At Davies Wealth Management, we understand that financial planning is a crucial investment in your future. However, many people hesitate to seek professional advice due to concerns about costs.

The average cost of a financial plan can vary widely depending on several factors. In this post, we’ll break down the typical expenses associated with financial planning services and help you understand what to expect.

What Influences Financial Plan Costs?

Complexity of Your Financial Situation

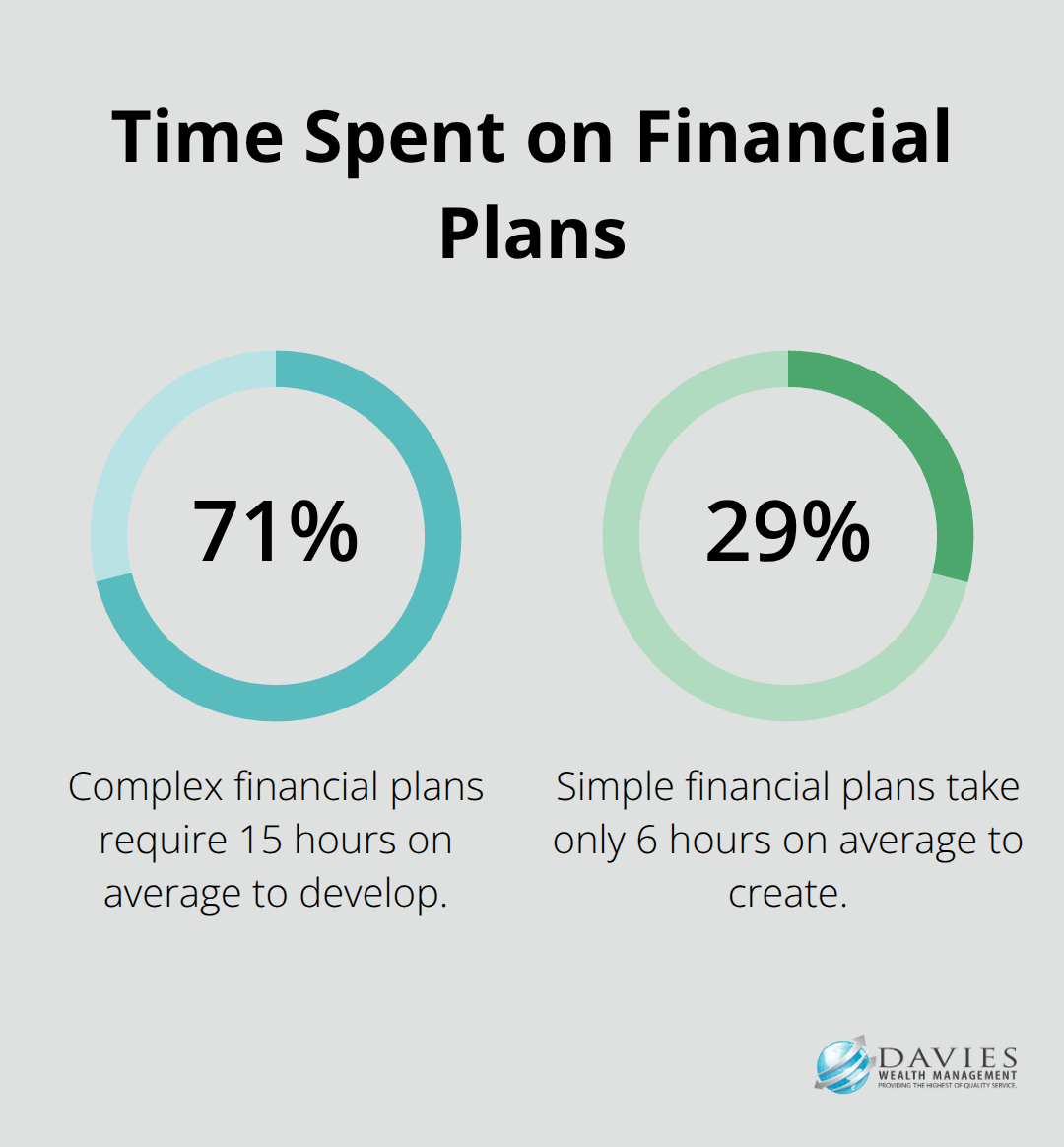

The intricacy of your finances directly affects the cost of your financial plan. High-net-worth individuals with multiple income streams, diverse investments, and international assets typically pay more than those with simpler financial profiles. A 2023 Kitces Research study found that advisors dedicate an average of 15 hours to develop comprehensive plans for complex cases, compared to just 6 hours for simpler situations.

Scope of Services

The range of services included in your financial plan impacts its cost. A basic plan focusing solely on retirement savings costs less than a comprehensive plan covering investment management, tax strategies, estate planning, and risk management. The Financial Planning Association reports that advisors charge an average of $2,500 for a basic financial plan, while comprehensive plans can exceed $5,000.

Advisor Expertise and Credentials

Your financial advisor’s qualifications and experience significantly influence costs. Certified Financial Planners (CFPs) or advisors with advanced degrees typically command higher fees due to their specialized knowledge. According to the 2022 Kitces Research Study on Advisor Productivity, CFP professionals take home more money per hour worked than non-CFP professionals.

Geographic Location

Your location can substantially impact financial planning costs. Urban areas with higher living costs generally have higher advisory fees. Financial planners in New York City or San Francisco might charge 20-30% more than those in smaller cities or rural areas.

Customization and Specialization

Some financial situations require specialized expertise. For instance, professional athletes often face unique financial challenges. Professional athletes often deal with fluctuating incomes due to varying career lengths, risk of injury leading to early retirement, and managing substantial earnings. Advisors who specialize in these areas may charge premium rates for their targeted knowledge and experience.

The cost of a financial plan reflects the value it provides. While price is an important consideration, it’s equally crucial to evaluate the potential long-term benefits of professional financial advice. As we explore different fee structures in the next section, you’ll gain a clearer understanding of how financial advisors charge for their services.

How Do Financial Advisors Charge for Their Services?

At Davies Wealth Management, we prioritize transparency in our fee structures. Understanding the various ways financial advisors charge for their services will help you make an informed decision about your financial planning needs. Let’s explore the most common fee structures in the industry.

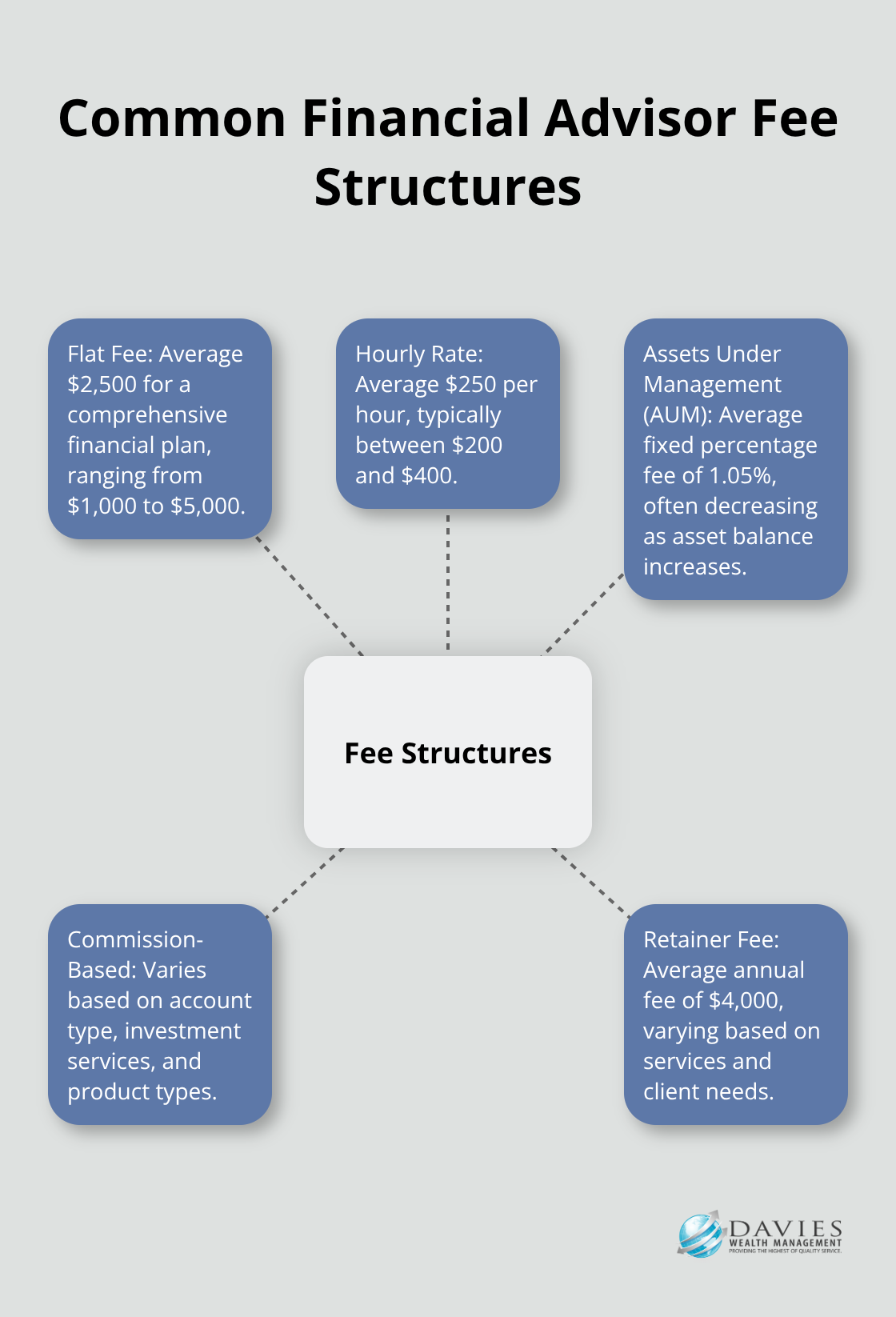

Flat Fee or Project-Based Fee

Many advisors offer flat fees for specific projects or comprehensive financial plans. This approach provides upfront clarity on costs. A 2023 Kitces Research study revealed that the average flat fee for a comprehensive financial plan is $2,500 (ranging from $1,000 to $5,000 depending on complexity).

Hourly Rate

Some advisors bill by the hour, which benefits clients with specific, limited needs. The Financial Planning Association reports that financial advisors charge an average hourly rate of $250 (typically between $200 and $400 per hour).

Assets Under Management (AUM) Fee

This popular model involves advisors charging a percentage of the assets they manage for you. The average fixed percentage fee for a financial advisor is 1.05%. This percentage often decreases as the asset balance increases (e.g., 1.2% on the first $1 million, but only 0.8% on amounts over $5 million).

Commission-Based Fee

Some advisors earn commissions on financial products they sell. While this can result in lower upfront costs, it’s important to consider potential conflicts of interest. These costs can vary based on the type of account you have, the investment services you’re signed up for and the types of products in which you’re investing.

Retainer Fee

A growing trend in the industry is the retainer model, where clients pay a set fee (often monthly or quarterly) for ongoing financial advice and management. A 2023 survey by the XY Planning Network found that the average annual retainer fee is $4,000 (varying widely based on services provided and client needs).

Financial advisors often use a combination of these fee structures to accommodate different client needs and preferences. The choice of fee structure can significantly impact your overall costs and the alignment of your advisor’s interests with your financial goals. As we move forward, we’ll examine the average cost ranges for different types of financial plans to give you a clearer picture of what to expect when seeking professional financial advice.

What Do Financial Plans Actually Cost?

At Davies Wealth Management, we provide transparent information about the costs associated with financial planning. This knowledge will help you make an informed decision about your financial future.

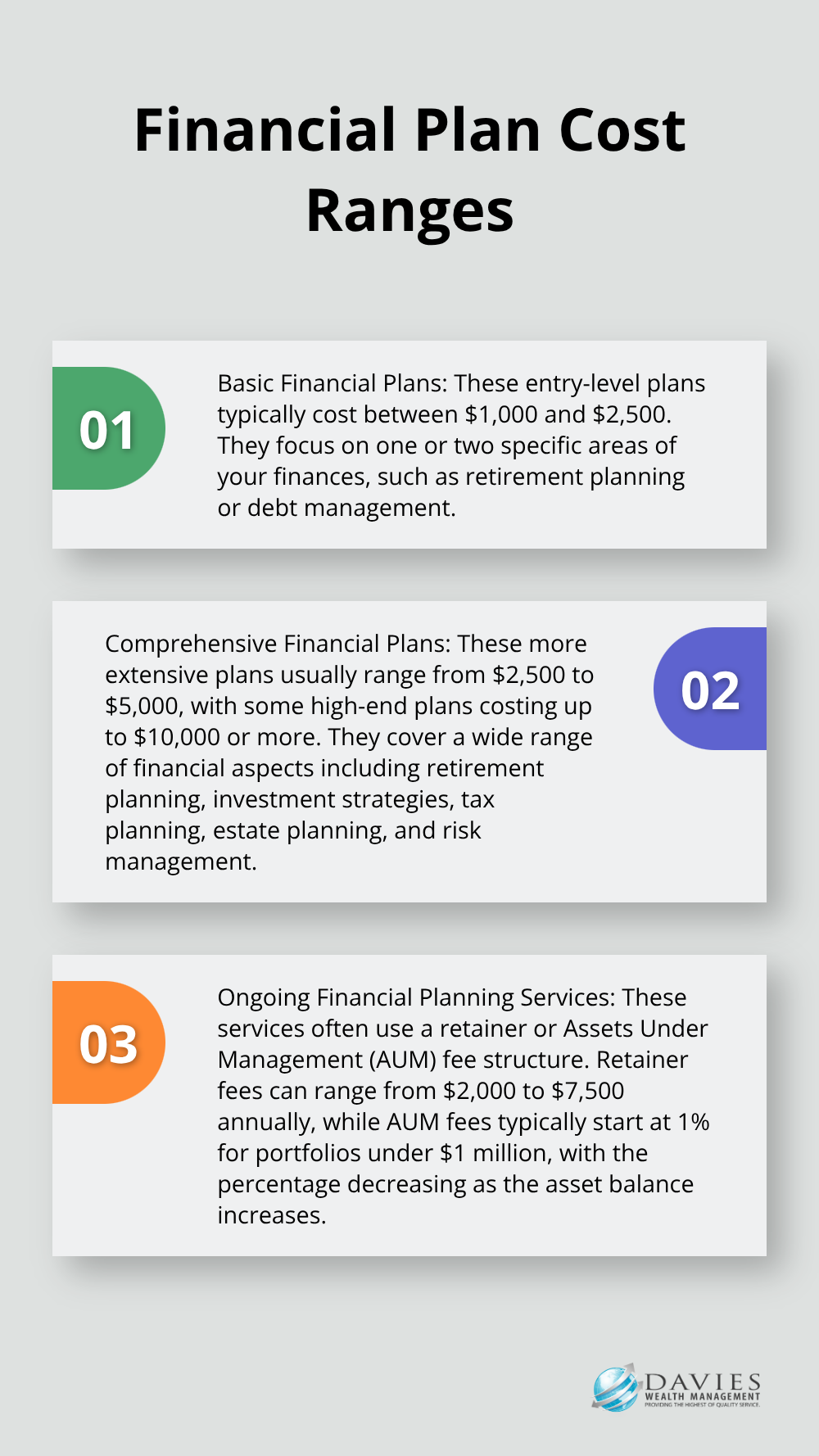

Basic Financial Plans: Entry-Level Pricing

Basic financial plans focus on one or two specific areas of your finances, such as retirement planning or debt management. These plans typically cost between $1,000 and $2,500.

Basic plans may not provide comprehensive coverage for more complex financial situations. They suit individuals who start their financial journey or those with straightforward financial needs.

Comprehensive Financial Plans: A Broader Investment

Comprehensive financial plans cover a wide range of financial aspects (retirement planning, investment strategies, tax planning, estate planning, and risk management). These plans typically range from $2,500 to $5,000, with some high-end plans costing up to $10,000 or more.

The higher cost reflects the increased time and expertise required to create a holistic financial strategy. A 2022 Kitces Research study on “How Financial Planners Actually Do Financial Planning” showed that financial planners spend significant time developing comprehensive plans for complex cases, which justifies the higher price point.

Ongoing Financial Planning Services: Continuous Support

Many individuals value ongoing financial planning services, which provide continuous guidance and adjustments to your financial plan. These services often use a retainer or Assets Under Management (AUM) fee structure.

Retainer fees can range from $2,000 to $7,500 annually, depending on the complexity of your financial situation and the level of service provided. AUM fees typically start at 1% for portfolios under $1 million, with the percentage decreasing as the asset balance increases.

Robo-Advisors vs. Human Advisors: Cost Comparison

Robo-advisors have gained popularity due to their lower costs, with median fees of 0.25% of assets per year. This option attracts those with straightforward financial needs, but it’s important to consider the limitations of automated advice.

Human advisors offer personalized strategies and can address complex financial situations that robo-advisors may not handle. While human advisors generally charge higher fees, the value of tailored advice often outweighs the cost difference, especially for high-net-worth individuals or those with unique financial circumstances (such as professional athletes).

When you consider the cost of a financial plan, look beyond the price tag and consider the potential long-term benefits and personalized guidance that come with professional financial advice.

Final Thoughts

The average cost of a financial plan varies based on complexity, scope, and advisor expertise. Fee structures range from flat fees to AUM percentages, each with unique advantages. The investment in professional financial advice often yields significant long-term benefits through improved strategies and risk management.

Choosing the right financial planning option requires careful consideration of your unique circumstances. Robo-advisors might suffice for straightforward situations, while human advisors provide invaluable insights for complex needs. The value of personalized guidance often outweighs the initial cost.

At Davies Wealth Management, we offer tailored financial planning solutions for various needs (including professional athletes). Our team of experts will help you navigate wealth management complexities and achieve your financial goals. Contact us today to start your journey towards long-term financial success.

Leave a Reply