Estate planning is a critical aspect of financial management that many people overlook. At Davies Wealth Management, we’ve seen how proper estate planning can protect your assets and ensure your wishes are carried out after you’re gone.

Choosing the right financial planner for estate planning is a decision that can have far-reaching consequences for you and your loved ones. This guide will help you navigate the process of selecting a qualified professional to assist with your estate planning needs.

Why Estate Planning Matters

The Essence of Estate Planning

Estate planning is the process of designating the distribution of your assets upon your death. It also dictates how your affairs will be conducted. At Davies Wealth Management, we have observed the significant difference proper estate planning makes in our clients’ lives and the lives of their beneficiaries.

The Broad Scope of Estate Planning

Estate planning encompasses a wide array of financial and legal decisions. It involves determining the management and distribution of your assets, designating individuals to make medical decisions on your behalf in case of incapacitation, and implementing strategies to minimize tax burdens on your heirs. The absence of a solid plan can result in lengthy probate processes, unnecessary taxes, and potential family disputes for your estate.

The Value of Professional Guidance

Collaborating with a financial planner who specializes in estate planning offers invaluable benefits. Certified estate planners are equipped with advanced knowledge in tax laws and proficient at creating strategies to minimize estate taxes. They assist you in navigating complex financial situations, particularly if you own a diverse portfolio of assets or face unique family circumstances.

Tailored Solutions for Unique Situations

Professional athletes, for instance, often encounter distinctive challenges in estate planning due to their high earnings over a short career span. Davies Wealth Management specializes in creating estate plans for athletes that protect their wealth and provide for their families long after their playing days conclude.

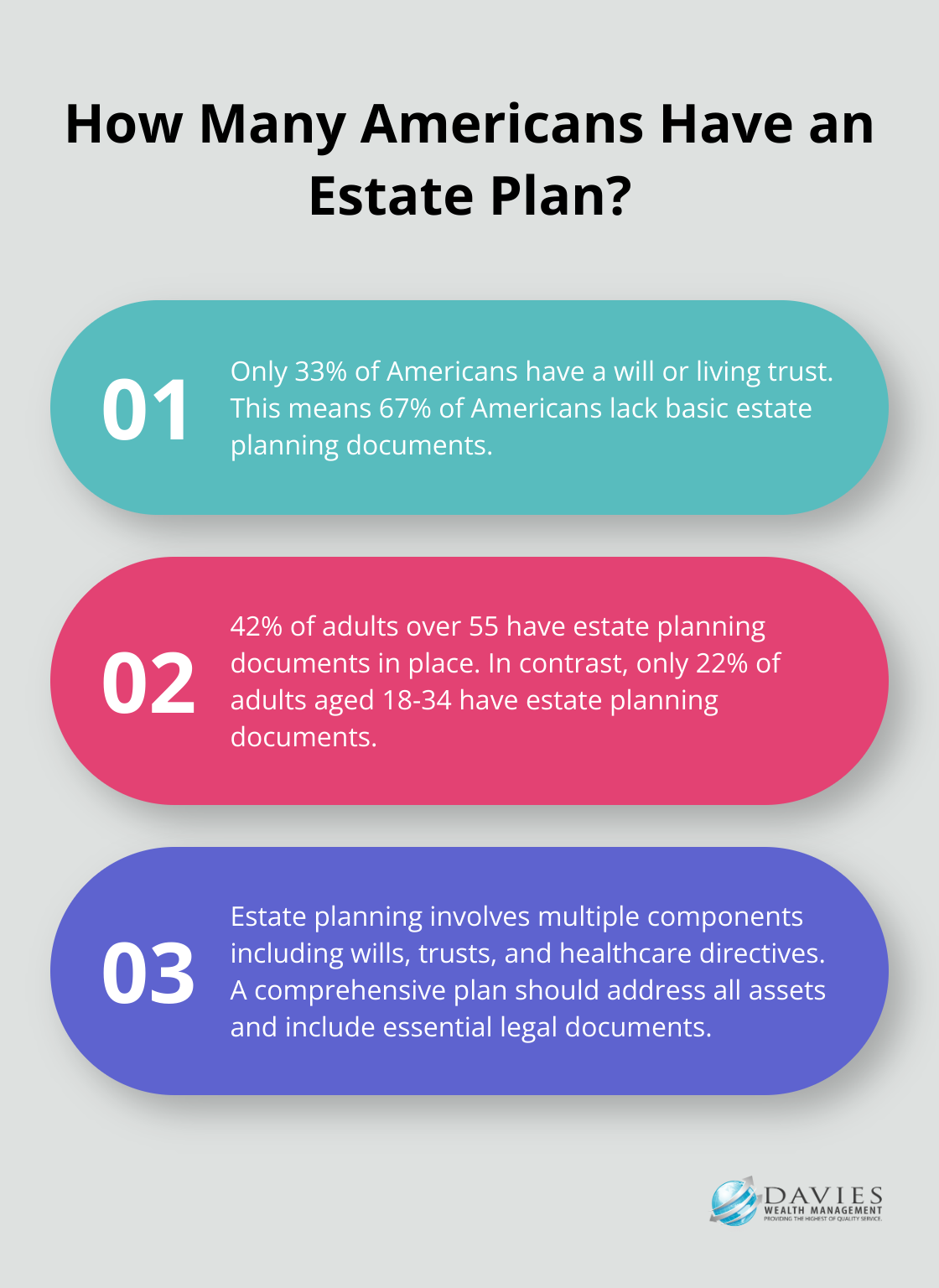

Components of a Comprehensive Estate Plan

A thorough estate plan should address all your assets, including your home and other real estate, cars, jewelry, artwork, and other physical assets. It should also include recent statements from your bank accounts and investments. The plan extends beyond wealth distribution; it focuses on preserving your legacy and ensuring the care of your loved ones according to your wishes.

Your plan should incorporate essential legal documents such as a will, living trust, power of attorney, and healthcare directive. These documents clarify your wishes and make them legally binding, thus reducing the potential for disputes or misinterpretation.

Estate planning requires regular review and updates to reflect changes in your life, financial situation, and the law. A skilled financial advisor can help you create a dynamic estate plan that evolves with your needs and safeguards what matters most to you. As you consider the importance of estate planning, the next step involves identifying the key qualifications to look for in a financial planner who can guide you through this complex process.

Essential Qualifications for Your Estate Planning Financial Advisor

Professional Certifications: A Mark of Expertise

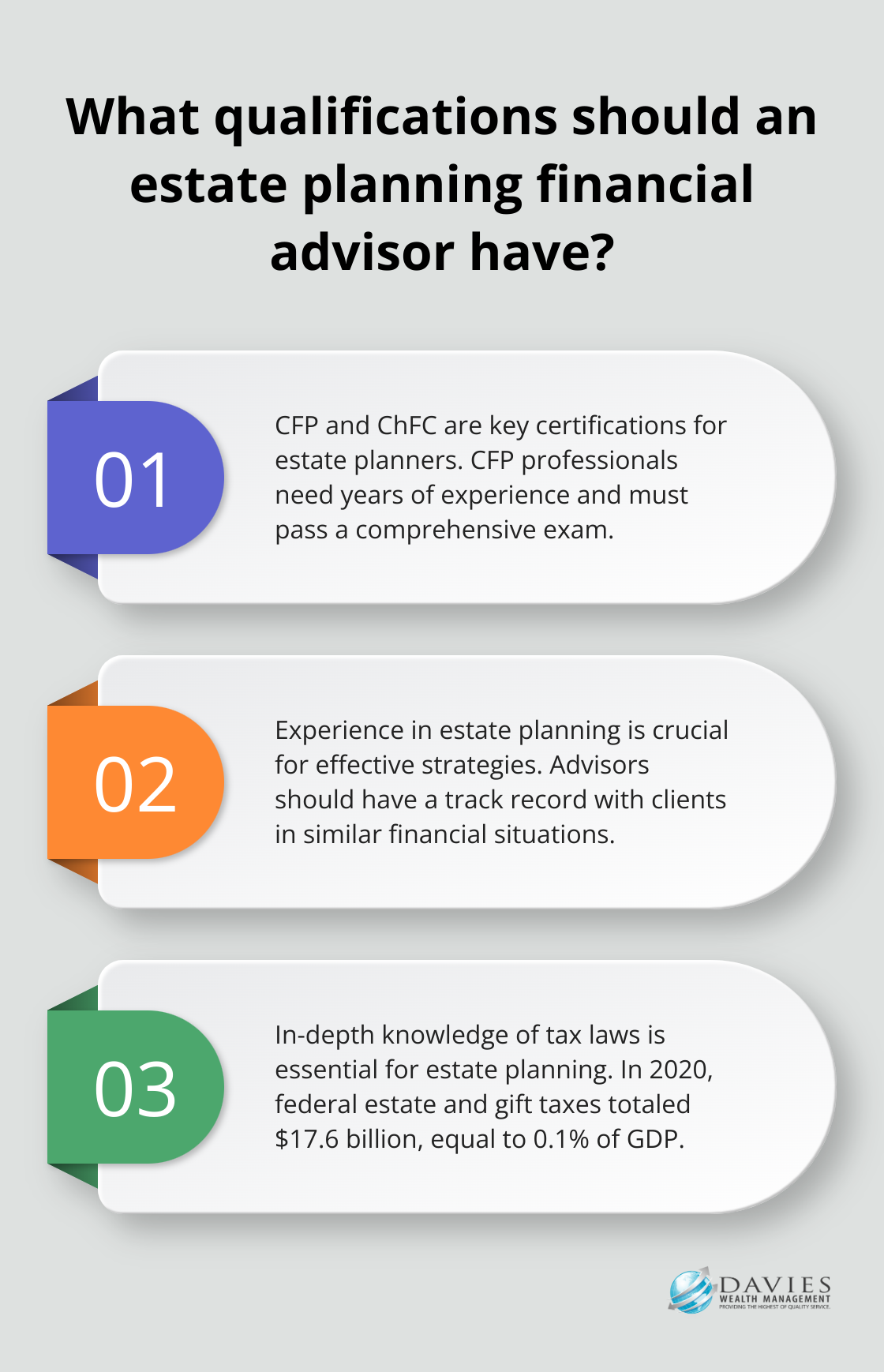

When selecting a financial planner for estate planning, professional certifications serve as a reliable indicator of expertise. The Certified Financial Planner (CFP) designation stands out as a widely recognized credential. CFP professionals must acquire several years of experience related to delivering financial planning services to clients and pass a comprehensive exam. These professionals must complete extensive education and adhere to strict ethical standards.

Another valuable credential is the Chartered Financial Consultant (ChFC). The ChFC Program offers comprehensive education in the essentials of financial planning, including insurance, taxation, retirement, and estate planning. This designation focuses on comprehensive financial planning and estate planning strategies.

Proven Track Record in Estate Planning

Experience plays a vital role in effective estate planning. Your chosen advisor should demonstrate a substantial history of creating and managing estate plans. Ask potential planners about their experience with clients who have similar financial situations to yours. For instance, if you’re a professional athlete, look for advisors who specialize in creating estate plans that address the unique challenges faced by athletes with high earnings over short career spans.

In-Depth Knowledge of Tax Laws

Estate tax laws present complex challenges that require expert navigation. Your financial planner must possess a thorough understanding of current tax laws and their impact on estate planning. In 2020, revenues from federal estate and gift taxes totaled $17.6 billion, equal to 0.1 percent of gross domestic product (GDP). However, state-level estate taxes can affect a broader range of individuals. A knowledgeable advisor can help you navigate these complexities and potentially save your heirs significant sums in taxes.

Collaborative Approach with Other Professionals

Effective estate planning often requires collaboration with other professionals (such as attorneys and accountants). Your financial planner should maintain a network of trusted professionals and willingly work alongside them to create a comprehensive estate plan. This collaborative approach ensures that all aspects of your estate receive proper attention, from legal documents to tax strategies.

As you consider these qualifications, the next step involves preparing a list of questions to ask potential financial planners during the interview process. This will help you gauge their expertise and determine if they align with your specific estate planning needs.

Interviewing Financial Planners for Estate Planning

Approach to Estate Planning

When you select a financial planner for estate planning, you must ask the right questions. We at Davies Wealth Management recommend you prepare a comprehensive list of inquiries to find the best fit for your needs.

