Estate planning is a critical aspect of financial management that many people overlook. At Davies Wealth Management, we’ve seen firsthand the consequences of poor estate planning decisions.

This blog post will guide you through 10 common estate planning mistakes and how to avoid them. By understanding these pitfalls, you can protect your assets and ensure your wishes are carried out effectively.

Why No Estate Plan Is a Costly Mistake

The Legal Limbo of Dying Intestate

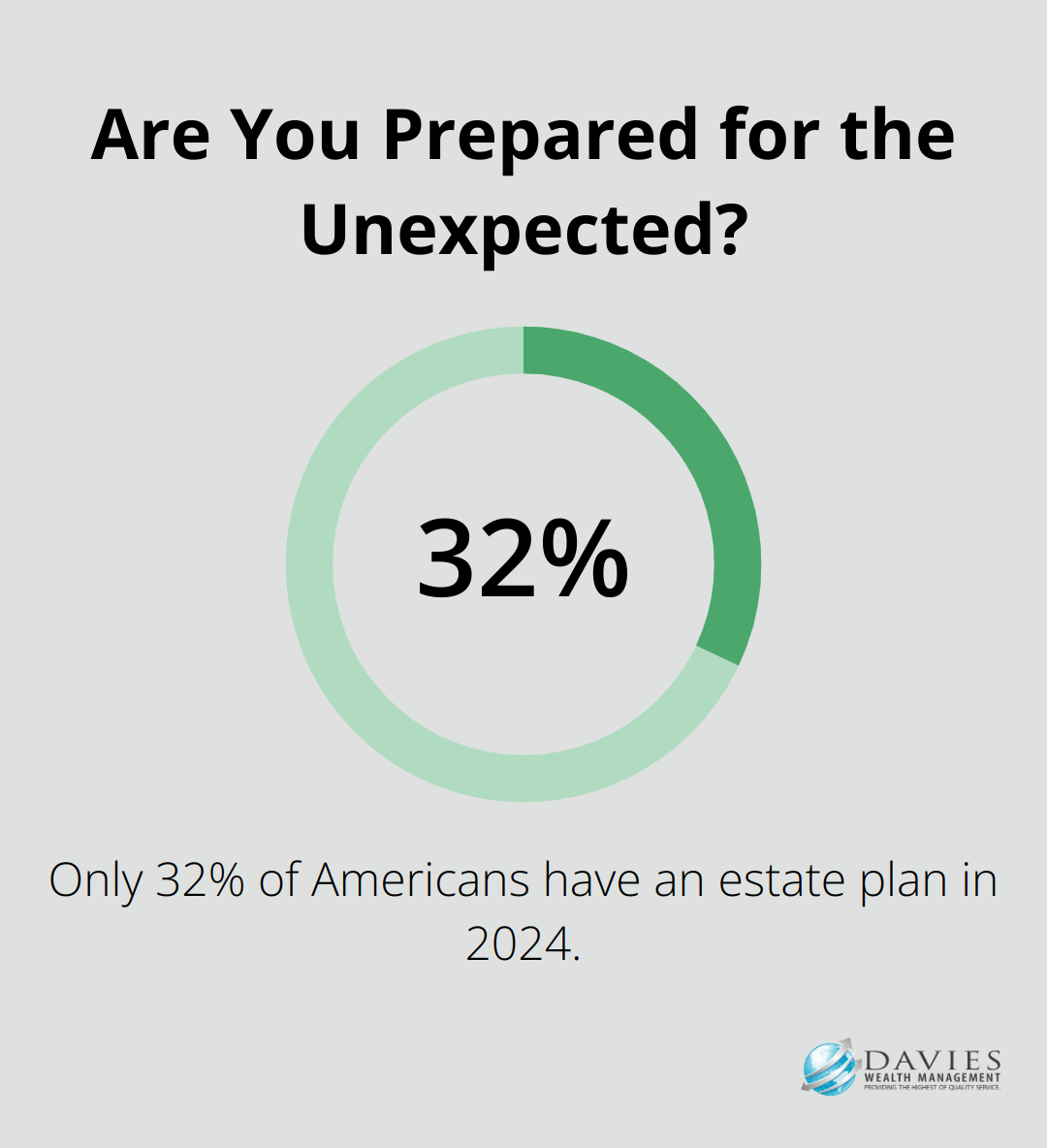

Failing to create an estate plan ranks as one of the most significant financial missteps you can make. A 2024 survey by Caring.com reveals a startling fact: only 32% of Americans have an estate plan in 2024, a 6% decline from last year. This statistic should raise alarm bells, considering the potential ramifications.

When you die without a valid will or estate plan, the law considers you to have died “intestate.” This status means state laws determine how to distribute your assets, often in ways that may not align with your wishes. For example, in some states, if you’re married with children, your spouse might receive only a portion of your assets, with the rest going to your children – even if that’s not what you would have wanted.

