At Davies Wealth Management, we often encounter clients grappling with the decision between wealth management and financial planning. These two services, while related, offer distinct approaches to managing your financial future.

Understanding the key differences between wealth management vs financial planning is essential for making an informed choice. In this post, we’ll break down both options to help you determine which service aligns best with your financial goals and needs.

What is Wealth Management?

Wealth management provides a more holistic approach to financial planning that extends beyond basic investment advice. This service typically caters to high-net-worth individuals with complex financial needs.

The Scope of Wealth Management

The threshold for wealth management services often starts at $20 million in investable assets, according to a 2023 report by Cerulli Associates. However, this figure can vary depending on the firm and the specific services offered. Wealth management covers a wide range of financial aspects, including investment management, tax planning, estate planning, risk management, and retirement planning.

Key Components of Wealth Management

Investment Management

Investment management forms the core of wealth management services. It involves the creation and maintenance of a diversified portfolio aligned with the client’s risk tolerance and financial goals.

Tax Planning

Tax planning is another critical component. Wealth managers work to minimize tax liabilities through various strategies.

Estate Planning

Estate planning ensures the efficient transfer of wealth to future generations or charitable causes. This includes strategies like setting up trusts, which can potentially save families millions in estate taxes.

Benefits of Comprehensive Wealth Management

The primary benefit of wealth management is the integration of various financial services under one roof. This holistic approach ensures that all aspects of a client’s financial life work in harmony towards their goals.

Wealth management provides peace of mind.

Moreover, wealth management can lead to better financial outcomes.

As we transition to our next topic, it’s important to note that while wealth management offers comprehensive financial services, financial planning provides a more focused approach to achieving specific financial goals. Let’s explore the differences between these two services in more detail.

What Is Financial Planning

Comprehensive financial planning involves multiple aspects of your finances, including taxes, investing, retirement and estate planning. Unlike wealth management, which typically caters to high-net-worth individuals, financial planning serves people at various income levels and life stages.

Setting Clear Financial Goals

The first step in financial planning involves the identification of short-term and long-term financial objectives. These might include saving for a house down payment, funding children’s education, or planning for retirement.

Creating a Comprehensive Financial Plan

A well-crafted financial plan typically includes several key components:

- Budgeting and cash flow management

- Debt reduction strategies

- Emergency fund establishment

- Retirement planning

- Investment strategy

- Insurance needs analysis

- Tax planning considerations

Each of these elements works in concert to create a holistic view of your financial situation and a clear path forward.

Implementation and Adjustment

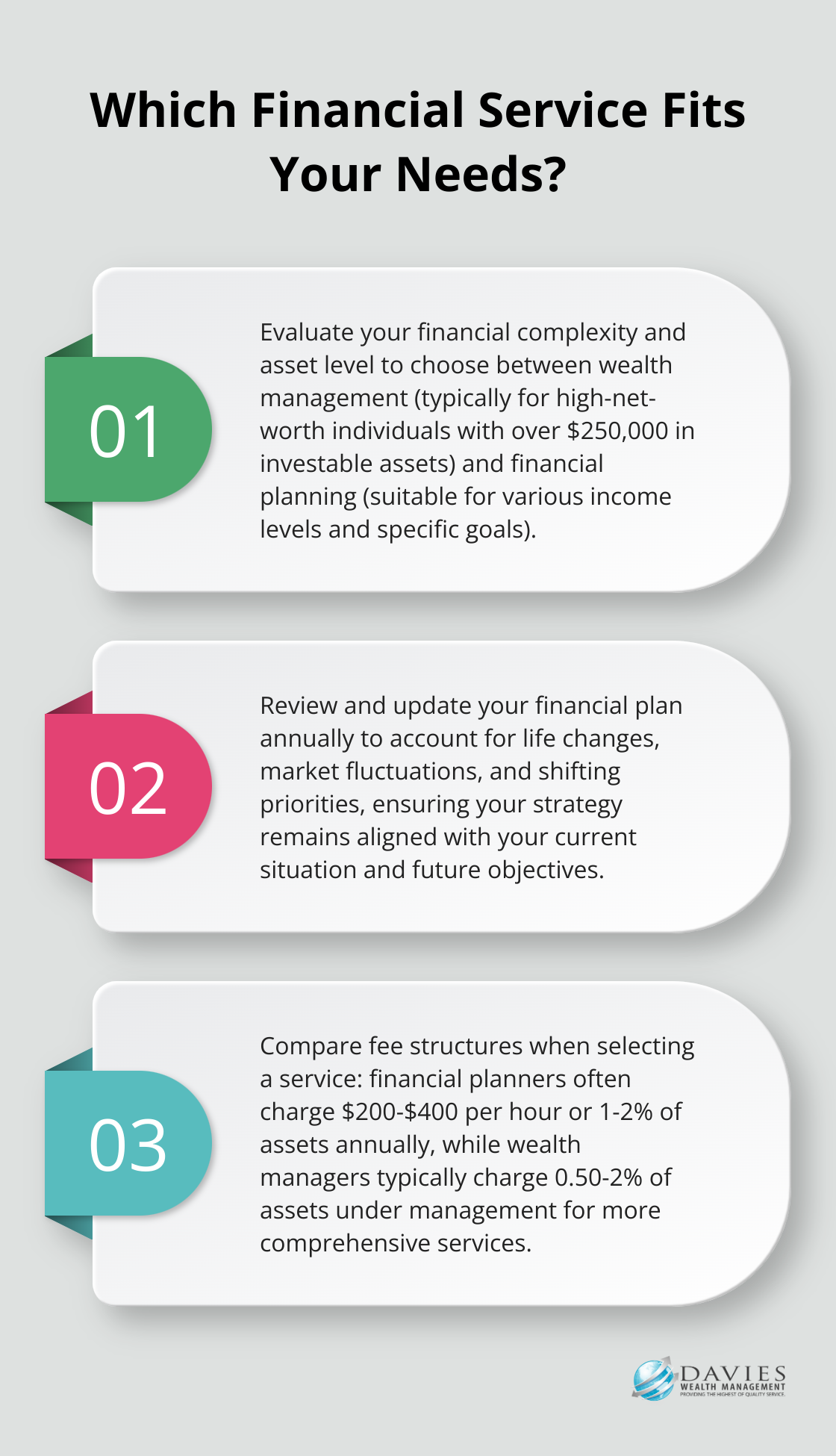

The implementation of your financial plan marks the beginning of your journey, not the end. Life changes, market fluctuations, and shifting priorities can all impact your financial plan. Most experts recommend revisiting your long-term goals and financial projections once a year. This gives you enough time to spot patterns in sales or spending.

The Role of a Professional Financial Planner

A professional financial planner offers valuable insights, promotes accountability, and facilitates informed decision-making about your financial future. Their expertise proves beneficial whether you’re a young professional starting out or an established individual looking to optimize your finances.

Financial planning transcends a one-time event; it represents an ongoing process. A well-structured financial plan provides the guidance and clarity needed to achieve your financial aspirations (regardless of your current financial situation or life stage).

As we move forward, it’s important to understand how financial planning differs from wealth management. The next section will explore these differences in detail, helping you determine which service best suits your needs.

