At Davies Wealth Management, we often encounter clients grappling with the decision between a financial consultant and a financial advisor.

Understanding the distinction between these two roles is vital for making an informed choice about your financial future.

This blog post will explore the key differences between financial consultants and financial advisors, helping you determine which professional aligns best with your unique financial needs and goals.

What Does a Financial Consultant Do?

The Scope of Financial Consulting

Financial consultants offer a wide array of services to help individuals and businesses navigate complex financial landscapes. These professionals focus on providing comprehensive financial strategies tailored to their clients’ specific needs and goals. Their services often include investment planning, risk management, retirement planning, and estate planning. A financial consultant analyzes a client’s entire financial picture to develop long-term strategies that align with their objectives. For example, they might help a business owner create a succession plan or assist an individual in optimizing their investment portfolio for retirement.

Expertise and Responsibilities

The primary responsibility of a financial consultant is to provide expert advice on financial matters. This involves conducting thorough assessments of a client’s financial situation, identifying potential risks and opportunities, and recommending appropriate financial products or strategies. Financial consultants often specialize in specific areas such as tax planning, wealth management, or corporate finance.

A recent study by McKinsey & Company highlighted that demand for wealth management services is strong, and capturing it will require wealth managers to tackle the impending shortage of advisors.

Qualifications and Certifications

To ensure credibility and expertise, financial consultants typically hold relevant qualifications and certifications. The Certified Financial Planner (CFP) designation is widely recognized in the industry and requires completion of a CFP Board Registered Education Program, passing the CFP® Exam, holding or earning a 4-year degree, demonstrating financial planning experience, and meeting ethics requirements.

Other common certifications include Chartered Financial Consultant (ChFC) and Certified Investment Management Analyst (CIMA). These credentials demonstrate a consultant’s commitment to ongoing education and ethical standards in the financial industry.

Specialized Expertise

Many financial consultants develop expertise in niche areas to cater to specific client groups. For instance, some consultants specialize in professional athlete financial planning, addressing the unique financial challenges faced by athletes. This specialized knowledge allows consultants to provide tailored advice that meets the specific needs of their clientele.

Client Relationships

Financial consultants often build long-term relationships with their clients. They work closely with individuals or businesses to understand their financial goals, risk tolerance, and life circumstances. This ongoing relationship allows consultants to adjust strategies as needed and provide continuous support throughout various life stages or business cycles.

As we transition to exploring the role of financial advisors, it’s important to note that while there are similarities between consultants and advisors, there are also distinct differences in their approach and focus.

What Does a Financial Advisor Do?

The Role of a Financial Advisor

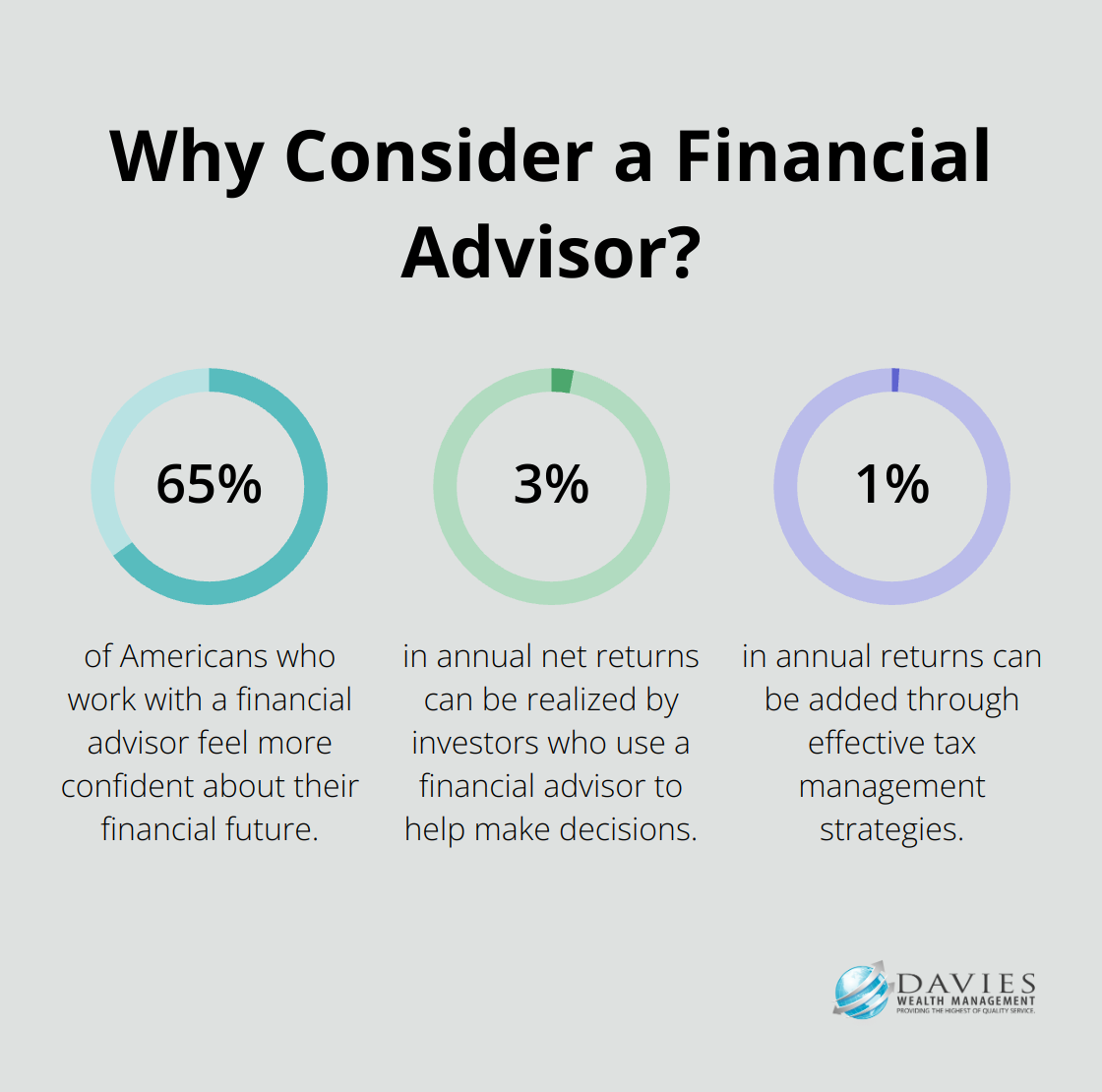

Financial advisors play a key role in helping individuals and families manage their finances and achieve their financial goals. They focus primarily on investment management and financial planning. These professionals work closely with clients to develop personalized investment strategies, manage portfolios, and provide ongoing advice on various financial matters. A 2023 study by the Financial Planning Association reveals that 65% of Americans who work with a financial advisor feel more confident about their financial future.

Areas of Expertise

Financial advisors typically specialize in several key areas:

Investment Management

A primary function of financial advisors involves helping clients build and manage investment portfolios. This task includes selecting appropriate investments based on the client’s risk tolerance, financial goals, and time horizon. A Vanguard research concluded that an investor could realize at least 3% in annual net returns if they used a financial advisor to help make decisions.

Retirement Planning

Financial advisors help clients prepare for retirement by creating comprehensive retirement plans. Their responsibilities include calculating retirement needs, recommending suitable retirement accounts, and developing strategies to generate income during retirement. The National Institute on Retirement Security reports that individuals who work with a financial advisor are twice as likely to feel prepared for retirement compared to those who don’t.

Tax Planning

Many financial advisors offer tax planning services to help clients minimize their tax liabilities. This service may involve recommending tax-efficient investment strategies or identifying opportunities for tax deductions. A study by Morningstar found that effective tax management strategies can add up to 1% in annual returns.

Credentials and Regulatory Requirements

To ensure the highest level of expertise and ethical standards, financial advisors often hold various credentials. The Certified Financial Planner (CFP) designation is widely recognized and requires extensive education, experience, and adherence to a strict code of ethics. According to the CFP Board, more than 100,000 people in the United States hold CFP® certification.

Financial advisors are also subject to regulatory oversight. Those who manage over $100 million in assets must register with the Securities and Exchange Commission (SEC), while those managing less typically register with state securities regulators. This regulatory framework helps protect investors and ensure advisors act in their clients’ best interests.

The distinction between financial advisors and consultants becomes clearer when we examine their specific roles and responsibilities. Let’s now explore the key differences between these two financial professionals to help you make an informed decision about which one might best suit your needs.

Navigating the Consultant vs Advisor Landscape

Service Scope and Specialization

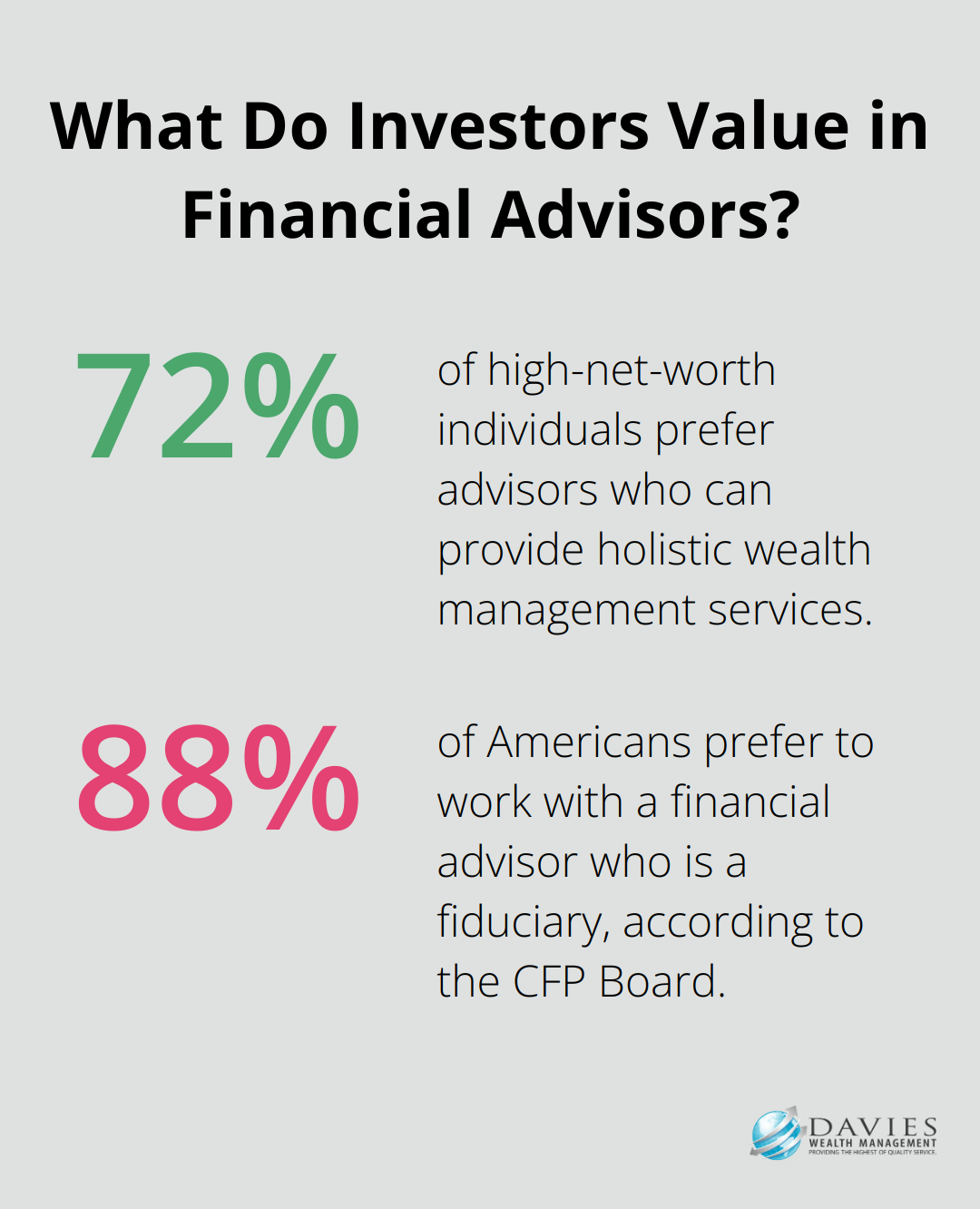

Financial advisers are often more focused on overseeing an investment portfolio for an individual, while financial planners are more big picture oriented. They often specialize in areas like business succession planning or complex estate management. A study by Cerulli Associates found that 72% of high-net-worth individuals prefer advisors who can provide holistic wealth management services.

Financial advisors concentrate more on investment management and personal financial planning. They excel in areas like portfolio optimization and retirement planning. The Financial Planning Association reports that 65% of Americans working with a financial advisor feel more confident about their financial future.

