Navigating the world of financial professionals can be confusing, especially when it comes to understanding the difference between financial advisors and wealth managers. At Davies Wealth Management, we often encounter clients who are unsure which type of expert best suits their needs.

This guide will clarify the roles, services, and target clientele of both financial advisors and wealth managers, helping you make an informed decision about your financial future.

What Does a Financial Advisor Do?

Services Offered by Financial Advisors

Financial advisors offer a wide range of services to help individuals and families manage their money and achieve their financial goals. These professionals provide investment management, retirement planning, and general financial guidance. They assist clients in creating budgets, saving for major purchases, and developing strategies for debt reduction. Many advisors also offer insurance planning, tax optimization, and basic estate planning services.

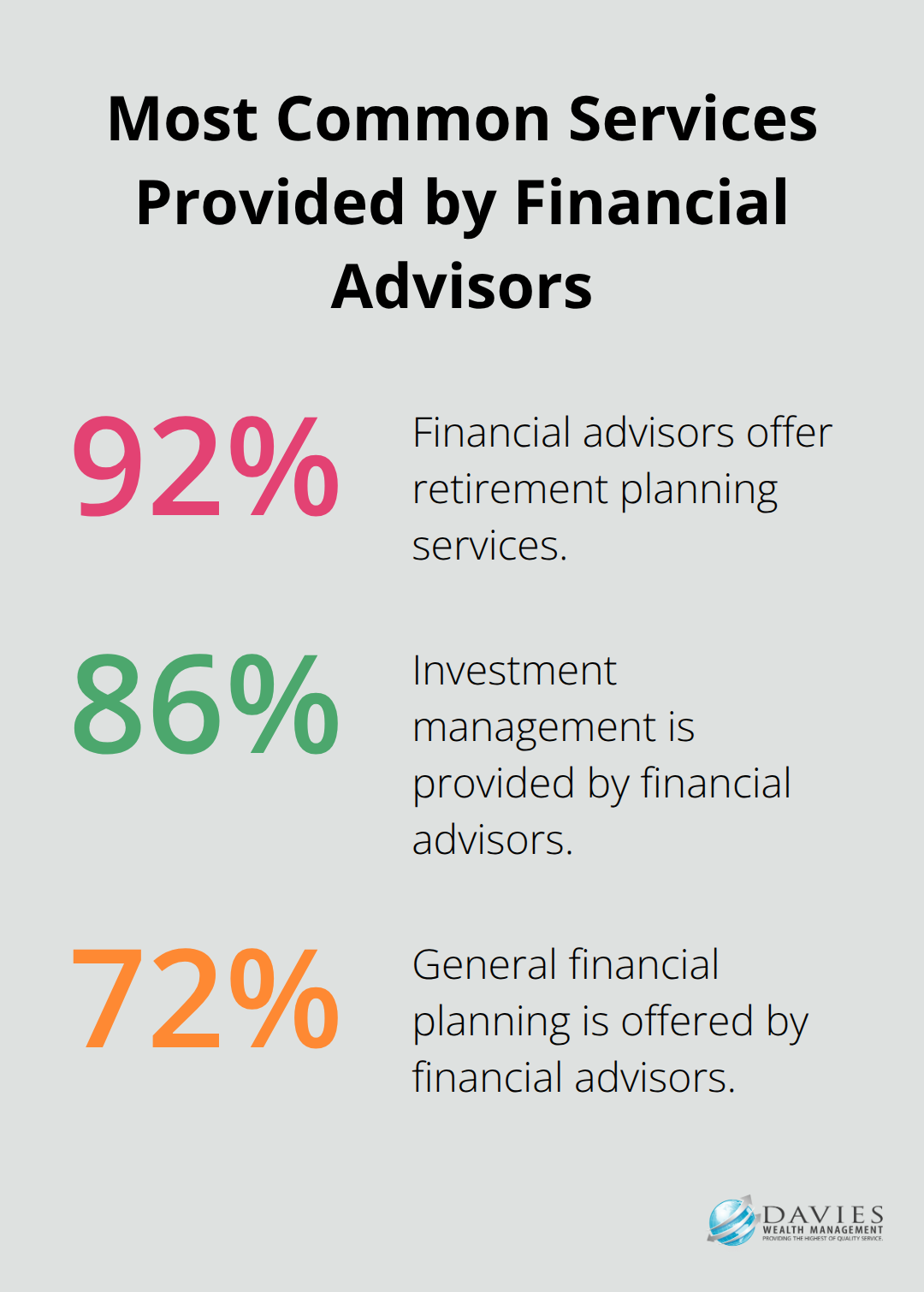

A 2022 survey by the Financial Planning Association revealed that the most common services provided by financial advisors include retirement planning (92%), investment management (86%), and general financial planning (72%).

Target Clientele for Financial Advisors

Financial advisors serve a broad spectrum of clients, from young professionals starting their careers to retirees looking to preserve their wealth.

It’s worth noting that many financial advisors now offer services to clients with lower asset levels, recognizing the growing need for financial guidance across all income brackets.

Qualifications and Licensing

To practice as a financial advisor, individuals must obtain specific licenses and certifications. The most common include the Series 7 and Series 66 licenses, which allow advisors to sell securities and provide investment advice.

Many advisors pursue additional certifications to enhance their expertise. The Certified Financial Planner (CFP) designation stands out as the gold standard in the industry. To obtain this certification, individuals must complete a CFP Board Registered Education Program, pass the CFP® Exam, hold or earn a 4-year degree, and demonstrate financial planning experience.

Ongoing Education and Professional Development

The financial industry constantly evolves, and advisors must stay current with new regulations, investment products, and economic trends. Many firms (including Davies Wealth Management) emphasize the importance of continuous learning and professional development for their advisors.

This commitment to ongoing education ensures that clients receive up-to-date and comprehensive financial guidance. Advisors often attend conferences, participate in workshops, and complete additional certifications to expand their knowledge and skills.

As we move forward, it’s important to understand how wealth management differs from traditional financial advisory services. The next section will explore the role of wealth managers and the comprehensive services they provide to high-net-worth individuals and families.

What Is Wealth Management?

