At Davies Wealth Management, we understand that financial planning goes beyond just managing investments.

Holistic financial advisor services encompass a comprehensive approach to your financial well-being, addressing every aspect of your financial life.

In this post, we’ll explore the key components of these services and how they can help you achieve your financial goals.

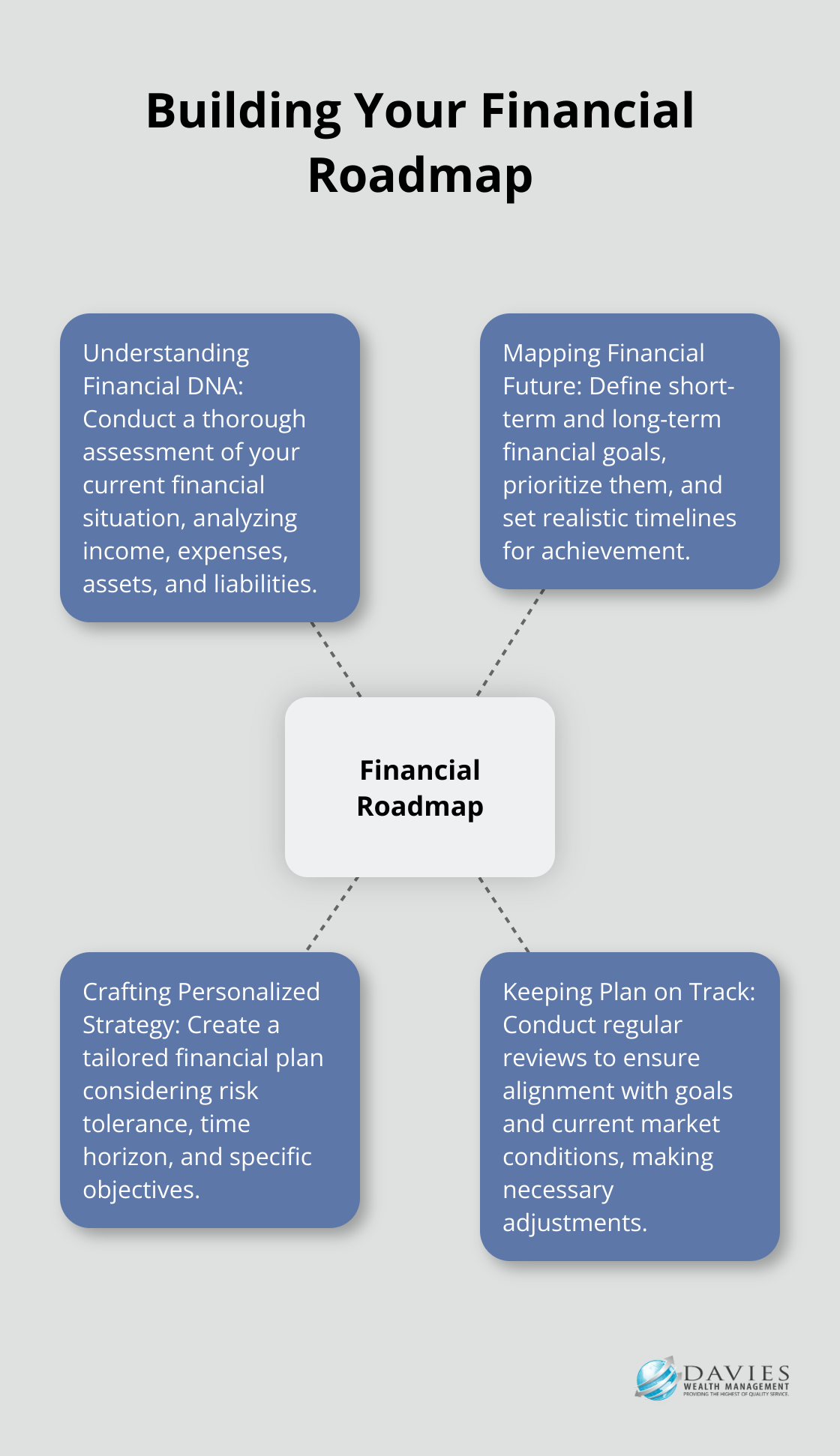

How We Build Your Financial Roadmap

Understanding Your Financial DNA

At Davies Wealth Management, we start by conducting a thorough assessment of your current financial situation. This involves an analysis of your income, expenses, assets, and liabilities. We review your tax returns, investment statements, and insurance policies to get a clear picture of your current financial situation. This step provides the foundation for all future planning.

Mapping Your Financial Future

Once we understand your current position, we work with you to define your short-term and long-term financial goals. These might include buying a home, funding your children’s education, or planning for retirement. We help you prioritize these goals and set realistic timelines for achieving them.

Crafting Your Personalized Strategy

With a clear understanding of your current situation and future goals, we create a personalized financial strategy. This strategy is not a one-size-fits-all solution; it’s a carefully crafted plan that takes into account your risk tolerance, time horizon, and specific objectives. We consider various factors such as tax implications, investment opportunities, and potential risks to ensure a well-rounded approach.

For our professional athlete clients, we pay special attention to the unique challenges they face. We develop strategies to manage these complexities and secure their financial future beyond their playing years. A competent team is crucial for professional athletes’ financial success.

Keeping Your Plan on Track

Financial planning is not a set-it-and-forget-it process. We conduct regular reviews of your financial plan to ensure it remains aligned with your goals and current market conditions. These reviews allow us to make necessary adjustments, whether it’s rebalancing your investment portfolio, updating your insurance coverage, or modifying your savings strategy.

Our commitment to providing clear, actionable solutions that evolve with your changing needs ensures that every aspect of your financial life is considered. This comprehensive approach gives you the confidence to pursue your goals and secure your financial future.

As we move forward, let’s explore how we optimize your investment portfolio to align with your personalized financial roadmap.

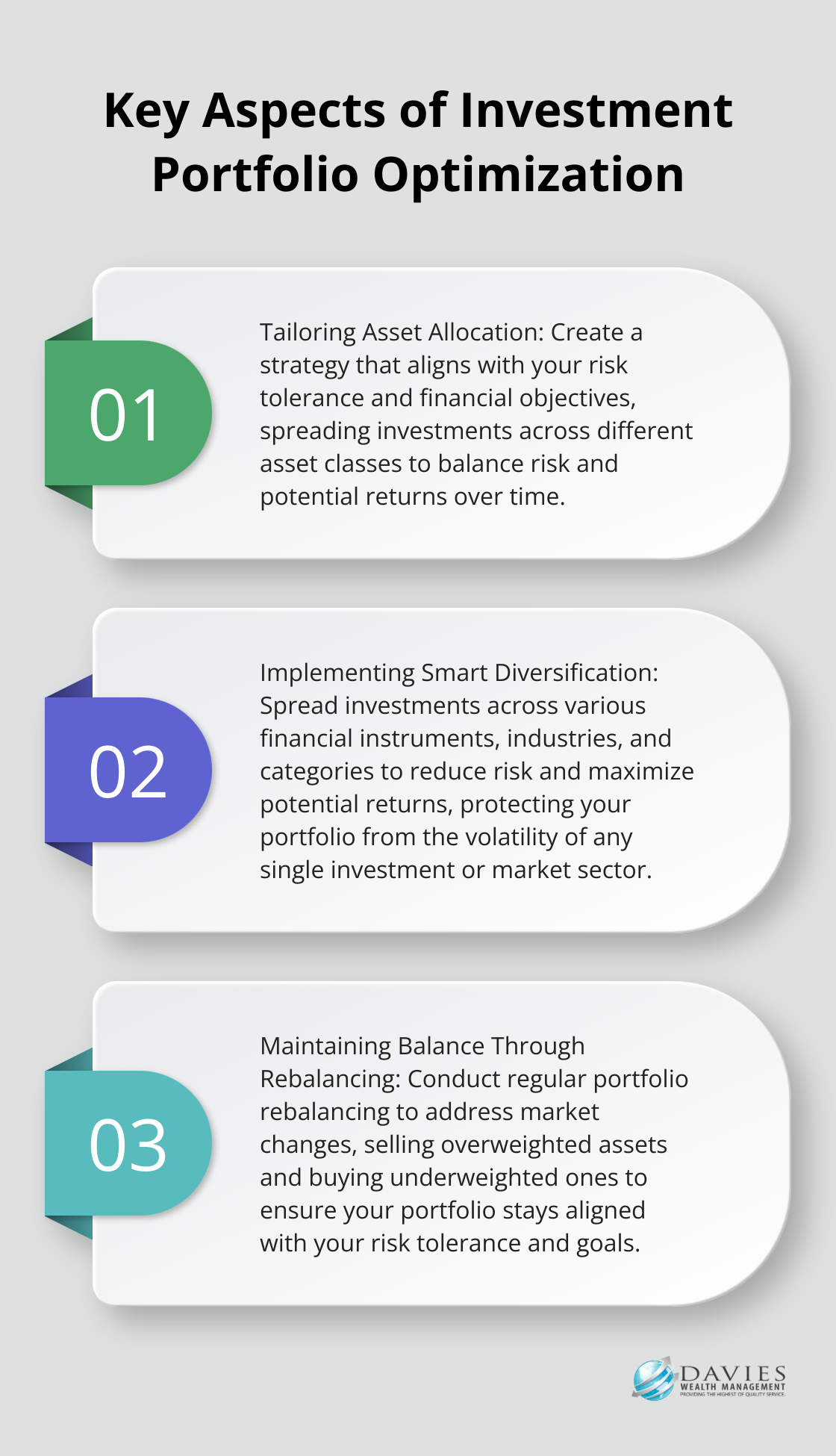

How We Optimize Your Investment Portfolio

At Davies Wealth Management, we believe successful investment management extends beyond stock or mutual fund selection. Our portfolio optimization approach stems from a comprehensive understanding of your financial goals, risk tolerance, and unique circumstances.

Tailoring Your Asset Allocation

We create an asset allocation strategy that aligns with your risk tolerance and financial objectives. This process involves spreading investments across different asset classes, rather than relying on one, to balance risk and potential returns over time. For a young professional with a long investment horizon, we might recommend a more aggressive allocation with a higher percentage of stocks. For those nearing retirement, we suggest a more conservative approach with a greater emphasis on fixed-income securities.

Implementing Smart Diversification

Diversification forms the cornerstone of our investment philosophy. We spread your investments across various financial instruments, industries, and other categories to reduce risk and maximize potential returns. This strategy protects your portfolio from the volatility of any single investment or market sector. Our diversification approach might include a mix of domestic and international stocks, government and corporate bonds, and alternative investments like real estate investment trusts (REITs) or commodities.

Maintaining Balance Through Regular Rebalancing

Markets change constantly, and over time, your portfolio’s allocation can drift from its target. We conduct regular portfolio rebalancing to address this issue. This process involves selling overweighted assets and buying underweighted ones, ensuring your portfolio stays aligned with your risk tolerance and goals.

Maximizing Tax Efficiency

We employ various tax-efficient investing techniques to help you retain more of your earnings. This strategy uses specific products and accounts in a portfolio to maximize returns and minimize the taxes paid on those returns. These strategies include tax-loss harvesting (selling underperforming investments to offset capital gains taxes on winning investments). We also consider the tax implications of different investment vehicles. For instance, we might recommend placing high-yield bonds in tax-advantaged accounts like IRAs, while keeping more tax-efficient investments like index funds in taxable accounts.

For our professional athlete clients, we pay special attention to tax planning given their unique income situations. We use strategies like income smoothing or strategic charitable giving to manage tax liabilities effectively.

Our proactive approach ensures that your investment strategy remains optimized and aligned with your goals. We continuously monitor market conditions, economic trends, and your changing financial situation to make informed adjustments. This ongoing vigilance sets the stage for our next critical service: comprehensive risk management and insurance planning.

Safeguarding Your Financial Future

Uncovering Hidden Financial Risks

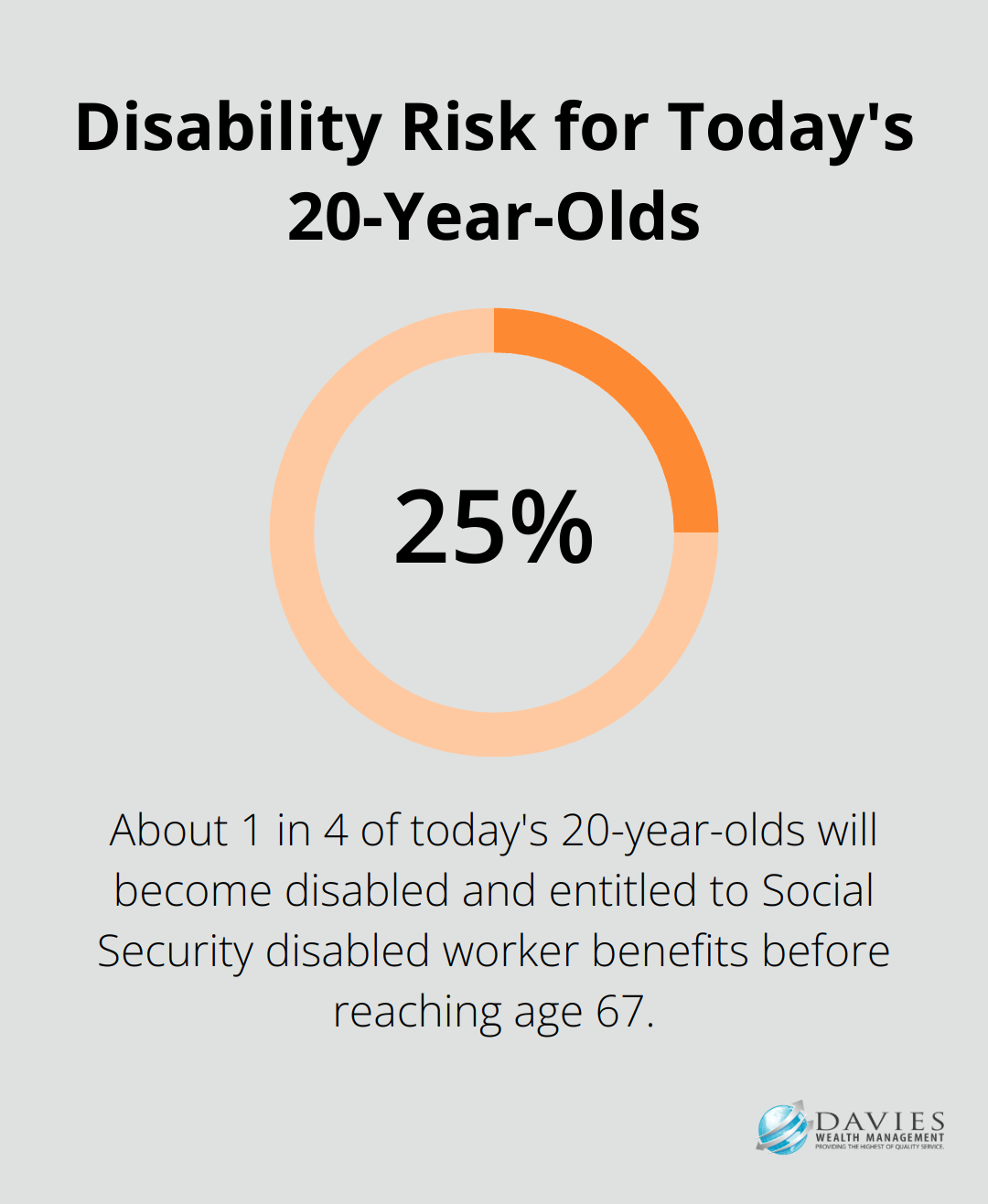

We start with a comprehensive risk assessment of your financial situation. This analysis covers various aspects of your life, including your career, family situation, and assets. We identify risks such as disability, premature death, or liability issues that could derail your financial plans.

A study by the Social Security Administration reveals that about 1 in 4 of today’s 20-year-olds will become disabled and entitled to Social Security disabled worker benefits before reaching age 67. This statistic highlights the importance of thorough risk assessment, especially for younger clients.

Evaluating Your Insurance Safety Net

After we identify potential risks, we review your existing insurance coverage. This examination includes your life, health, disability, and property insurance policies. We look for gaps in coverage that could expose you to significant financial loss.

For professional athlete clients, we focus on career-ending injury insurance and loss-of-value coverage. These specialized policies provide crucial protection for athletes whose careers and earnings potential closely tie to their physical abilities.

Tailoring Insurance Solutions

Our assessment informs our recommendations for insurance solutions tailored to your specific needs. This process might involve adjusting coverage limits, adding riders to existing policies, or exploring new insurance products.

For clients nearing retirement age, we might suggest long-term care insurance. The U.S. Department of Health and Human Services reports on the likelihood of needing long-term care services for those turning 65 today.

Securing Your Legacy

Estate planning forms a critical component of our risk management strategy. We help you develop a comprehensive plan to transfer your wealth efficiently and in line with your wishes. This plan includes creating or updating wills, establishing trusts, and implementing strategies to minimize estate taxes.

For high-net-worth individuals, we recommend advanced techniques like Grantor Retained Annuity Trusts (GRATs) or Intentionally Defective Grantor Trusts (IDGTs). These strategies can be part of advanced estate planning which goes beyond a basic will and includes tools like trusts, gifting strategies, and tax planning.

Ongoing Protection Strategies

Effective risk management and insurance planning require ongoing attention. We regularly review and adjust your protection strategies to ensure they keep pace with your evolving financial situation and changing market conditions. This proactive approach helps maintain the integrity of your financial safeguards over time.

Final Thoughts

Holistic financial advisor services offer a comprehensive approach to managing your financial life. At Davies Wealth Management, we address every aspect of your financial well-being to help you achieve true financial success. Our expert team provides personalized strategies, optimized investment portfolios, and robust risk management plans to maximize your opportunities for growth and security.

A holistic financial advisor acts as your dedicated partner, offering ongoing guidance as your life and financial needs evolve. This continuous relationship allows for timely adjustments to your financial plan, ensuring it remains aligned with your goals and responsive to changing market conditions. Our team at Davies Wealth Management works diligently to understand your unique financial situation, goals, and challenges.

We provide tailored strategies to help you achieve your objectives, whether you’re a professional athlete navigating a complex financial landscape or an individual seeking to secure your financial future. Our full suite of services includes retirement planning, tax-efficient strategies, and estate planning. Contact Davies Wealth Management today to gain a dedicated partner committed to your long-term financial success.

Leave a Reply