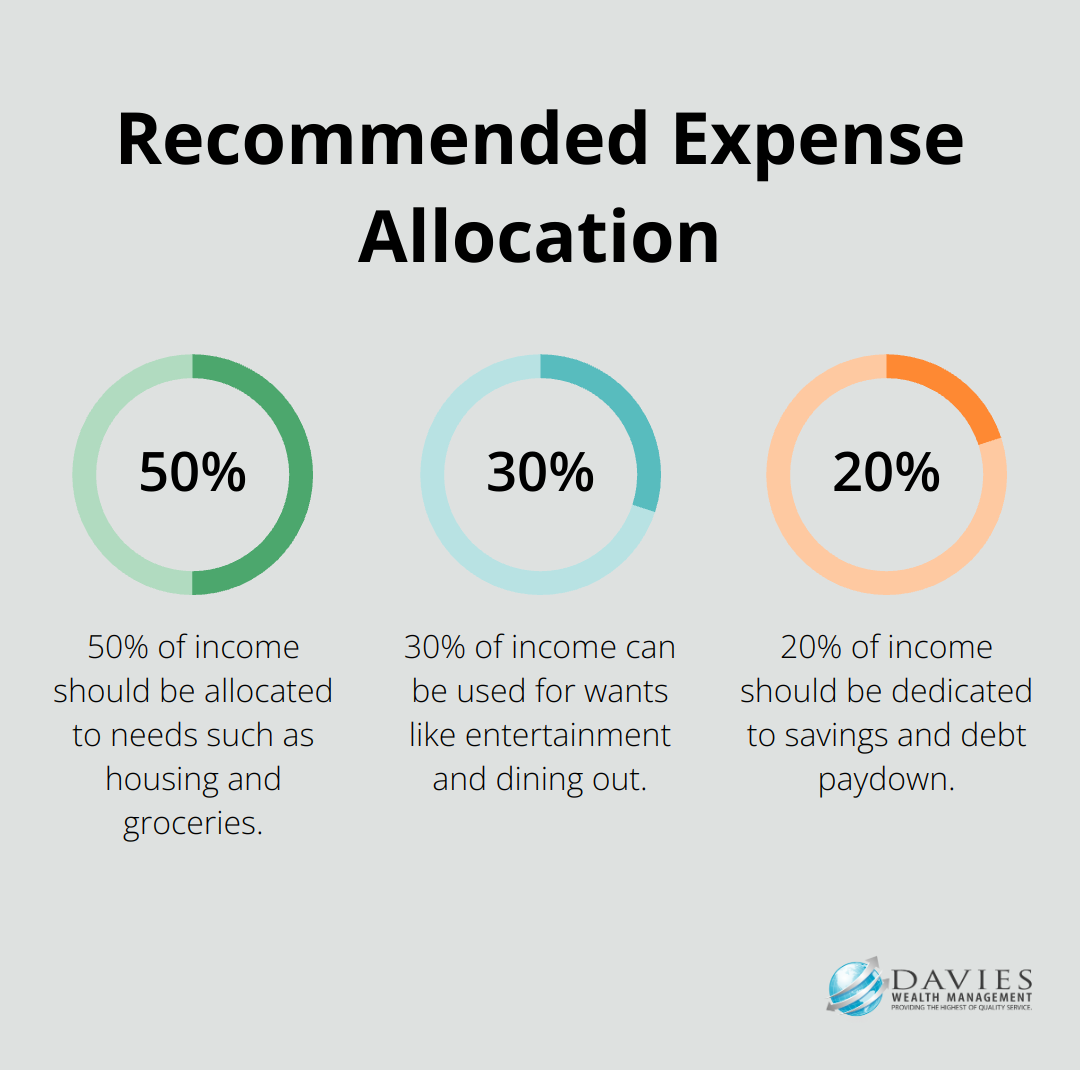

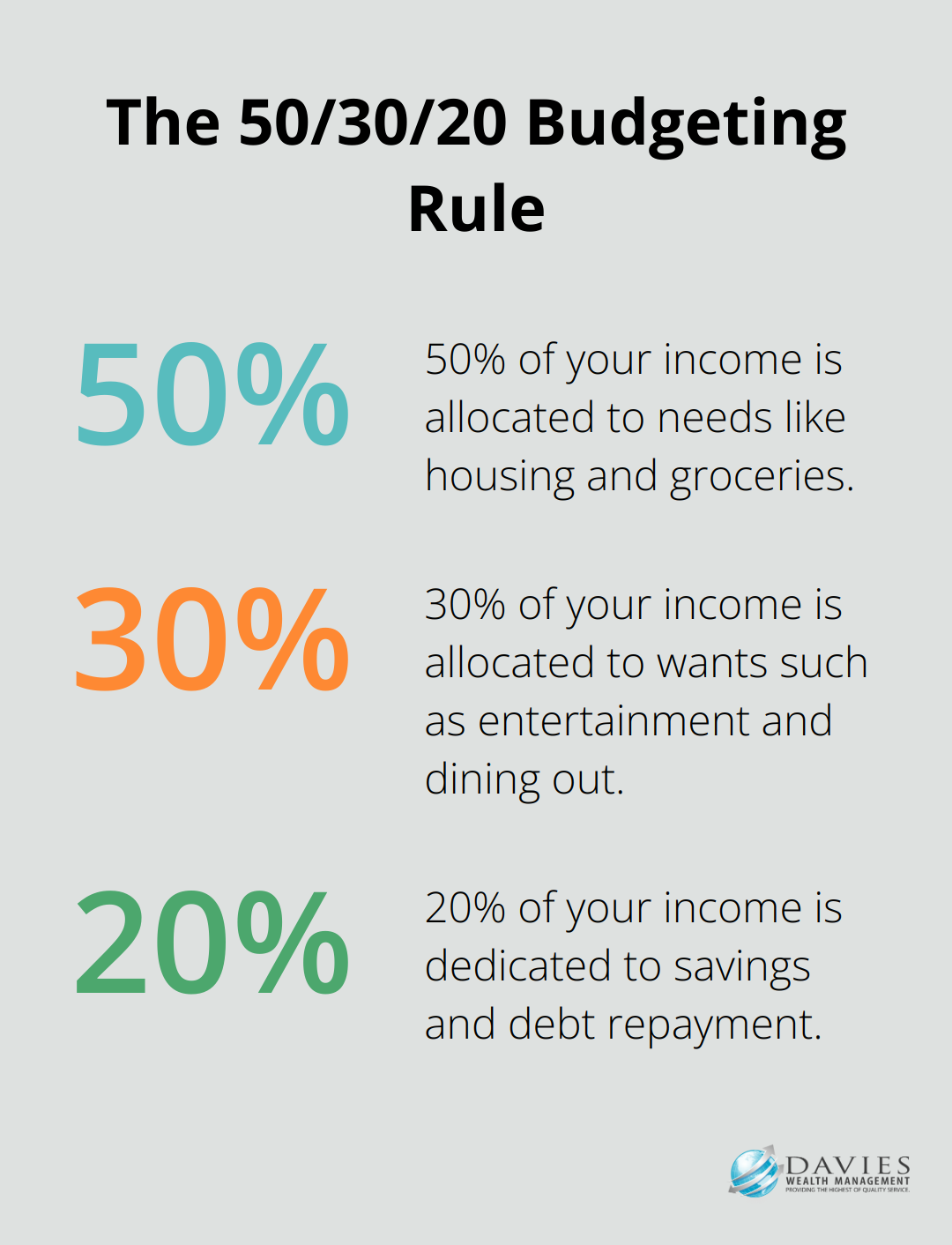

Implement the 50/30/20 Budgeting Rule

To optimize your savings, consider adopting the 50/30/20 budgeting rule. This approach allocates 50% of your income for needs, 30% for wants, and 20% to savings and debt paydown. Following this rule ensures that a significant portion of your income is dedicated to building your financial future.

For instance, if your monthly income is $5,000, you’d allocate $2,500 to needs (like housing and groceries), $1,500 to wants (like entertainment and dining out), and $1,000 to savings and debt repayment. This structured approach can help you maintain a balanced financial life while consistently progressing towards your savings goals.

Explore Additional Income Streams

Boosting your income can significantly accelerate your savings progress. Consider freelancing, starting a side business, or monetizing a hobby. The gig economy has opened up numerous opportunities for supplemental income.

Even a modest additional income can have a substantial impact on your savings. If you earn an extra $500 per month and commit it entirely to savings, you’ll add $6,000 to your annual savings. Over five years, this could amount to $30,000 (not including compound interest).

Review and Adjust Your Strategy

Your savings plan should evolve as your financial situation changes. Try to review your savings plan quarterly to ensure it aligns with your current circumstances and goals. This regular assessment allows you to make necessary adjustments, capitalize on new opportunities, and stay on track towards your financial objectives.

Final Thoughts

A well-structured finance savings plan forms the foundation of financial success. You set yourself up for a secure future when you assess your situation, set clear goals, and implement effective savings strategies. Your future self will appreciate the financial discipline you practice today, as even small amounts can grow significantly through compound interest.

We encourage you to take action and start your savings journey now. Calculate your net worth, track your expenses, and identify areas to cut back. Set SMART financial goals that align with your aspirations and create a realistic plan to achieve them (leverage high-yield savings accounts and automate your savings to accelerate your progress).

At Davies Wealth Management, we commit to helping individuals and families achieve their financial objectives. Our team of experts can provide personalized guidance for your finance savings plan. We support you every step of the way, whether you’re a professional athlete with complex financial needs or an individual seeking long-term financial security.

Leave a Reply