The Scope of Wealth Management

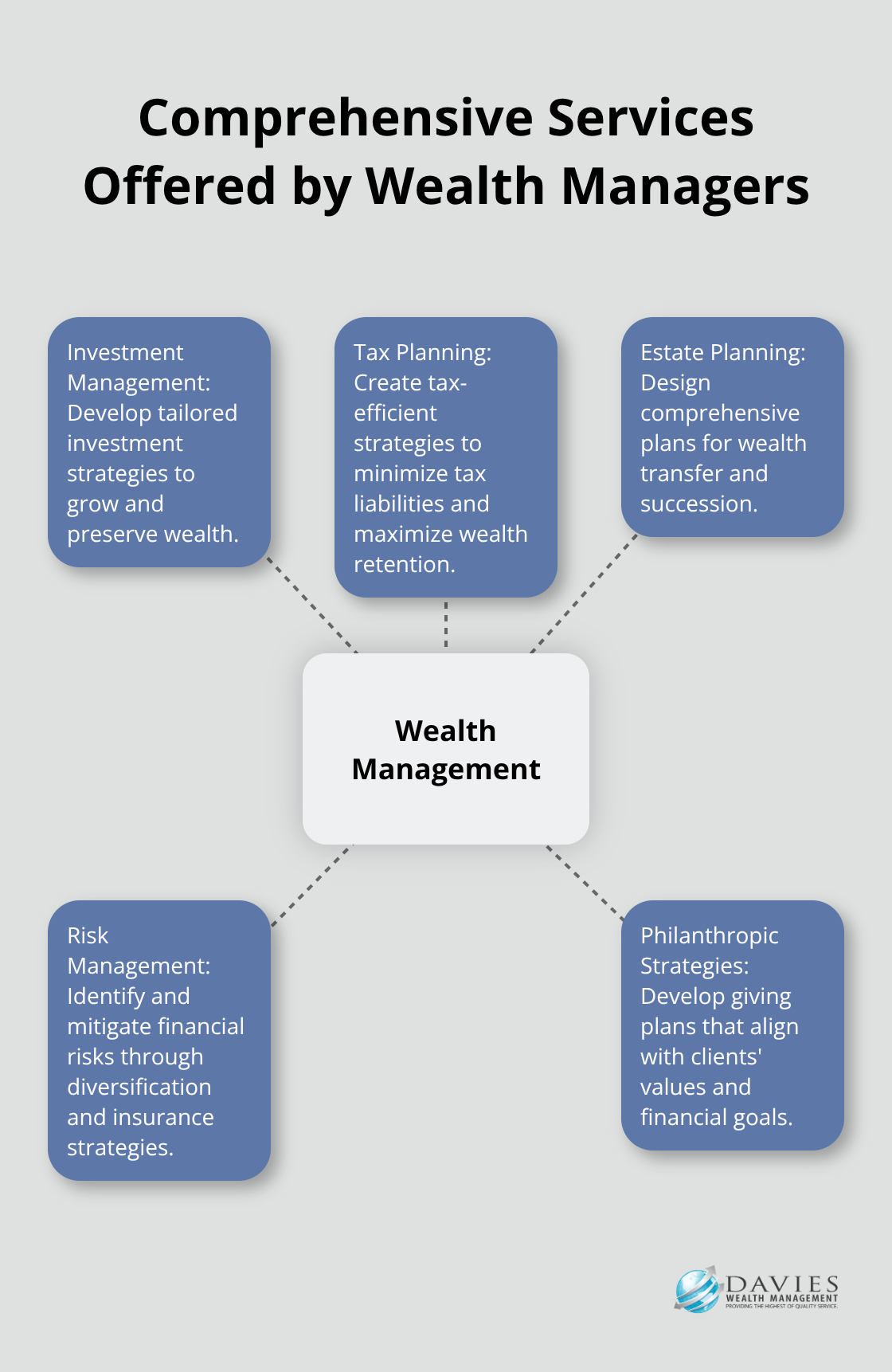

Wealth management is an investment advisory service that uses financial services to address the needs of affluent clients. It encompasses a wide range of financial services, including investment management, tax planning, estate planning, risk management, and philanthropic strategies. A report by Cerulli Associates projects the global wealth management market to reach significant assets under management by 2025, highlighting the growing demand for these specialized services.

Comprehensive Services Offered

Wealth managers offer a holistic approach to financial planning. They often coordinate with a team of experts, including tax attorneys, estate planners, and insurance specialists, to address all aspects of a client’s financial life. A wealth manager might develop a tax-efficient investment strategy, create a succession plan for a family business, and establish a charitable giving strategy that aligns with the client’s values and financial goals.

Target Clientele for Wealth Management

Wealth management services typically cater to individuals with at least $1 million in investable assets. However, some firms set higher minimums. A survey by Fidelity Investments found that the average minimum for wealth management services among their respondents was $2.5 million.

Professional athletes can benefit greatly from wealth management services. These services help athletes navigate their unique financial situations, including managing irregular income streams and planning for life after their sports careers.

Expertise and Qualifications of Wealth Managers

Wealth managers often hold advanced certifications beyond those required for financial advisors. The Chartered Financial Analyst (CFA) designation is particularly respected in the wealth management field. As of 2023, the CFA Institute reports over 170,000 CFA charterholders worldwide (demonstrating the rigorous standards of the profession).

Many wealth managers also hold the Certified Private Wealth Advisor (CPWA) certification, which focuses on the needs of high-net-worth clients. The CPWA® certification program was accredited by ANAB (ANSI National Accreditation Board) in 2022, affirming its consistent standards.

The Value of Specialized Wealth Management

Specialized wealth management services, such as those offered by Davies Wealth Management, provide tailored solutions for unique financial situations. These services address complex financial decisions and help clients achieve their long-term financial goals. The next section will explore the key differences between financial advisors and wealth managers to help you determine which professional best suits your needs.

Financial Advisors vs Wealth Managers: Key Differences

When it comes to managing your finances, the choice between a financial advisor and a wealth manager can significantly impact your financial future. We at Davies Wealth Management understand that this decision isn’t always straightforward. Let’s break down the key differences to help you make an informed choice.

Scope of Services and Expertise

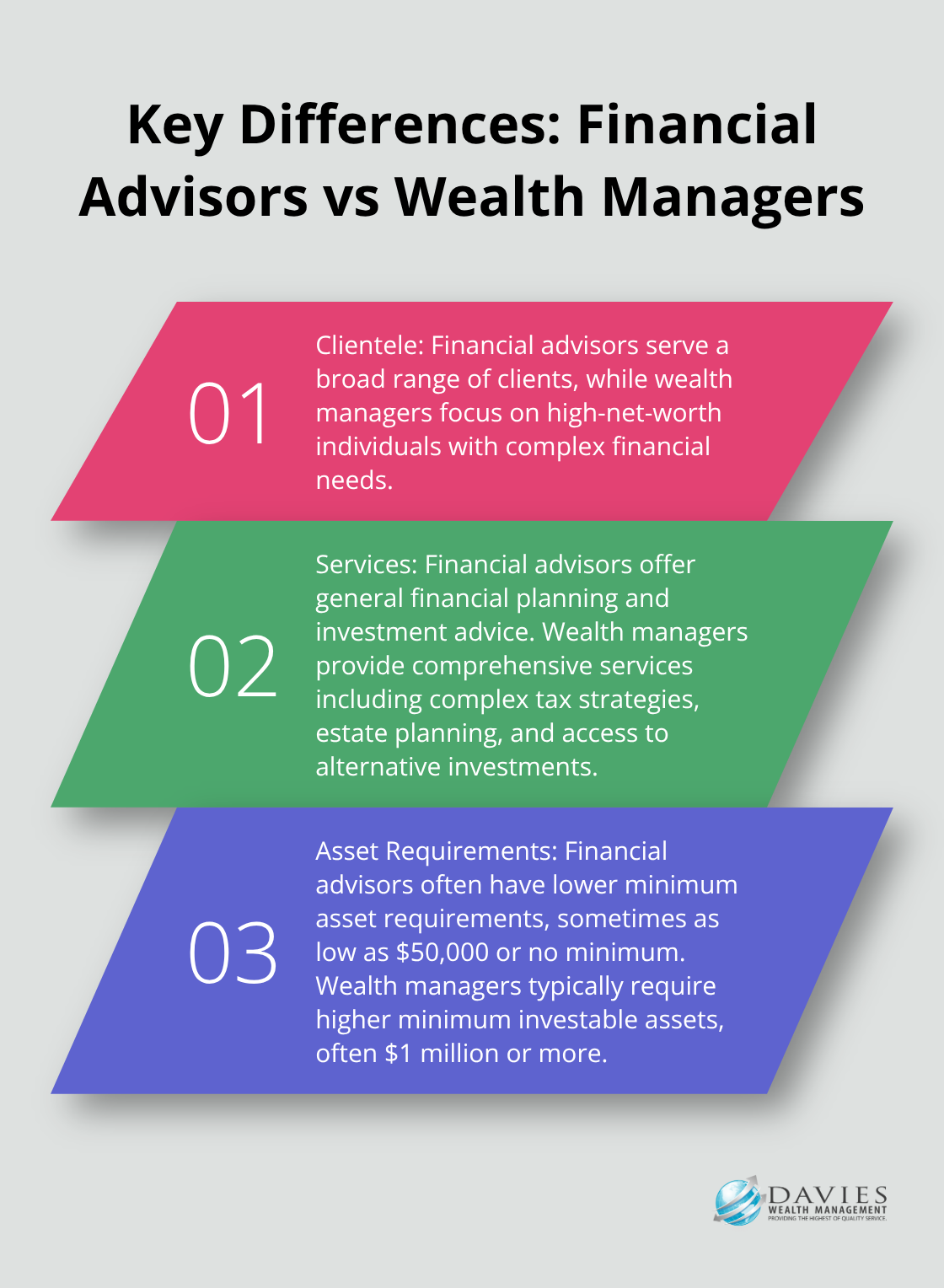

Financial advisors offer a broad range of services to a diverse clientele. They focus on fundamental financial planning, including retirement planning, investment advice, and basic tax strategies.

Wealth managers cater to high-net-worth individuals and provide a more comprehensive suite of services. They often coordinate with a team of specialists to address complex financial situations.

Investment Strategies and Asset Allocation

Financial advisors typically work with more traditional investment vehicles like mutual funds, ETFs, and individual stocks. They often follow a standardized approach to asset allocation based on risk tolerance and time horizon.

Wealth managers have access to a broader range of investment options, including alternative investments like private equity, hedge funds, and real estate. A report by McKinsey & Company showed that global private markets navigated uncertain conditions in 2024, leading to an uneven recovery across different asset classes.

Fee Structures and Compensation Models

Financial advisors often charge a percentage of assets under management (AUM), typically ranging from 0.5% to 1.5%. Some may also work on a commission basis or charge hourly rates for specific services.

Wealth managers usually employ a fee-based model, with rates often starting at 1% of AUM but decreasing for larger portfolios.

Minimum Asset Requirements

Financial advisors often have lower minimum asset requirements, sometimes as low as $50,000 or even no minimum at all. This makes their services accessible to a wider range of clients.

Wealth managers typically require higher minimum investable assets.

Personalization and Level of Attention

While financial advisors strive to provide personalized service, they often manage a larger number of clients.

Wealth managers usually maintain a smaller client base, allowing for more personalized attention.

Final Thoughts

Financial advisors and wealth managers serve different client needs. The main difference between financial advisors and wealth managers lies in their target clientele and service scope. Financial advisors typically work with a broader range of clients, offering general financial guidance and investment management. Wealth managers focus on high-net-worth individuals, providing comprehensive services including complex tax strategies and estate planning.

Your financial situation and goals determine which professional suits you best. If you have straightforward financial objectives, a financial advisor might suffice. For substantial assets or complex financial needs, a wealth manager could offer more tailored solutions. Davies Wealth Management specializes in providing customized wealth management solutions for individuals, families, and businesses.

We offer a comprehensive approach to financial planning, combining investment management, retirement planning, and tax-efficient strategies. Our team aims to help you navigate your financial journey with confidence, whether you want to build, protect, or transfer your wealth. Choosing the right financial professional marks a significant step towards securing your financial future and achieving your long-term goals.

Leave a Reply