At Davies Wealth Management, we understand that financial planning is a crucial investment in your future. However, many people hesitate to seek professional advice due to uncertainty about the costs involved.

The average cost of a financial plan can vary widely depending on several factors. In this post, we’ll break down these factors and provide insight into typical fee structures and cost ranges, helping you make an informed decision about your financial future.

What Drives Financial Planning Costs?

Your Financial Complexity

The intricacy of your financial situation significantly influences the price of your financial plan. A young professional with a single income stream and minimal assets will likely pay less than a business owner with multiple income sources, diverse investments, and complex tax considerations. A 2024 study by Kitces Research reveals that advisors often decrease their AUM fees as client assets increase, reflecting how income complexity impacts pricing.

Advisor Expertise and Credentials

The qualifications and experience of your financial planner directly affect their fees. Certified Financial Planners (CFPs) and advisors with advanced degrees or specialized certifications typically command higher rates. This premium often justifies their deeper knowledge and ability to handle more complex financial situations. CFP® professionals are associated with increased advisor productivity and more satisfied clients.

Scope of Services

The breadth and depth of financial planning services you require will impact the overall cost. A basic investment strategy costs less than a comprehensive financial plan that includes retirement planning, tax strategies, estate planning, and risk management. Some advisors offer à la carte services, which allow you to pay only for what you need. For instance, if you focus solely on retirement planning, you might pay less than someone seeking a full financial overhaul.

Geographic Location

The cost of financial planning services can vary significantly based on your location. Advisors in major metropolitan areas or financial hubs (such as New York or San Francisco) often charge higher fees due to increased operating costs and higher demand for their services. In contrast, advisors in smaller cities or rural areas might offer more competitive rates.

Frequency of Service

The frequency of meetings and updates with your financial planner also affects the cost. Some clients prefer quarterly check-ins, while others opt for annual reviews. More frequent interactions typically result in higher fees, but they also provide more opportunities for adjustments and guidance.

As we move forward, it’s important to understand how these factors translate into different fee structures that financial planners use. Let’s explore the common pricing models you’re likely to encounter when seeking financial planning services.

How Do Financial Planners Charge?

Financial planners use various fee structures to charge for their services. Understanding these structures will help you make an informed decision about which financial planning service best suits your needs and budget.

Hourly Rates

Many financial planners charge hourly rates ranging from $200 to $400. This model benefits clients who need specific, limited advice rather than ongoing management. For example, a retirement plan review might cost $400 to $800 for a two-hour session. This approach allows flexibility and can prove cost-effective for those with straightforward financial situations.

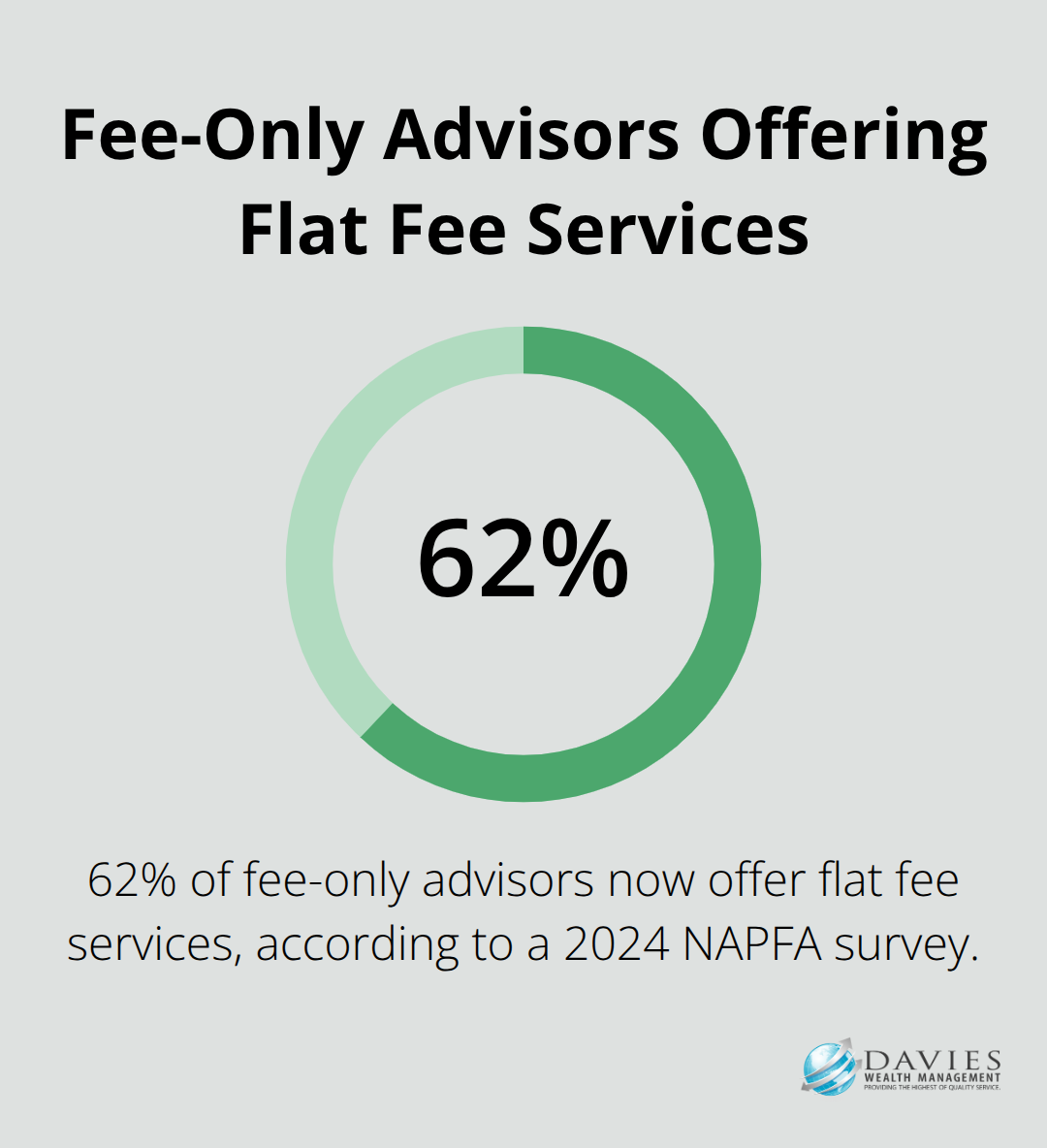

Flat Fees

Flat fees have gained popularity among financial planners. A 2024 survey by the National Association of Personal Financial Advisors (NAPFA) found that 62% of fee-only advisors now offer flat fee services. These fees range from $1,000 to $3,000 for a comprehensive financial plan. The advantage of this model lies in its transparency – you know the exact cost upfront. A mid-range flat fee of $2,000 might cover a full financial plan (including investment strategy, retirement planning, and basic estate planning).

Percentage of Assets Under Management (AUM)

The AUM model prevails among advisors who manage investment portfolios. Financial advisor costs typically range from 0.25% to 2% of the total assets managed annually. For a $500,000 portfolio, you might pay between $1,250 and $10,000 per year. Many advisors use a tiered system where the percentage decreases as the asset value increases. This model aligns the advisor’s interests with yours, as their compensation grows when your portfolio grows.

Commission-Based Models

Some financial advisors earn commissions on the products they sell, such as mutual funds or insurance policies. While this can sometimes result in lower upfront costs for clients, potential conflicts of interest exist. These costs can vary based on the type of account you have, the investment services you’re signed up for, and the types of products in which you’re investing. Always ask for full disclosure of all fees and commissions when considering this model.

Hybrid Models

Some financial advisors combine different fee structures to create a hybrid model. This approach allows them to tailor their services and fees to each client’s specific needs. For instance, an advisor might charge a flat fee for creating a financial plan and then switch to an AUM model for ongoing portfolio management.

The fee structure a financial planner uses will impact the overall cost of your financial plan. As we explore the average cost ranges for different types of financial plans, keep these fee structures in mind to better understand how they translate into actual costs.

What’s the Real Cost of Financial Planning?

Financial planning costs vary significantly based on the complexity of your financial situation and the level of service you require. We’ll break down the typical cost ranges for different types of financial plans to give you a clearer picture of what to expect.

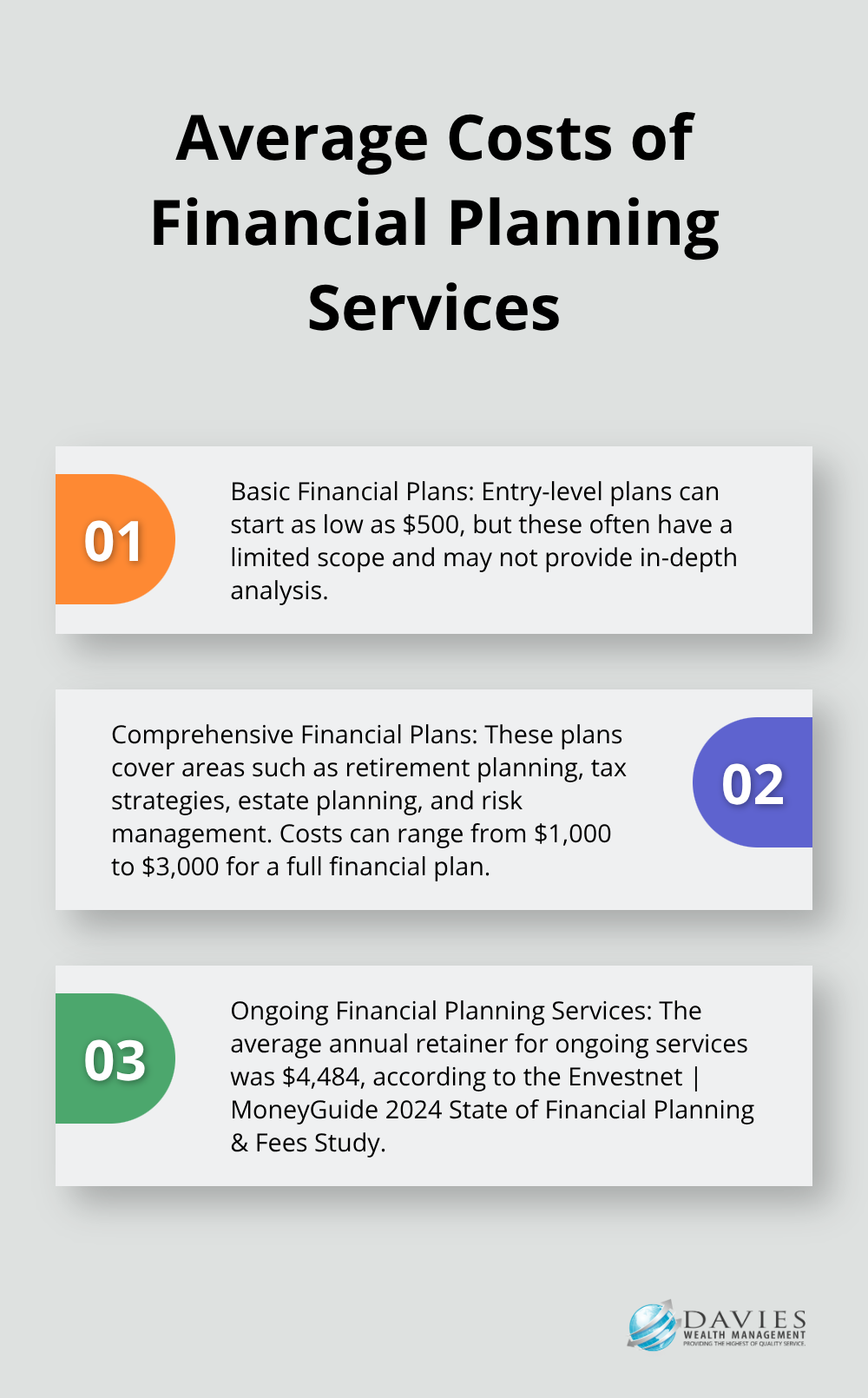

Basic Financial Plans

For those with straightforward financial situations, a basic financial plan might suffice. These plans typically cover fundamental aspects like budgeting, saving, and investing. Some firms offer entry-level plans for as low as $500, but these often have a limited scope and may not provide in-depth analysis.

Comprehensive Financial Plans

Comprehensive financial plans examine your financial life more thoroughly, covering areas such as retirement planning, tax strategies, estate planning, and risk management.

Ongoing Financial Planning Services

Many individuals opt for ongoing financial planning services to ensure their strategies remain aligned with changing life circumstances and market conditions. These services often operate on a retainer or subscription model. The Envestnet | MoneyGuide 2024 State of Financial Planning & Fees Study found that the average annual retainer was $4,484.

Specialized Financial Planning

High-net-worth individuals or those with complex financial situations (such as professional athletes or business owners) often require specialized financial planning services that command higher fees. These plans often start at $10,000 and can go much higher depending on the complexity and scope of services required. Davies Wealth Management offers tailored solutions for professional athletes, addressing their unique financial challenges such as short career spans and fluctuating incomes.

Factors Influencing Cost

The actual cost of your financial plan may vary from these averages. Your location, the advisor’s experience, and the specific services included can all influence the final price. When considering a financial planner, always ask for a clear breakdown of their fee structure and what services are included. The cost of a good financial plan should be viewed as an investment in your financial future (potentially saving you money and stress in the long run).

Final Thoughts

Financial planning costs vary based on several factors, including your financial complexity and the advisor’s expertise. The average cost of a financial plan ranges from a few hundred dollars for basic services to several thousand for comprehensive planning. Understanding different fee structures helps you choose a financial planner that aligns with your specific needs and financial goals.

Professional financial planning is a strategic decision that can significantly impact your financial future. A well-crafted plan can help you navigate complex financial landscapes, optimize investments, and secure long-term financial well-being. The potential returns from sound financial planning often exceed the initial costs (which makes it a worthwhile investment).

Davies Wealth Management specializes in creating personalized financial plans that address the unique needs of our clients. We offer comprehensive wealth management solutions, from investment strategies to retirement planning. Our team commits to building long-term relationships, ensuring your financial plan evolves with your changing life circumstances.

Leave a Reply