Digital assets have created new legal challenges that traditional lawyers often struggle to navigate. The cryptocurrency market reached $2.3 trillion in 2021, yet many investors lack proper legal guidance.

We at Davies Wealth Management see clients facing regulatory issues, tax complications, and compliance problems daily. Finding the right digital assets lawyer can protect your investments and prevent costly mistakes.

What Digital Assets Need Legal Protection

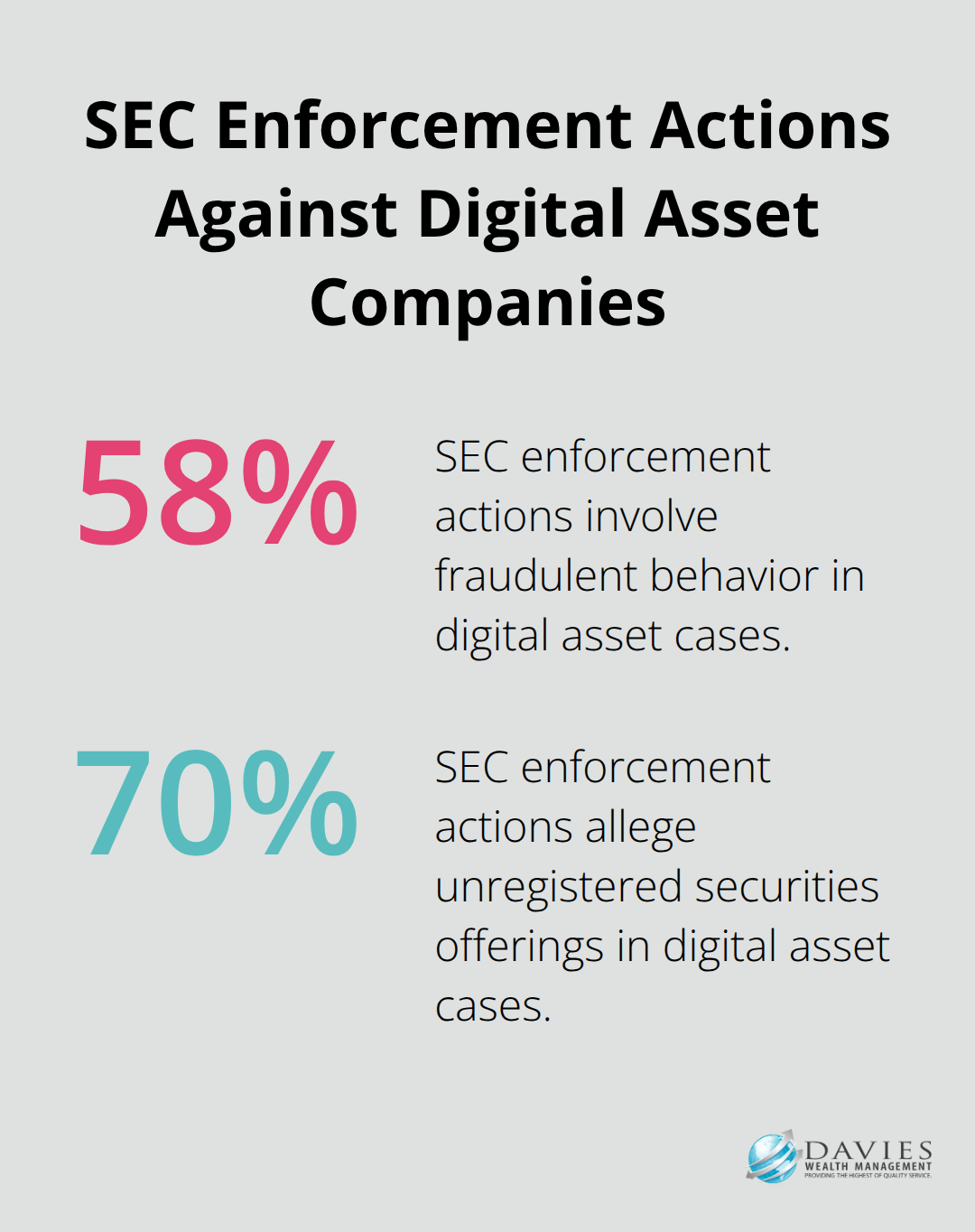

Digital assets span far beyond Bitcoin and Ethereum. Cryptocurrency holdings, NFTs, tokenized real estate, digital collectibles, and blockchain-based intellectual property all require specialized legal expertise. The SEC has filed enforcement actions against digital asset companies since 2013, with 58% involving fraudulent behavior and 70% alleging unregistered securities offerings. Smart contracts, decentralized finance protocols, and digital art marketplaces face unique regulatory challenges that traditional corporate lawyers cannot handle effectively.

