Stuart residents face unique financial challenges, from Florida’s tax advantages to coastal property investments. Wealth coaching provides the personalized guidance needed to navigate these opportunities effectively.

We at Davies Wealth Management understand that managing money goes beyond basic investment advice. The right wealth coach transforms your relationship with finances through education, behavioral insights, and strategic planning tailored to your specific goals.

What Makes a Wealth Coach Different

A wealth coach operates as your financial educator and behavioral guide, not just an investment manager. Traditional financial advisors focus primarily on product sales and portfolio management. They earn commissions from the investments they sell. Wealth coaches work on a fee-only basis, which eliminates conflicts of interest that arise when advisors profit from specific product recommendations. This fundamental difference means wealth coaches prioritize your financial education over sales targets.

The Education-First Philosophy

Wealth coaches spend significant time to teach you financial concepts rather than simply manage your money. This educational approach addresses a critical gap – financial literacy often isn’t taught in schools or families, which leaves many Americans unprepared for wealth creation. Emotional decision-making significantly impacts investment outcomes, as behavioral finance research demonstrates. A wealth coach helps you understand why certain strategies work, how market cycles affect your portfolio, and what specific steps you should take during different economic conditions. This knowledge empowers you to make informed decisions independently, reduces anxiety about market volatility, and builds confidence in your financial future.

Behavioral Change Creates Lasting Results

The most significant difference lies in how wealth coaches address money behaviors and mindset. Wealth coaches recognize that 73 percent of adults report doing okay financially or living comfortably, yet many still struggle with financial behaviors rather than income limitations. They help identify your personal financial triggers, eliminate debt systematically, and develop sustainable habits that stick. This behavioral focus produces measurable results – clients typically increase their savings rates and improve investment performance through better decision-making processes. Wealth coaches also prepare you for life transitions (job changes, inheritance, or retirement) through financial resilience strategies that adapt to changing circumstances.

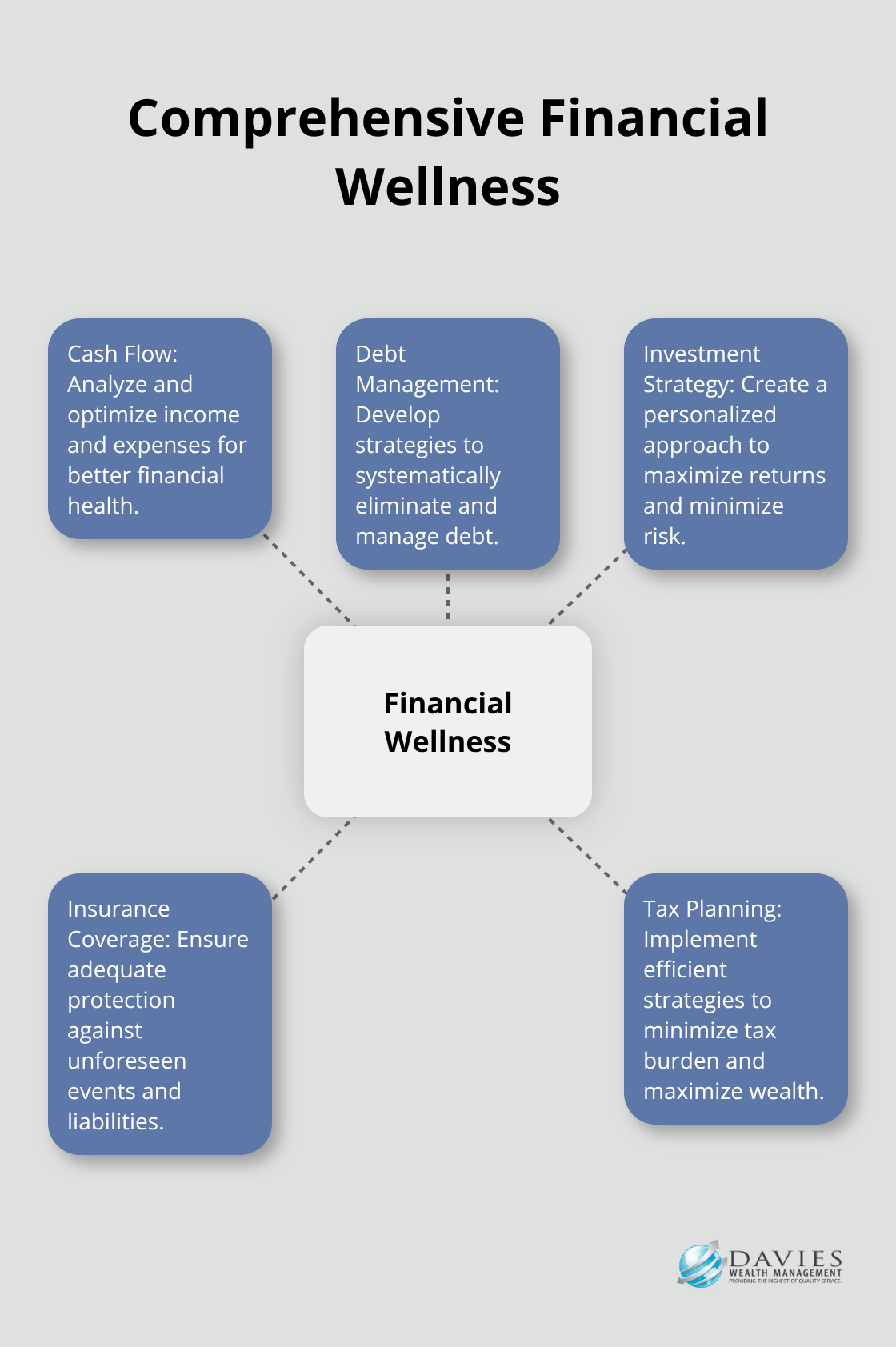

Comprehensive Financial Wellness

Wealth coaches take a holistic view of your entire financial picture rather than focus solely on investment returns. They examine your cash flow patterns, debt structure, insurance coverage, and tax situation to create an integrated strategy. This comprehensive approach often reveals opportunities that traditional advisors miss – such as tax-efficient wealth transfer strategies or cash flow optimization techniques. The result is a coordinated financial plan where each component supports your overall objectives, creating synergies that maximize your wealth-building potential across all areas of your financial life.

Key Financial Services a Wealth Coach Provides in Stuart

Stuart wealth coaches deliver three core services that directly impact your financial growth. Investment portfolio optimization goes beyond basic asset allocation – wealth coaches analyze your risk tolerance, time horizon, and tax situation to create portfolios that outperform generic market approaches. Research from Morningstar shows that higher fees correlate with worse long-term performance, which is why wealth coaches focus on low-cost index funds and tax-loss harvesting strategies.

Investment Portfolio Management and Optimization

Wealth coaches rebalance portfolios quarterly and adjust allocations based on life changes rather than market emotions. They implement systematic approaches that remove emotional decision-making from investment choices. Florida residents benefit from state-specific strategies like municipal bond investments that provide tax-free income at both federal and state levels. These coaches also utilize dollar-cost averaging techniques and maintain disciplined withdrawal strategies that preserve capital during market downturns.

Retirement Planning Strategies for Florida Residents

Florida’s zero state income tax creates unique retirement opportunities that wealth coaches leverage effectively. They structure Roth IRA conversions during lower-income years to maximize tax savings, since Florida residents avoid state taxes on converted amounts. Wealth coaches also recommend specific withdrawal strategies from retirement accounts that minimize federal taxes while maximize Social Security benefits.

While retirees generally report high levels of financial well-being according to the Federal Reserve, those with income from employment, pensions, or investments perform substantially better. Florida residents who work with wealth coaches typically accumulate more retirement wealth due to optimized tax strategies. Wealth coaches also address healthcare costs (which average $300,000 per couple in retirement according to Fidelity research) through Health Savings Account maximization and long-term care insurance evaluation.

Tax-Efficient Wealth Building Techniques

Wealth coaches implement advanced tax strategies that significantly accelerate wealth accumulation. They utilize tax-loss harvesting to offset capital gains and reduce tax liability while optimizing investment strategy. Estate planning becomes particularly important for Stuart residents with coastal properties – wealth coaches structure trusts and gifting strategies to minimize federal estate tax on assets that exceed the $13,610,000 threshold for 2024 according to IRS guidelines.

These professionals also recommend tax-efficient investment vehicles like I Bonds for inflation protection and 529 plans for education funding that provide state tax deductions in many cases. The next step involves selecting the right wealth coach who can implement these strategies effectively for your specific situation.

How to Choose the Right Wealth Coach in Stuart

The credentials that matter most are CFP (Certified Financial Planner) certification and fiduciary status. CFP professionals complete 6,000 hours of financial planning experience and pass comprehensive examinations that cover investment planning, tax planning, and estate planning. Fiduciary advisors must act in your best interest by law, while non-fiduciary advisors only need to recommend suitable investments. Fee-only compensation structures eliminate conflicts of interest that arise when coaches earn commissions from product sales. Over 25 years of investment advisory experience provides the market knowledge necessary to navigate different economic cycles effectively.

Professional Credentials and Licensing Requirements

Stuart wealth coaches should demonstrate specific experience with Florida tax strategies, coastal property investments, and retirement planning for state residents. Look for professionals who hold Series 65 licenses for investment advisory services and maintain continuing education requirements. The Financial Planning Association reports that advisors with comprehensive credentials produce better client outcomes than those with limited qualifications. Verify their regulatory record through FINRA BrokerCheck and SEC Investment Adviser Public Disclosure databases. Coaches with clean regulatory histories and established local practices typically provide more reliable service than newer firms without track records.

Key Questions for Initial Consultations

Ask how they charge fees and whether they receive any compensation from investment products they recommend. Request specific examples of tax-loss harvesting strategies they implement and how they optimize portfolios for Florida residents. Inquire about their client communication frequency and portfolio review schedule. Effective wealth coaches provide quarterly updates and annual comprehensive reviews. Ask for references from current clients in similar financial situations. The most important question involves their investment philosophy – coaches who focus on low-cost index funds and evidence-based strategies typically outperform those who chase market trends or recommend actively managed funds with high expense ratios.

Red Flags That Signal Poor Service

Avoid coaches who guarantee specific investment returns or promise to beat market performance consistently. No legitimate professional can predict market outcomes with certainty (despite what some may claim). Be wary of high-pressure sales tactics or recommendations for complex investment products like variable annuities or hedge funds without clear explanations of fees and risks. Coaches who refuse to provide written fee disclosures or avoid discussing their fiduciary status create unnecessary risks for clients. Multiple regulatory violations or customer complaints indicate poor business practices that could affect your financial security and long-term wealth growth.

Final Thoughts

Local Stuart wealth coaches offer distinct advantages that remote advisors cannot match. These professionals understand Florida’s tax landscape, coastal property markets, and retirement opportunities specific to the region. They build community relationships and provide face-to-face consultations that strengthen trust and communication.

Schedule consultations with qualified wealth coaches to discuss your specific financial situation. Prepare a list of your current assets, debts, and financial goals before these meetings. Compare their approaches, fee structures, and credentials to find the best fit for your needs.

Wealth coaching addresses both technical money management aspects and behavioral patterns that drive financial decisions. Research shows that 85% of clients who work with financial planners feel more financially secure compared to those who manage investments alone (compared to just 15% who feel equally secure without professional guidance). We at Davies Wealth Management specialize in comprehensive wealth management solutions for individuals, families, and businesses through personalized investment management, retirement planning, and tax-efficient strategies.

Leave a Reply