At Davies Wealth Management, we understand that one of the most common questions potential clients ask is, “How much does a financial advisor charge?” It’s a crucial consideration when seeking professional financial guidance.

The cost of financial advice can vary widely based on several factors, including the type of advisor, their fee structure, and the complexity of your financial situation.

In this post, we’ll break down the different types of financial advisor fees and explore the factors that influence these costs, helping you make an informed decision about your financial future.

Understanding Financial Advisor Fee Structures

Financial advisors use various fee structures to charge for their services. Let’s explore the most common fee arrangements you’ll encounter in the financial advisory landscape.

Fee-Only Advisors: A Transparent Approach

Fee-only advisors charge directly for their services without earning commissions from product sales. This model aligns the advisor’s interests with yours, as their income depends solely on the fees you pay. Typically, fee-only advisors charge either a percentage of assets under management (AUM), a flat fee, or an hourly rate.

Fee-Based and Commission-Based Models

Fee-based advisors charge fees for their services but may also earn commissions from certain product recommendations. This hybrid model can offer flexibility but requires careful consideration of potential conflicts of interest. Commission-based advisors earn their income primarily through commissions on financial products they sell. While this can result in lower upfront costs, it’s essential to scrutinize product recommendations for suitability.

Retainer and Hourly Rates: Flexibility in Pricing

Some advisors offer retainer arrangements, where clients pay a fixed fee for ongoing services. This can benefit those with complex financial situations requiring regular attention.

Hourly rates are another option, particularly useful for specific, one-time financial planning needs. According to the Bureau of Labor Statistics, the median hourly wage for personal financial advisors is $31.41.

Tailoring Fee Structures to Client Needs

The best financial advisors (like those at Davies Wealth Management) tailor their fee structure to best serve each client’s unique needs. This approach ensures that clients receive value-driven financial advice without unnecessary costs. When considering an advisor, it’s important to understand not just the fee structure, but also how it aligns with your financial goals and the level of service provided.

As we move forward, let’s examine the factors that influence these costs, providing you with a comprehensive understanding of what determines financial advisor fees.

What Drives Financial Advisor Costs?

Financial advisor fees vary widely based on several key factors. Understanding these elements will help you navigate the financial advisory landscape more effectively.

Assets Under Management (AUM)

The amount of money you invest significantly affects advisor fees. Most advisors use a sliding scale approach, where the percentage fee decreases as your assets increase. This detailed guide provides current insights into the average costs and fee arrangements of financial advisors in 2024.

Complexity of Financial Situation

Your financial situation’s intricacy plays a crucial role in determining costs. A straightforward investment portfolio will typically incur lower fees than a complex estate with multiple trusts, international assets, or intricate tax situations. Advisors often charge more for handling sophisticated financial scenarios because they require more time, expertise, and resources to manage effectively.

Service Scope and Specialization

The range of services you require will directly impact your costs. Basic investment management tends to cost less than comprehensive financial planning, which encompasses your entire financial situation including cash flow, tax planning, and more. Specialized services, such as those for business owners or individuals with unique financial circumstances, often come at a premium due to the additional expertise required.

Advisor Credentials and Experience

An advisor’s qualifications and years in the industry can significantly influence their fee structure. Highly credentialed professionals (such as Certified Financial Planners or Chartered Financial Analysts) often charge more due to their advanced training and expertise. Similarly, advisors with decades of experience may command higher fees than those new to the field.

Geographic Considerations

Location plays a role in advisor fees, much like it does in other professional services. Advisors in major metropolitan areas or financial hubs typically charge more than those in smaller cities or rural areas. This difference reflects the higher cost of living and operating expenses in these locations.

The rise of virtual financial planning services has started to level the playing field in terms of costs. Many clients now have access to top-tier advisors regardless of location, which may influence pricing structures in the future. As we move forward, let’s examine the average fees you can expect to encounter when seeking financial advice.

What Are Average Financial Advisor Fees?

Percentage of Assets Under Management (AUM)

