At Davies Wealth Management, we understand the unique financial landscape NHL players navigate throughout their careers. Professional hockey athletes face distinctive challenges, from short career spans to complex tax situations across multiple jurisdictions.

This blog post explores the essential components of financial planning tailored specifically for NHL players, addressing their unique needs and long-term financial goals.

What Financial Hurdles Do NHL Athletes Face?

NHL athletes face a unique set of financial challenges that require specialized planning and management. Several key areas demand focused financial strategies for professional hockey players.

The Race Against Time

NHL careers are notoriously short, averaging just 4.5 years. However, the top 25% of players have an average career length of 12 years. This brief window of high earnings creates an urgent need for smart financial planning. Players must maximize their income during their active years to support potentially decades of retirement. NHL clients should adopt aggressive savings strategies, aiming to set aside 40-50% of their after-tax income for long-term investments.

Injury Risk and Income Protection

The physical nature of hockey puts players at high risk for career-altering injuries. A study published in the National Library of Medicine found that the injury rate was 52.1 per 1000 player-game hours, with other studies reporting rates ranging from 53 to 84 per 1000 player-game hours. This unpredictability necessitates robust disability insurance coverage. Players should secure policies that can replace up to 65% of their income in case of a career-ending injury.

Navigating Multi-State Tax Complexities

NHL players often play in multiple states and countries throughout a season, creating a tax nightmare. Each jurisdiction may claim a portion of the player’s income, leading to potential double taxation. To combat this, sophisticated tax planning strategies (such as establishing residency in tax-friendly states like Florida or Texas) can save players significant amounts in state taxes annually.

Managing Sudden Wealth

Many NHL players come into significant wealth quickly, often before they’ve developed financial literacy. A study by the National Bureau of Economic Research found that nearly 15 percent of NFL players will have declared bankruptcy by 25 years after retirement, highlighting the importance of proper wealth management. Players should focus on learning about sustainable spending habits and long-term investment strategies to prevent similar outcomes in the NHL community.

The Need for Specialized Financial Guidance

The complex financial landscape NHL players navigate requires expert guidance. Financial advisors who specialize in working with professional athletes (like those at Davies Wealth Management) can provide tailored strategies to address these unique challenges. These professionals help players focus on their on-ice performance while managing the intricacies of their financial lives.

As we move forward, we’ll explore the essential components of a comprehensive financial plan designed to address these challenges and set NHL athletes up for long-term financial success.

Building a Robust Financial Game Plan for NHL Athletes

Dual-Purpose Budgeting

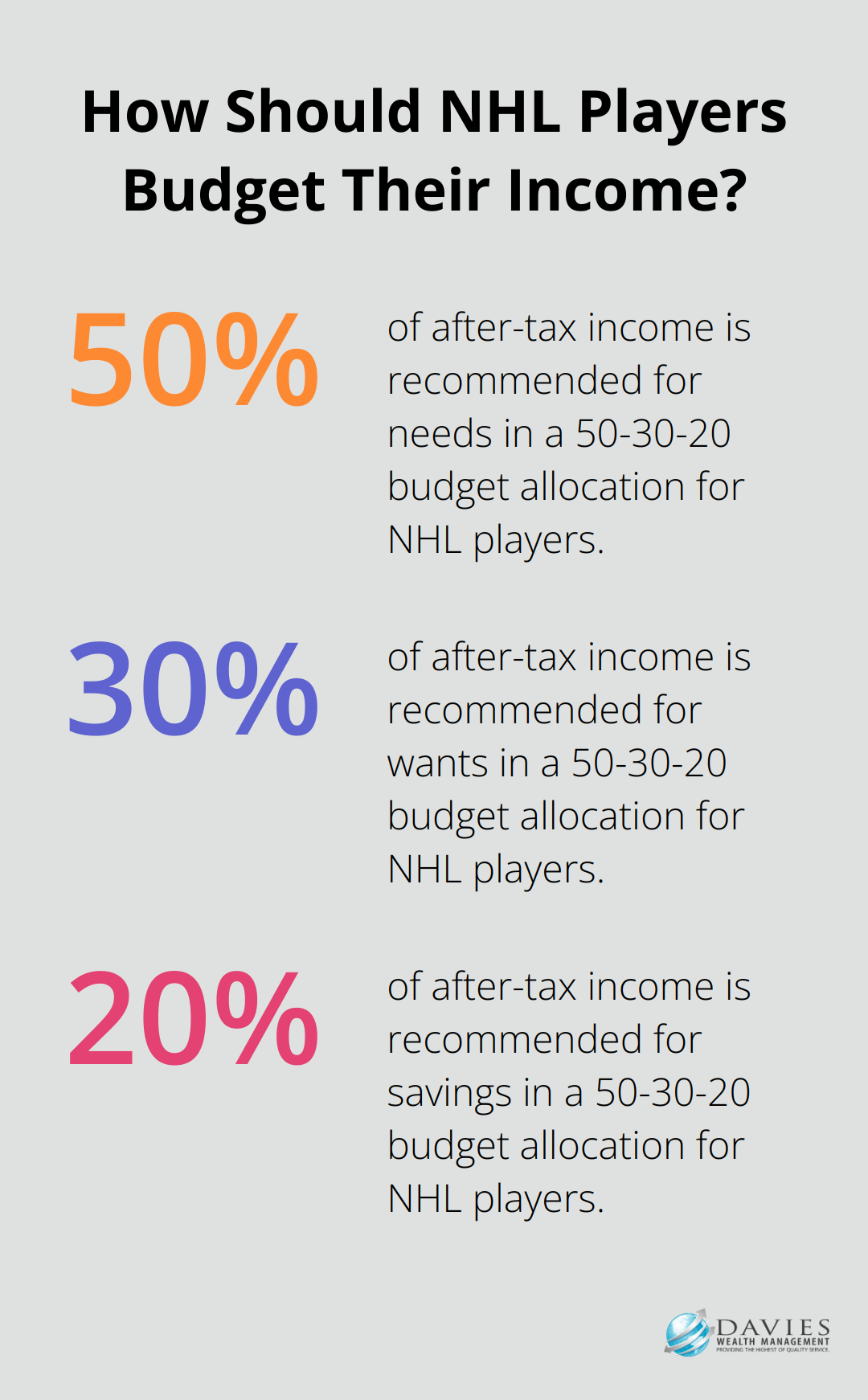

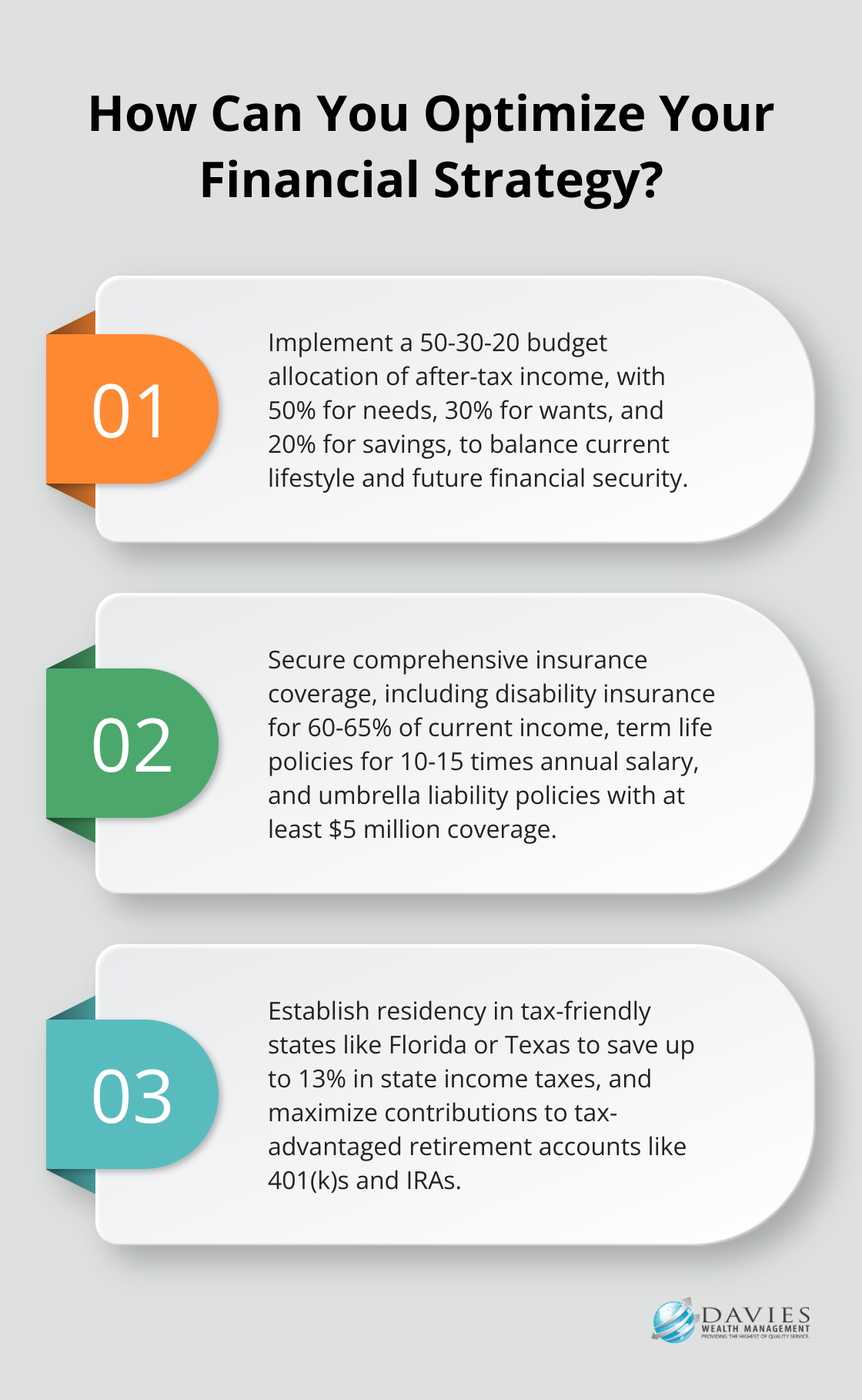

NHL players need a budget that works during their active career and in retirement. We recommend a 50-30-20 allocation of after-tax income: 50% for needs, 30% for wants, and 20% for savings. This approach allows players to enjoy their current lifestyle while building a substantial nest egg for the future.

For post-retirement planning, we advise our clients to estimate their annual expenses at 70-80% of their pre-retirement spending. This calculation helps determine the savings required to maintain their desired lifestyle after their playing career ends.

Strategic Investment Approaches

Long-term wealth preservation for NHL athletes requires a diversified investment strategy. We typically recommend a mix of 60-70% stocks and 30-40% bonds for players in their 20s and early 30s, gradually shifting to a more conservative split as they approach retirement. As a hedge against market volatility, players should consider allocating 10% of their portfolio to alternative investment asset classes.

Real estate investments can also play a significant role. Many NHL clients allocate 10-15% of their portfolio to income-producing properties, providing a steady cash flow stream during and after their playing careers.

Comprehensive Insurance Coverage

Insurance is a non-negotiable aspect of financial planning for NHL players. We advise our clients to secure disability insurance that covers 60-65% of their current income. This coverage is essential, given the high injury rates in professional hockey.

Life insurance is equally important. We recommend term life policies with coverage of 10-15 times the player’s annual salary. This ensures financial security for their families in case of unexpected tragedy.

Liability insurance is often overlooked but vital. We suggest umbrella policies with coverage of at least $5 million to protect against potential lawsuits or claims.

Tax-Efficient Strategies

NHL players face complex tax situations due to playing in multiple jurisdictions. We employ several strategies to minimize tax burdens:

- Establish residency in tax-friendly states like Florida or Texas (this can save players up to 13% in state income taxes).

- Utilize tax-loss harvesting in investment portfolios to offset gains and reduce taxable income.

- Maximize contributions to tax-advantaged retirement accounts like 401(k)s and IRAs to lower current tax liabilities while building long-term wealth.

- Explore opportunities for charitable giving to support causes players care about and provide significant tax benefits.

These strategies form the foundation of a solid financial plan for NHL players. However, the journey doesn’t end here. The next chapter will explore how to effectively plan for retirement, a critical aspect of long-term financial success for professional athletes.

Securing Your Financial Future After Hockey

Maximizing Retirement Savings

NHL players have access to a pension plan and a 401(k) program, which offer significant tax advantages. Players should maximize their contributions to these plans. A player with 10 years of service qualifies for the maximum payment of $210,000/year from the NHL pension plan. Players can contribute up to $23,000 to their 401(k), with an additional $7,500 catch-up contribution for those 50 and older.

For high-earning players, these contributions alone may not suffice to maintain their lifestyle in retirement. Supplementing these plans with after-tax investment accounts, focusing on tax-efficient investment strategies, will minimize the impact of taxes on long-term growth.

Exploring Alternative Investments

To create a robust retirement portfolio, NHL players should consider alternative investment options. Private equity, venture capital, and real estate investment trusts (REITs) can offer potentially higher returns and diversification benefits. Private equity seems to be everywhere in sports these days, but the first investment only happened in 2006, and the sector has just recently taken off.

Real estate investments are particularly popular among NHL players. Many invest in multi-family properties or commercial real estate, which can provide steady cash flow during retirement. Well-managed real estate investments have achieved annual returns of 8-12% for some players.

Planning for Post-Hockey Careers

Preparing for a post-hockey career is essential for long-term financial stability. Players should identify their interests and skills that can translate into new career opportunities. This might involve pursuing further education, starting a business, or transitioning into coaching or management roles within hockey.

Some former players have established sports-related businesses, leveraging their name recognition and network. Others have pursued careers in broadcasting or player development. Players should start planning for this transition early (often 3-5 years before anticipated retirement).

Creating Passive Income Streams

Developing multiple streams of passive income is vital for maintaining financial stability in retirement. Players should focus on creating diverse income sources that can replace their playing salary. This might include:

- Dividend-paying stocks: Players should try to build a portfolio yield of 2-3%, which can provide a steady income stream.

- Rental properties: Many players invest in residential or commercial real estate, targeting properties that generate a 6-8% annual cash-on-cash return.

- Royalties and licensing deals: Players with strong personal brands should explore opportunities to generate ongoing income from endorsements and licensing agreements.

- Business investments: Some players choose to become silent partners in businesses, aiming for returns of 10-15% annually.

These strategies can help NHL players build a financial foundation that supports them long after they retire from professional hockey.

Final Thoughts

Financial planning for NHL players requires expert guidance to address unique challenges. Short careers, injury risks, and complex tax situations demand specialized strategies. At Davies Wealth Management, we offer tailored solutions to help NHL athletes navigate their financial journey during and after their playing careers.

Retirement planning is essential for NHL players due to their brief high-earning window. Maximizing pension and 401(k) contributions, exploring alternative investments, and creating passive income streams contribute to long-term financial stability. Professional athletes who take a proactive approach to their finances position themselves for lasting success.

NHL players who seek expert guidance and implement comprehensive financial strategies can secure their future. This approach allows them to focus on their on-ice performance while ensuring financial security for years to come. Addressing financial planning early and consistently builds a strong foundation for NHL athletes’ long-term success.

Leave a Reply