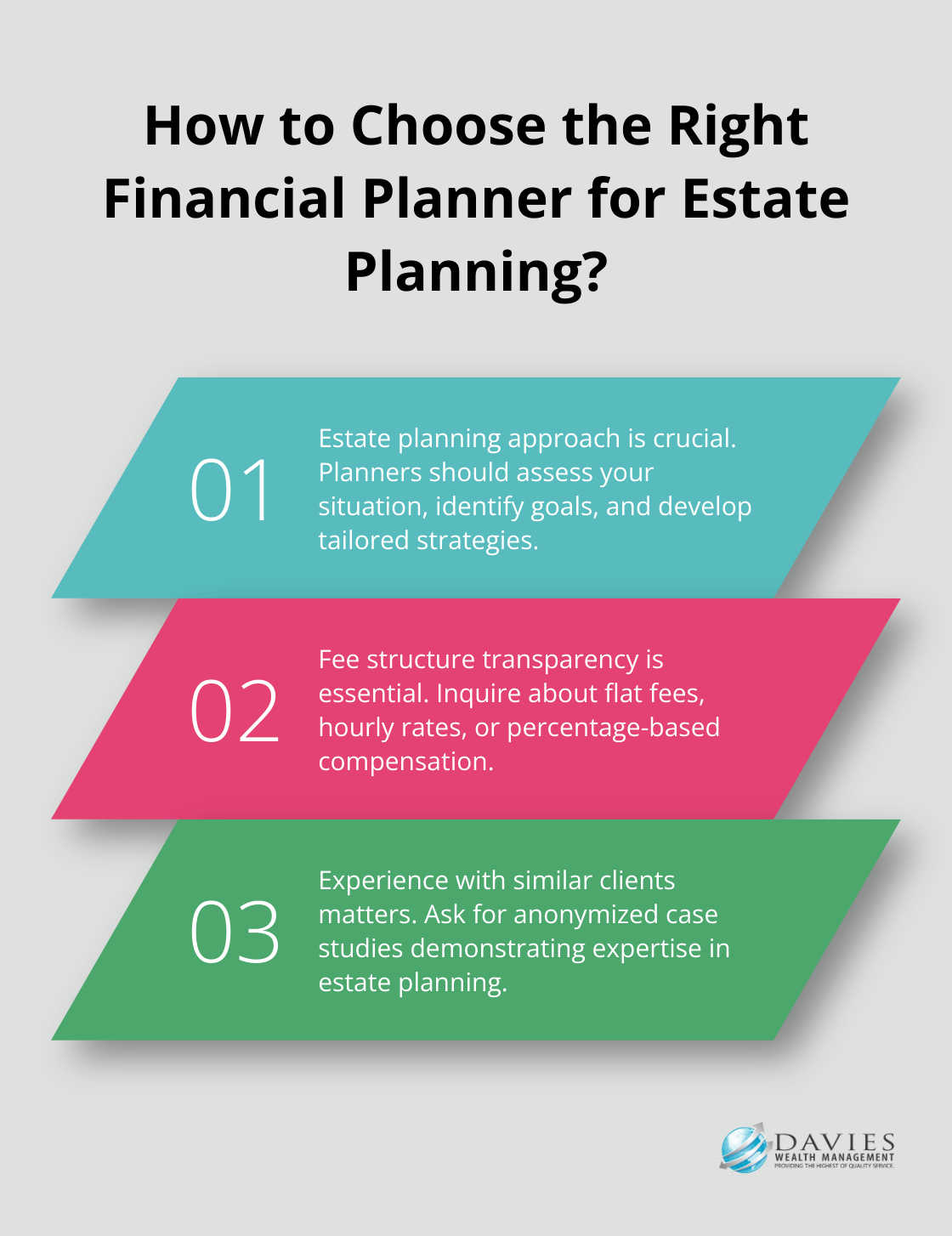

Start by asking potential planners about their specific approach to estate planning. A competent advisor should explain their process in detail, including how they assess your current financial situation, identify your goals, and develop strategies to achieve them. They should also discuss how they stay updated on changing tax laws and estate planning regulations.

You might ask: “How do you typically structure an estate plan for someone in my financial situation?” This question can reveal the planner’s depth of knowledge and ability to tailor solutions to your unique circumstances.

Fee Structure and Potential Conflicts

Understanding how a financial planner receives compensation is essential. Ask about their fee structure – whether they charge a flat fee, an hourly rate, or a percentage of assets under management.

Inquire about any potential conflicts of interest. For instance, if they receive commissions for selling certain financial products, this could influence their recommendations. A fiduciary advisor has a job to carry out the wishes of the person who appointed them, even if their wishes don’t align with their own beliefs or core values.

Experience with Similar Clients

You should work with a planner who has experience in the industry and with clients in similar financial situations. It’s important to note that estate planning is typically directed by an attorney, not a financial planner. A financial planner focuses on your long-term financial goals.

Ask for specific examples of how they’ve helped clients with similar estate planning needs. While they can’t disclose names due to confidentiality, they should provide anonymized case studies or general scenarios that demonstrate their expertise.

Client References and Track Record

Don’t hesitate to ask for references from current or past clients. While financial planners may have limitations in what they can share due to privacy regulations, they should provide some form of client feedback or testimonials.

Additionally, inquire about their track record. Ask questions like: “What percentage of your clients have successfully implemented the estate plans you’ve created?” or “How often do you typically review and update estate plans?”

The goal of these questions is to gauge the planner’s expertise, transparency, and ability to meet your specific estate planning needs. A reputable advisor will welcome these questions and provide clear, comprehensive answers to help you make an informed decision.

Final Thoughts

Selecting the right financial planner for estate planning will significantly impact your financial legacy. A qualified professional can help you navigate complex tax laws, create strategies to minimize estate taxes, and ensure your assets are distributed according to your wishes. They can also address unique situations, such as those faced by professional athletes with high earnings over short career spans.

The long-term benefits of professional estate planning are substantial. A well-crafted estate plan provides peace of mind, knowing that your loved ones will be taken care of and your legacy preserved. It can also help avoid potential family disputes, minimize tax burdens, and streamline the asset transfer process.

We encourage you to find a qualified financial planner for your estate planning needs. Look for professionals with relevant certifications, extensive experience, and a track record of success in estate planning. At Davies Wealth Management, we specialize in providing comprehensive financial planning services, including estate planning for individuals, families, and professional athletes.

Leave a Reply