Cryptocurrency Compliance Requirements

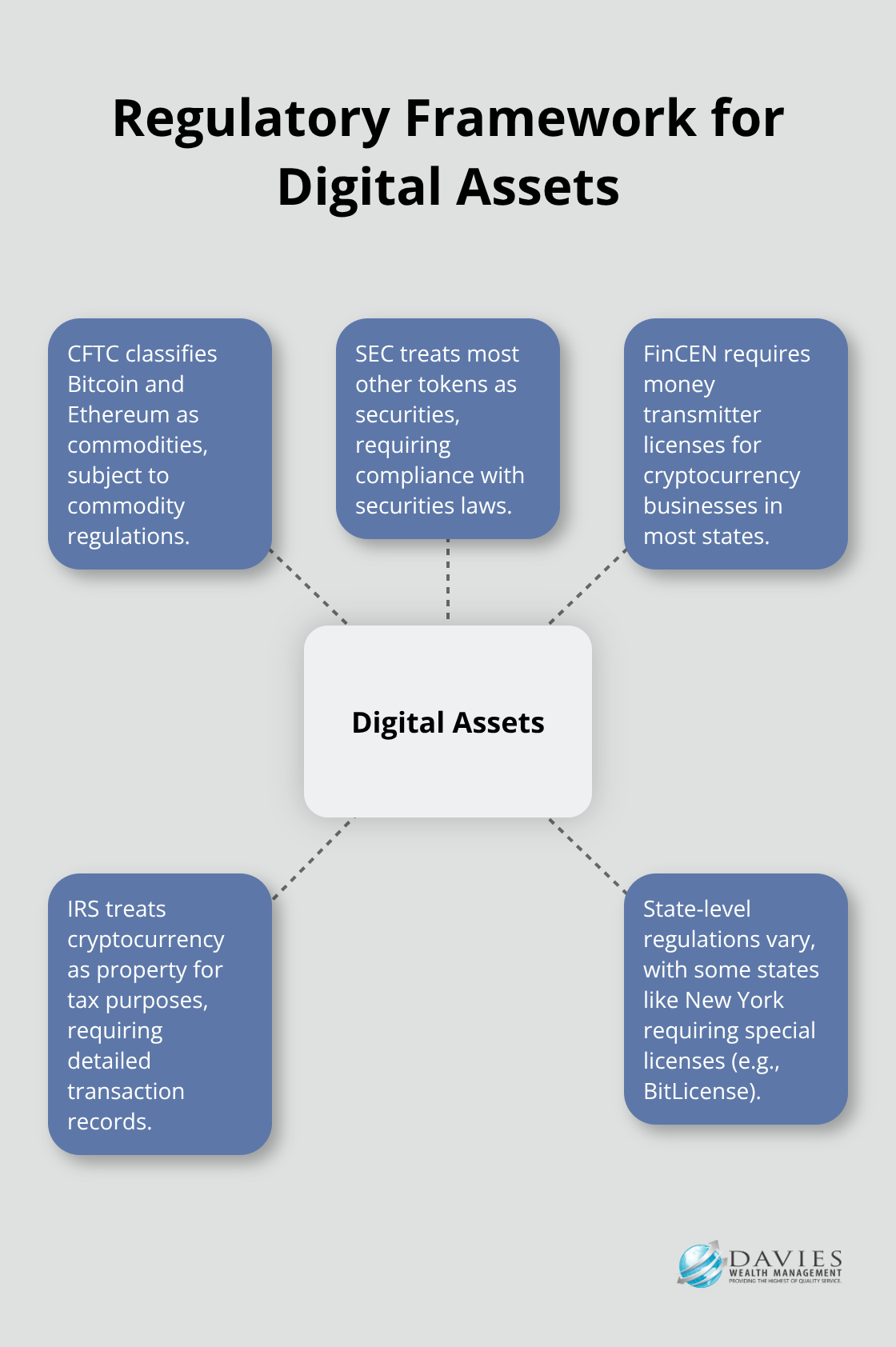

The Howey Test determines whether digital assets qualify as securities, which creates massive compliance burdens for token issuers. FinCEN requires money transmitter licenses for cryptocurrency businesses in most states, with penalties that reach $1.2 million for violations. Tax obligations under IRS Notice 2014-21 treat cryptocurrency as property, which requires detailed transaction records for capital gains calculations. Clients face audits because they failed to report DeFi yield income or NFT sales properly.

NFT and Smart Contract Legal Risks

NFT creators face copyright lawsuits when they use unauthorized content, with damages that average $150,000 per violation. Smart contract vulnerabilities have caused significant financial losses, which makes legal review mandatory before deployment. Platform terms of service often conflict with NFT ownership rights, which creates disputes over royalty payments and resale restrictions. Legal documentation must address intellectual property rights, platform dependencies, and dispute resolution mechanisms (protecting both creators and buyers).

Regulatory Framework Complexity

The CFTC classifies Bitcoin and Ethereum as commodities, while the SEC treats most other tokens as securities. This creates conflicting jurisdictional requirements that change based on token functionality and distribution methods. Anti-money laundering compliance requires Know Your Customer procedures for exchanges and wallet providers, with violations that result in criminal charges. State-level regulations vary dramatically, with New York’s BitLicense requiring entities to apply for either a BitLicense or charter under New York Banking Law.

These complex legal requirements make it essential to identify lawyers who understand the specific qualifications needed for digital asset representation.

What Qualifications Should Your Digital Assets Lawyer Have

The right digital assets lawyer must possess specific technical knowledge that goes beyond traditional legal education. Look for attorneys who understand blockchain protocols, smart contract architecture, and cryptocurrency operations. Latham & Watkins earned Band 1 rankings in Chambers FinTech 2024 for blockchain expertise, while firms like Davis Polk & Wardwell and Goodwin demonstrate the specialized focus required. Your lawyer should explain complex concepts like hash functions, consensus mechanisms, and token economics without technical jargon. They must understand how decentralized autonomous organizations operate and the legal implications of immutable blockchain transactions.

Securities Law Mastery

Securities expertise separates competent digital assets lawyers from generalists who dabble in cryptocurrency law. The SEC has classified most digital tokens as securities, which triggers extensive compliance requirements under the Securities Act of 1933 and Securities Exchange Act of 1934. Your attorney must navigate the Howey Test analysis with precision and understand how token distribution methods, marketing strategies, and utility functions affect securities classification. They should have experience with Regulation D exemptions, Form S-1 registrations, and no-action letter requests. Firms like Perkins Coie and Sidley Austin have successfully guided clients through SEC investigations and enforcement actions.

Proven Track Record in Digital Asset Cases

Experience with real digital asset cases matters more than theoretical knowledge. Your lawyer should provide specific examples of clients they have represented in SEC enforcement actions, CFTC investigations, or criminal defense matters. They must understand money transmission regulations across all 50 states and have experience with BitLicenses or similar regulatory approvals. Look for attorneys who have structured compliant token offerings, defended against fraud allegations, or handled cryptocurrency exchange licenses. The best lawyers maintain relationships with regulators at FinCEN, the Treasury Department, and state authorities (which proves invaluable during complex negotiations).

Regulatory Expertise Across Jurisdictions

Digital assets operate across multiple regulatory frameworks that require specialized knowledge. Your attorney must understand how the CFTC treats Bitcoin and Ethereum as commodities while the SEC classifies most other tokens as securities. They should navigate state-level variations in cryptocurrency regulations and help you comply with anti-money laundering requirements. The lawyer must understand how different token functionalities affect regulatory classification and compliance obligations (particularly for DeFi protocols and yield programs).

These qualifications form the foundation for effective legal representation, but you also need to ask the right questions to evaluate potential attorneys properly.

What Questions Should You Ask Potential Digital Assets Lawyers

Ask specific questions about their experience with cases similar to yours rather than accept vague claims about cryptocurrency expertise. Demand concrete examples of SEC enforcement defenses, CFTC investigations, or criminal cryptocurrency cases they have handled. Request client references from token issuers, cryptocurrency exchanges, or NFT platforms they have represented. The lawyer should provide specific case outcomes, settlement amounts, or regulatory approvals they have achieved. Paul Hastings LLP and White & Case LLP maintain strong client bases in digital asset transactions, which demonstrates the type of specialized experience you need.

Regulatory Relationships and Experience

Ask about their relationships with regulators at FinCEN, the Treasury Department, and state authorities. These connections prove invaluable during complex negotiations or enforcement proceedings. Request details about their experience with specific regulatory processes like SEC no-action letters, money transmitter licenses, or BitLicense applications. The attorney should explain how they have navigated regulatory challenges for previous clients and what outcomes they achieved. Strong regulatory relationships often determine the success of complex compliance matters.

Fee Structures and Payment Terms

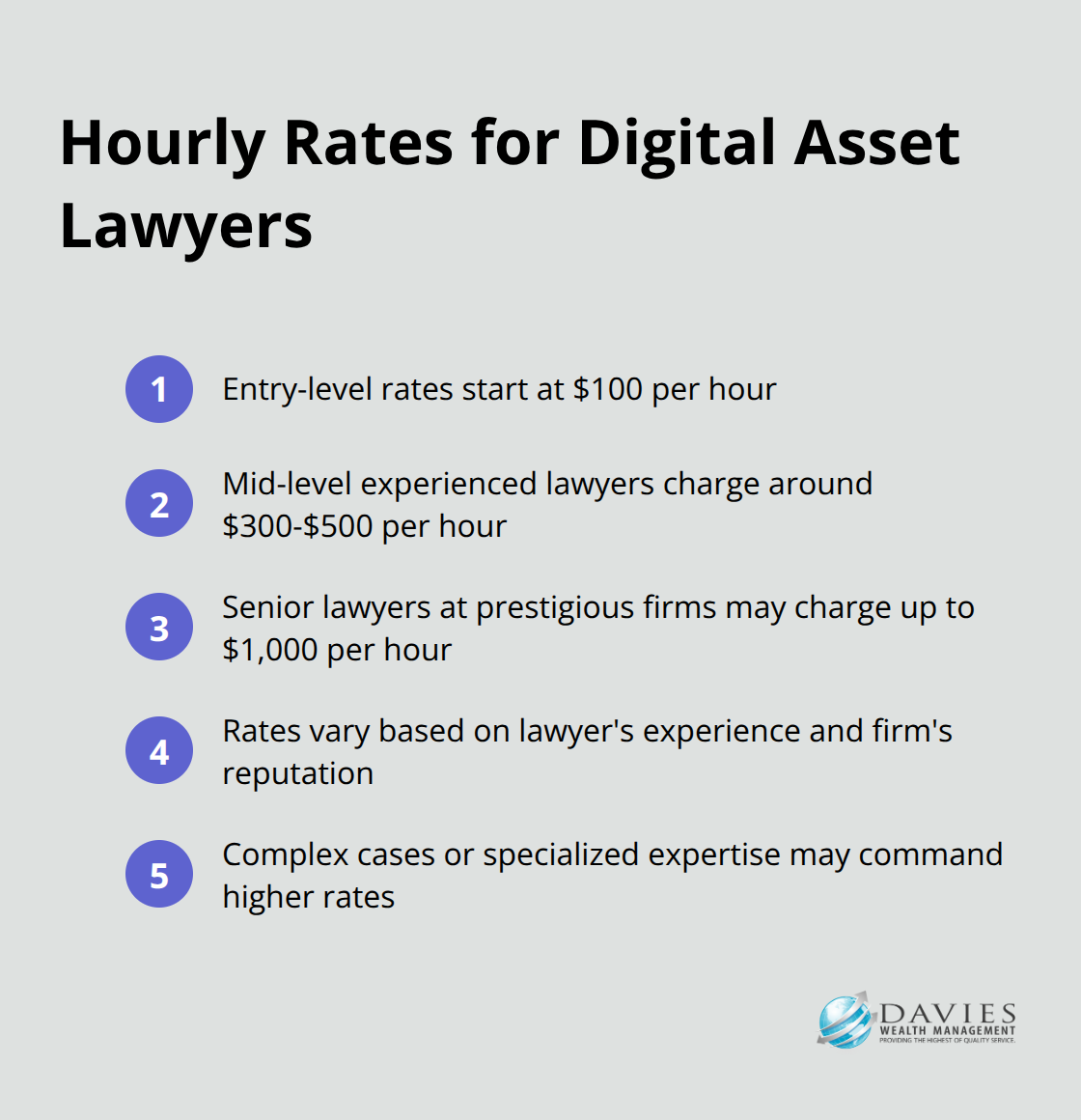

Most digital asset lawyers charge hourly rates between $100 to $1,000 depending on their experience level and firm prestige. Avoid lawyers who demand cryptocurrency payments or promise contingency arrangements for regulatory matters (as these arrangements create ethical conflicts and compliance issues). Request detailed fee estimates for specific services like SEC no-action letters, which typically cost $50,000 to $150,000, or money transmitter license applications that range from $500 to over $5,000 per state. Ask about monthly retainer requirements and whether they offer fixed-fee arrangements for routine compliance work. The best lawyers provide transparent practices with detailed time entries and regular invoices.

Communication Standards and Response Times

Establish clear communication expectations before you hire any digital assets lawyer. Regulatory deadlines in cryptocurrency matters often require rapid responses within 24 to 48 hours, particularly during SEC investigations or CFTC enforcement actions. Ask about their typical response time for urgent matters and whether they provide direct access to senior attorneys rather than junior associates. Request their preferred communication methods and availability during market volatility or regulatory announcements that affect your business operations. The lawyer should explain complex regulatory concepts in plain English without excessive technical jargon that obscures important legal implications (which helps you make informed decisions about your digital asset strategy).

Final Thoughts

The right digital assets lawyer must demonstrate blockchain expertise, securities law mastery, and a proven track record with cryptocurrency cases. They should understand complex regulatory frameworks across multiple jurisdictions and maintain strong relationships with agencies like the SEC and CFTC. Their experience must include specific cases with token offerings, exchange licenses, and enforcement defense rather than general corporate law practice.

Technical knowledge separates qualified digital assets lawyers from traditional attorneys who lack cryptocurrency specialization. The lawyer should explain blockchain protocols, smart contract vulnerabilities, and regulatory compliance requirements without confusing jargon. Their fee structure must remain transparent with realistic estimates for services like SEC no-action letters or money transmitter applications.

Communication standards matter significantly during regulatory investigations or market volatility when rapid responses become necessary. The attorney should provide direct access to senior lawyers rather than junior associates for complex digital asset matters. We at Davies Wealth Management help clients navigate the intersection of traditional finance and emerging digital assets while maintaining regulatory compliance (and our comprehensive wealth management solutions support your investment strategies across all asset classes).

Leave a Reply