Stuart’s financial landscape is experiencing a digital revolution. Wealth tech solutions are transforming how investors manage their portfolios and plan for the future.

We at Davies Wealth Management witness firsthand how artificial intelligence, mobile platforms, and automated tools are reshaping client relationships. These innovations deliver faster insights and more personalized financial strategies than ever before.

Which Digital Tools Are Revolutionizing Wealth Management

Robo-advisors now manage over $1.4 trillion globally and are anticipated to reach $3.2 trillion by 2033 according to market research. Platforms like Betterment and Wealthfront have cut investment fees to 0.25% annually while they deliver automated rebalancing and tax-loss harvesting. These tools execute thousands of portfolio adjustments daily without human intervention, which makes sophisticated investment strategies accessible to investors with modest account minimums of $500 or less.

Advanced Portfolio Analytics Transform Decision Making

Modern portfolio management software processes real-time market data from 50+ exchanges simultaneously. Charles Schwab’s analytics platform tracks over 3,000 individual securities and generates Monte Carlo simulations with thousands of potential scenarios within seconds. This computational power identifies risk patterns and correlation shifts that human analysis would miss. Professional wealth managers now rely on machine learning algorithms that analyze historical data to predict portfolio performance, with algorithmic strategies outperforming passive strategies in terms of risk-adjusted returns.

Mobile Financial Monitoring Delivers Instant Insights

Financial apps provide push notifications for market movements that exceed 2% thresholds and send alerts when portfolios deviate from target allocations by more than 5%. Real-time account aggregation pulls data from banks, brokerages, and retirement accounts into single dashboards that update every 15 minutes. Users can execute trades, transfer funds, and adjust investment allocations from smartphones 24/7. Mobile platforms now handle 73% of all retail investment transactions, with average response times under 3 seconds for account balance queries and trade confirmations.

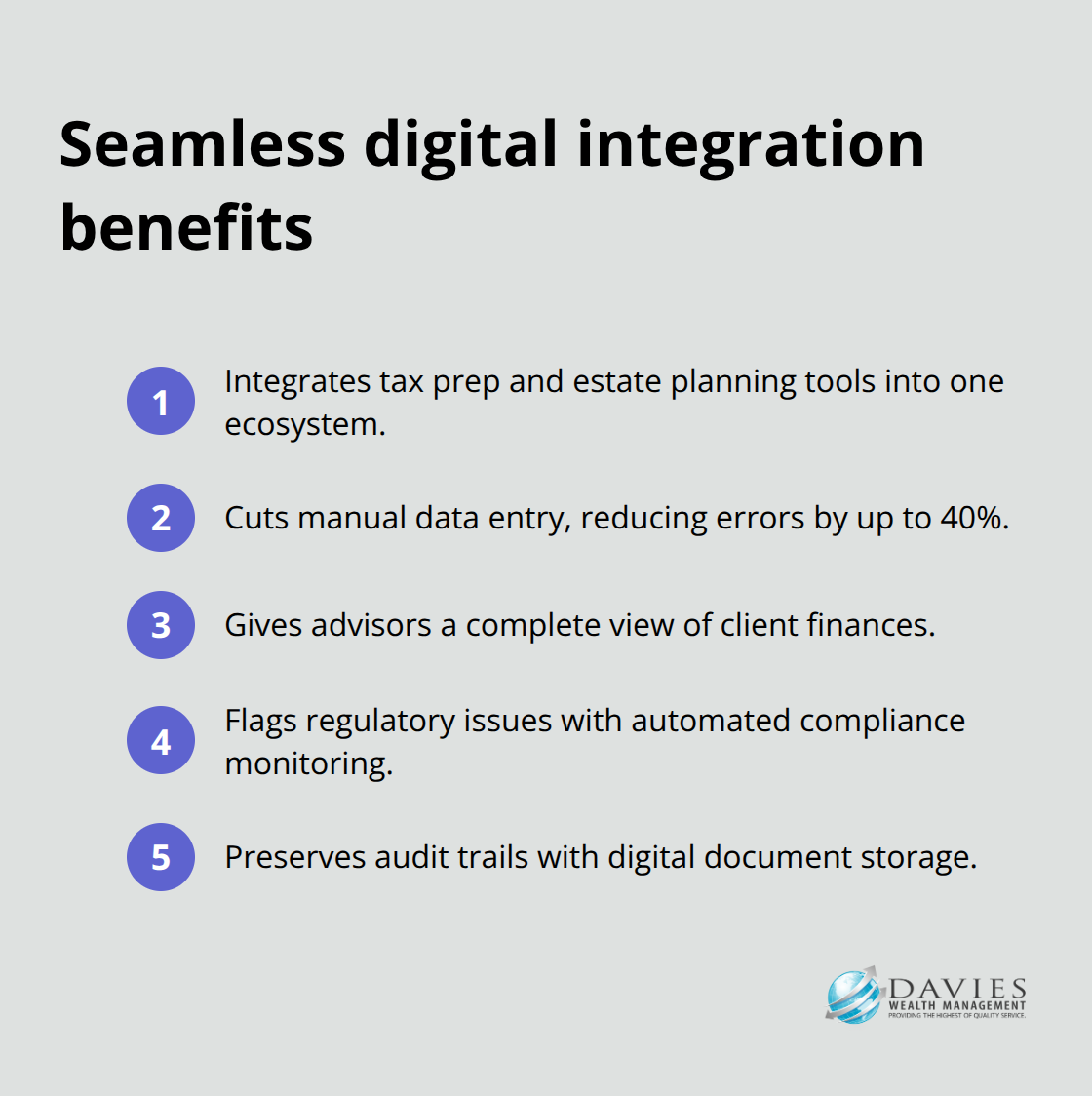

Digital Integration Creates Seamless Workflows

Investment platforms now integrate with tax preparation software and estate planning tools to create comprehensive financial ecosystems. These connections eliminate manual data entry (which reduces errors by up to 40%) and provide advisors with complete client financial pictures. Automated compliance monitoring flags potential regulatory issues before they become problems, while digital document storage systems maintain audit trails for all client interactions and transactions.

The sophistication of these digital tools sets the foundation for even more advanced capabilities. Artificial intelligence and predictive analytics now take wealth management personalization to unprecedented levels.

How AI Predicts Your Investment Future

Machine learning algorithms analyze historical market data and predict asset performance. JPMorgan Chase applies AI to real-world challenges across multiple use cases, demonstrating the technology’s growing impact in financial services. Goldman Sachs uses neural networks that process over 200 economic indicators simultaneously to forecast market trends three months ahead. These systems identify patterns in earnings reports, Federal Reserve communications, and global trade data that human analysts miss. BlackRock’s Aladdin platform optimizes portfolios and calculates potential tax implications, while Morgan Stanley’s AI models adjust portfolio allocations based on real-time sentiment analysis from news sources daily.

Personalized Recommendations Transform Portfolio Construction

AI systems create individual risk profiles by analyzing spending patterns, income volatility, and behavioral biases from client transaction histories. Vanguard’s Personal Advisor Services uses machine learning to match clients with investment strategies based on personal characteristics, which results in portfolio recommendations that differ from standard model allocations. These algorithms factor in life stage transitions, career changes, and family circumstances to suggest tactical shifts before major life events occur. The technology identifies when clients should increase equity exposure during market downturns or reduce risk before retirement with high precision rates.

Advanced Risk Management Prevents Portfolio Disasters

Modern risk assessment tools monitor correlation breakdowns across asset classes and send automated alerts when portfolio risk exceeds predetermined thresholds. Fidelity’s risk management system processes options pricing data from global exchanges to calculate Value at Risk metrics. These platforms identify concentration risks and suggest diversification strategies that reduce portfolio volatility without sacrificing expected returns. Stress testing algorithms simulate market scenarios to reveal potential losses during extreme events, with results that show which portfolios survive market crashes similar to 2008 or 2020.

These AI-powered insights create the foundation for enhanced client experiences. Technology now transforms how wealth managers interact with clients and deliver personalized service.

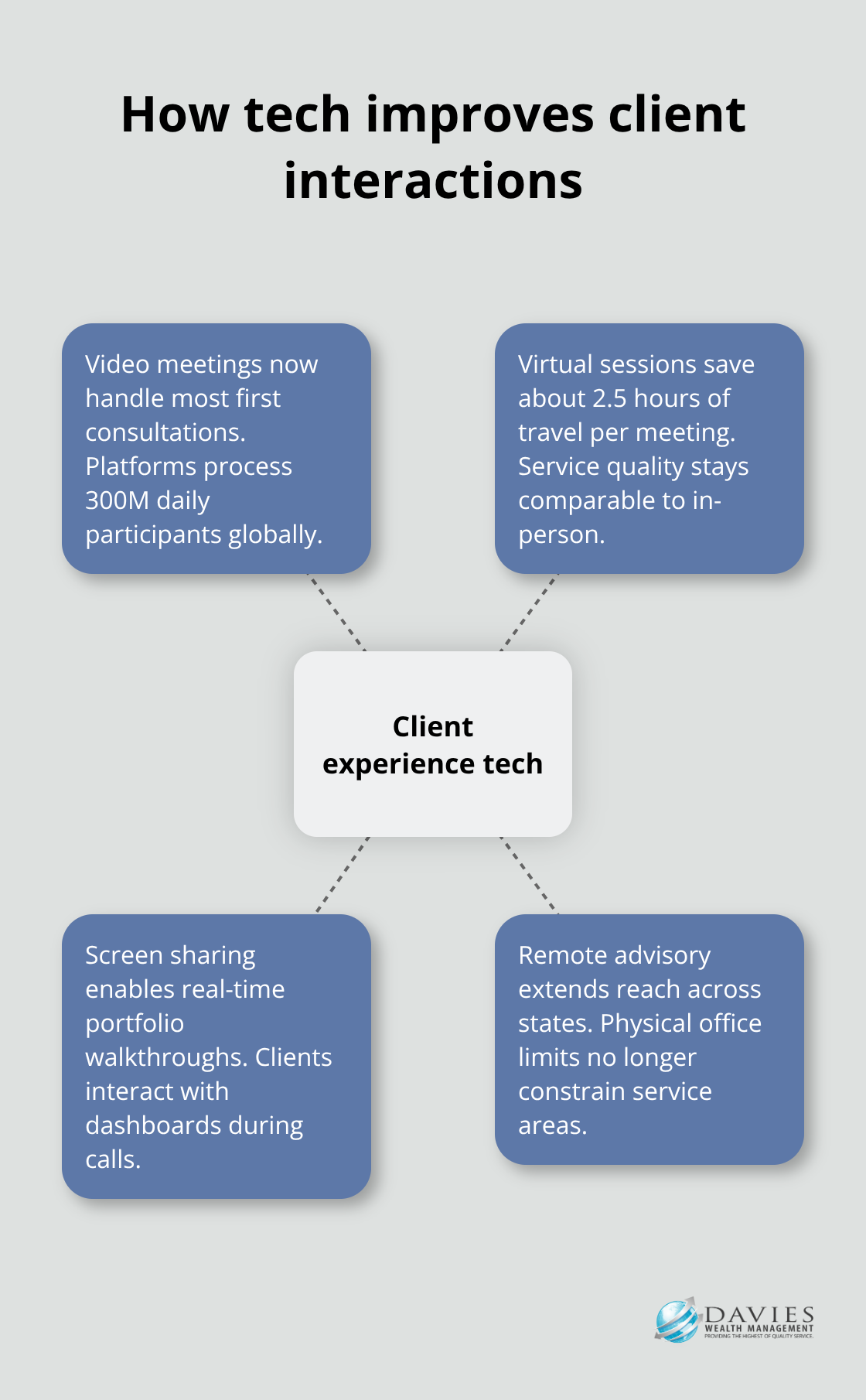

How Technology Transforms Client Interactions

Video conferencing platforms now handle most initial client consultations at wealth management firms, with Zoom and Microsoft Teams processing over 300 million daily meeting participants globally. Virtual advisory sessions reduce client travel time by an average of 2.5 hours per meeting while they maintain the same service quality as in-person interactions. Screen sharing capabilities allow advisors to walk clients through portfolio performance in real-time, with interactive dashboards that clients can manipulate during calls. Remote advisory services have expanded geographic reach for wealth management firms significantly, enabling advisors to serve clients across multiple states without physical office limitations.

Digital Onboarding Eliminates Paperwork Delays

Electronic signature platforms like DocuSign streamline new account openings compared to traditional paper processes that require 7-10 business days. Digital identity verification systems cross-reference Social Security numbers, driver’s licenses, and bank account information within minutes to complete Know Your Customer requirements. Automated document collection workflows send personalized checklists to new clients and track completion rates in real-time, with most digital processes completed within 48 hours. Cloud-based document management systems provide instant access to client files from any location, eliminating the need for physical file storage and reducing compliance risks through automated audit trails.

Real-Time Performance Tracking Builds Trust

Client portals now update portfolio values every 15 minutes during market hours and provide transparency that paper statements delivered monthly cannot match. Interactive performance charts allow clients to view returns across multiple time periods and compare results against benchmark indices with single-click functionality. Automated tax features generate realized gains and losses summaries instantly, while fee transparency tools show exactly what clients pay for advisory services down to the basis point. Mobile notifications alert clients to significant portfolio changes or market events that affect their investments, with 74% of respondents checking their portfolios through their advisor’s client portal at least weekly, demonstrating the demand for immediate financial planning information access.

Final Thoughts

Wealth tech has fundamentally transformed how Stuart residents manage their financial futures. AI-powered analytics now process market data faster than human analysis, while robo-advisors deliver sophisticated investment strategies at a fraction of traditional costs. Digital platforms provide 24/7 portfolio access and real-time performance tracking that builds stronger client relationships through transparency.

Advisors benefit from automated compliance monitoring and streamlined workflows that reduce manual tasks by 40%. Clients gain instant access to portfolio insights and can execute trades from mobile devices within seconds. Virtual consultations eliminate travel time while they maintain service quality (expanding advisor reach across multiple states).

The integration of machine learning algorithms with traditional advisory services creates personalized investment recommendations based on individual risk profiles and life circumstances. These technological advances position Stuart’s wealth management industry for continued growth as digital adoption accelerates. We at Davies Wealth Management combine these technological innovations with personalized advisory services to help clients achieve their financial goals.

Leave a Reply