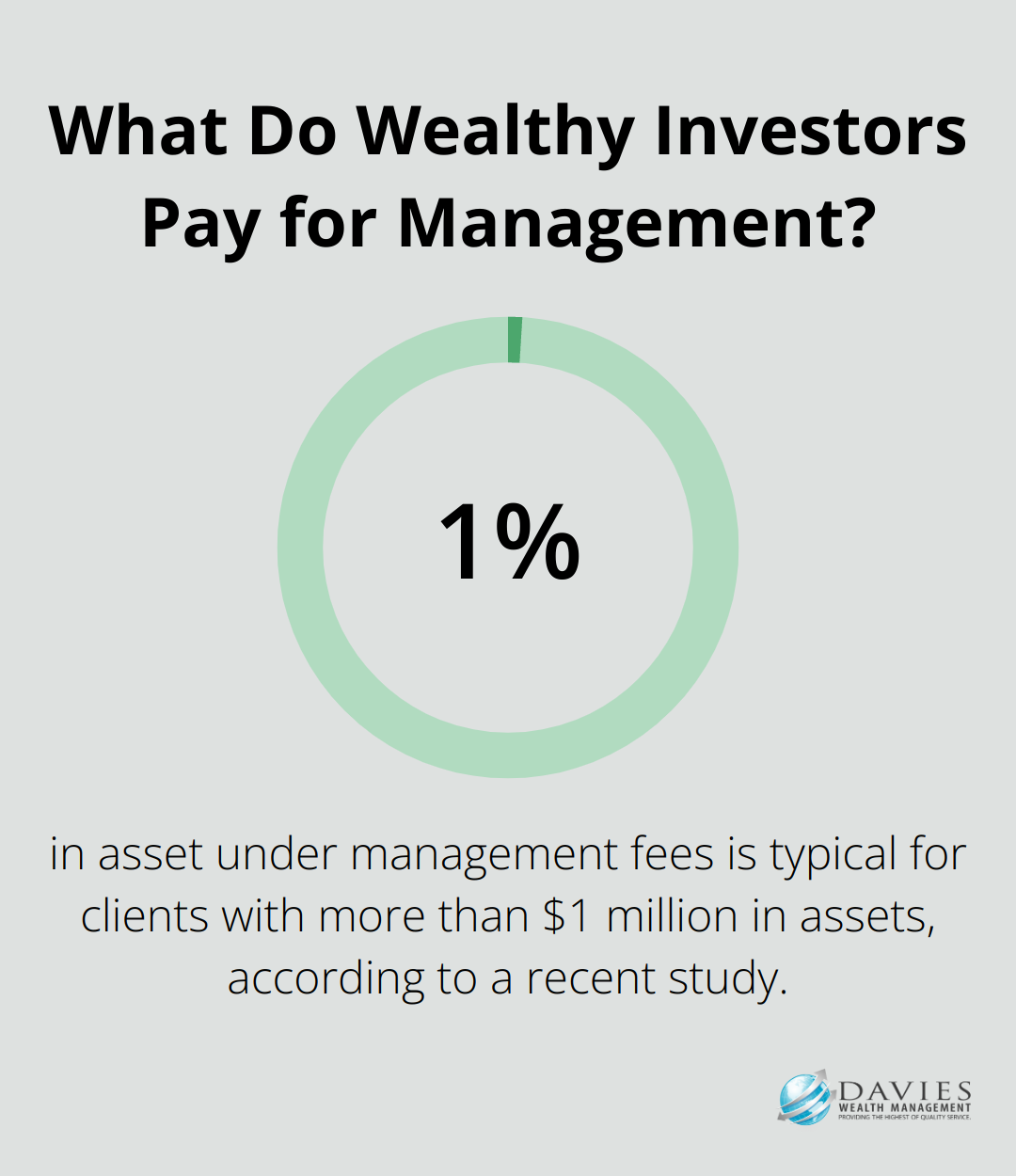

Financial advisors often structure their fees based on a percentage of assets under management (AUM). A recent study found that 1% in asset under management fees is typical if you have more than $1 million in assets. This percentage typically decreases as the asset value increases. Clients with $5 million in assets might pay around 0.85%, while those with $10 million could see fees drop to 0.75% or lower.

These percentages translate to substantial amounts over time. For a $1 million portfolio, a 1% fee equals $10,000 annually. Clients should assess whether the cost aligns with the services provided and the value received.

Hourly and Flat Fee Structures

Some financial advisors prefer hourly rates or flat fees, particularly for specific projects or one-time consultations. The Bureau of Labor Statistics reports that the median annual wage for personal financial advisors was $99,580 in May 2023.

Flat fees present another option, especially for comprehensive financial plans. These can range from $1,000 to $3,000 for a basic plan, while more complex situations might command fees of $10,000 or more. Some advisors offer annual retainer fees, which can start at around $2,000 and increase to $7,500 or higher (depending on the complexity of the financial situation and the level of ongoing support provided).

Comparing Costs Across Advisory Models

Different advisory models come with varying cost structures. Traditional human advisors typically charge higher fees but offer personalized service and comprehensive planning. Robo-advisors have disrupted the market with significantly lower fees, often ranging from 0.25% to 0.50% of AUM. However, these automated services generally provide less personalized advice and may not suit complex financial situations.

Hybrid models, which combine human expertise with technology-driven solutions, have gained popularity. These services often charge fees between those of traditional advisors and robo-advisors, typically ranging from 0.30% to 0.89% of AUM.

Factors Influencing Fee Structures

Several factors influence financial advisor fees:

- Complexity of financial situation

- Range of services provided

- Advisor’s experience and qualifications

- Geographic location

Clients with intricate financial needs or those requiring specialized services may incur higher fees. Similarly, advisors with advanced certifications or extensive experience often command premium rates.

Transparency in Pricing

We at Davies Wealth Management believe in transparent pricing that aligns with the value we provide. Our fee structure offers comprehensive wealth management services while ensuring that our clients’ interests always come first. We encourage potential clients to discuss fees openly and understand the full scope of services included before making a decision.

While cost is an important factor, it should not be the only consideration when choosing a financial advisor. The value of expert guidance, personalized strategies, and peace of mind can outweigh the fees for many individuals and families navigating complex financial landscapes.

Final Thoughts

The world of financial advisor fees can be complex, but understanding these costs is essential for making informed decisions about your financial future. We have explored various fee structures, from fee-only and fee-based models to commission-based approaches, each with its own set of advantages and considerations. The factors that influence these costs include assets under management, complexity of financial situations, and advisor qualifications.

The cheapest option isn’t always the best value when considering how much a financial advisor charges. It’s important to weigh the cost against the potential benefits and long-term value of professional financial guidance. A skilled advisor can potentially save you money, optimize your investments, and help you achieve your financial goals more efficiently.

At Davies Wealth Management, we provide transparent, value-driven financial advice tailored to each client’s unique needs. Our team’s extensive experience and comprehensive approach to wealth management aim to deliver long-term value that extends far beyond our fee structure. We strive to help our clients navigate complex financial landscapes, optimize their wealth, and secure their financial futures.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply