Choosing the right financial advisor for 529 plan management can make the difference between reaching your education savings goals and falling short. With college costs rising 6.8% annually according to College Board data, professional guidance becomes increasingly valuable.

We at Davies Wealth Management see families struggle with complex state tax benefits, investment allocation decisions, and beneficiary change strategies. The right advisor transforms these challenges into a clear roadmap for education funding success.

Understanding 529 Plan Basics and Advisor Requirements

What 529 Plan Features Matter Most

The two main 529 plan types serve different purposes, and families who pick wrong lose money. Education Savings Plans offer investment flexibility with age-based portfolios that shift from aggressive growth to conservative bonds as your child approaches college. Prepaid Tuition Plans lock in today’s tuition rates at participating schools but limit flexibility if your child changes plans. Only nine states still offer prepaid plans today, which makes savings plans the practical choice for most families.

Professional Help vs Solo Management

Families can manage 529 plans solo when they have simple goals and understand tax implications. Professional guidance becomes necessary when you juggle multiple children’s timelines, need state tax deduction strategies, or manage complex family situations like divorced parents who share education costs. Research shows families with advisor-managed 529 plans contribute more annually than DIY investors. The tipping point typically hits at $50,000 in assets or when you contribute over $10,000 yearly across multiple accounts.

Required Advisor Credentials

Look for the 529 Pro designation first – advisors pass an exam that covers college funding specifics. Certified Financial Planner certification indicates broader expertise, while Chartered Financial Consultant credentials show advanced education planning knowledge. Fee-only advisors who charge 0.5% to 1% annually on assets under management align better with your interests than commission-based advisors who sell high-fee products. Verify credentials through CFP Board’s database and check SEC records for any disciplinary actions (this takes five minutes online). Skip advisors without specific 529 experience or those who push universal life insurance as education funding alternatives.

The credentials matter, but how wealth advisors apply their expertise to your specific situation matters more. Next, we’ll examine the key areas where advisor experience makes the biggest difference in your 529 plan outcomes.

Evaluating Financial Advisor Expertise and Services

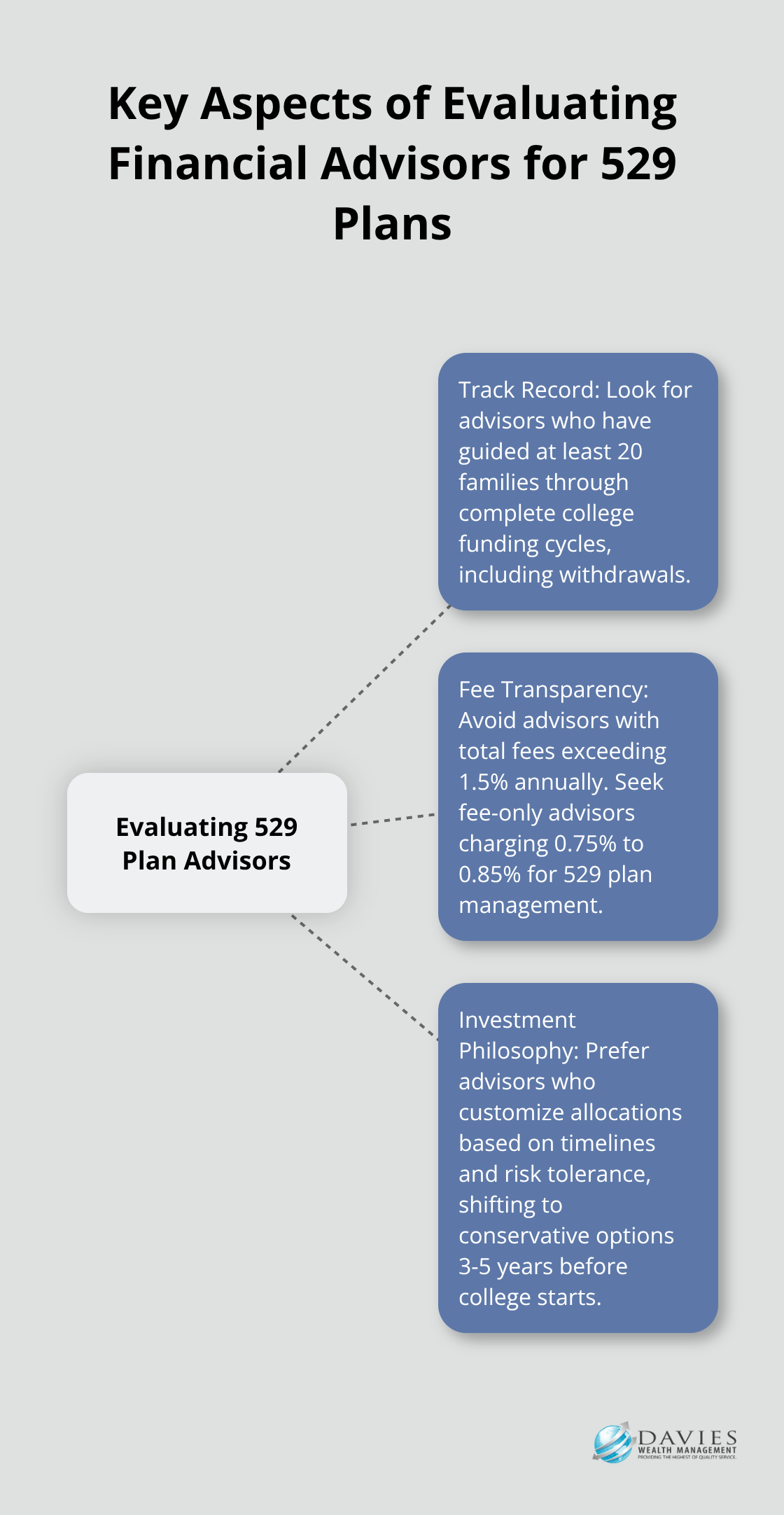

Track Record With Education Planning

Advisor experience separates successful 529 outcomes from disappointing results. Ask potential advisors how many families they have guided through complete college funding cycles, not just plan setups. The best advisors have managed withdrawals for at least 20 families during actual college years and understand timing strategies that maximize tax benefits. They know which expenses qualify beyond tuition – room, board, books, and required technology purchases. Quality 529 plans receive recognition from research firms like Morningstar, which evaluates plans based on their overall merit and awards Gold ratings to standout options.

Fee Transparency Makes The Difference

Fee structures reveal advisor priorities immediately. Avoid advisors who charge both management fees and embedded fund expenses that exceed 1.5% annually total. The industry median sits at 1% for asset management according to Kitces research, but education-focused advisors often charge 0.75% to 0.85% for 529 plan management. Fee-only advisors are often fiduciaries who prioritize clients’ best interests and reveal conflicts of interest, while commission-based advisors hide costs in fund expense ratios. Calculate total annual costs on a $100,000 account – the difference between 0.85% and 1.8% fees costs you $9,500 over ten years (before you consider lost compound growth).

Investment Management Philosophy

Age-based portfolios work for most families, but experienced advisors customize allocations based on specific timelines and risk tolerance. Static portfolios that maintain 60% stocks regardless of college proximity often underperform. The best advisors shift to conservative allocations 3-5 years before college starts, which protects accumulated gains from market volatility. They also understand state tax implications – Virginia residents can deduct contributions up to $4,000 per account for state income tax purposes when using their state plan, while Nevada and Utah plans offer superior investment options despite no state tax benefits. Portfolio rebalancing frequency matters too (quarterly adjustments outperform annual changes in volatile markets).

The right questions help you identify advisors who possess this expertise and can apply it to your specific situation. Next, we’ll examine the specific questions that separate qualified 529 advisors from generalists who lack education planning depth.

Questions That Separate Expert 529 Advisors From Generalists

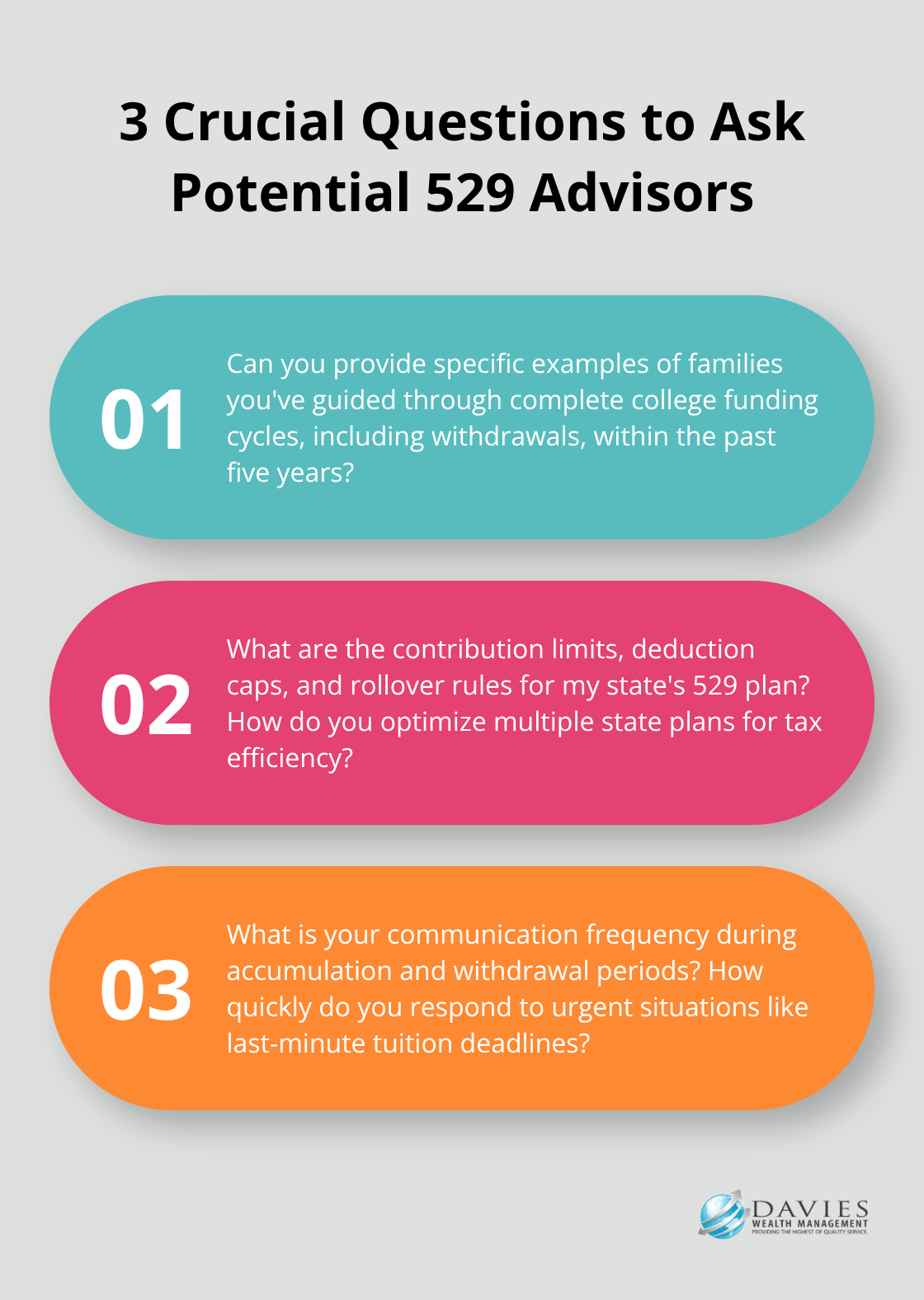

Proven Experience With Real College Withdrawals

Ask potential advisors to name specific families they guided through complete college funding cycles within the past five years. Generic responses like helping families save for education signal limited experience. Quality advisors provide concrete examples: they helped a family withdraw $80,000 over four years while they maintained tax-free status, or they guided parents through qualified expense documentation when their child studied abroad. Request references from families whose children finished college recently. The College Savings Plans Network reports that penalties on non-qualified 529 plan distributions are typically 1-3% of the distribution amount, which experienced advisors prevent through proper planning.

State Tax Strategy Mastery

Test advisor knowledge with specific state scenarios relevant to your situation. Ask about contribution limits, deduction caps, and rollover rules for your state plan. Quality advisors understand complex state-specific rules and tax implications. They understand complex situations like maintaining residency benefits after moving states or optimizing multiple state plans for tax efficiency. For example, they know that California withdrawals are subject to state income tax and an additional 2.5% California tax, with K-12 withdrawals limited to $10,000 per year for K-12 tuition. Weak advisors provide vague answers about checking with tax professionals instead of demonstrating direct knowledge.

Communication Structure and Support Framework

Pin down exact communication frequency and support processes before you sign agreements. Top 529 advisors schedule quarterly reviews during accumulation years and monthly check-ins during college withdrawal periods. They provide specific timelines for responding to questions (24-48 hours maximum) and offer multiple contact methods including secure messaging platforms. Ask about their process for handling urgent situations like last-minute tuition payment deadlines or beneficiary changes. Advisors who promise availability without specific response commitments often disappoint when you need immediate guidance. Quality advisors also provide annual tax reporting summaries that simplify your accountant’s work during filing season.

Final Thoughts

The right financial advisor for 529 plan management possesses the 529 Pro designation combined with CFP certification, which demonstrates specialized education planning expertise. Fee-only advisors who charge 0.75% to 1% annually align better with your interests than commission-based alternatives who push high-fee products. Advisors who cannot provide specific examples of families they guided through complete college funding cycles raise red flags, as do those who charge combined fees exceeding 1.5% annually.

Start your search by requesting references from families whose children recently completed college. Verify credentials through CFP Board databases and SEC records (this takes five minutes online). Schedule consultations with at least three candidates to compare their communication styles and 529 plan expertise.

We at Davies Wealth Management understand the complexities of education funding and provide personalized strategies that align with your family’s specific timeline and goals. Our comprehensive approach addresses both accumulation and withdrawal phases while optimizing tax benefits throughout the process. Contact Davies Wealth Management to discuss how we can help you achieve your education savings objectives.

Leave a Reply