At Davies Wealth Management, we’ve seen a growing interest in green investing among our clients. This trend reflects a broader shift in the investment landscape, where environmental considerations are becoming increasingly important.

Aligning your investment portfolio with your environmental values is not only possible but can also be financially rewarding. In this post, we’ll explore practical strategies to help you create a more environmentally responsible investment portfolio without compromising your financial goals.

Understanding ESG Investing: A Modern Approach to Portfolio Management

The Essence of ESG Investing

ESG investing has emerged as a pivotal strategy in modern portfolio management. This approach involves evaluating a company for a possible investment based on its performance relating to environmental, social, and governance criteria. ESG investing enables investors to align their portfolios with their values while potentially enhancing long-term returns.

The Remarkable Growth of ESG

The ESG investing landscape has experienced exponential growth. Morningstar reports that as of March 2025, global sustainable fund assets reached USD 3.16 trillion, showing a slight retreat of 0.7% from USD 3.18 billion three months earlier. This trend reflects investors’ increasing awareness of their investments’ impact on the world.

Environmental Factors in Focus

When evaluating the environmental aspect of ESG, investors concentrate on several key factors:

- Carbon footprint

- Energy efficiency

- Waste management practices

- Water usage

Companies that commit to science-based climate targets (verified by the U.N.-backed Science Based Targets Initiative) often receive favorable consideration from ESG investors.

The Financial Argument for ESG

A common misconception suggests that ESG investing sacrifices returns. However, evidence points to a more nuanced picture. Morgan Stanley reports that sustainable funds hit a record AUM of $3.56 trillion but posted a median return of 0.4%, compared to traditional funds’ 1.7%. This data demonstrates that aligning your portfolio with environmental values may involve trade-offs in terms of financial performance.

ESG and Long-Term Resilience

Investors who incorporate ESG factors into their investment strategies often express more confidence in their portfolios’ long-term resilience. They recognize that companies addressing environmental challenges position themselves better to navigate future regulatory changes and market shifts.

As we move forward, let’s explore specific strategies you can employ to align your investment portfolio with your environmental values. These practical approaches will help you create a more environmentally responsible investment portfolio without compromising your financial objectives.

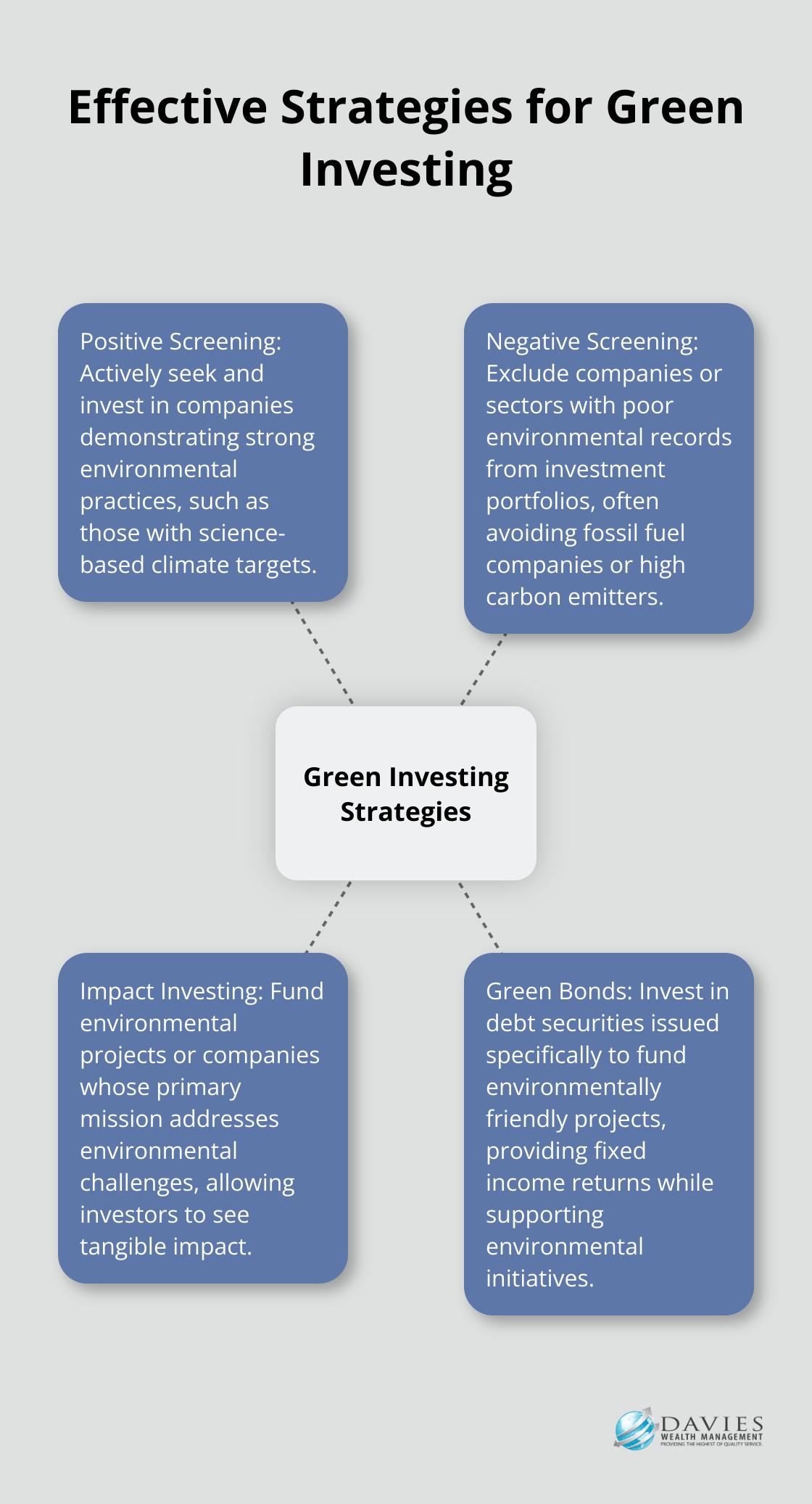

Effective Strategies for Green Investing

Positive Screening: Investing in Environmental Leaders

Positive screening actively seeks out and invests in companies that demonstrate strong environmental practices. This strategy identifies businesses that lead the way in areas such as renewable energy, sustainable resource management, and innovative environmental technologies.

Investors might consider companies that have committed to science-based climate targets. These targets offer companies a clear, actionable path to align emissions reductions with the Paris Agreement goals.

Negative Screening: Avoiding Environmental Laggards

Negative screening excludes companies or sectors with poor environmental records from investment portfolios. This approach often avoids investments in fossil fuel companies, businesses with high carbon emissions, or those involved in environmentally damaging practices.

Investors can implement negative screening through tools that assess exposure to fossil fuel reserves and identify companies effectively managing their carbon emissions.

Impact Investing: Direct Environmental Action

Impact investing funds environmental projects or companies whose primary mission addresses environmental challenges. This strategy allows investors to see a tangible impact from their investments while potentially earning financial returns.

Green Bonds: Supporting Specific Environmental Initiatives

Green bonds are debt securities issued specifically to fund environmentally friendly projects. These bonds provide a way for investors to support specific environmental initiatives while receiving fixed income returns.

The green bond market has seen significant growth in recent years. According to the Climate Bonds Initiative, by the end of Q3 2024, cumulative aligned green bond volume reached USD3.4tn, representing 62% of total aligned GSS+ volume.

Customizing Your Green Investment Strategy

Each investor’s green investment strategy should align with their unique financial goals and environmental values. Some investors might prefer a combination of these strategies, while others might focus on one specific approach.

Professional financial advisors can provide valuable guidance in navigating these various strategies and creating a portfolio that aligns with environmental values without compromising financial goals. They can offer personalized advice on how to implement these approaches in a way that suits individual circumstances and risk tolerance.

As we move forward, let’s explore the practical steps you can take to green your investment portfolio and make a positive environmental impact through your financial decisions.

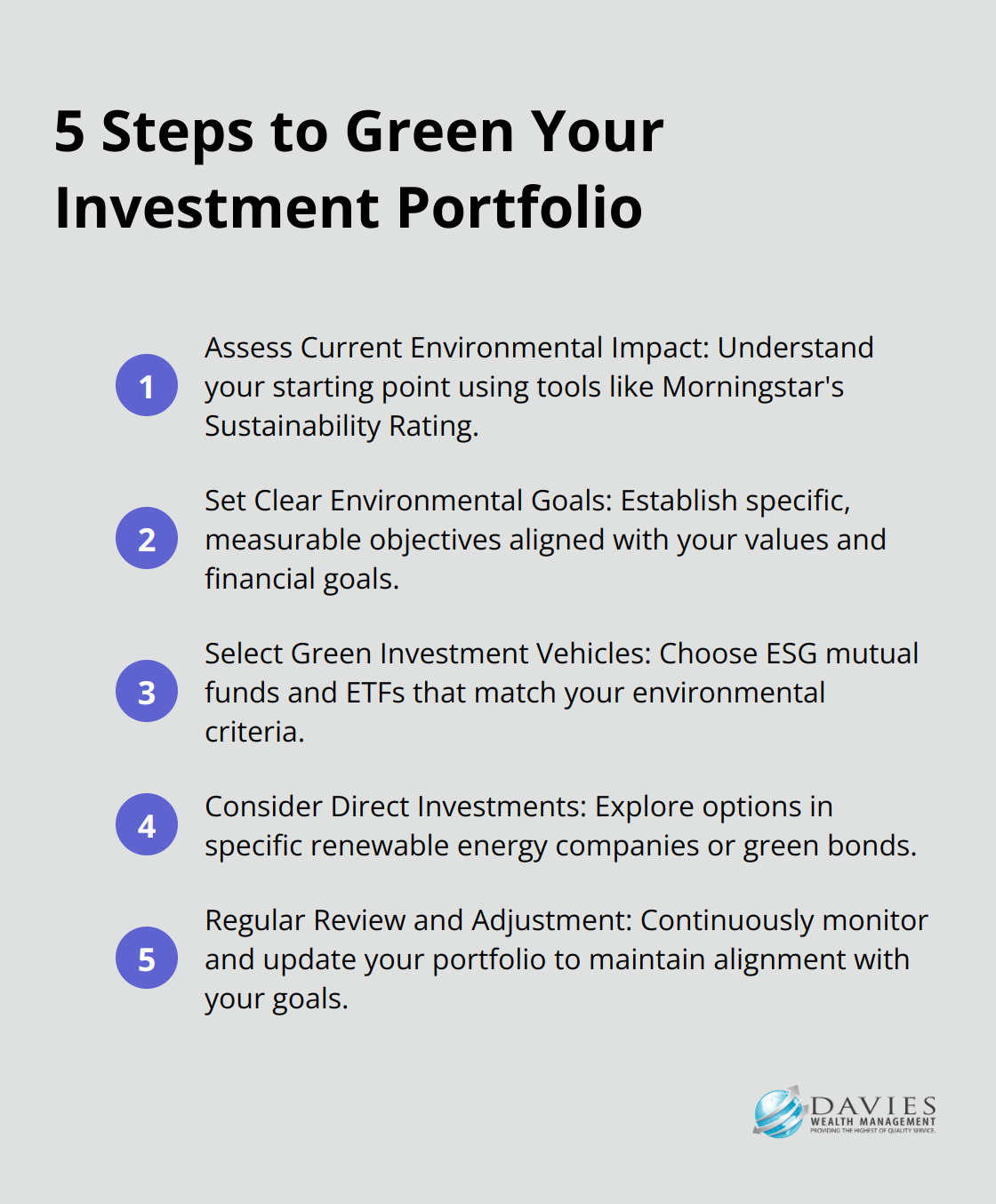

Greening Your Portfolio: A Step-by-Step Guide

Assess Your Current Environmental Impact

The first step to green your portfolio is to understand your starting point. Many investors are unaware of the environmental impact of their current investments. Tools like Morningstar’s Sustainability Rating provide insights into the ESG performance of mutual funds and ETFs. For individual stocks, resources such as MSCI ESG Ratings offer detailed environmental assessments.

A thorough portfolio review might reveal unexpected investments in companies with poor environmental records. You might discover that your index fund includes significant holdings in fossil fuel companies or businesses with high carbon emissions.

Set Clear Environmental Goals

After you understand your current position, set clear, measurable environmental goals for your investments. These goals should align with your values and financial objectives. You might try to reduce your portfolio’s carbon footprint by 50% over the next five years or allocate 20% of your investments to renewable energy companies.

Specificity and realism are key when setting goals. Instead of vague objectives like “invest in green companies,” consider goals such as “invest 10% of my portfolio in companies with science-based climate targets by the end of the year.”

Select Green Investment Vehicles

With clear goals in place, select investment vehicles that align with your environmental objectives. Environmental, Social, and Governance (ESG) mutual funds and Exchange-Traded Funds (ETFs) offer a straightforward way to invest in companies with strong environmental records.

When you evaluate these funds, look beyond the label. Some funds marketed as “green” or “sustainable” may not meet your specific environmental criteria. Review the fund’s prospectus and holdings to ensure they align with your goals. For example, the iShares Global Clean Energy ETF (ICLN) focuses specifically on clean energy companies, while the Vanguard ESG U.S. Stock ETF (ESGV) takes a broader approach to sustainability.

Consider Direct Investments

For those interested in more direct involvement, consider investing in specific renewable energy or sustainable technology companies. However, this approach requires more research and potentially carries more risk than diversified funds.

Green bonds present another option for environmentally conscious investors. These fixed-income securities fund specific environmental projects. The green bond market is expected to pass the $1 trillion mark in cumulative issuance in 2020, which indicates the growing popularity and availability of these instruments.

Regular Review and Adjustment

Greening your portfolio is an ongoing process. Regularly review and adjust your investments to ensure they continue to align with your environmental goals and financial needs. This approach allows you to stay on track with your objectives and make necessary changes as the market evolves.

At Davies Wealth Management, we help our clients navigate this process, providing expert guidance to create portfolios that reflect both their values and financial objectives. Our team understands the complexities of green investing and can offer personalized strategies to help you achieve your environmental and financial goals.

Final Thoughts

Green investing offers a powerful way to make a positive impact on the world while pursuing financial growth. The strategies we discussed provide options for investors to tailor their portfolios to specific environmental goals. These approaches allow you to contribute to important initiatives such as renewable energy development and sustainable resource management.

Many environmentally responsible investments have shown competitive returns over time. Companies with strong environmental practices may be better positioned for long-term success as environmental concerns shape global policies and consumer behaviors. We at Davies Wealth Management understand the complexities of integrating environmental considerations into your investment strategy.

Our team of experts can help you create a portfolio that aligns with both your financial goals and values. We encourage you to start this journey today by reassessing your current investments or exploring green investment vehicles. To learn more about how we can help you create a personalized, environmentally responsible investment strategy, visit us at Davies Wealth Management.

Leave a Reply