Compensation Models

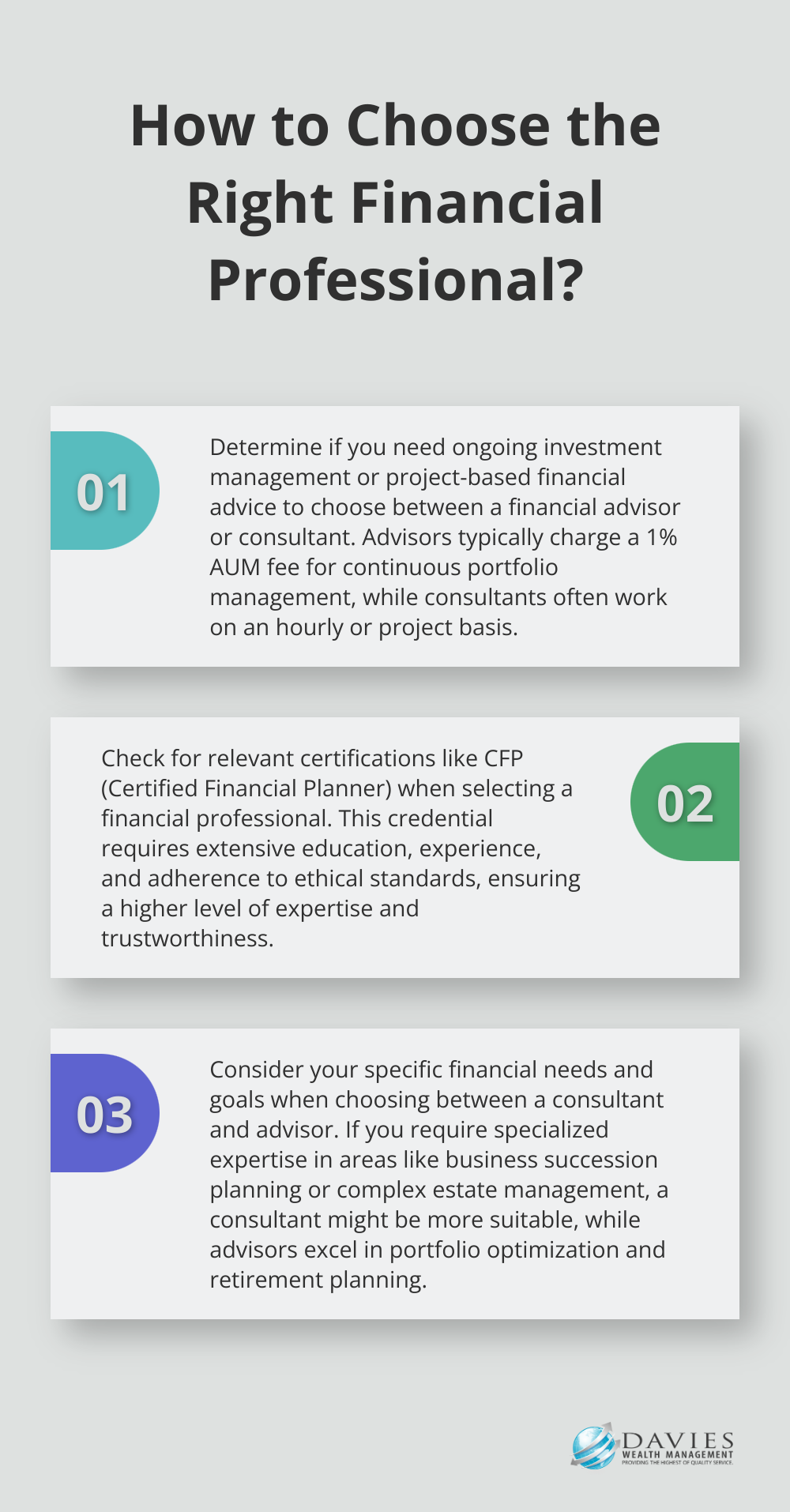

The fee structures between consultants and advisors vary significantly. Financial consultants often work on a project basis or charge hourly rates.

Financial advisors typically charge 1% AUM fees, although this can vary. The Investment Company Institute reports that the median advisory fee is about 0.8% for accounts under $250,000 (decreasing as the account size grows).

Client Engagement Patterns

Financial consultants usually engage with clients on a short-term or project basis. They might solve specific financial challenges or develop strategies for particular life events.

Advisors foster long-term relationships, providing ongoing management and adjustments to financial plans. A study by Vanguard Investments put the value added at about 3%.

Regulatory Landscape

Both consultants and advisors operate under regulatory oversight, but the specifics differ. Financial advisors managing over $100 million in assets must register with the SEC, while those managing less typically register with state securities regulators.

Consultants may have different regulatory requirements depending on their specific services. However, both generally adhere to fiduciary standards. The CFP Board reports that 88% of Americans prefer to work with a financial advisor who is a fiduciary.

Impact on Financial Outcomes

The choice between a consultant and an advisor can significantly impact your financial outcomes. A study by Morningstar found that working with a financial advisor can result in 1.5% to 4% higher returns annually compared to DIY investing.

For those with complex financial situations, such as professional athletes or business owners, the specialized expertise of a consultant can prove invaluable. Tailored strategies for these unique situations can lead to more effective wealth preservation and growth.

Final Thoughts

The choice between a financial consultant vs financial advisor depends on your specific financial needs and goals. Financial consultants offer broader services, focusing on comprehensive strategies and often specializing in niche areas. Financial advisors concentrate on investment management and personal financial planning, providing ongoing management and adjustments to financial plans.

At Davies Wealth Management, we understand the importance of aligning your financial needs with the right professional. Our team of experts offers comprehensive wealth management solutions tailored to your unique circumstances. We invite you to explore how our personalized approach to financial planning can help you achieve your financial goals.

Your decision between a financial consultant and a financial advisor will impact your financial journey significantly. Carefully consider your needs and the distinct offerings of each role to make an informed decision. This choice will set you on the path to financial success and security.

Leave a Reply