Wealth Management vs Financial Planning: Key Differences and Considerations

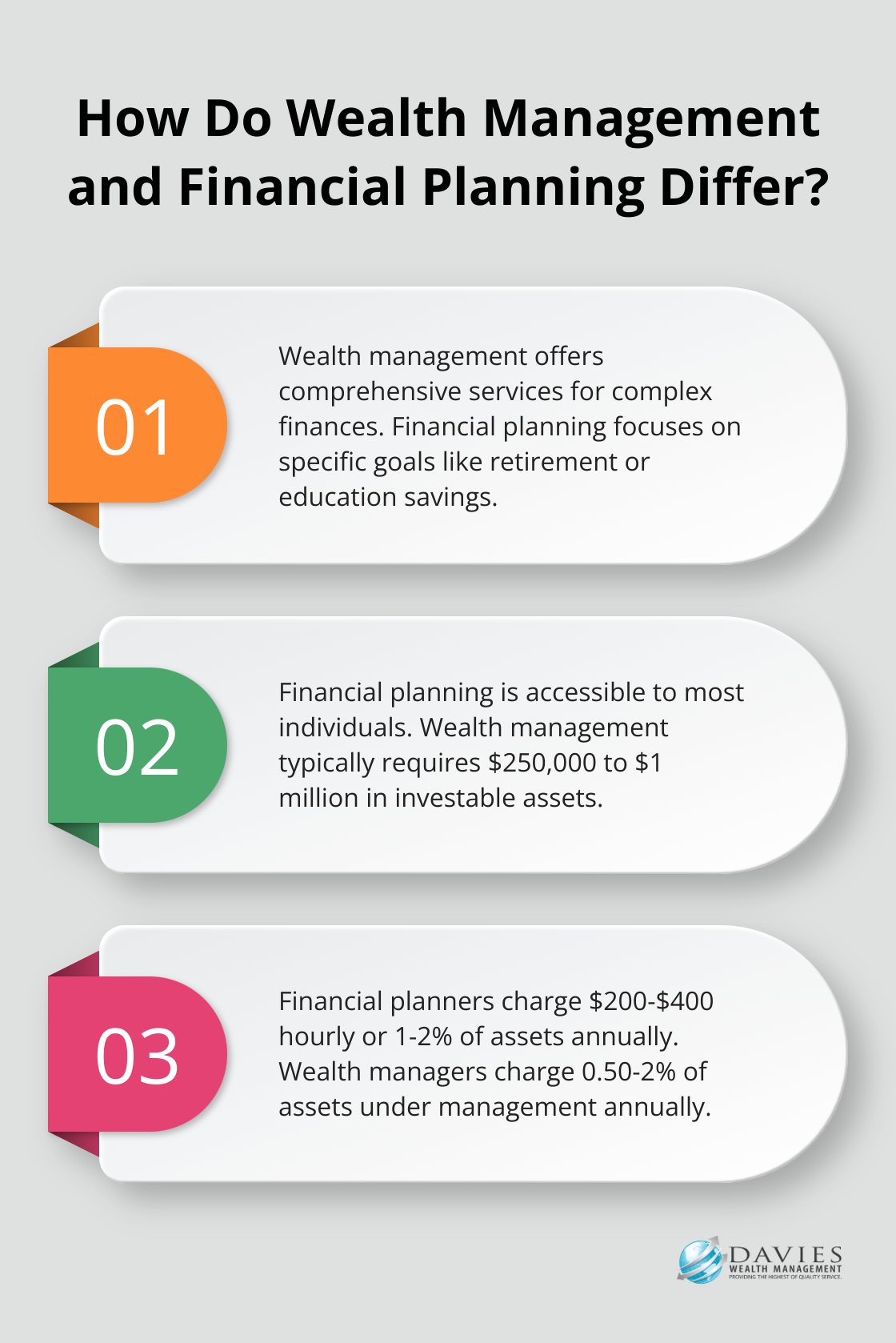

Service Scope and Complexity

Wealth management provides a comprehensive approach, encompassing a wide range of financial services. Financial planning involves managing your income and specific goals such as retirement planning or saving for a child’s education.

The complexity of your financial situation often determines which service you need. For example, a professional athlete with multiple income streams, endorsement deals, and a short career span would benefit more from wealth management. A wealth manager can navigate the complexities of such a financial landscape, ensuring wealth protection and growth even after the playing career ends.

Asset Thresholds and Target Clientele

Financial planning services are accessible to a wider range of individuals, regardless of their net worth. Wealth management, however, typically caters to high-net-worth individuals. Many wealth management firms set minimum asset requirements. These thresholds can vary, but they often start at $250,000 to $500,000 in investable assets, with some firms requiring $1 million or more.

Fee Structures and Costs

The cost difference between these services can be substantial. Financial planners often charge hourly rates (ranging from $200 to $400 per hour), flat fees for specific projects (typically $1,000 to $3,000 for a comprehensive plan), or a percentage of assets under management (usually 1% to 2% annually).

Wealth management fees are generally higher due to the more comprehensive service offering. Most wealth managers charge a percentage of assets under management. This fee typically ranges from 0.50% to 2% annually, depending on the size of the portfolio and the complexity of services provided.

Relationship Dynamics

Financial planning often involves a more project-based approach. You might engage a financial planner to create a retirement plan or to help with a specific financial goal. Once the plan is created, you might only check in annually or when significant life changes occur.

Wealth management, however, involves an ongoing, long-term relationship. Wealth managers maintain regular contact with clients, continuously monitor and adjust strategies as market conditions and personal circumstances change. This ongoing relationship allows for more proactive management of your financial affairs.

Choosing the Right Service

Your individual circumstances, financial complexity, and long-term goals determine whether wealth management or financial planning is more suitable for you. If you’re unsure which service best suits your needs, consider scheduling a consultation with a professional who can assess your situation and provide personalized recommendations.

Final Thoughts

Wealth management vs financial planning offers distinct approaches to managing your financial future. Wealth management provides comprehensive services for high-net-worth individuals with complex needs, while financial planning focuses on specific goals for a broader range of clients. Your choice depends on your net worth, financial complexity, and long-term objectives.

At Davies Wealth Management, we specialize in tailored wealth management solutions. Our team works closely with clients to develop personalized strategies that address their unique needs, helping them build, protect, and transfer their wealth effectively.

The right approach (wealth management or financial planning) will align your financial strategies with your life goals and values. We encourage you to take proactive steps towards securing your financial future by partnering with experienced professionals who understand your specific requirements.

Leave a Reply