Family Turmoil and Financial Strain

The absence of an estate plan can spark family disputes and unnecessary financial burdens. Probate court proceedings often drag on for six months to two years and can prove expensive. This process not only depletes the assets you intended for your beneficiaries but can also cause significant stress and conflict among family members during an already difficult time.

Loss of Control Over Your Legacy

Without an estate plan, you forfeit the opportunity to make important decisions about your legacy. This includes not just financial assets, but also:

- Guardianship of minor children

- Care for pets

- Continuation of a family business

- Charitable contributions

- Establishment of trusts for future generations

Creating a comprehensive estate plan isn’t just for the wealthy. It’s a vital step for anyone who wants to protect their assets, minimize taxes, and ensure respect for their wishes.

The Importance of Professional Guidance

Navigating the complexities of estate planning can prove challenging without expert help. A professional can guide you through the process, helping you create a plan that reflects your values and secures your legacy for years to come. They can also help you avoid common pitfalls and ensure your plan complies with current laws and regulations.

As we move forward, let’s explore another critical aspect of estate planning: the necessity of regular updates to your plan. Life changes, and your estate plan should change with it.

Why Your Estate Plan Needs Regular Updates

Life Events That Trigger Estate Plan Updates

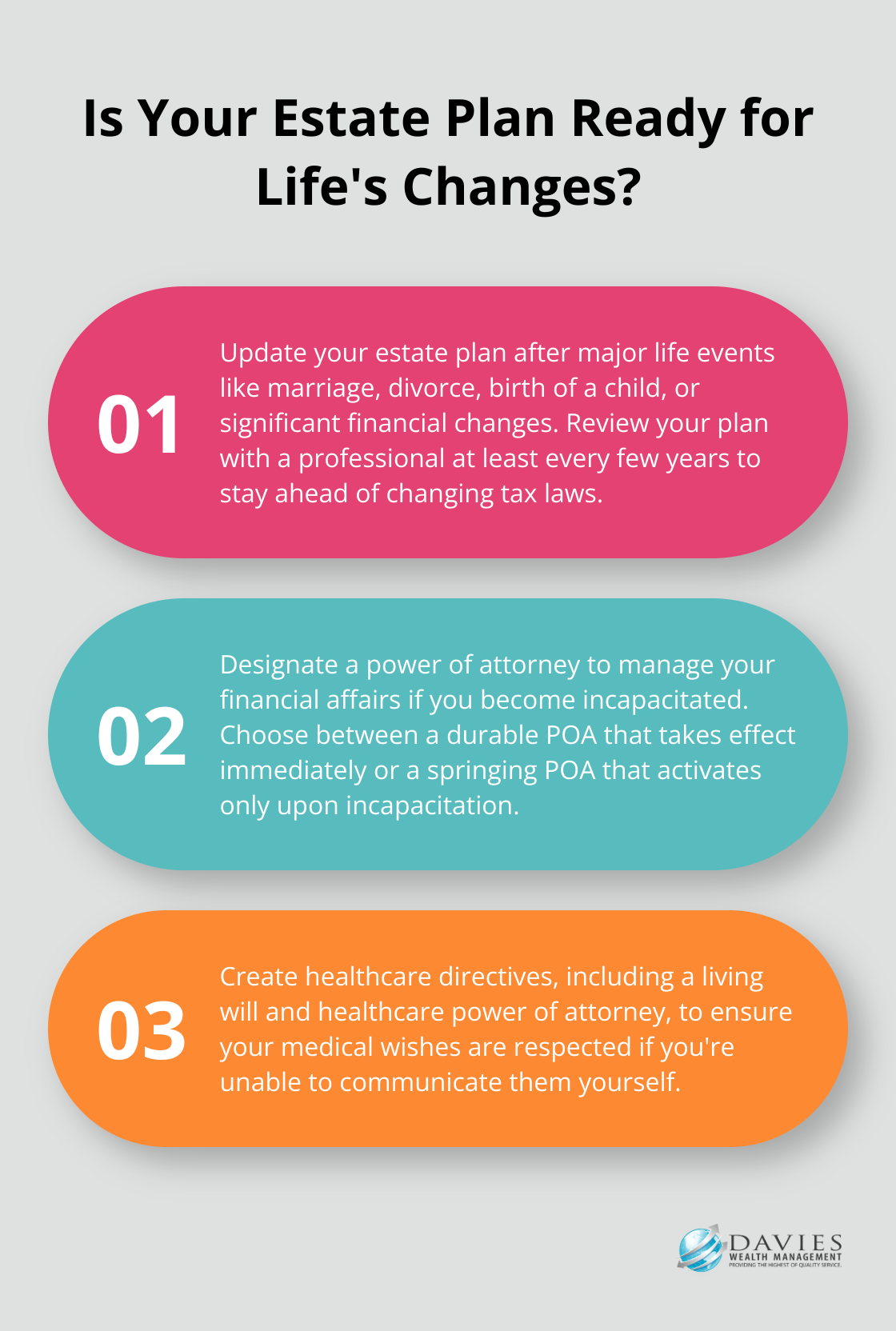

Estate planning requires continuous attention. Life changes, and your estate plan must adapt. Major life events often necessitate updates to your estate plan. These include:

- Marriage or divorce

- Birth of a child

- Death of a beneficiary

- Significant changes in financial situation

For instance, a recent divorce will likely prompt you to remove your ex-spouse as a beneficiary from your will and life insurance policies.

A 2023 study by Caring.com revealed that only 32% of Americans with a will or living trust updated it in the past year. This statistic raises concerns, given how rapidly personal circumstances can shift.

The Perils of Outdated Beneficiary Designations

One of the most common mistakes in estate planning involves failure to update beneficiary designations on retirement accounts and life insurance policies. These designations typically override your will, making it essential to keep them current.

Consider this scenario: You’ve remarried but haven’t updated your 401(k) beneficiary from your ex-spouse to your current spouse. In this case, your ex could inherit your retirement savings (regardless of what your will states). This oversight can lead to lengthy legal battles and significant financial loss for your intended heirs.

Staying Ahead of Changing Tax Laws

Tax laws evolve constantly, and these changes can significantly impact your estate plan. The Tax Cuts and Jobs Act of 2017 doubled the estate tax exemption. If this provision expires, the exemption in 2026 will be about $14.3 million for married couples.

To stay ahead of these changes, try to review your estate plan with a professional at least every few years. Estate planning attorneys recommend reviewing your estate plan after any major life changes.

The Role of Professional Guidance

Navigating the complexities of estate planning can prove challenging without expert help. A professional can guide you through the process, helping you create a plan that reflects your values and secures your legacy. They can also help you avoid common pitfalls and ensure your plan complies with current laws and regulations.

As we move forward, let’s explore another critical aspect of estate planning: the importance of including all necessary documents in your plan. A comprehensive estate plan goes beyond just a basic will, and understanding these additional components can make a significant difference in how effectively your wishes are carried out.

What Documents Your Estate Plan Needs

Beyond the Basic Will

A comprehensive estate plan requires more than a simple will. Many clients believe a basic will suffices to protect their assets and express their wishes. This oversight can lead to significant complications for loved ones.

The Power of Attorney: Your Financial Safeguard

A power of attorney (POA) allows you to designate someone to manage your financial affairs if you become incapacitated. Without a POA, your family may face a lengthy and expensive court process to handle your finances.

Two main types of POAs exist:

- Durable POA: Takes effect immediately and continues if you become incapacitated.

- Springing POA: Only becomes effective if you’re deemed incapacitated.

Only 33% of U.S. adults have created estate planning documents.

Healthcare Directives: Ensuring Your Medical Wishes

Healthcare directives outline your preferences for medical treatment if you’re unable to communicate them yourself. These typically include:

- Living Will: Specifies the types of medical treatments you do or don’t want in end-of-life situations.

- Healthcare Power of Attorney: Designates someone to make medical decisions on your behalf if you’re incapacitated.

A survey found that while 92% of Americans say it’s important to discuss end-of-life care with their loved ones, only 32% have actually done so. These documents provide clarity and reduce stress for your family during difficult times.

Trust Documents: Protecting Your Legacy

Trusts help you avoid probate, minimize taxes, and maintain privacy. Various types of trusts serve different purposes. For example, a revocable living trust allows you to maintain control of your assets during your lifetime while providing for smooth asset transfer upon your death.

Financial professionals (like those at Davies Wealth Management) work closely with clients to determine which trust structures best suit their unique situations. They create comprehensive estate plans that address all aspects of your financial legacy, ensuring your wishes are carried out effectively and efficiently.

Final Thoughts

Estate planning requires careful consideration and regular attention to avoid 10 common estate planning mistakes. Professional guidance proves invaluable in navigating the intricacies of this complex process. At Davies Wealth Management, we understand the challenges of creating and maintaining a comprehensive estate plan.

Our team of experienced advisors can help you develop a strategy tailored to your unique needs and goals. We offer personalized wealth management services, including comprehensive estate planning guidance. With our extensive experience, we can help you navigate the complexities of estate planning and develop a strategy that aligns with your objectives.

Trust us to help you build a secure financial future and leave a lasting legacy. Don’t leave your legacy to chance – take proactive steps to secure your financial future and provide peace of mind for yourself and your loved ones (contact us today to get started).

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply