Receiving sudden wealth through inheritance, business sale, or legal settlement creates unique financial challenges that require specialized expertise. Most traditional financial advisors lack experience with these complex situations.

At Davies Wealth Management, we understand that choosing the right sudden wealth financial advisor can make the difference between preserving your newfound wealth and losing it to poor decisions.

Why Sudden Wealth Requires Different Expertise

Complex Tax Implications Hit Immediately

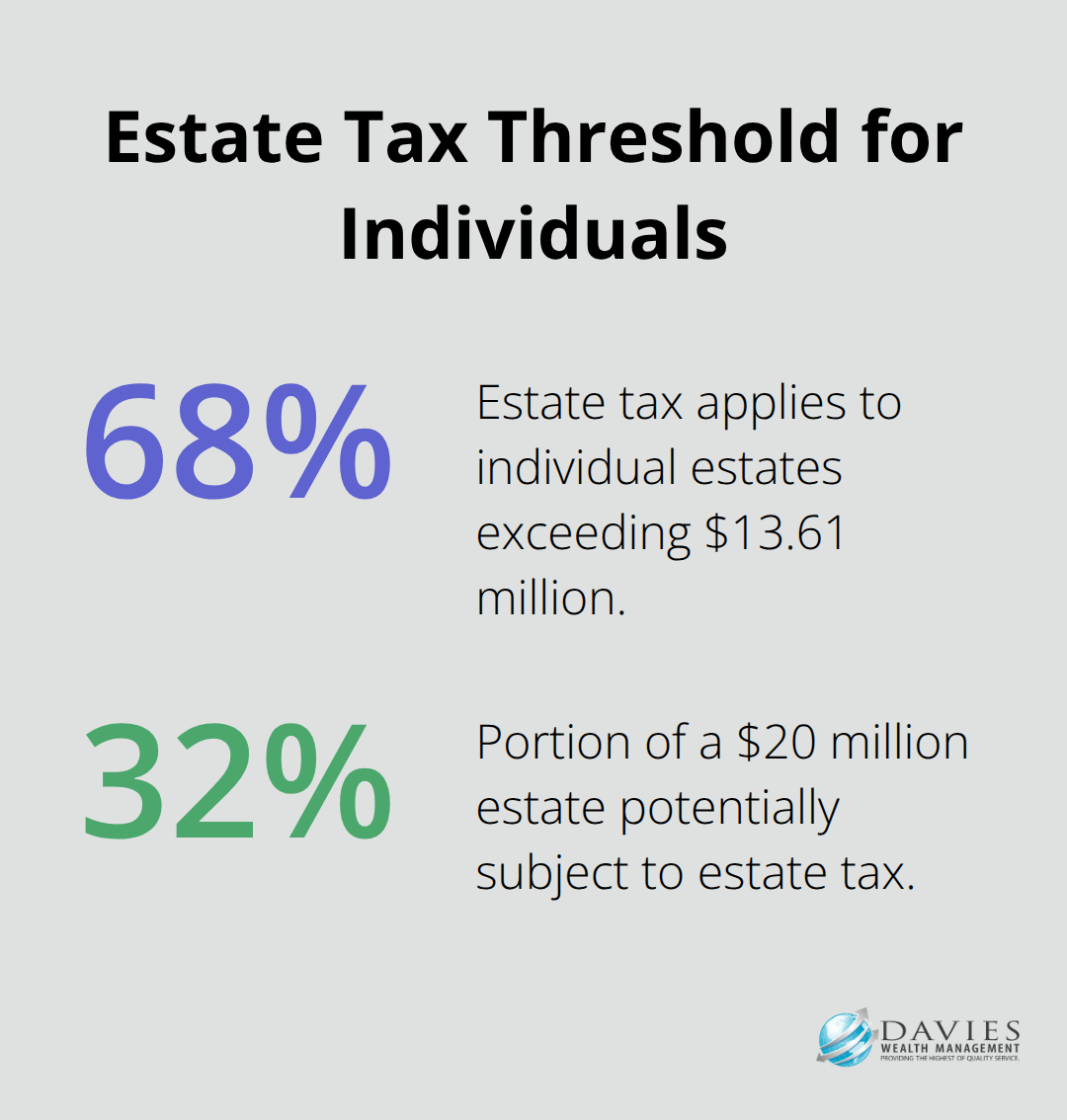

Sudden wealth triggers immediate tax consequences that most people never face. A $5 million inheritance can generate estate taxes for estates exceeding $13.61 million for individuals without proper management. Business sales often create capital gains taxes of 20% to 37% (depending on your income bracket). Legal settlements may be partially taxable, which creates confusion about actual net proceeds. These tax obligations require immediate attention because the IRS expects payments within months, not years.

Emotional Pressure Creates Poor Financial Decisions

Sudden wealth overwhelms most people emotionally, which leads to costly mistakes. The psychological impact of sudden wealth can significantly affect mental health and decision-making abilities. Family members and friends immediately pressure recipients for loans or gifts, which creates relationship strain and financial drain. The fear of losing newfound wealth often pushes people toward overly conservative investments that fail to maintain purchasing power against inflation.

Time-Sensitive Opportunities Disappear Quickly

Sudden wealth creates narrow windows for optimal financial strategies. Estate tax elections must be filed within nine months of death for inherited assets. Business sale proceeds need immediate reinvestment to avoid large tax bills in the current year. Charitable giving strategies lose effectiveness without implementation before year-end. Insurance needs change instantly with increased net worth, but coverage gaps can take weeks to address.

Professional Experience Makes the Difference

Professional athletes and business owners understand these timing pressures well, which explains why specialized advisors focus on rapid response capabilities rather than lengthy planning processes. Traditional advisors who handle typical retirement accounts and basic investment portfolios lack the expertise to navigate these complex situations. The stakes are too high for on-the-job training when millions of dollars hang in the balance.

These unique challenges make advisor selection critical for anyone who receives sudden wealth. The right financial advisor brings specialized knowledge that can save hundreds of thousands in taxes and prevent costly mistakes that destroy wealth permanently.

Key Qualifications to Look for in a Wealth Advisor

Proven High-Net-Worth Client Experience

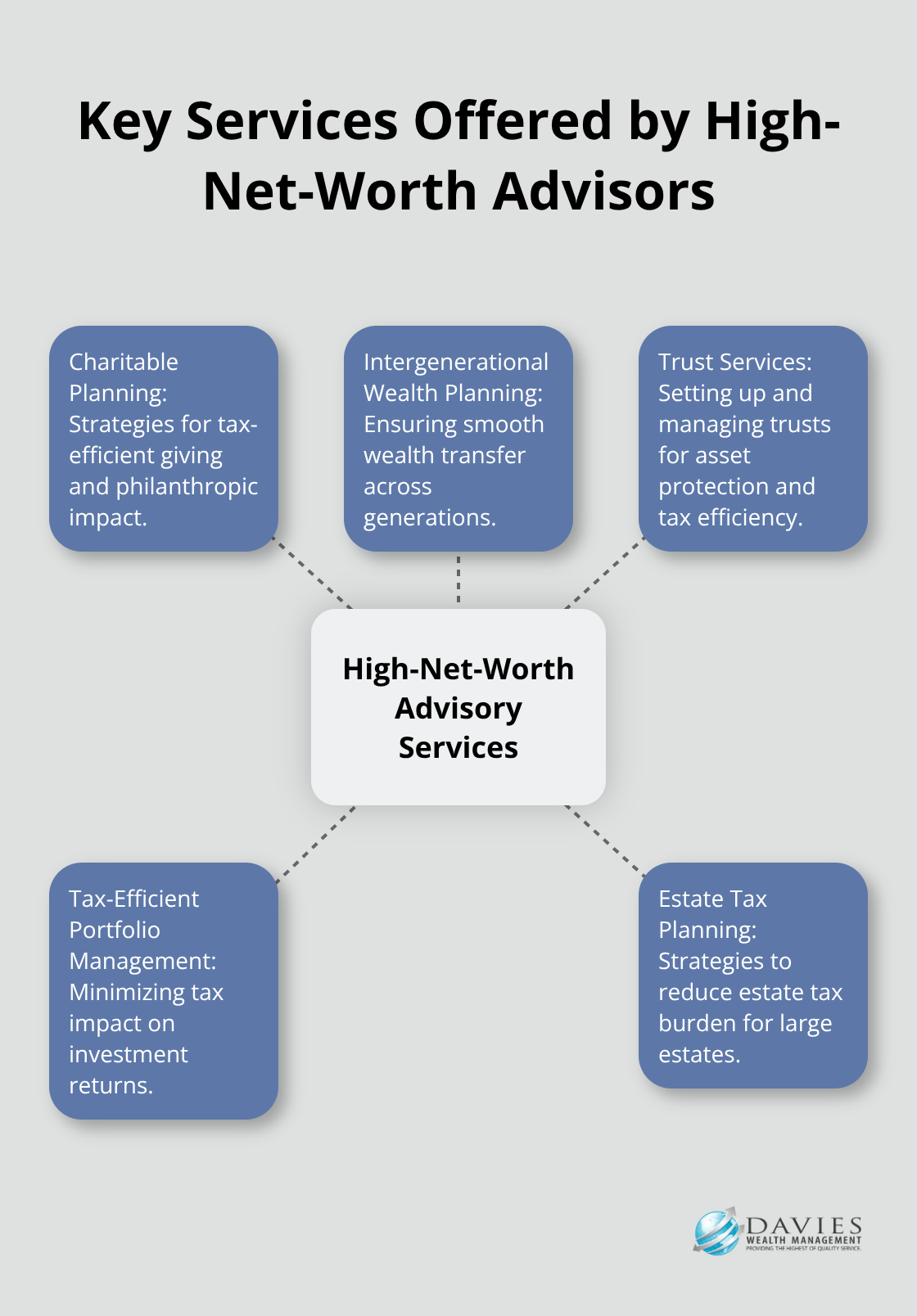

Your advisor must demonstrate specific experience with clients who possess assets exceeding $1 million. Cerulli’s 2024 study reveals that advisory practices focused on high-net-worth clients offer 11.5 services compared to 7.1 across advisory practices broadly. This service depth matters because sudden wealth requires specialized solutions like charitable planning, intergenerational wealth planning, and trust services that typical advisors cannot provide.

Ask potential advisors for specific examples of sudden wealth situations they have managed. The advisor should detail how they handled business sale proceeds, inheritance tax planning, or legal settlement structuring. Vague responses indicate insufficient experience. Request references from clients who received similar windfalls within the past two years.

Comprehensive Team Structure and Service Model

High-net-worth advisors need specialized teams to address complex needs effectively. Your advisor should work with certified public accountants, estate attorneys, and insurance specialists as part of their regular practice.

The advisor must offer personalized portfolio management with custom models rather than generic investment products. Tax-efficient separately managed accounts should be standard, not optional. Direct indexing and option overlay strategies demonstrate advanced capabilities that protect and grow sudden wealth. Firms that lack these services will cost you significant returns and tax efficiency over time.

Fiduciary Standards and Transparent Fee Structure

Only work with fee-only fiduciary advisors who are legally required to act in your best interests. Fee-based advisors can earn commissions that create conflicts of interest in their recommendations. The average financial advisor fee is approximately 1.05% for assets under management, but high-net-worth clients often negotiate lower rates as assets increase.

Demand complete fee transparency that includes all underlying investment costs, trading fees, and third-party service charges. Hidden fees can reduce returns by 0.5% to 1.5% annually, which compounds to hundreds of thousands in lost wealth over decades. The advisor should provide written documentation of all costs before you sign any agreements.

Specialized Sudden Wealth Expertise

Your advisor must understand the unique pressures that sudden wealth creates. Professional athletes face short career spans and fluctuating income patterns that require specialized strategies. Business owners need immediate reinvestment plans to minimize tax consequences. Inheritance recipients face estate tax deadlines that cannot be extended.

The advisor should offer immediate response capabilities rather than lengthy planning processes. Traditional advisors who handle typical retirement accounts lack the expertise to navigate these time-sensitive situations. The wrong choice here can cost you hundreds of thousands in unnecessary taxes and missed opportunities that never return.

Red Flags to Avoid When Choosing an Advisor

Aggressive Sales Pressure and Unrealistic Return Promises

Legitimate sudden wealth advisors never push you into immediate decisions or guarantee specific investment returns. Suze Orman specifically warns against advisors who make unrealistic promises about investment returns. Any advisor who claims they can deliver 15% annual returns or guarantee market-beating performance lacks professional integrity.

The S&P 500 has averaged 10.5% annually over the past 50 years, and no advisor can consistently outperform market indices while taking on less risk. Pressure tactics like same-day signing requirements or limited-time investment opportunities signal desperation rather than expertise. Professional advisors present options and allow you time to make informed decisions.

Missing Credentials and Regulatory Violations

Your advisor must hold current CFP certification and maintain clean regulatory records with both SEC and FINRA. Check the CFP Board database to verify their credentials remain active and review their Form ADV for any disciplinary actions or client complaints.

Advisors with suspended licenses, customer disputes exceeding $25,000, or bankruptcy filings within five years present unacceptable risks to your wealth. The SEC’s Investment Adviser Public Disclosure database reveals regulatory violations that disqualify advisors from managing sudden wealth situations. Never work with advisors who cannot provide current licensing documentation or refuse to share their regulatory history.

Communication Failures and Limited Accessibility

Professional wealth advisors respond to client communications within 24 hours during business days and provide multiple contact methods (including direct phone lines and secure messaging platforms). Advisors who take weeks to return calls or rely solely on administrative staff for client communication lack the responsiveness sudden wealth requires.

Your advisor should schedule quarterly review meetings proactively and provide written updates on portfolio performance, tax implications, and market conditions. Advisors who disappear during market volatility or fail to explain complex strategies in understandable terms will cost you money when quick decisions become necessary. Test their responsiveness during initial consultations to gauge their commitment to client service.

Final Thoughts

You must select the right sudden wealth financial advisor with patience despite the urgency you feel. Quick decisions about advisor relationships cost more than the extra weeks you spend to evaluate credentials, experience, and service capabilities. The wrong choice destroys wealth through poor tax strategies, inadequate investment approaches, and missed opportunities that never return.

Specialized wealth management professionals possess expertise that general financial advisors cannot match. They understand the unique pressures of sudden wealth, from immediate tax obligations to family relationship challenges (including requests for loans or gifts). Their comprehensive service offerings protect your assets while they maximize growth opportunities through sophisticated strategies like direct indexing and tax-efficient portfolio management.

We at Davies Wealth Management focus specifically on sudden wealth situations and help individuals navigate complex financial transitions with confidence. Our team provides personalized strategies that address the unique challenges of inheritance, business sales, and legal settlements. Start your search by verifying advisor credentials through the CFP Board and SEC databases, then schedule consultations with multiple candidates to compare their sudden wealth experience and service offerings with Davies Wealth Management.

Leave a Reply