At Davies Wealth Management, we understand that comprehensive financial planning is the cornerstone of a secure financial future. It’s a roadmap that guides you through life’s financial journey, helping you navigate challenges and seize opportunities.

Creating a comprehensive financial plan may seem daunting, but it’s an essential step towards achieving your financial goals. In this guide, we’ll break down the process into manageable steps, empowering you to take control of your financial destiny.

Where Do You Stand Financially?

Net Worth: Your Financial Snapshot

Understanding your current financial position is the first step in creating a comprehensive financial plan. This process involves a thorough examination of your assets, liabilities, income, expenses, and existing financial strategies.

Your net worth provides a snapshot of your financial health at a given moment. To calculate your net worth, list all your assets (savings, investments, property) and subtract your liabilities (mortgages, loans, credit card debt). This figure gives you a clear picture of where you stand financially and helps identify areas for improvement.

Income and Expenses: The Foundation of Your Financial Plan

Understanding your cash flow is essential for effective financial planning. Start by tracking all sources of income, including salary, investments, and any side hustles. Next, categorize your expenses into fixed (rent, utilities) and variable (entertainment, dining out) costs. This analysis reveals spending patterns and potential areas for cost-cutting or saving.

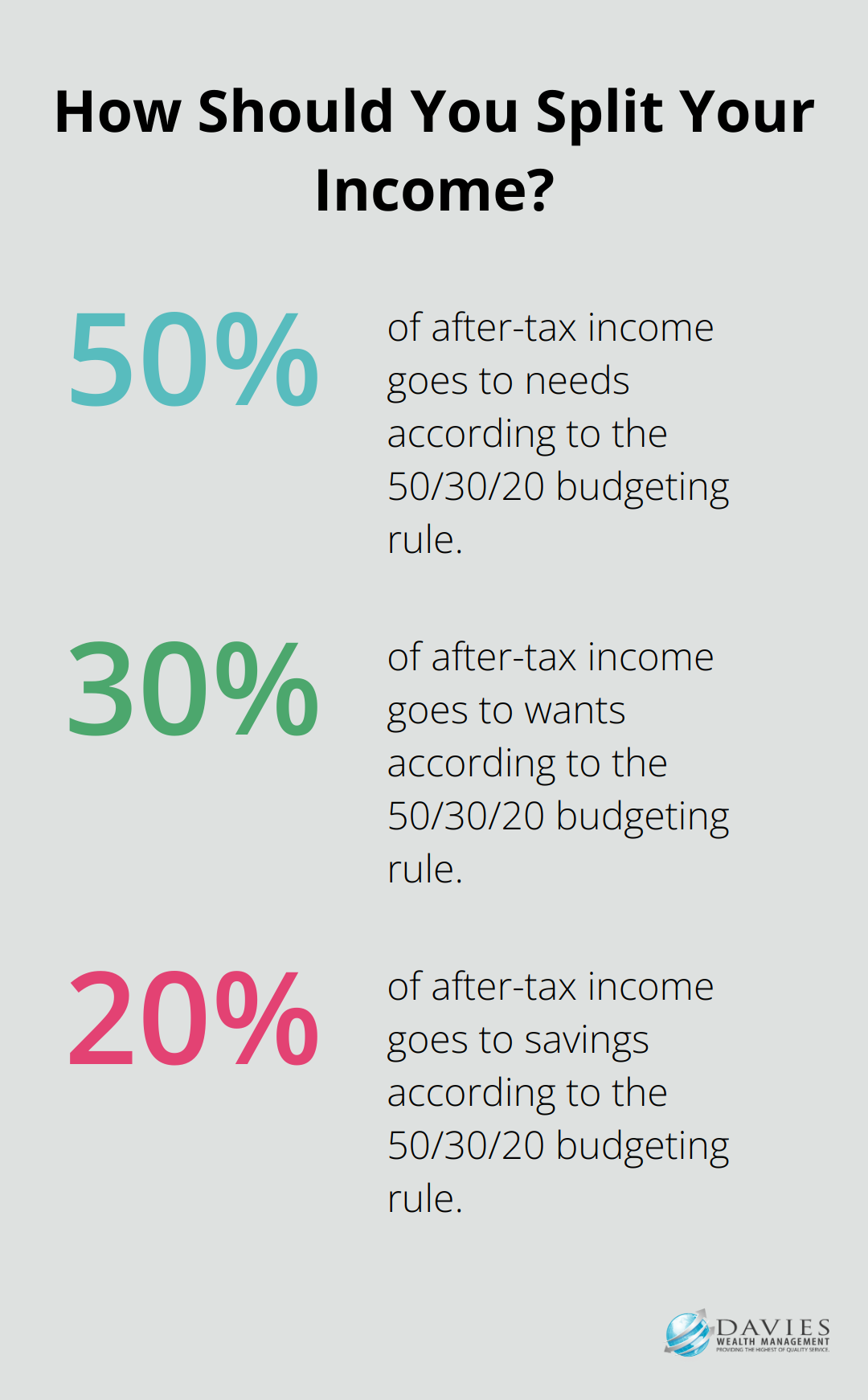

A useful tool for this process is the 50/30/20 rule. This rule involves splitting your after-tax income into three categories: 50% goes to needs, 30% goes to wants, and 20% goes to savings. This simple framework can guide your budgeting decisions and help prioritize your financial goals.

Investments and Debts: Balancing Growth and Obligations

Evaluate your existing investments to ensure they align with your risk tolerance and financial objectives. Consider factors such as diversification, fees, and performance. Portfolio analysis is a quantitative technique used to determine the specific characteristics of an investment portfolio. If you’re unsure about your investment strategy, consulting with a financial advisor can provide valuable insights and recommendations.

Simultaneously, assess your debts. Focus on high-interest debts first, as they can significantly impede your financial progress. Create a debt repayment plan that balances aggressive debt reduction with other financial priorities.

Insurance Coverage: Protecting Your Financial Future

Adequate insurance coverage is a critical component of a solid financial plan. Review your existing policies, including health, life, disability, and property insurance. Ensure they provide sufficient coverage for your current life stage and financial situation. Insurance needs change over time, so regular reviews are essential.

For professional athletes and high-net-worth individuals, specialized insurance products may be necessary to protect against unique risks. Personal professional sports insurance policies protect an athlete’s future income in the event of a career-ending injury or illness. A qualified financial advisor can help you navigate these complex insurance needs and ensure comprehensive protection for your assets and income.

A thorough assessment of these key areas of your financial life will equip you with a clear understanding of your current position. This foundation is essential for setting realistic, achievable financial goals. In the next section, we’ll explore how to define and prioritize these goals to create a roadmap for your financial future.

What Are Your Financial Goals?

Short-Term vs. Long-Term Goals

At Davies Wealth Management, we believe that setting clear financial goals forms the foundation of a successful financial plan. Without well-defined objectives, you might lose focus and make decisions that don’t align with your long-term aspirations.

Financial goals typically fall into two categories: short-term and long-term. Short-term goals might include saving for a vacation, building an emergency fund, or paying off credit card debt (objectives you aim to achieve within the next one to three years). Long-term goals could involve saving for retirement, funding your children’s education, or purchasing a home (these goals usually have a timeline of five years or more).

When you set your goals, it’s essential to strike a balance between short-term and long-term objectives. While it’s tempting to focus solely on immediate needs, neglecting long-term planning can leave you unprepared for major life events or retirement.

Prioritizing Your Financial Objectives

Once you identify your goals, the next step is to prioritize them. This process involves assessing the importance and urgency of each objective. For example, building an emergency fund might take precedence over saving for a luxury vacation. Similarly, if you’re in your 20s or 30s, starting to save for retirement should be a high priority due to the power of compound interest.

A useful technique for prioritizing goals is to create a matrix with two axes: importance and urgency. Goals that are both important and urgent should be your top priorities, while those that are less important and less urgent can be addressed later.

Creating SMART Financial Goals

To increase the likelihood of achieving your financial objectives, we recommend using the SMART framework. SMART stands for Specific, Measurable, Achievable, Realistic, and Timely. Let’s break this down:

Specific: Instead of saying “I want to save more,” a specific goal would be “I want to save $10,000 for a down payment on a house.”

Measurable: Your goal should have a clear metric for success. In the example above, the $10,000 target is easily measurable.

Achievable: While it’s good to challenge yourself, your goals should be realistic given your current financial situation. If you’re earning $50,000 a year, saving $100,000 in one year might not be achievable.

Relevant: Your goals should align with your overall life plans and values. If homeownership isn’t a priority for you, saving for a down payment might not be a relevant goal.

Time-bound: Set a deadline for your goal. For example, “I want to save $10,000 for a down payment on a house within two years.”

The SMART framework creates a clear roadmap for success. This clarity makes it easier to track progress and stay motivated.

Aligning Goals with Personal Values

Financial goals are deeply personal and should reflect your unique values and lifestyle. For instance, if environmental sustainability is important to you, your investment goals might include allocating a portion of your portfolio to green energy companies or ESG (Environmental, Social, and Governance) funds.

Similarly, if you value experiences over material possessions, your financial plan might prioritize saving for travel or learning new skills rather than accumulating assets. The key is to ensure that your financial goals harmonize with what truly matters to you.

For professional athletes, goal-setting often involves planning for a potentially short career span and managing irregular income streams. We work closely with these clients to develop strategies that balance immediate financial needs with long-term security, including post-career planning.

Setting clear, well-defined financial goals is a vital step in creating a comprehensive financial plan. These goals serve as the North Star for all your financial decisions, helping you stay focused and motivated on your journey to financial success. Now that you’ve established your goals, it’s time to explore strategies to help you achieve them effectively.

How to Turn Your Financial Goals into Reality

Build a Robust Budget and Savings Plan

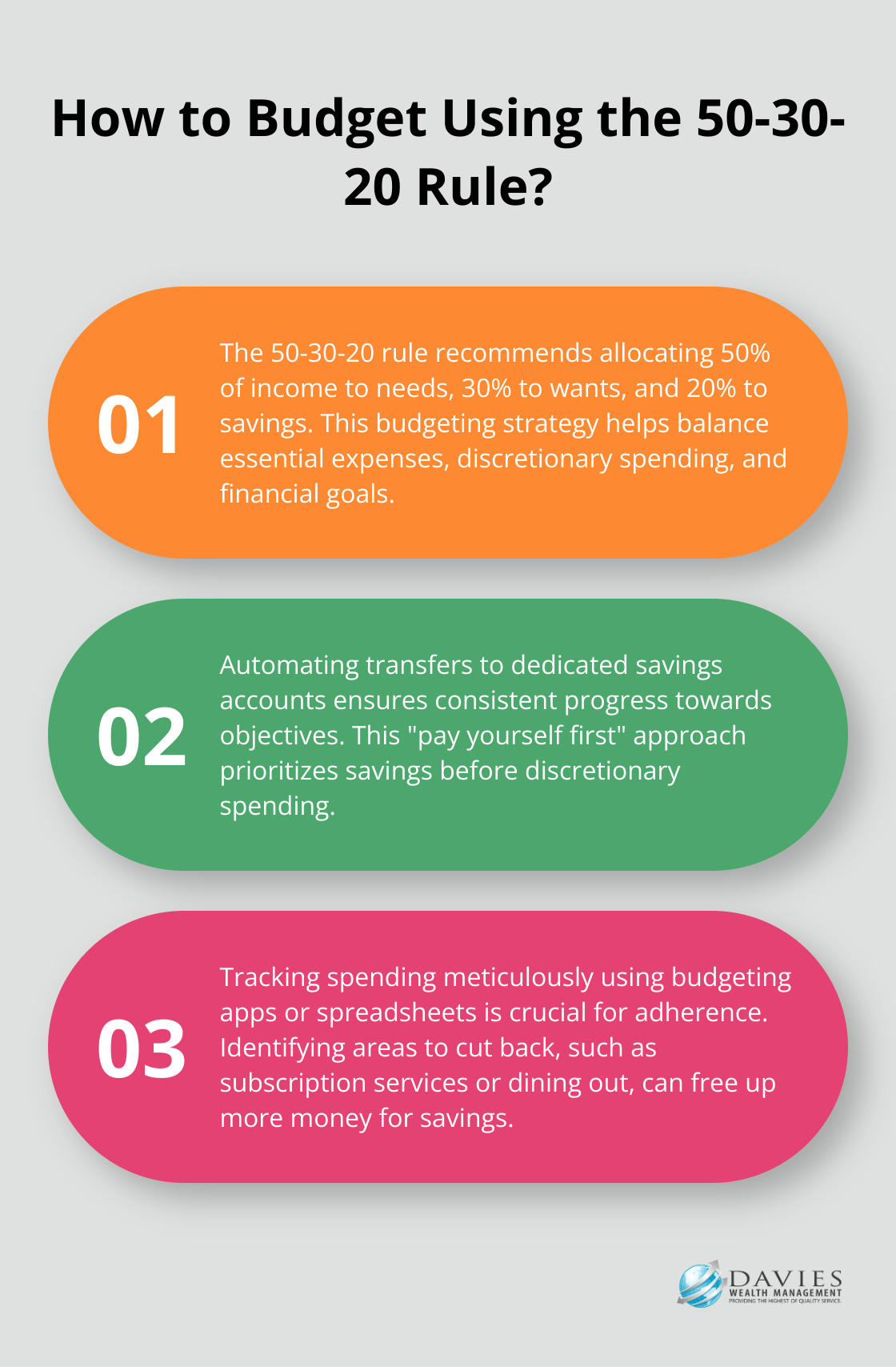

The foundation of any successful financial strategy is a well-structured budget. Start by identifying your short-term and long-term financial objectives. The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. Use budgeting apps or spreadsheets to track your spending meticulously.

For savings, consider automating transfers to dedicated accounts for each of your financial goals. This “pay yourself first” approach ensures you consistently work towards your objectives. If you struggle to find room in your budget for savings, look for areas to cut back (such as subscription services or dining out).

Craft a Diversified Investment Strategy

Investing is essential for long-term wealth building. A diversification strategy is designed to help your investment portfolio generate more consistent returns over time and protect against market risks. Consider a mix of stocks, bonds, real estate, and alternative investments based on your risk tolerance and time horizon.

For those new to investing, low-cost index funds or ETFs can provide broad market exposure. More experienced investors might consider individual stocks or actively managed funds. Your investment strategy should align with your specific goals and risk profile.

Tackle Debt and Boost Your Credit Score

High-interest debt can derail your financial plans. Prioritize paying off credit card balances and personal loans. Consider the debt avalanche method (focusing on high-interest debts first) or the debt snowball method if you need psychological wins to stay motivated.

Improving your credit score can lead to better loan terms and lower interest rates. Pay bills on time, keep credit utilization below 30%, and regularly check your credit report for errors. A good credit score can save you thousands over your lifetime.

Secure Your Financial Future

An emergency fund can be used for large or small unplanned bills or payments that are not part of your routine monthly expenses and spending. Try to save 3-6 months of living expenses in a readily accessible account. This fund can prevent you from derailing your long-term plans when unexpected expenses arise.

For retirement planning, take full advantage of tax-advantaged accounts like 401(k)s and IRAs. If you’re a high-income earner or have maxed out traditional retirement accounts, consider a backdoor Roth IRA or other advanced strategies.

Tax efficiency is important for wealth preservation. Strategies like tax-loss harvesting, utilizing municipal bonds in taxable accounts, and strategic charitable giving can help minimize your tax burden. Always consult with a tax professional to ensure compliance with current laws.

Estate planning isn’t just for the wealthy. At minimum, have a will, power of attorney, and healthcare directive in place. For more complex situations, trusts can offer additional control and potential tax benefits.

Financial planning is an ongoing process. Regularly review and adjust your strategies as your life circumstances and goals evolve. With dedication and the right guidance, you can turn your financial aspirations into reality.

Final Thoughts

Creating a comprehensive financial plan empowers you to secure your financial future. You will assess your current situation, set clear goals, and develop strategies to achieve them. This process lays the groundwork for long-term financial success and requires regular review as your life circumstances change.

Comprehensive financial planning covers various aspects of your financial life, from budgeting and saving to investing and protecting your assets. It involves making informed decisions that align with your values and long-term objectives. While you can create a financial plan independently, a professional financial advisor can provide valuable expertise and personalized guidance.

At Davies Wealth Management, we specialize in comprehensive financial planning tailored to your unique needs and goals. Our team of experts can help you navigate complex financial decisions and optimize your investment strategy. We encourage you to take control of your financial future and start creating your comprehensive financial plan today.

Leave a Reply